GST, i.e., Goods and Services Tax, rolled out in July 2017 transformed the whole taxation system in India. GST, which is a major economic reform, impacted all trading and business activities across the country. Thus, every person doing any business, selling any goods or providing any services from anywhere in India needs to have GST knowledge. A person running a Start-Up to a person having its own general stores shop, all would be affected by GST law.

The very purpose of this article is to provide a basic understanding and the general overview of the GST Law. All the major concepts of the GST Act has been explained in this article.

What is GST?

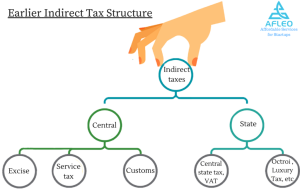

GST is a tax which applies to goods as well as services all over the country. It is levied on the manufacture, production, and sale of products and provision of services. It has replaced the majority of the existing Central taxes and State levies, changing the whole indirect tax structure.

Earlier Indirect Tax Structure

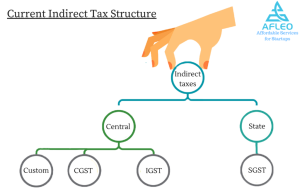

Current Indirect Tax Structure

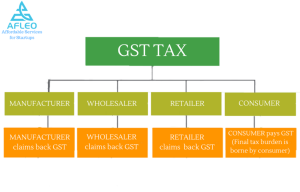

In simple terms, GST is collected by the registered taxable person and paid to the government. They can reduce their output tax liability by claiming set off of tax paid on purchases made by them. This means that only the end consumers are required to pay GST and borne the final tax burden whereas GST is claimable for manufacturer, wholesaler, and retailer.

GST TAX

CGST, SGST, IGST

GST is the first concurrent tax of the nation. Earlier, the taxes were charged either by the Central government or by the State government, but GST is levied concurrently by the Central and State Government.

CGST full form is Central Goods and Services Tax which is charged by the Central Government.

SGST full form is State Goods and Services Tax which is charged by State Governments.

IGST full form is Integrated Goods and Services Tax which is charged by the Central Government.

Union Territory Goods and Services Tax (UTGST) is charged by union territories. UTGST is identical to SGST but is levied by Union Territories of the country.

CGST and SGST/UTGST are levied on intra-state supplies and IGST is levied on inter-state supplies.

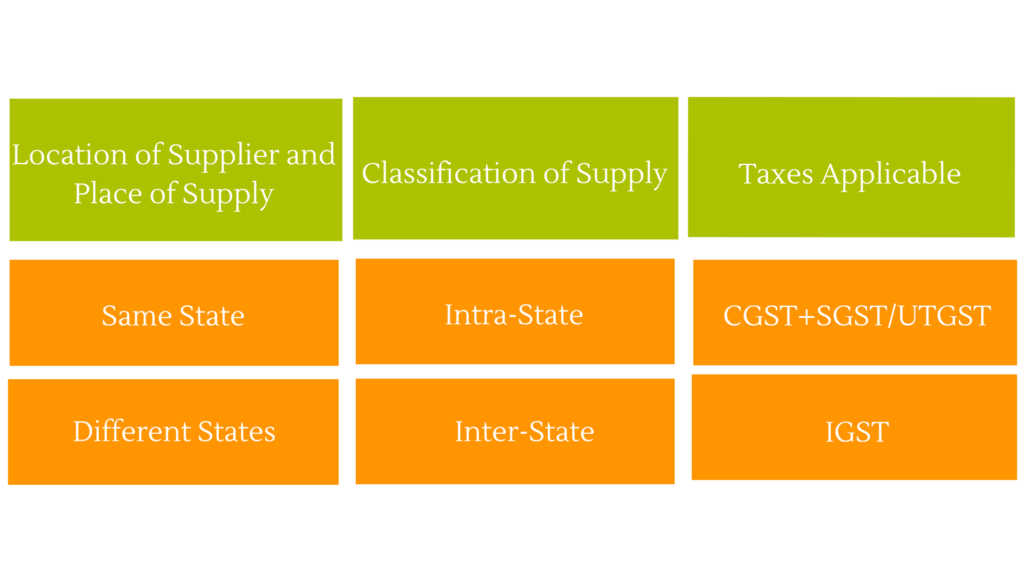

Intra-State Supplies and Inter-State Supplies

The applicability of CGST and SGST/UTGST or IGST depends upon the classification of supplies into intra-state and inter-state.

This classification is dependent upon two factors, location of the supplier (seller) and place of supply (where goods/services are consumed).

If the location of the supplier and the place of supply are in the same state, then it is an intra-state supply i.e., the supply is within the same state. For example, if Mr. M of Mumbai (Maharashtra) supplies goods to Mr. P in Pune (Maharashtra), then CGST and SGST would be applicable as it is an intra-state supply.

If the location of the supplier and the place of supply are in different states, then it is an inter-state supply, i.e., the supply is from one state to another state. For example, if Mr. M of Mumbai (Maharashtra) supplies goods to Mr. G in Surat (Gujarat), then IGST would be applicable as it is an inter-state supply.

Summary Table for above 2 points (2 and 3) is as follows:

Registration

The commencement point under GST compliance is to get registration under the GST Act. It is obligatory to register when the ‘aggregate turnover’ of the supplier exceeds the limit of Rs.20 Lakhs. In the North Eastern States, this limit is Rs.10 Lakhs. Here, the aggregate turnover of goods and/or services includes the value of taxable and exempt supplies and value of exports made. These supplies of goods and/or services are considered on a PAN-India basis.

The provision of voluntary registration is also available under GST. A person may register under GST prior to exceeding the threshold limit. However, once a person is registered, he will be required to abide by all the provisions of the GST Act.

