List of services

AFLEO Consultants

DGFT Regional office

- IEC and its modification/Yearly Update/IEC Surrender.

- Revoke IEC from DEL, Suspension, Cancellation etc / Merger/Demerger of IEC’s.

- DGFT Identity card.

- Advance License - Issuance and Redemptions

- Export Promotion Capital Goods (EPCG) License - Issuance and Redemptions

- Duty-Free Import Authorization (DFIA)

- Remission of duties or Taxes on Export Product (RoDTEP)

- Merchandise Export from India Scheme (MEIS).

- Services Export from India Scheme (SEIS).

- Rebate of State and Central Taxes and Levies (RoSCTL)

- Transport and Marketing Assistance (TMA)

- Certificates of origin (COO) - SAPTA, APTA, ISLFTA, GSTP, India-Dubai CEPA etc.

- Import Monitoring System - (Steel Import Monitoring System, Coal Import Monitoring System,Copper/Aluminium Import Monitoring System, Chip Import Monitoring System)

- Deemed Export Benefits – Apply for Refund of TED/DBK/Brand rate Fixation.

- Star Export House Certificate.

- Free Sale & Commerce Certificate, End User Certificate.

- Enforcement cum Adjudication Proceedings at RA Mumbai.

- E-RCMC Certificate from DGFT – APEDA, FIEO, EEPC, PHARMEXCIL, CHEMEXCIL ETC.

- Gems & Jewelry Schemes.

- Application for Interest Equalization Scheme.

- REX Registration.

- Abeyance Cases for IEC’s in DEL.

- FREE SALE AND COMMERCE CERTIFICATE.

- END USER CERTIFICATE.

DGFT HQ, New Delhi

- Norms Fixation - Handling 25+ Norms Fixation cases every month across various Product groups. (Engineering, Pharmaceutical, Chemical, Textiles & Leather, Plastic & Rubber, Food, Sports & Misc. products)

- Policy Relaxation Committee (PRC Matters) - Proudly representing 20+ cases every month.

- EPCG Committee Approvals - Handling 10+ complex cases every month.

- Permission for Restricted/Negative list of Import Items & Export Items - Experience in Handling 100+ cases till date.

- Registration Certificates for Export & Import Items.

- SCOMET Licenses.

- TRQ (Tariff Rate Quotas)

- Appeal Matters under FTP.

Custom Related Services

- AA/EPCG/DFIA License Registration.

- Bond & Bank Guarantee (BG) Cancellation of EPCG/Advance License.

- ICEGATE Registration.

- Refund under Section 74.

- Pending Duty Drawback from Customs.

- Factory stuffing– Self-sealing permission. [FSP]

- Pending IGST Refund from Customs.

- Removal of IEC from Alert list of Customs.

- GST Services – Refund of ITC from GST.

- Authorized Economic Operator (AEO T1, T2 & T3) certification.

- Reply & Follow-up of Customs Notices if any.

- GST Services – Refund of GST for Service Exporters.

- AD Code/IFSC Registration.

- SIIB Matters (Special Investigation and Intelligence Branch)

- SVB Matters.

- Registration Procedures for First time Importers/ Exporters

- DPD/DPE Registration.

Other Certification:

- All Types of Digital Signature Certificates.

- Health Certificate for Export Products

- EPR Certification for Producers, Importers and Brand owners.

- Phytosanitory Certificate.

- BIS Certification.

- Banking & RBI related liaison for Exporters & Importers.

- Sea Cargo Consolidation – Import & Export

- Sea Freight Forwarding - Import & Export

- Air freight - Import & Export

- Land freight

- Warehousing

- Customs clearance

- Insurance

- Buying of scrips - MEIS / SEIS / RoDTEP / RoSCTL / DFIA

- Selling of scrips - MEIS / SEIS / RoDTEP / RoSCTL / DFIA

Find our brochure for more details:

An Overview

Advance Authorisation Scheme (AAS) or Advance License Scheme is a type of duty exemption scheme introduced by the Government of India under the Foreign Trade Policy 2015-2020. Under this scheme, exemption from the payment of import duties is given to raw materials/inputs required for the manufacture of export products i.e., you can import raw materials/inputs at zero customs duty for the production of export products. The purpose of this scheme is to make India’s products competitive in the global market. When duties paid on raw materials are saved, it automatically brings down the cost of the final export product.

