Export Promotion Capital Goods (EPCG) scheme was introduced by the Government of India to increase the manufacturing competitiveness of Indian Exporters by allowing import of machinery/capital goods at zero customs duty. This machinery/capital goods may be used at production, pre-production, and post-production of high-quality goods. To avail this benefit of duty-free Import of capital goods/machinery for the production of high-quality export goods, Government of India provides a license, this license is known as EPCG License. This article intends to educate the applicant to understand all the important documents required for EPCG License registration.

Watch this short introductory video on the EPCG Scheme; which explains the complex concept of EPCG in an easy to understand manner. It Explains What is EPCG Scheme and its application process; details about Export obligation & Redemption of EPCG License; entire summary and step by step procedures involved in the EPCG scheme.

[To get a complete introduction of the EPCG Scheme, read our article on "The complete Guide on Export Promotion Capital Goods (EPCG ) Scheme For Beginner's"]

Contents

Documents required for EPCG License Application

To obtain the EPCG License under the EPCG scheme, it is important to file an application and submit the supporting documents- company and personal details to Director General of Foreign Trade (DGFT) who are the licensing authority.

Let’s have a look at the complete list of the documents required for the EPCG license application to the DGFT.

- Import Export Code (IEC Code)

- DGFT Digital Signature

- Registration-cum-membership Certificate (RCMC)

- MSME/SSI/Udyog Aadhar/IEM/Industrial License

- GST Certificate (if applicable)

- Pro forma Invoice / Purchase order

- ANF – 5A (Application form)

- Appendix – 5A (CE Certificate)

- Appendix – 5B (CA Certificate)

- Government Official Application Fees / EFT Payment proof

- Statement of Duty Saved Amount

- Necessary Declarations

Import Export Code (IEC Code)

EPCG License can be applied by a Manufacturer Exporter or a Merchant Exporter tied with a supporting Manufacturer. In both cases, a valid IEC code issued by DGFT is also one of the mandatory documents required for EPCG registration.

DGFT Digital Signature

It is one of the most important pre-requisite required for applying for an EPCG License from DGFT. Since the application for EPCG License has to be made electronically to jurisdictional DGFT Office, the applicant should compulsorily have a DGFT Digital Signature. No manual applications are allowed.

Registration-Cum-Membership Certificate (RCMC)

In order to avail of the benefit under the EPCG Scheme, the applicant must compulsorily register himself with the relevant export promotion council. A self-certified copy of the registration certificate along with proof of membership payment has to be submitted.

MSME/SSI/Udyog Aadhar/IEM/Industrial License

Since the EPCG scheme involves the production of export goods with the help of imported duty-free machinery, any proof of manufacturing is mandatory to be submitted. The following registrations/certificates may be submitted as proof of manufacturing.

- MSME/SSI Registration.

- Udyog Aadhar Registration.

- IEM (Industrial Entrepreneurs Memorandum)

- Industrial License.

Note: Export product for which the EPCG License is applied & factory address where the machinery will be installed should be present in the above certificates.

GST Certificate

If the applicant is registered under GST. A self-certified copy of the GST certificate may also be submitted as additional business proof.

Proforma Invoice / Purchase Order

A copy of the Proforma invoice or purchase order may also be submitted confirming the purchase of said EPCG machinery from overseas suppliers. It must indicate name, model number and other technical specifications of the machinery along with the quantity & cost.

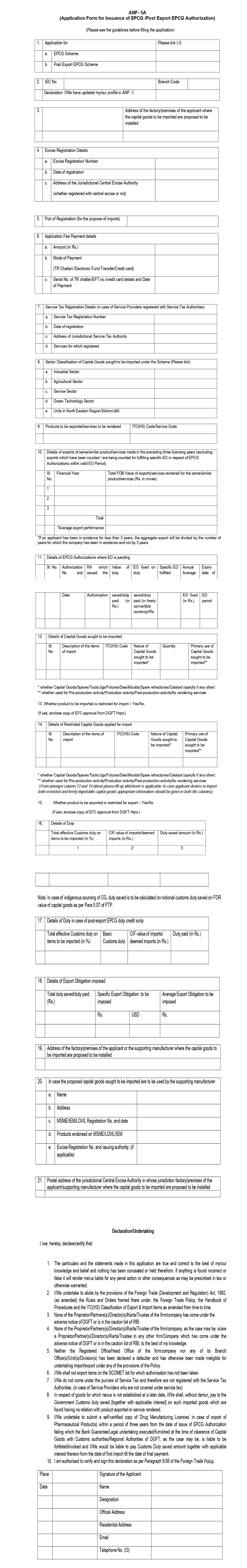

ANF – 5A (Application form)

Application form for applying EPCG License is known as ANF 5A. It consists of 21 sections under which relevant details need to be filled by the applicant for issuance of EPCG Authorization from DGFT.

Let’s look at a few important sections of EPCG application form:

-

- Section 3 – Here, the factory address for the installation of imported capital goods/machinery is to be filled. Make sure that the same factory address is visible in IEC, RCMC and SSI Certificates.