Returns

After GST registration, next comes the GST returns. Every registered taxperson is required to file GST returns, even if the total turnover of any particular month/quarter is Nil. The return filing is mandatory compliance. The details of inward supplies (purchases), outward supplies (sales), input tax credit (tax paid on purchases), tax liability, exports made, imports made, etc. are to be provided in returns. Different types of returns are notified for the different class of taxpayers.

[For complete guide on GST Return Filling, you can visit https://afleo.com/registration/gst-return-filing/ ]

Concept of Supply

The concept of supply is crucial to understand the GST architecture. The taxable event under GST regime is supplying. Once the taxable event, i.e., supply occurs, GST is levied. The term ‘supply’ is defined u/s 7(1) of the SGST/CGST Act. The same definition also applies to the IGST Act.

The essentials of the ‘supply’ definition are as follows:

- All forms of supply such as sale or transfer, exchange or barter, lease or rental, license or disposal are liable to GST

- Supply includes the transactions wherein the goods/services are already supplied or are agreed to be supplied between the parties, which means GST is applicable on advances also. However, as per the notification issued by the government, GST liability does not arise on the advances received by the supplier for supply of goods (this relaxation is related to supply of goods only)

- Supply should be made for consideration or monetary value; however certain transactions are mentioned in Schedule I of the Act that comes under the scope of supply even though they are made without consideration

- Supply should be for business purpose

- Importation of services, whether for personal use or business purpose, comes under the scope of supply if it is made for a consideration

Concept of ITC and ITC Adjustment.

Input Tax means taxes paid on purchases of inputs, input services and capital goods which are used for the production, manufacture or supply of taxable goods and/or services. The registered taxpayers under GST can claim the amount of GST paid on the purchase of business inputs by setting off the tax paid amount against the output tax liability. This set off of input tax is known as Input Tax Credit (ITC). Only businesses which are registered under the GST Act can levy and collect GST from consumers and can claim ITC against output tax.

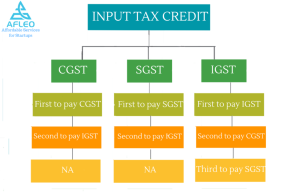

ITC Adjustment- How to adjust CGST/SGST/IGST?

- ITC of CGST shall be first utilized to pay CGST, and the remaining balance can be used to pay IGST

- ITC of SGST shall be first utilized to pay SGST, and the remaining balance can be used to pay IGST

- ITC of IGST shall be first utilized to pay IGST, then it can be used to pay CGST and the remaining balance can be used to pay SGST

The adjustment of ITC of CGST against the payment of SGST and vice versa is not allowed. The primary reason for such disallowance is that both the taxes are charged and collected by separate governments hence cross utilization is not permissible.

However, the same is not applicable to ITC of IGST. The very purpose of introducing IGST is to allow free flow of credits in a supply chain; hence ITC of IGST can be utilized against CGST as well as SGST.

Input Tax Credit

Tax Slabs/Rates under GST

The various tax rate slabs under GST are 0% (Nil)/5% /12% /18% /28%. All the goods and services are classified as per above slabs. With so many items in the tax list and multiple tax slabs, it can be difficult to keep track of what tax rate is applied to which item; hence it is necessary to have a breakdown of essential items in different tax slabs. The given below are a few examples of items under different slab rates:

0% (Nil) Rate– No tax will be charged on milk, curd, eggs, salt, fresh vegetables, education services, health services, etc.

5% Rate– 5% tax rate is applicable to items like sugar, tea, spices, fabric, coal, footwear below Rs.500, lifesaving drugs, etc.

12% Rate– 12% tax rate is applicable to the transportation of passengers by air (other than economy class) and items like butter, fruit juice, ghee, mobiles, etc.

18% Rate– 18% tax rate is applicable to restaurants having an air-conditioning facility or central heating, outdoor catering services, etc. It is applicable to items like toothpaste, soaps, pasta, footwear above Rs.500, etc.

28% Rate– Luxury items like television, refrigerator, washing machines, perfumes, chewing gum, etc. are covered under 28% slab rate.

Also, there are two more GST rates of 0.25% and 3% which are applicable for goods only. The items which are liable for 0.25% GST rate are rough and unworked diamonds and precious stones. The items which are liable for 3% GST rate are gold, silver, diamonds, precious stones, platinum, the scrap of precious metals, etc.

Non-GST/ Nil rated/ Exempted/ Zero-rated supplies

The differentiation between the above-mentioned supplies is extremely significant from the practical perspective. In filing GST returns, the registered taxperson is required to furnish these details. Let us understand each one of them.

Non-GST Supplies– The supply of goods/services which are outside the purview of GST law are known as non-taxable/non-GST supplies. GST law is not applicable to such supplies. For example, petroleum crude, aviation turbine fuel, alcohol for human consumption, etc.

Nil Rated Supplies– The goods and services which are listed under 0% tax rate slab are known as nil rated goods and services. 0% GST rate is applicable to the supply of such goods and services. For example, milk, curd, salt, fresh vegetables, etc.

Exempted Supplies– It includes non-GST supplies, nil rated supplies and certain specific supplies which are wholly exempted from levy of GST. The government notifies such specific-supplies from time to time.

Zero Rated Supplies– It includes the export of goods and services or supply of goods and services to Special Economic Zones (SEZ) or SEZ developers.

Conclusion

As can be seen from above, the gamut of GST is broad, and most of the businesses (small or big) and corporate entities are exposed to GST as a service provider, receiver of goods/services, importer and exporter of goods/services or otherwise. It is important to receive legal opinions on complex tax issues, interpretation of law and applicability of GST provisions on your business.

Afleo provides you with a helping hand by offering various advisory and consulting services for better GST compliance. If you require more information or have any queries, Please fill below form to get in touch and get your queries solved.