A ten-digit number allotted by Directorate General of Foreign Trade (DGFT) for conducting an import-export business is known as Import Export Code (IEC). It is obligatory for all businesses or an individual who is engaged in importing and exporting of goods/services to have an IEC. To avail the benefits from Export Promotion Council or Customs or DGFT, one needs to have an IEC number. For obtaining an IEC, proper procedure and documentation is required, so that the Government can ensure your identity as an individual or as a business. In this article, we are going to discuss in details about what documents required for IEC code.

Contents

Documents required for IEC code

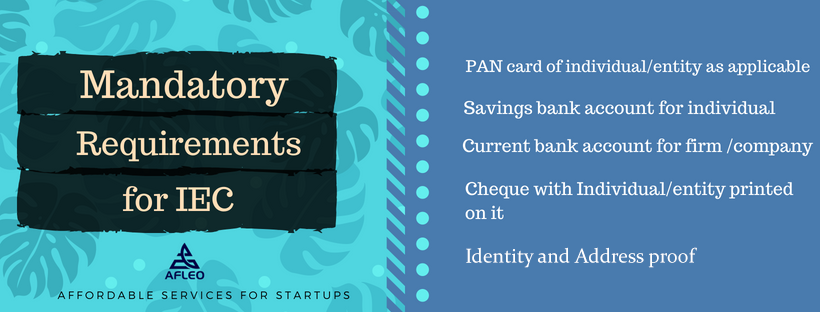

- The applicant should have a PAN Card.

- He should have a Current or Savings bank account in a bank which deals in Foreign Exchange.

- He should have sale deed, rental/lease deed, electricity/phone bill for address verification

- If an applicant is Non-Resident Indian (NRI) or there is Non-Resident interest in the firm/company they are required to submit the scanned copy of RBI approval letter.

- He should have an email-id and mobile number.

