If you remember, a video was released on our channel on 7 February 2023, stating that the government is going to bring an amnesty scheme in the new foreign trade policy.

And on March 31, 2023, it proved to be true and the government has opened a special one-time window for this.

This amnesty scheme is a one-time solution for cases of default in export obligation by Advance and EPCG license holders. This means that you had taken the benefit of duty-free import under one of your advance license or EPCG license and you are no longer fulfilling the required export obligation, then with the help of this scheme you will have to pay less duty + interest and you can exit it.

On 1st April 2023, under Public Notice No.2/2023, the guidelines of this scheme have been given.

So in this blog, we will share all the details regarding the amnesty scheme like who is eligible? Can there be savings? What is the procedure?

Contents

Eligibility

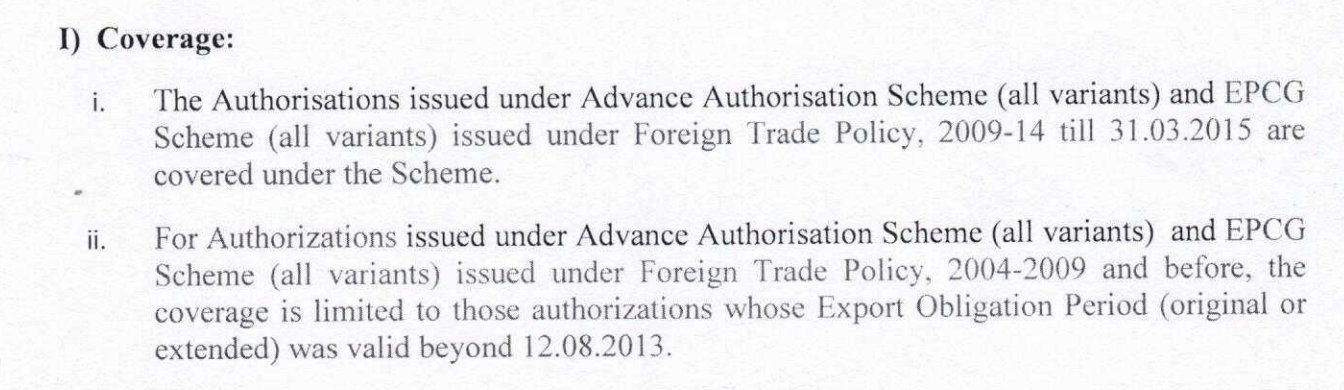

1st question is who is eligible for this scheme?

{Eligibility of Amnesty Scheme}

Image wise all advance licenses and epcg licenses under issue for ftp 2009-14 till 31.03.2015 are covered under this scheme. This means that this scheme is not eligible for any Advance or EPCG license issued after April 01, 2015.

And that too for all AA and EPCG licenses covered in the first issue of 2009, whose initial or extended EO period was valid after 12.08.2013.

Let us understand this second condition with the help of two-three examples.

Example 1 - Suppose you have taken an epcg license that is dated. 21.11.2005, whose EO period was for 8 years. This means the last date of your EO period was 21.11.2013. And because your pay period is still valid after 12.08.2013, you are eligible for this scheme

2nd Example - Suppose you have a date in one of your EPCG licenses. 21.11.2003, which means EO period for 8 years, means the last date of your EO period is 21.11.2011. But you had extended its EO for two more years and got it done till 21.11.2013. And now as your extended EO period is valid even after 12.08.2013, you are eligible for this scheme.

3rd Example - Suppose you have taken an advance license which is dated. 21.11.2007, whose initial EO period was of 3 years. You had also taken an extension of 1 year on that. Still, your last date of EO will be - 21.11.2011, and as your extended EO period was also not valid beyond 12.08.2013, you are not eligible for this scheme

Remember one thing this clause dated 12.08.2013 is only for those licenses which were issued before FTP 2009-14. If any license is issued under FTP 2009-14 up to 31.03.2015 by default is eligible even if its EO period expires anytime

Benefits of this Amnesty Scheme

Hope the eligibility is clear now. Now understand what is actually going to be beneficial in this scheme.

In a normal case if the case is not adjudicated then you have to pay duty + interest for all the years starting from the date of import. And if your case has been adjudicated, then the penalty amount is also added to it. While the interest subvention under the scheme is limited to 100%. and interest on the component of Additional Duty of Customs and Special Additional Duty of Customs is not to be paid.

Let us understand this with the help of an example:

{Benefits of Amnesty Scheme}

Suppose you have taken an advance license such that the CIF value is Rs. 100. If you have not completed any EO, then you have to pay duty + interest on the entire import. Suppose the total import duty [including Additional Duty of Customs and Special Additional Duty of Customs] is Rs.50. The value after deducting the duty exempt portion [means additional duty of customs and special additional duty of customs] is Rs.32. So the maximum interest you can get is Rs. 32 only to be paid.

This means to close this case you have to pay only Rs. 50 + 32 = Rs.82 only to be paid.

Watch this video on Amnesty Scheme, which explains the eligibility, benefits & procedure, and how we at AFLEO Group can assist you to avail the advantages of the scheme

Practical Example & Comparison

Now understand the importance of this scheme with actual numbers

Suppose you have taken an EPCG license on 1st January 2006 and the cost of the machine is 20 lakhs. The total custom duty is 10 lakhs and after deducting additional custom duty and special additional customs duty comes to 5 lakhs. Now let us compare Duty + Interest to be paid for Normal case vs Amnesty Scheme

| Particulars | Normal case | Amnesty Scheme |

|---|---|---|

| Total Duties to be Paid | Rs. 10 lakh | Rs. 10 lakh |

| Interest | 15% Annual Interest to be paid on entire 10 Lakhs for 17 years which comes out to be Rs. 25,50,000 | Maximum Interest to be paid Rs. 5 Lakhs |

| Total Duty + Interest | 35 Lakhs | 15 Lakhs |

| Savings | NIL | Roughly 20 Lakhs |

{Example & comparison for Amnesty scheme}

It is understood from this table that even a normal EPCG license with machine value of 20 lakhs can be saved up to 20 lakhs. This scheme will be more beneficial for big licenses.

Process

If you are eligible and want to take advantage of this scheme, then you will have to register by filling an application form on the website of DGFT before 30.06.2023

The last date for payment of customs duty after registering is 30.09.2023.

Any case under investigation or adjudication for fraud/misdeclaration/unauthorized diversion of materials and/or capital goods will not be eligible for the scheme. While normal adjudication cases are allowed.

All may please note that the facility is one-time and will lapse on 30.09.2023 if no extension is received. Hence the license holders need to act fast.

Who are we Why Choose Us?

We at Afleo Group, are a team of DGFT & Customs Experts having a rich experience of 10+ Years in Exim Consultancy & International Logistics [Freight Forwarding]. With our vast knowledge and experience in this field, we can represent your case for all the activities pertaining to the Amnesty Scheme and get it cleared in a hassle-free manner.

So do get in touch with us for any of your requirements and our team will be happy to help you.

We request you share this information with your other Industry friends, Trade associations, as this information might help them as well.