What can be imported duty-free under Advance Authorization Scheme?

In the Advance Authorisation Scheme, the exporter can import raw materials duty-free. As per Chapter 9 of FTP para, 9.44 “Raw material” means input(s) required for the manufacturing of goods. These inputs either can be in a raw/natural/unrefined/unmanufactured or manufactured state. Hence, Advance License is issued to allow duty-free import of inputs, which is physically incorporated in export products (after making normal allowance for wastage). In addition to this, fuel, oil, the catalyst which is consumed/utilized in the process of production of export product, may also be allowed.

Duties Exempted under the Advance Authorisation Scheme.

Imports under Advance License are exempted from the payment of Basic Customs Duty (BCD), Additional Customs Duty, Education Cess, Anti-dumping Duty, Countervailing Duty, Safeguard Duty, Transition Product Specific Safeguard Duty, wherever applicable. Under the Advance Authorisation, imports for physical exports are also exempted from the whole of the integrated tax and Compensation Cess and such imports shall be subject to pre-import condition. Imports against Advance Authorisations Scheme for the physical exports are exempted from Integrated Tax and Compensation Cess up to 31.03.2020 only. As per Notification No. 57/2015-20 dated 31.03.2020, this exemption is renewed till 31.03.2021.

Eligibility Criteria for Advance Authorisation Scheme DGFT.

Since Advance Authorisation Scheme comes with an actual user condition, it can be issued to either manufacturer exporter or merchant exporter tied with a supporting manufacturer.

As per the Para 4.05(c) of the FTP, Advance Authorisation is issued for:-

- Physical Export (including Export to SEZ).

- Intermediate Supply, i.e. supply to someone who is holding an Advance

License. - Supply of goods- Deemed exports.

- Supply of ‘stores’ on board of foreign going vessels/ aircraft.

Watch this short video on the Advance Authorisation Scheme which explains How does the scheme work? Who all are eligible to claim, its application process, export obligation & EODC/Redemption procedures & finally how can we at Afleo Consultants help you in getting Advance License benefits from the Govt.

What is the Advance License for Deemed Exports?

- Deemed Export: Deemed Export refers to the supply of finished goods that do not leave the country, and the payment of transaction can be in INR or free foreign exchange.

- Following are the categories of supply that are considered as Deemed Exports:

- Supply of goods to EOU / STP / EHTP / BTP units.

- Supply of goods against Advance Authorization / Advance Authorization for

annual requirement / DFIA - Supply of Capital Goods/Machinery against EPCG Authorization.

- Supply to other Government Funded projects, etc.

- One can apply for an Advance License for Deemed exports from the DGFT office.