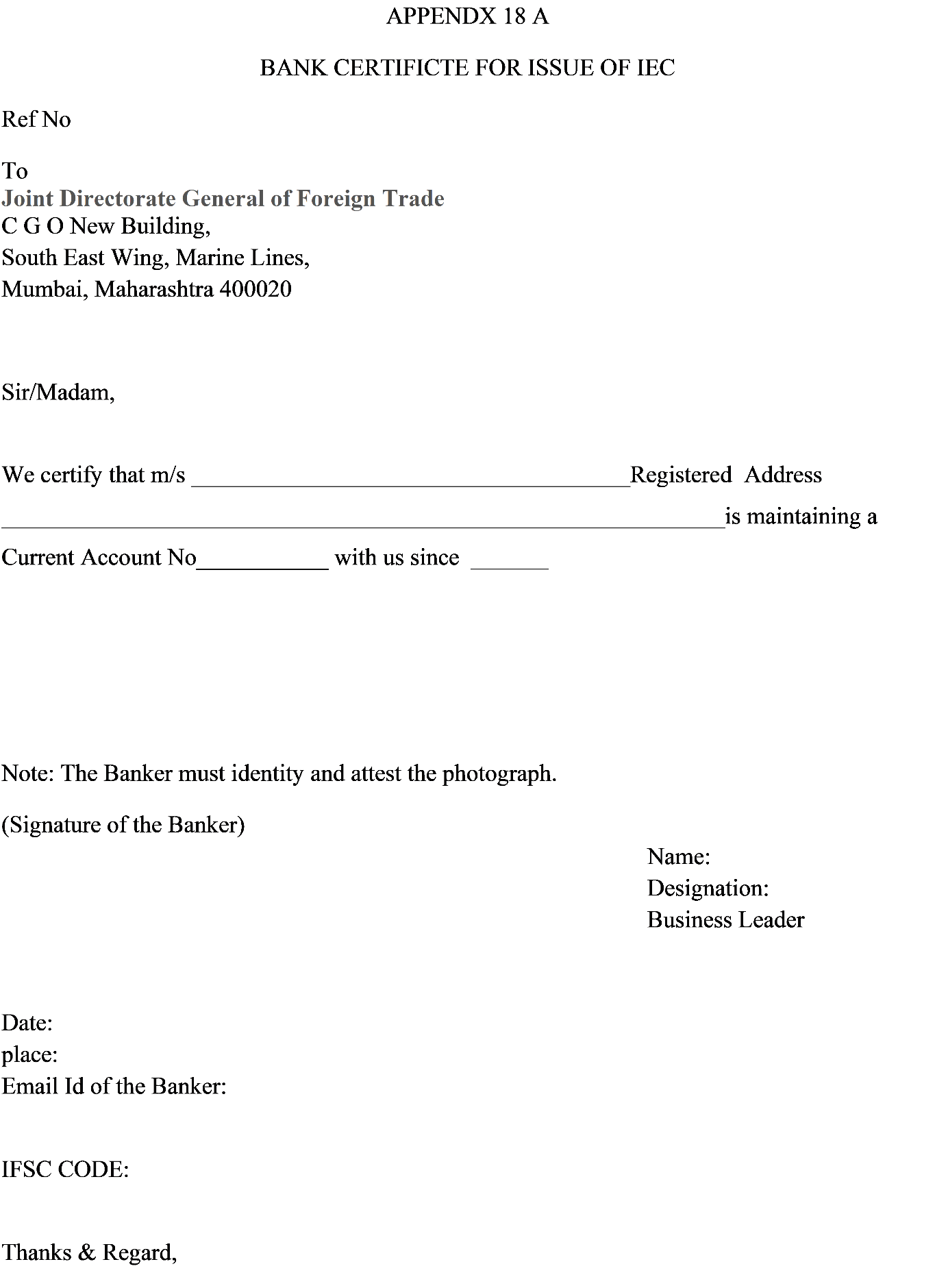

- He should have a Cancelled Cheque with Entity’s or Individual’s name pre-printed on it OR he should have Bankers Certificate in the prescribed format.

Format of Bank Certificate for IEC

- He should have a Net Banking account or Debit/Credit card for Online payment of Government Fees of Rs. 500/-

[There are updates in the fees for applying IEC Code to know about the precise and updated fees for IEC Code read our article on " Import Export License Fees"]

- According to the Previous Notification, it was mandatory to have a Digital Signature for filing an application for IEC Code.

[Update: As per the new update from DGFT, the digital signature is not required for the application of IEC Code]

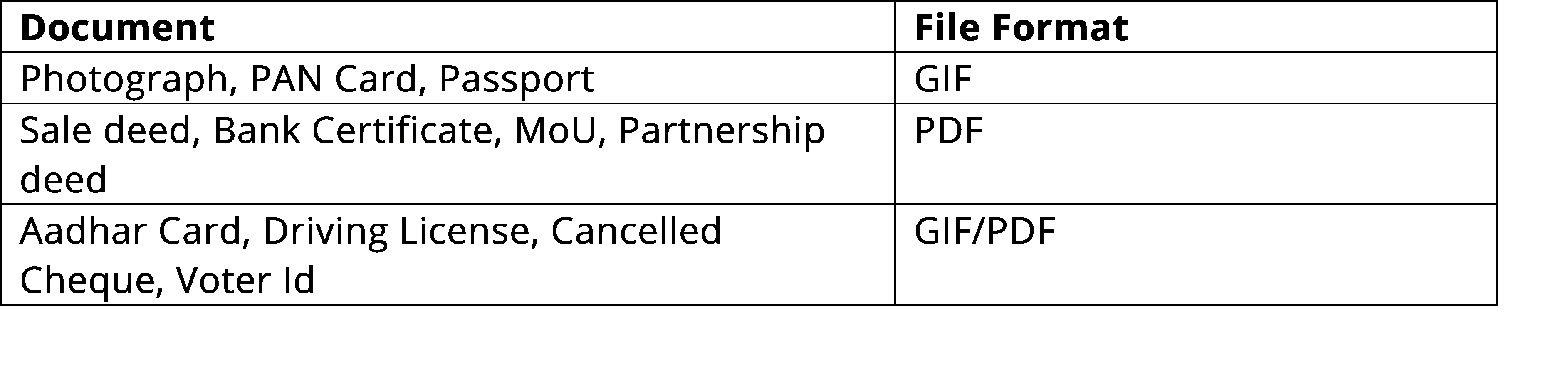

[Note: Scanned copies of documents are allowed only in GIF or PDF format]

Documents for IEC Code - Entity Wise

To get the IEC Code, a different type of companies/entities has to submit different additional documents. Type of Companies/entities such as Proprietor, Partnership, Private limited, HUF, Registered Society, etc has to submit different additional documents required for IEC code along with the mandatory documents mentioned below.

