The Objective of the Advance License Scheme introduced under foreign trade policy is to provide duty-free raw materials and inputs required to manufacture the export products. The Manufacturer exporter or the Merchant exporter tied with supporting Manufacturers is eligible to take the benefits of the Advance Authorisation Scheme.

The following exports are eligible to avail the benefits of Advance License:-

- Physical Exports.

- Exports to SEZ.

- Intermediate supply to another Advance License Holder.

- Deemed exports such as Exports to EOU, BTP, EHTP units, etc.

Now, the Advance License procedure is quite complex. It involves liaising with both DGFT and Custom Authorities. A proper understanding of the entire process is important to avoid any difficulty while applying & closing of Advance License. This article intends to give you a fair idea about the entire Advance License procedure as a whole.

Contents

Advance License Procedure

An Advance License is obtained from DGFT and it also has to be closed after all the compliances are met and export obligation is completed. Let us now understand the entire Advance License procedure in a step by step manner.

Step 1 - Make a list of all the raw materials required for duty-free Import

Make a list of all the raw materials required along with their Quantities for the manufacture of 1 Unit of Export Product. This list will be important in the entire Advance License process. It will give clarity and also help to decide the Advance License method under which application needs to be done.

Step 2 - Application for Advance License at DGFT

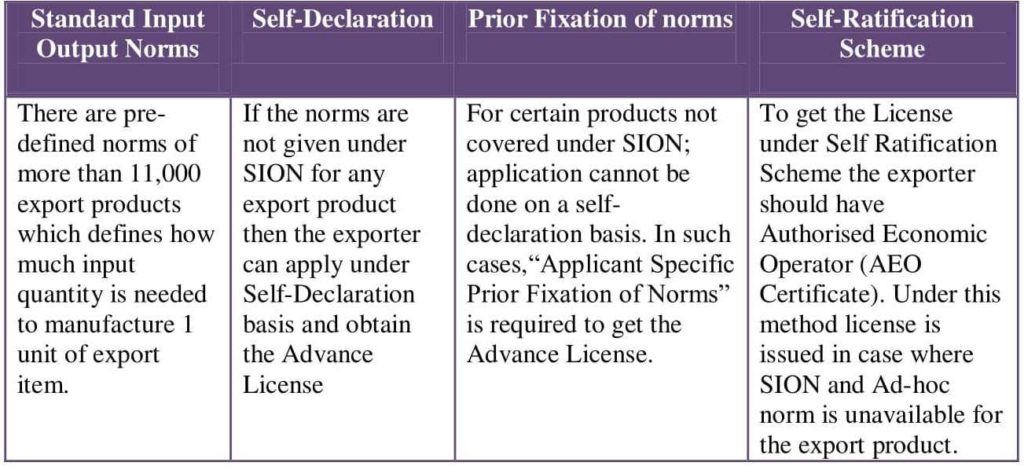

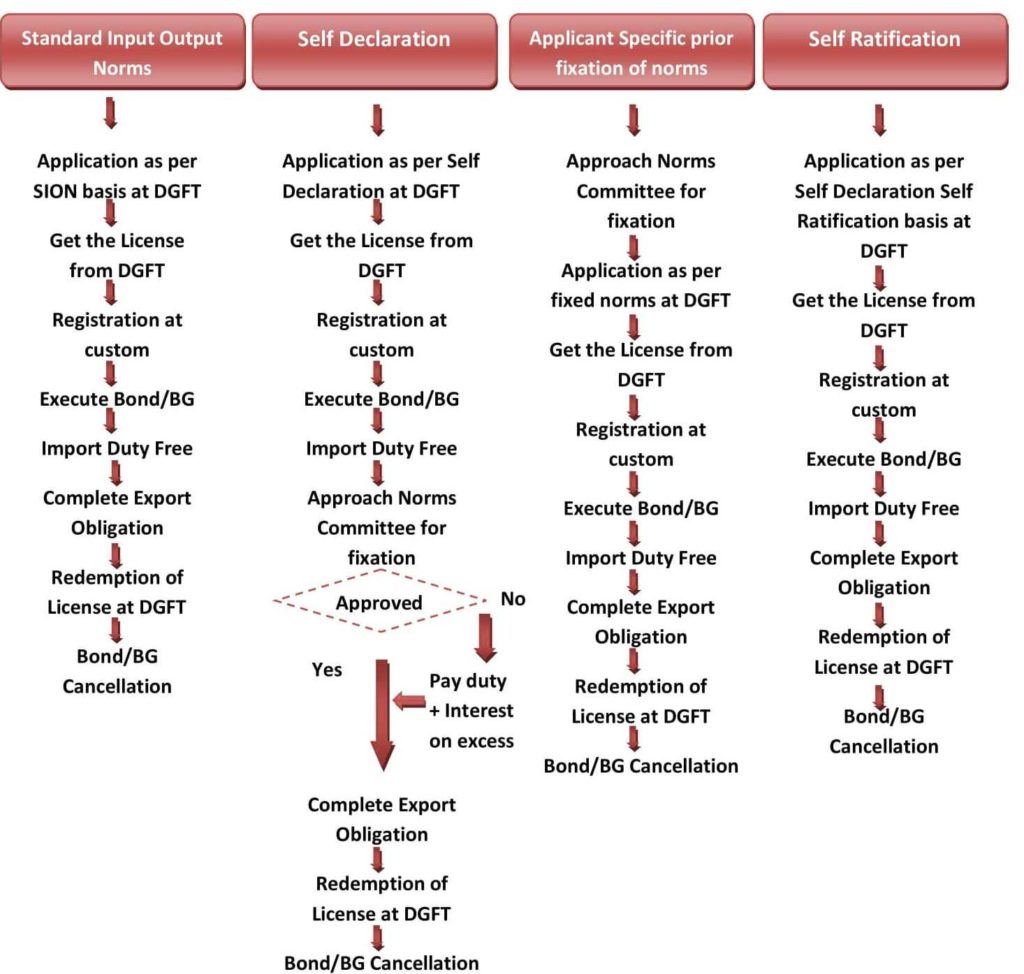

There are following four methods to get the Advance License from the DGFT:

- SION (Standard Input Output Norms)

- Self-Declaration basis.

- Prior Fixation of norms

- Self-Ratification basis

Application to get an Advance License has to be made electronically to the jurisdictional DGFT office with the help of a Digital Signature. Some of the Important documents required are:

- The valid copy of IEC and RCMC (Registration Cum-Membership Certificate),

-

- IEC/RCMC should show the applicant as a manufacturer exporter.