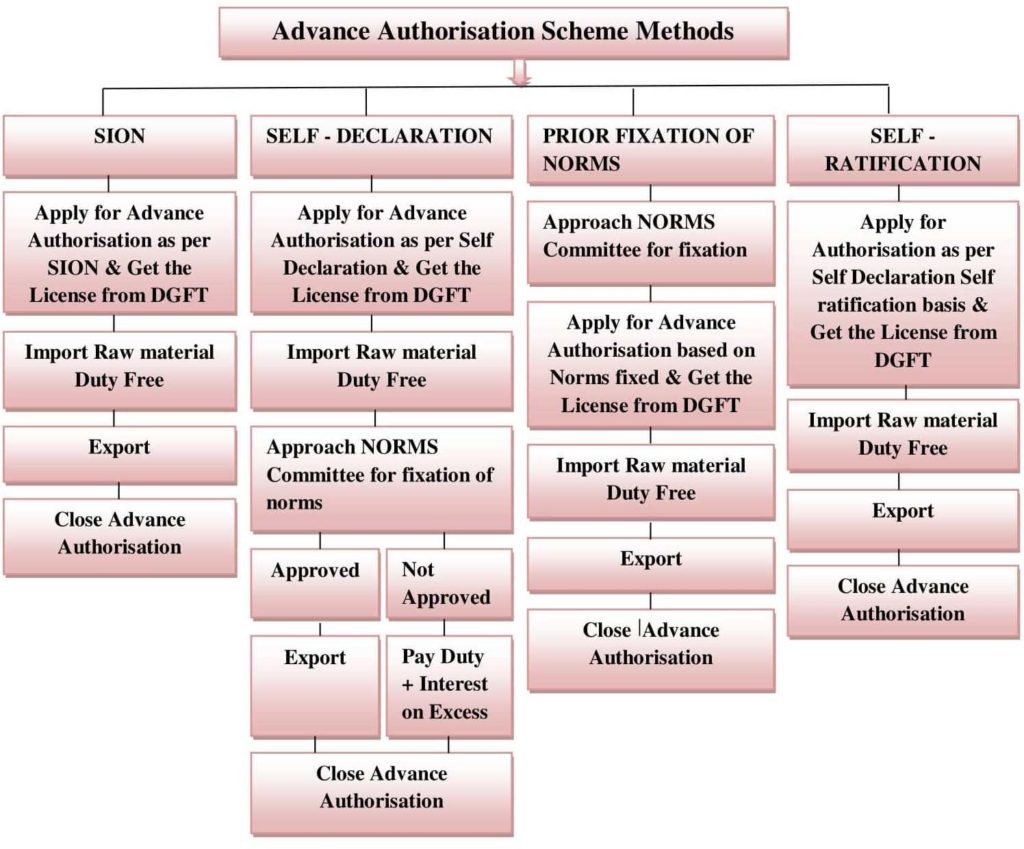

Methods for issuing Advance License.

An exporter can apply for fresh Advance Authorisation by four ways-

- SION (Standard Input and Output Norms).

- Based on Self-Declared Norms, to be approved subsequently (Under Para 4.07 of HBP, Ad-hoc Norms).

- Applicant Specific Prior-Fixation of Norms by the Norms Committee.

- Based on Self-Declaration & Self-Ratification. (Self-Ratification Advance Authorisation Scheme).

Standard Input-Output Norms (SION Norms)

Under this method, Norms for thousands of products falling under different segments like Chemical and allied products, Electronics, Engineering, Food products, Handicrafts, Leather, Plastics, Sports, textile, etc. are pre-fixed. In this method, you apply for Advance Authorisation License under the said Sr.NO. of SION and get the license from DGFT.

Self-Declared Norms

Under this method, an exporter can apply for an Advance Authorisation License on a self-declaration basis, if the required export product is not there in the SION or he is not satisfied with Import Quantity allowed. Here, he will select the Import Items and Quantity of Import Items as per his requirement. In this method, Applicant has to apply to the Norms Committee (DGFT Delhi) for fixation of Ad-hoc Norms and get the Norms Ratified. The advance License will be closed only if the norms are ratified/approved by the Norms Committee. However, if the applied norms are not accepted by the Norms Committee, then the applicant has to pay Customs Duty + Interest on the excess import quantity and close the Advance License.

Applicant Specific- Prior Fixation of Norms

Under this method, you have to first approach the Norms Committee and get the norms fixed/ratified. Only then DGFT will issue an Advance License based on the fixed norms. Rest all the procedure remains the same.

Self-Ratification Advance Authorisation Scheme

Fixation of Norms used to consume a lot of time & money. Hence keeping in mind the ease of doing business of the Government of India, DGFT introduced a new method known as the Self ratification Advance Authorisation Scheme. Under this method, Advance License will be issued by the DGFT on a self- declaration basis, but there is no need to approach the Norms Committee in Delhi to ratify your norms. It is assumed to be self ratified, and no further questions will be asked. However not all the exporters are eligible for this scheme, there are some conditions, please find them below:

- Only Exporter (either merchant or manufacturer) who holds an AEO Certification (Authorized Economic Operator) is eligible to opt for this scheme.