- Section 5 – Port of Registration. Here, the port at which the machinery is going to arrive is to be filled. Once the application is submitted, the port of registration cannot be changed.

- Section 9 – Here, all the products that will be exported using the said imported machinery/capital goods are to be listed. Include only those products which can be made using the machinery. Any product can be deleted/added in the future if required.

- Section 12 – All the Items sought to be imported or indigenously procured are to be listed here along with their HS Code, Quantity and primary use.

- Section 18 – Details of Export Obligation imposed are to be filled in the section. Obligation can be derived based on the total duty saved value. Hence duty saved value is to be calculated with great accuracy.

- Undertaking – Carefully read the undertaking part which is to be filled & certified by the applicant.

Find the Image of ANF – 5A below for better understanding:

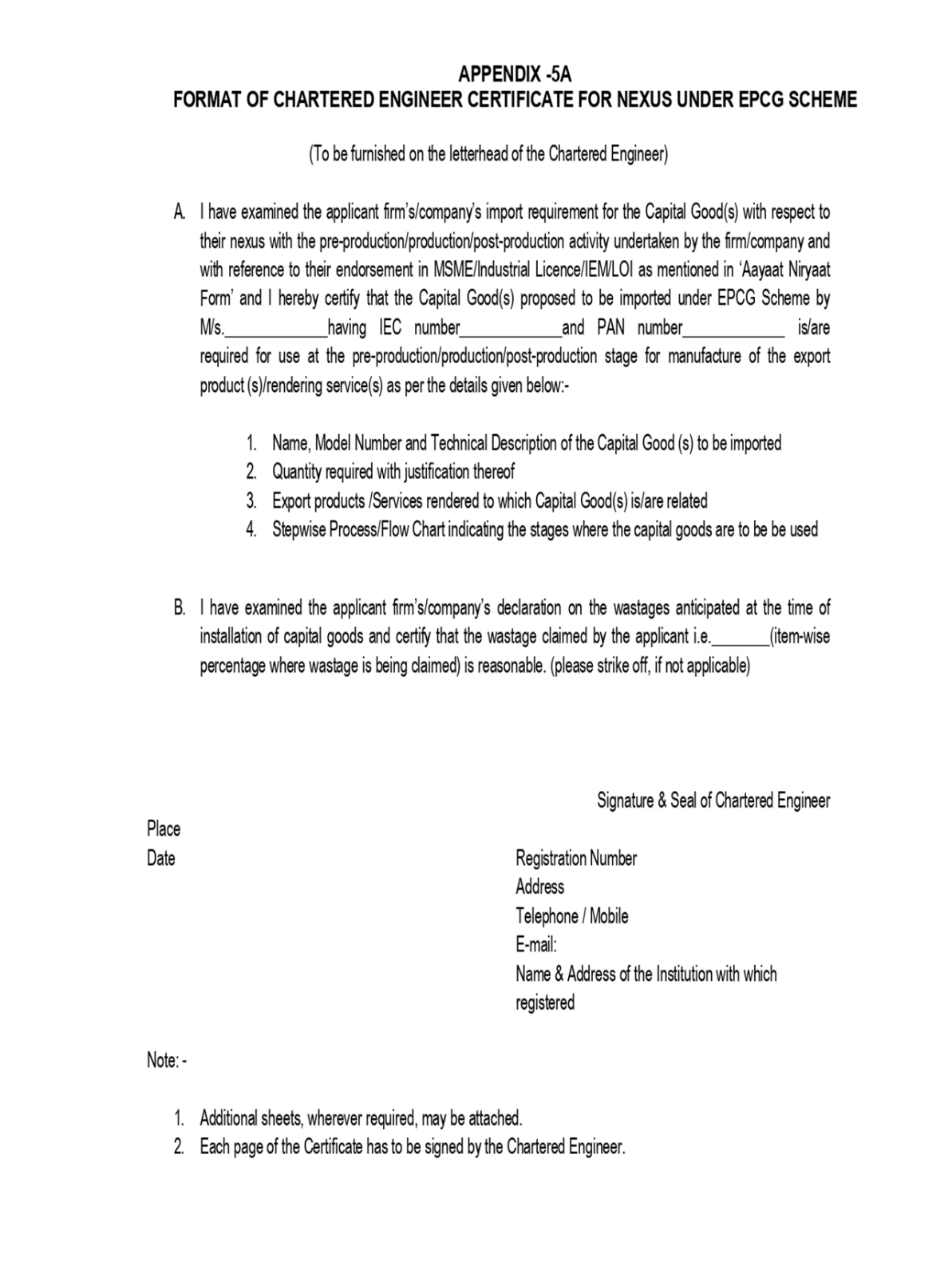

Appendix 5A (CE Certificate)

Since the EPCG Scheme allows the duty-free import of machinery only when it is used in the manufacturing of export products, it becomes important to check the nexus between the imported machinery and export products.

In simple language, DGFT needs to confirm whether the export product can be made out of the imported machinery/capital goods or not?

Therefore, to confirm this nexus or relation between imported machinery and export products, DGFT requires a certification from an Independent & reputed Chartered Engineer (CE). Please make a note that the Chartered Engineer should have the relevant domain expertise.