- IEC/RCMC should have the address where the raw materials are proposed to be taken for processing.

- Application form ANF 4A – 2 copies duly filled with striking off inapplicable options and tick marking applicable options.

- Copy of SSI/IEM/MSME/Copy of GST Certificate

-

- MSME/SSI/Manufacturing proof should have the export products listed in the Advance License.

- Copy of Export House Certificate (If Applicable)

After arranging all the required documents online application shall be done on the DGFT Website – www.dgft.gov.in with the help of DSC. After login - Select Services from Online Ecom Application and click on “Advance Authorisation".

Fill all the required details and attach the necessary documents and submit the application.

DGFT will issue the License after a successful application.

Step 3 - Registration of Advance License at Customs

After License issuance from the DGFT, the next important step shall be the registration of license at customs to check the genuineness of the License issued from DGFT.

License registration at the Port where the imported material shall come is mandatory to be able to clear the material at the Port. Customs Department will execute a bond or bank guarantee at the time of license registration at the port.

Step 4 – Import Raw Materials/Inputs Duty-free

After executing the Bond/BG at the time of registration of license at custom, now the exporter will be able to clear the material imported at the port. The inputs imported under the Advance License shall be subject to Actual User condition, which shall not be transferred even after the completion of export obligation.

Take the raw materials to the factory address and start manufacturing the export product to complete the export obligation.

Step 5 - Export Obligation under Advance Authorisation Scheme

Export Obligation is the condition to issue the license under the Advance Authorisation scheme. While the exporter enjoys the benefits of duty-free import, they are required to achieve a certain target of exports (Value added goods of the imported materials), and this requirement is known as an Export Obligation. Export Obligation is mentioned on the license received under the scheme and should be fulfilled both in terms of quantity & value.