- The scheme shall not be available for all export products covered under Chapter 1 to 24 & Chapter 71 of ITC HS, etc.

- Inputs imported or locally procured shall be subject to pre-import condition. i.e., Inputs should be imported and physically incorporated in the export product before exports take place.

- An audit may be conducted by DGFT or any authorized person.

- If the result of the Audit points to any mis-declaration and/or it is detected that the inputs claimed are not used in the manufacturing process, or excess Qty of inputs is claimed than originally required/consumed. In such cases, demand and recovery actions will be initiated.

Documents required for applying for an Advance license from DGFT

Documents for filing Advance Authorisation application depends as per the above four methods. Please find below basic Important documents required-

- DGFT DSC.

- Copy of IEC.

- Application form ANF – 4A.

- Copy of SSI/IEM/MSME

- Copy of Export House Certificate (if applicable)

- Copy Valid RCMC

- Copy of GST Certificate.

Advance License scheme procedure

Please find an image below which explains all the above four methods in a simple and easily understandable manner-

Please find below procedure for online application of Advance Licence:

- Prepare documents as per the above-mentioned list of documents.

- Visit the DGFT Official Website- www.dgft.gov.in.

- Login with DSC & Select Services from Online Ecom Application.

- Click on Advance Authorisation (DES).

- Fill all the details and upload the necessary documents.

- Kindly note that the following important points to be noted to make sure the

documents are prepared error-free:- IEC/RCMC should show the applicant as a manufacturer exporter.

- IEC/RCMC should have the address where the raw materials are proposed to

be taken for processing. - MSME/SSI/Manufacturing proof should have the export products listed in the

Advance License.

- After filling all the details, submit the application.

- After a successful application, DGFT will issue the Advance License.

How can we assist you for Advance Authorisation Scheme?

Our experts assist you in getting Advance License Benefits from DGFT & Customs as under:

- We help you in preparing documents for application of Advance License.

- Obtaining Advance License from Director General of Foreign Trade.

- Guiding regarding the procedural requirement & Compliances to be followed by the Client after issuance of Advance Authorization.

- Obtaining Amendment, Enhancements or Extension for the Advance License.

- Getting Redemption Letter from DGFT RA and release of Bond after fulfilling the export obligation from Customs.

Important Terms & conditions under Advance Authorisation Scheme.

The benefit under Advance Authorisation scheme comes with certain terms and conditions, please find them below:

- Items prohibited for exports or imports are not allowed under AA.

- AA is issued Subject to Actual User Condition.

- Inter Unit Transfer of Inputs permitted.

- 15% is the minimum Value Addition to be achieved.

- Certain products have less/more Value Addition.

- Certain categories of Inputs are ineligible for benefits.

- Free of cost Material permitted for imports.

- Duty Drawback shall be available for only duty paid inputs used. (All Industry Rate of Drawback will not be available)

- Import of restricted items shall also be allowed under Advance Authorisation (AA) Scheme.

Actual User Condition under Advance Authorisation Scheme.

The material imported under Advance Authorisation shall be subject to the “Actual User” condition. It means that the material cannot be transferred and it has to be used in the premises of the License holder only. It is not transferrable even after the completion of Export Obligation (EO). However, the Advance License holder will have the option to dispose of/sell products manufactured out of duty-free input once the Export Obligation is completed.

Pre-Import Condition under Advance Authorisation Scheme.

It means that the raw material should be imported first; physically incorporated in the export product and then the export should take place. You cannot export first using the duty paid material that you have and then Import raw material duty-free. This is not allowed. Items that have the pre import condition have been indicated in Appendix 4J or SION Norms List.

Value-Addition under Advance Authorisation Scheme.

