Contents

Bank Guarantee(BG) under EPCG

As we all know that the guarantee term means giving something as security and a Bank guarantee is when a bank gives the guarantees/surety for the business obligation on behalf of their customers within certain regulations.

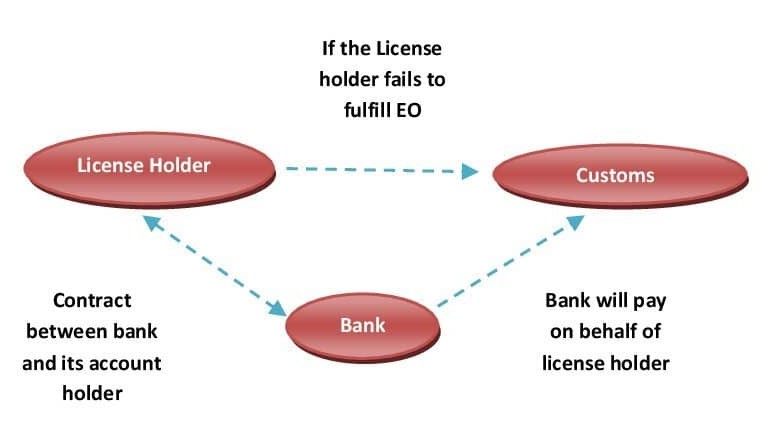

Thus under EPCG Scheme, the Bank guarantee is the financial instrument/guarantee given by the bank on behalf of his account holder to the customs for assurance of payment in the event of default by the applicant. Under BG the bank takes the responsibility for payment when the account holder fails to fulfill the commitment.

Execution of BG under EPCG Scheme

The License is issued under EPCG Scheme to allow duty-free import of capital goods/machinery for pre-production, production, post-production stages. Under EPCG Scheme the heavy custom duties are saved which makes the goods and services cost-competitive in the international market.

The EPCG License is issued with conditions to fulfill the export obligation (EO) equal to six times of duty saved value in 6 years.

The customs ask for Bond execution and interest payable if the export is not made within the given time period as per the license under EPCG Scheme.

In some cases, they also ask to give a bank guarantee as additional security. Giving a Bank guarantee or signing the Bond is the usual practice in Govt. related works.

Importance of BG under EPCG

BG gives the payment commitment to the custom on behalf of the license holder. On the other hand, if the License holder is unable to fulfill the export obligation then they will be liable to pay the penalty to the custom as per the amount agreed in the bond. Hence it protects both the party from any kind of default or risks.

(Refer to the image below to understand the concept of Bank Guarantee under EPCG)

Bank Guarantee Exemption under EPCG Scheme

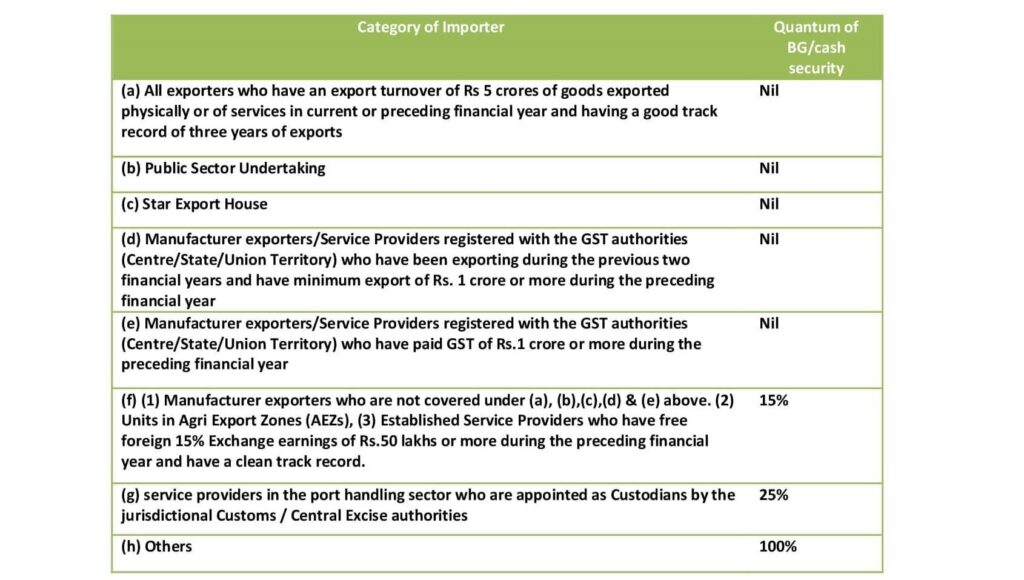

The Bank guarantees exemption given on the basis of certain criteria such as - achievement of a certain level of export performance, Payment of duty, or having export house certification issued from DGFT.

Refer the below tabular data given, in which the category of the importers are mentioned with BG has to be furnished to allow the clearance of capital goods/machinery imported under the EPCG Scheme.

BG exemption given would be valid subject to the following condition

The License holder does not default on the Export Obligation (EO) under EPCG Scheme in the past for any issued license. The BG exemption would be withdrawn if DGFT/Customs comes across such default in Export Obligation.

The EPCG License holder should not have been penalized under the provision of the following act, during the previous three financial years.

- The Customs Act, 1962

- The Central Excise Act, 1944

- The Foreign Exchange Management Act (FEMA), 1999 or the Foreign Trade (Development and Regulation) Act, 1992

If the License holder is a registered member of an Export Promotion Council (EPC) he is required to produce a certificate of export performance/payment of duty/GST for the purpose of availing BG exemption from the concerned EPC.

In other cases where the license holder is not a member of EPC, he shall produce a certificate duly authenticated by a practicing Chartered Accountant (CA), who is registered with the GST Department (Centre/State/Union Territory) for payment of GST. The CA has to mention his GSTIN and other registration details in the certificate.

How Afleo can be the best service provider for EPCG related matters

We serve a broad spectrum of clients with the help of experienced and qualified professionals and provide end-to-end solutions for DGFT/Customs related matters. We work closely with our clients to develop strategies and implementation plans that provide concrete savings to the bottom line. Our experience in the industry gives us a business-oriented approach, Coupled with our expertise on DGFT matters, Customs Procedures & related issues.

Afleo Consultants is a professional EPCG consulting firm providing the following services under EPCG Scheme -

- Assistance in documentation to get the EPCG License,

- Online application for issuance,

- Modification/Amendment in EPCG License. [For Example addition of export products or services]

- Invalidation/Certificate of supplies for EPCG Authorisation.

- Clubbing of EPCG Authorisation.

- Submission of Installation Certificate to DGFT.

- Application for EOP Extension/Block-wise Extension.

- Handling/Submission of EPCG Committee cases.

- Application for EPCG License redemption

- EPCG License registration at customs/Bond Execution

- Representation with Government authorities for exporters and importers.

- Bond Cancellation at customs

[Not sure whether your company is taking all the Export incentives notified by the Govt? – Refer to our article on "18 latest Export promotion schemes/Export Incentives in India"]

We have a PAN India presence.

We would appreciate your comments and views on the above topic.