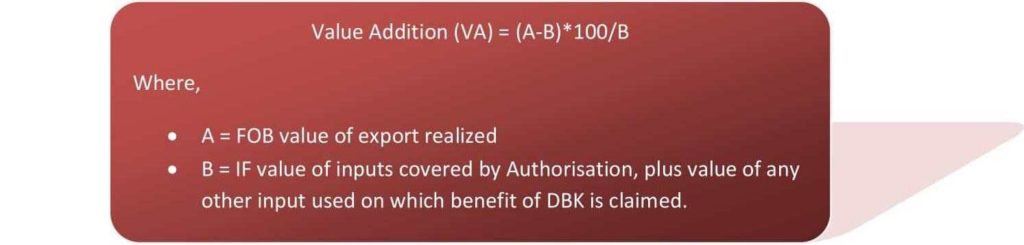

Calculation of Value Addition

Under the Advance Authorisation Scheme, the minimum value addition required to be achieved is 15%.[It may be more or less for some specific products]

To calculate the value addition:-

Example:-

Consider an exporter importing the inputs worth 500 Rs and the product made with the input for the export is worth 600 Rs, Then the value addition would be calculated as follows -

VA ={(600-500)/500}*100

= {100/500} * 100

= 0.2*100

= 20%

Value Addition would be 20%.

Another Export obligation is the time period. Validity to import is 12 months from the License issue date; whereas the period to complete export is 18 months from the license issue date.

Step 6 - Redemption/Closure of Advance License at DGFT

After Completion of the Export Obligation (EO), the exporter has to submit relevant proof of export to DGFT for the closure of the Advance License.

For the redemption of the advance License, the exporter has to submit the Application form ANF 4F to the regional authority of DGFT with the signature on each page of the form.

All the details about the authorization and the applicant need to be filled in the ANF such as Authorisation No, issuance date, CIF Value of the license, Export obligation, Norms Details.

Export details including the Shipping bills no, export quantity, FOB Value shall be specified in the application form. The form will also include the information about the Import Items such as Quantity and CIF value of import, bill of entry details, etc.

After checking the completeness of the application in every aspect the regional authority of DGFT will issue the Export Obligation Discharge Certificate/ Redemption Letter to the Authorisation holder.

[ To know each and every detail about the EODC/Redemption of Advance Authorisation online on the newly launched DGFT portal watch the complete video given below-]

Step 7 - Bond/BG Cancellation at Customs

After the redemption/closure of the Advance license from DGFT, the last and the important step in the Advance License procedure is the cancellation of the Bond/Bank Guarantee which has been executed at the time of Import. To complete the last step Redemption Letter/Original EODC has to be submitted to the customs with the following documents.

- Original Advance License

- ANF 4F duly Certified by Charted Accountant

- No Bond Certificate

- Copy of Shipping bills

- Copy of Bill of Entry

- Other relevant documents submitted to DGFT

Therefore to summarize, Please find below a simple flowchart explaining the Advance License procedure under all the four application methods starting from the application stage to the redemption stage of the Advance license:

How Afleo Consultant can help you?

Afleo Consultants can help you with the Application as well as the closure of Advance License with DGFT & Customs. With more than 10+ Years of experience, we can also guide you with all the procedures related to the Advance Authorization Scheme.

We are the leading Import Export Consultant (DGFT Consultant) having a client-base across India. We provide all the services related to DGFT which includes the MEIS scheme, EPCG, SEIS, Advance Authorisation, DFIA, RoSCTL scheme, TMA scheme, RoDTEP scheme, etc.

Please share your thoughts about the article in the comments section below.

Fill the below form and get in contact with us for more details.

DOCUMENT FORMALITY REQUIRE FOR OBTAINING DFIA LICENSE.

PROCEDURE OF EXPORT AND IMPORT IN DFIA

The procedure shown is manual but now in the era of automation the above procedure is not helpful and useful

Respected Sir,

Thanks for commenting.

Advance License Closure/Redemption is now an online process – Get complete details here – “How to apply for Online EODC/Redemption/Closure of Advance Authorisation (Advance License) – Step by Step Guide“

if importer fail to complete their EO.

now Plan to make the duty payment with interest.

but material was imported from Korea under Preferential CEPA & duty should be 0% but however we have cleared the cargo under AA.

so can we use CEPA COO to make 0%??

Respected Sir,

In such cases, you have to approach the Policy Relaxation Committee (PRC) at DGFT New Delhi for relaxation.

Get in touch with us for more details.

Sir Above Procedure is confirm for advance license and which are document are required we need for export purpose