Value Addition shall be:![]()

Where,

A = FOB value of export realized or the FOR value of supply received.

B = CIF value of inputs covered by the authorisation, plus the value of any

other input used on which benefit of DBK is claimed or intended to be claimed.

Invalidation Letter under Advance License.

In case the exporter does not want to import directly under Advance Authorisation, i.e. he wants to procure raw materials indigenously from a domestic supplier. Then he/she needs to invalidate the Advance License for direct import and obtain the Invalidation letter from DGFT. Invalidation Letter is issued by DGFT RA at the time of Advance Authorisation or subsequently. The validity of the Invalidation letter is co-terminus with the validity of Advance Authorisation.

Redemption of Advance License / EODC.

On completion of the imports and exports, the license holder shall submit an application in ANF-4F for the Redemption of the Advance Authorisation License. The Regional Authority of DGFT will verify the completeness of the Application in all aspects. If Export Obligation (EO) and other conditions have been successfully fulfilled, the Regional Authority (RA) will issue the EODC (Export Obligation Discharge Certificate)/ Redemption Certificate to the Authorisation holder.

[ To know each and every detail about the EODC/Redemption of Advance Authorisation online on the newly launched DGFT portal watch the complete video given below- ]

FAQ's

To increase export from the country, our Government has introduced

various schemes. And one of them is the Advance Authorisation Scheme or also

known as the Advance License., in which we can import raw materials/inputs

required for the production of the export product at Zero Custom Duty, i.e., duty-

free. Oil, and catalyst, utilized in the process of production of export products, may also be allowed for duty-free import. An Export Obligation is set as a condition for

issuing the Advance License.

The Advance Authorisation Scheme is in place for the last 20-30 years. However, after the GST law has passed, there are many modifications done under the scheme. Earlier, the duties exempted include Basic Customs Duty, CVD, SAD, etc. However, for the Advance Authorisations Scheme under the GST, the import duties exempted include the Basic Customs duty, Integrated GST (IGST), Compensation Cess, etc. Exemption from payment of IGST and Compensation Cess is granted with following conditions:

- Only when AA is taken for physical exports.

- Imports that are exempted will be subject to pre-import conditions.

- The exemptions are valid only till 31.03.2021 (the date may change. Please

refer to the latest notification).

One can apply for the Advance License from Directorate General of Foreign Trade (DGFT) on the following basis- SION, Self-Declaration, Prior Fixation of Norms by Norms Committee, and By Self-Ratification Basis. While applying online, we will require a digital signature of the applicant. The applicant can be a manufacturer exporter or Merchant Exporter. He should have IEC and RCMC with the factory address mentioned. In the case of Merchant Exporter, supporting manufacturer details should be mentioned. We need to fill the online form ANF 4A and upload the required documents.

Please find the below steps that show the entire working of Advance

License Scheme –

- First, we need to apply for an Advance Authorisation at the Jurisdictional DGFT

office. - The Advance License issued from the DGFT will have all the details like

Export/Import Item description, HS Code, Quantity, FOB/CIF Value on it. - Then the said License should be registered at Customs – Port of Registration.

- Along with the registration, Exporters need to executive Bond/LUT with the

Customs Authority. - Then the raw materials can be imported duty-free and should be taken to

factory premises for the production of the export item. - Once Export Obligation under the Advance Authorisation scheme is completed,

the License can be closed, and Bond can be cancelled.

Duty Exemption Entitlement Certificate Scheme (DEEC Scheme) is an export promotion scheme, which enables duty-free import of inputs required for the manufacture of export products. DGFT issue Advance License to manufacturer/merchant exporter under DEEC Scheme for import of inputs at zero customs duty.

For importing duty-free raw materials, the exporter has to take Advance License. To import Capital goods duty-free, the exporter has to take EPCG License.

In Advance Authorisation, the exporter can import raw materials duty-free, i.e. zero custom duty. In Duty Drawback, the exporter has to pay all the customs duty while importing and then after exporting he can request for refund of customs duty.