1. Documents required for IEC Code for Proprietorship:

- Scanned copy of PAN (Front and back page) card of the Proprietor.

- Any of these – Scanned copy of Passport (first & last page)/Voter’s Card/ Driving License/Aadhar Card.

- Address proof of the Head Office and all the existing branches — Electricity/telephone bill or Rent/lease agreement, or sales deed in case of a self-owned premise.

- Bank Certificate in prescribed format or Cancelled Cheque bearing pre-printed name of the applicant and A/C No.

2. Documents required for IEC Code for Partnership:

- Scanned copy of PAN Card of all the managing partners and the Company.

- Residential proof of all the Managing Partner: Scanned copy of Passport (first & last page) or Voter’s Card or Driving License or an Aadhar card.

- Address proof of the Head Office and all the existing branches: Electricity/telephone bill or Rent/lease agreement, or sales deed in case of self-owned premise

- Bank Certificate or a canceled cheque with the name of the entity and Account Number.

3. Documents required for IEC Code for LLP /Government Undertaking/Public Limited Company/Private Limited Company/Section 25 Company:

- Scanned copy of PAN card of all the directors and the Company.

- Residential proofs of all the Managing Partner/Director signing the application – Scanned copy of Passport (first & last page) or Voter’s Card or a Driving License or an Aadhar card.

- Address proof of the Head Office and all the existing branches: Electricity/telephone bill or Rent/lease agreement, or sales deed in case of self-owned premise

- Certificate of incorporation as issued by the RoC.

- Bank Certificate as per prescribed format/Cancelled cheque having the name of the company and Account number.

4. Documents required for IEC Code for Registered Society:

- Copy of PAN card of the Chairman, Treasurer, Secretary and the Society.

- Residential proofs of the Chairman, Treasurer and Secretary – Scanned copy of Passport (first & last page) or Voter’s Card or Driving License or an Aadhar Card.

- Address proof of the entity: Electricity/telephone bill or Rent/lease agreement, or sales deed in case of the self-owned premise.

- Registration Certificate of the Society/Copy of the Trust Deed.

- Bank Certificate as per the prescribed format or a canceled cheque with applicant name and Account number.

5. Documents required for IEC Code for HUF:

- Scanned Copy of Karta’s PAN Card.

- Any of these residential proofs of the Karta’s Documents – Scanned copy of Passport (first & last page) or Voter’s Card or Driving License or Aadhar card.

- Address proof of the Head Office and all the existing branches: Electricity/telephone bill or Rent/lease agreement, or sales deed in case of self-owned premise

- Bank Certificate or a cancelled cheque with applicant name and account number.

- HUF registration number

[If you want to know the step by step process for online IEC application, refer our blog - IEC Online Application Process]

How Afleo can help you?

Too worked up while setting up your import/export business? Let us be of some help! We can help you get your passport for import/export business, i.e., IEC number. You just need to send your documents over mail, and we will take care of the rest. If you want to obtain IEC number, just give us your documents and then stop worrying about anything. We will fill your application and submit it on your behalf and keep you updated about all the government proceedings. With us, get your IEC number within a few days and without any hassle.

[Now, if you are planning to start your Export business from India. It is important for you to know that the Government of India gives certain incentives to Exporters. This Export Incentive or subsidy is given in the form of Merchandise Exports from India Scheme (MEIS Scheme). Exporters can get anywhere from 2% to 5% of their Invoice value in the form of Incentives. So want to know more about the scheme or want to know the rate of incentive your export product is eligible for? Find all the details here - "MEIS Scheme"]

If you want to apply an IEC code for an individual, please fill the below form to get in touch with us.

![New Foreign Trade Policy [FTP] 2023](https://afleo.com/wp-content/uploads/2023/04/New-Foreign-Trade-Policy-FTP-2023-Important-Highlights-315x242.jpg)