Now, let’s look at some of the important information which is to be given in this certificate:

- Name, Model no. & technical description of the capital goods to be imported – Mention the exact name of the machinery along with a relevant technical description as per the purchase order. Note that the name of machinery should match exactly as per ANF 5A.

- Quantity required with justification – Mention the quantity of machinery required here with the proper unit of measurement such as Sets, Numbers, etc. along with supporting justification.

- Export products/services to which capital goods are related – This is the most important section of this entire certification. Carefully list down all the export products which can be manufactured with the help of the said machinery using it at production, pre-production or post-production stage. The export obligation imposed under the EPCG scheme can then be fulfilled by the export of all the above-listed products only.

- Stepwise process/Flow Chart – A flow diagram is mandatory to explain as to where and at which stage capital goods are to be used for the production of above-listed export products.

Find the Image of Appendix 5A (CE Certificate) below for better understanding:

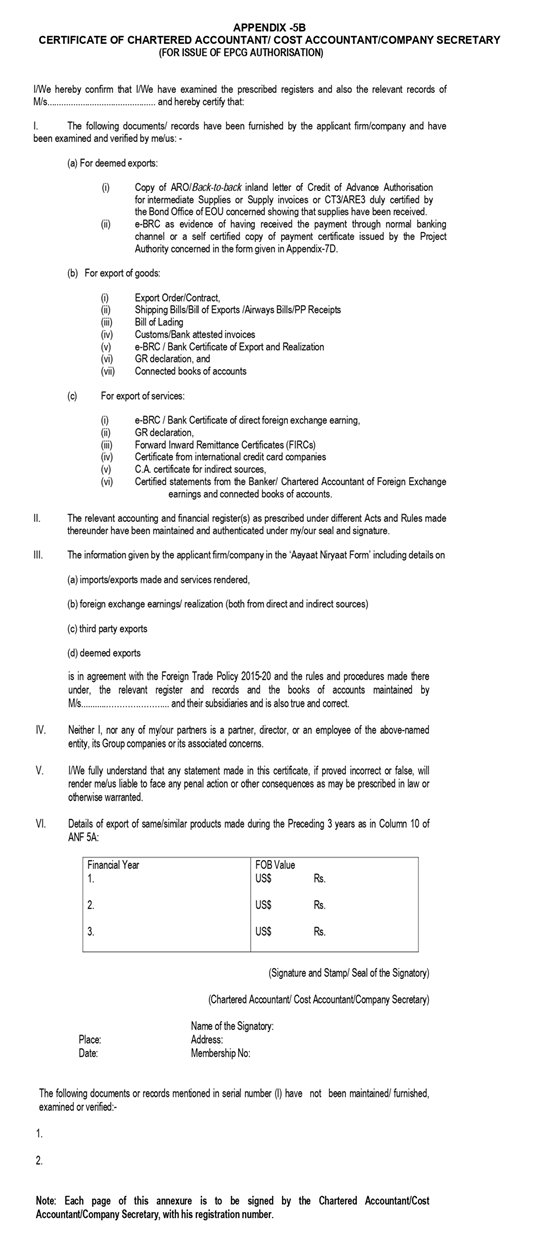

Appendix 5B (CA Certificate)

EPCG scheme comes with two types of export obligation

1) Specific export obligation 2) Average export obligation.

An average export obligation is imposed based on the past turnover (Average of last 3 financial years) of same/similar export products mentioned in ANF 5A & Appendix 5A above.

[You can find detailed information about Average Export Obligation here.]

Therefore, a certificate from either Chartered Accountant, Cost Accountant or Company Secretary is mandatory to certify the last 3 financial year turnover of the same/similar products.

Find the Image of Appendix 5B (CA Certificate) below for better understanding:

Government Official Application Fees / EFT Payment proof

Official Government fees for EPCG is 0.1% of the Duty saved value, which is to be paid online to the DGFT office. After the successful payment, a copy of payment proof is mandatory to be submitted to process your file further.

Note: Non-submission of payment proof may lead to rejection of the file.

Statement of Duty Saved Amount

A detailed statement indicating CIF Value, bifurcation of duties imposed, Duty saved value, specific and average export obligation to be imposed needs to be submitted for a better understanding of all the calculations.

Necessary Declaration

While submitting documents for EPCG License, one necessary declaration on the applicant’s letterhead needs to be submitted stating that "the capital goods sought to be imported are not under the restricted category".

[So after going through all the documents for EPCG License, the next step is to apply for the EPCG Scheme. To know more on the entire EPCG License procedure read our article on "How to obtain and close an EPCG License - Ultimate Guide"]

Why us?

Afleo Consultants is a leading Import Export consulting (DGFT Consultants) firm in India. We specialize in EPCG consulting and also offer services like EPCG License - Issuance and Redemption, Merchandise Export from India Scheme (MEIS), Services Export from India Scheme (SEIS), DFIA - Issuance and Transferability, Advance License - Issuance and Redemptions & also for obtaining other licenses from DGFT.

Please fill the below form to get in touch with us:-