Advance Authorisation Scheme(AAS) | Duty-Free Import Authorisation Scheme (DFIA) |

| In AAS, Exporter will receive a license, and then he will import and export | In DFIA, Exporter will export against file number, and then import license will be issued as per export. It is a post-export benefit. |

| In AAS, License received is not transferable. | In DFIA, License received is transferable. |

The Exporter has to fill online application form ANF 4A with the above relevant documents. We have experts who can help you to fill online application and to prepare documents as per DGFT guidelines and follow-up to get Advance License from DGFT.

For applying Advance Authorisation, the application fee depends on the CIF value of the Import product.

Duty-Free import benefit under Advance Authorisation comes with the commitment to Export certain pre-defined quantity and value of goods after using the imported raw material. This commitment to export is known as Export Obligation.

The Export Obligation under Advance Authorisation Scheme is of two types:

- Quantity-wise Export Obligation – Quantity of export made should be

proportionate to the number of imports made, as per Norms. - Value-wise Export Obligation – 15% Value addition has to be compulsorily

maintained in the Advance Authorization Scheme. - Note: Different value addition method can be prescribed for the Gems and

Jewelry sector, Tea, etc.

- The period of fulfillment of Export Obligation in Advance Authorisation is 18

months from the license issue date. - In the case of Deemed Export, the Export Obligation period depends on the

completion of the project. - But in case of exporting products related to defense, military store, aerospace,

and nuclear energy, the Export Obligation period will be of 24 months or co-

terminus with contracted duration of the export order whichever is more. - Also, please find below the import product list with their Export Obligation

period specified by DGFT as per Appendix 4J-Sr.No. Import Product List Export Obligation period 1 Spice

(a) Pepper; cardamom and chilies for Value Addition purpose like crushing / grinding /sterilisation or for manufacture of oils and oleoresins and not for simple cleaning, grading, repacking etc.

(b) Spices other than pepper, cardamom and chilies for manufacture of Spice oils. Oleoresins

(c) Other than (a) & (b) above.120 days However, for imports completed up to 31.12.2008, Export Obligation Period (EOP) shall be 150 days.

12 months.

90 days

2 Drugs (with a specific export order and pre-import condition) 12 months. 3 Penicillin and its salts [ITC(HS) Code No. 29411010] 12 months. 4 Tea 6 months. 5 Coconut Oil 90 days 6 Silk in any form 9 months. 7 Drugs from unregistered sources 12 months. 8 Precious Metal/Gold/Silver/Platinum 120 ys

Export Obligation product list BY DGFT

Standard input-output norms, in other words, we can say the standard norms which define the quantity of inputs/raw materials required to manufacture one unit of the export product. Under the SION, Norms for thousands of products falling under the different segments like chemical and allied products, electronics, Engineering, food products, handicrafts, leather, plastics, sports, textile, etc. are pre-defined by the DGFT.

As the name suggest, Annual Advance authorisation is taken by an exporter for his/her annual requirements. This provision of an annual license is given to avoid issuance of a large number of the Advance Authorisation by an exporter for a particular year. Thereby reducing compliance and saving time. However, there are specific criteria to be eligible for the application under the Advance Authorisation for the annual requirement. They are:

- Applicant should have made exports in at least preceding two Financial Years.

- The maximum entitlement of CIF would be 300% of the FOB value of previous FY or 1 Cr whichever is higher.

- It can only be applied for the products which are in SION or Adhoc Norms fixed category.

In Special Advance Authorisation Scheme, we can import duty-free fabric for the export of articles of apparel and clothing accessories. The exporter can apply as per SION. The Authorisation holder can import relevant fabrics and no other inputs like

packing material, fuel, oil, and catalyst will be allowed to import under this Special Advance Authorisation. The fabric imported against the authorisation is as per actual user condition and it is non-transferable also after fulfillment of Export Obligation. But it is transferable for job work if any. Duty Drawback would also be available on the other domestically procured inputs.

No, benefit under both schemes cannot be taken simultaneously. You can choose only one scheme. Carefully calculate the benefit under each scheme and then make a decision.

In such cases, you can claim the brand rate of Duty drawback on domestically procured/or duty paid imported raw material. At the time of making an application for Advance Authorisation Scheme, you have to indicate details of such duty paid inputs. The process is called brand rate fixation of duty drawback.

Yes, raw materials can be procured domestically. In such cases, DGFT will issue an Invalidation letter to invalidate the license for direct import. In some cases, DGFT may also issue an Advance Release Order (ARO).

It typically takes 15-20 working days to get Advance License from DGFT. We have experts who can accurately prepare documents as per DGFT’s requirements and get Advance License within 5-10 working days.

The Exporter has to fill the ANF 4F with relevant export documents to close Advance License.

Yes, We do have a team who will help you in the redemption of Advance License.

Yes, the Authorisation holder can surrender the license if not used to import duty-free.

On receiving the Advance License from DGFT, the next step would be to register the license at Customs. It is not possible to clear the raw materials duty-free unless you register the license at the port where the consignment will arrive. License is registered to the port of customs as mentioned in the license.

Yes, it is mandatory to register the Advance License at customs to import duty-free raw materials.

No, the Advance License is not transferable even after the holder has fulfilled the Export Obligation. This means that raw materials cannot be transferred even after the Export Obligation is completed. However, finished products made from excess raw materials may be disposed of/sold.

No, Advance License is not possible to sell. Also, not after fulfilling an export obligation.

Why Afleo Consultants?

- We only have the goal of providing very reliable services with the most competitive cost to the exporters under one roof.

- Social Media Presence: We wish to get every opportunity to grow our relationships with our clients and for which we made our presence on each social networking sites to update them about the latest Notifications, Circulars, Amendment done in foreign trade policies.

- 24/7 Telephonic Service: We believe in offering better and faster services to our clients who can't afford to wait until the morning for a problem to be fixed we are just a phone call away, they just need to call or drop a mail and we try to reach them as soon as possible.

- We have a separate team for follow up with DGFT and have a great understanding of the working of DGFT office, which helps us in obtaining & Closing Advance licenses without delay.

Latest Updates on Advance Authorisation Scheme

- Notification No. 71/2023 Dated. 11th March 2024: Enabling provisions for import of inputs that are subjected to mandatory Quality Control Orders (QCOs) by Advance Authorisation holders, EOU and SEZ - As everyone knows, the Government is implementing Quality Control Orders (QCOs) to halt the import of sub-standard products. For example, the Bureau of Indian Standards (BIS) has introduced QCOs for steel and various other products. According to the latest notification from the Directorate General of Foreign Trade (DGFT), the import of such products is exempted from QCO if it is imported under an Advance Authorisation License or by 100% Export Oriented Units (EOUs). An additional condition is that imports will be subject to a pre-import condition, and when applying for the Advance Authorisation, the applicant must specifically endorse that exemption from mandatory QCO is being sought for this License. There are currently three Ministries/Departments i.e. Ministry of Steel / Department for Promotion of Industry and Internal Trade [DPIIT] / Ministry of Textiles whose notifications on mandatory QCOs are exempted by DGFT.

Fill the below form to get in touch with us

Insights

- Restricted Import License for Laptops, Tablets, Personal Computers, Servers etc. February 12, 2024

- IGST Refund on Exports – All you need to know February 12, 2024

- EPR Targets under Plastic Waste Management Rules October 10, 2023

- Export Import [EXIM] Business Weekly Updates – General News | New Notifications | 28 Aug to 24 Sep 2023 September 26, 2023

- Export Obligation Period [EOP/EO] Extension under EPCG Scheme | COVID Relaxations, Process, Fees etc. September 12, 2023

Our Office

Unit No. 207, Centrum IT Park, Wagle Estate, Thane West, Mumbai, Maharashtra 400604

Drop a Line

You may contact us by filling in this form any time you need professional support.