Restricted Import License

List of Services

AFLEO Consultants DGFT Regional office

- IEC and its modification/Yearly Update/IEC Surrender.

- Revoke IEC from DEL, Suspension, Cancellation etc / Merger/Demerger of IEC’s.

- DGFT Identity card.

- Advance License - Issuance and Redemptions

- Export Promotion Capital Goods (EPCG) License – Issuance and Redemptions

- Duty-Free Import Authorization (DFIA)

- Remission of Duties or Taxes on Export Product (RoDTEP)

- Merchandise Exports from India Scheme (MEIS)

- Services Exports from India Scheme (SEIS)

- Rebate of State and Central Taxes and Levies (RoSCTL)

- Transport and Marketing Assistance (TMA)

- Certificates of Origin (COO) – SAPTA, APTA, ISLFTA, GSTP, India–Dubai CEPA, etc.

- Import Monitoring System (IMS) – Steel IMS, Coal IMS, Copper/Aluminium IMS, Chip IMS

- Deemed Export Benefits – Apply for Refund of TED/DBK/Brand rate Fixation.

- Star Export House Certificate.

- Free Sale & Commerce Certificate, End User Certificate.

- Enforcement cum Adjudication Proceedings at RA Mumbai.

- E-RCMC Certificate from DGFT – APEDA, FIEO, EEPC, PHARMEXCIL, CHEMEXCIL ETC.

- Gems & Jewelry Schemes.

- Application for Interest Equalization Scheme.

- REX Registration.

- FREE SALE AND COMMERCE CERTIFICATE.

- Abeyance Cases for IEC’s in DEL.

- END USER CERTIFICATE.

DGFT HQ, New Delhi

- Norms Fixation - Handling 25+ Norms Fixation cases every month across various Product groups. (Engineering, Pharmaceutical, Chemical, Textiles & Leather, Plastic & Rubber, Food, Sports & Misc. products)

- Policy Relaxation Committee (PRC Matters) - Proudly representing 20+ cases every month.

- EPCG Committee Approvals - Handling 10+ complex cases every month

- Permission for Restricted/Negative list of Import Items & Export Items - Experience in Handling 100+ cases till date.

- Registration Certificates for Export & Import Items.

- SCOMET Licenses.

- TRQ (Tariff Rate Quotas)

- Appeal Matters under FTP.

Custom Related Services

- AA/EPCG/DFIA License Registration.

- Bond & Bank Guarantee (BG) Cancellation of EPCG/Advance License.

- ICEGATE Registration.

- Refund under Section 74.

- Pending Duty Drawback from Customs.

- Factory stuffing– Self-sealing permission. [FSP]

- Pending IGST Refund from Customs.

- Removal of IEC from the Alert list of Customs.

- GST Services – Refund of ITC from GST.

- Authorized Economic Operator (AEO T1, T2 & T3) certification.

- Reply & Follow-up of Customs Notices if any.

- GST Services – Refund of GST for Service Exporters.

- AD Code/IFSC Registration.

- SIIB Matters (Special Investigation and Intelligence Branch)

- SVB Matters.

- Registration Procedures for First-time Importers/ Exporters

- DPD/DPE Registration.

Other Certification:

- All Types of Digital Signature Certificates.

- Health Certificate for Export Products

- EPR Certification for Producers, Importers and Brand owners.

- Phytosanitory Certificate.

- BIS Certification.

- Banking & RBI related liaison for Exporters & Importers.

AFLEO logistics

- Sea Cargo Consolidation – Import & Export

- Sea Freight Forwarding - Import & Export

- Air freight - Import & Export

- Land freight

- Warehousing

- Customs clearance

- Insurance

AFLEO Global

- Buying of scrips - MEIS / SEIS / RoDTEP / RoSCTL / DFIA

- Selling of scrips - MEIS / SEIS / RoDTEP / RoSCTL / DFIA

Find our brochure for more details:

Table of Contents

Restricted Import License

- An Overview

- Latest Updates

- Where importer can find the Restrictive items list for Import License?

- The Application fee and validity of Restricted Import License

- Application Procedure for Restricted Imports authorization

- Important Points regarding the online application

- Amendment of Restricted Imports License

- Revalidation of Restricted Import License

- What is the EFC and what is the role of EFC in Restricted Import Authorisation?

- How we can assist you to get Restricted Import License?

- FAQ’s

- Why Afleo Consultants?

An Overview

Latest Updates

- Notification No. 31/2025-26 dated 23.09.2025:

DGFT has revised the SCOMET List (Appendix-3) of ITC(HS) 2022, effective 30 days post-issuance. The revised list is published on DGFT’s “Regulatory Updates → Import, Export & SCOMET Policy” page. - New DGFT Silver Import Policy 2025 (announced Sep 2025):

India has placed plain silver and unstudded silver jewellery (under CTH 7113) under a Restricted category until 31 March 2026, requiring importers to obtain DGFT licences. This change addresses an import surge, especially from Thailand, where silver imports jumped nearly tenfold. The amendment took effect immediately. - 17 June, 2025: Notification No. 18/2025-26:-

The Import Policy of items covered under the ITC (HS) codes 71102100, 71102900, 71103100, 71103900, 71104100 and 71104900 is “Free”. However, import of Palladium, Rhodium and Iridium alloy consisting of gold more than 1 percent (1%) by weight is “Restricted”. - 17 June, 2025 : Notification No. 19 /2025-26:-

The Import Policy of items covered under CTH 2843 is revised from “Free” to “Restricted”, with immediate effect. - 14th September 2021: TRADE NOTICE 17/2021-22

Procedure for refund of application fees deposited by applicants for Restricted Import Authorisation of Pulses for the period 2021-22 –reg. - According to Trade Notice No. 47/2020-21 : Dated 23rd March 2021:

Issuance of Import Authorization for ‘Restricted’ items from DGFT HQs w.e.f. 22.03.2021, the DGFT has introduced a new online module for import authorisation for restricted items. So the import authorisation for restricted items needs to be submitted online to DGFT HQ.

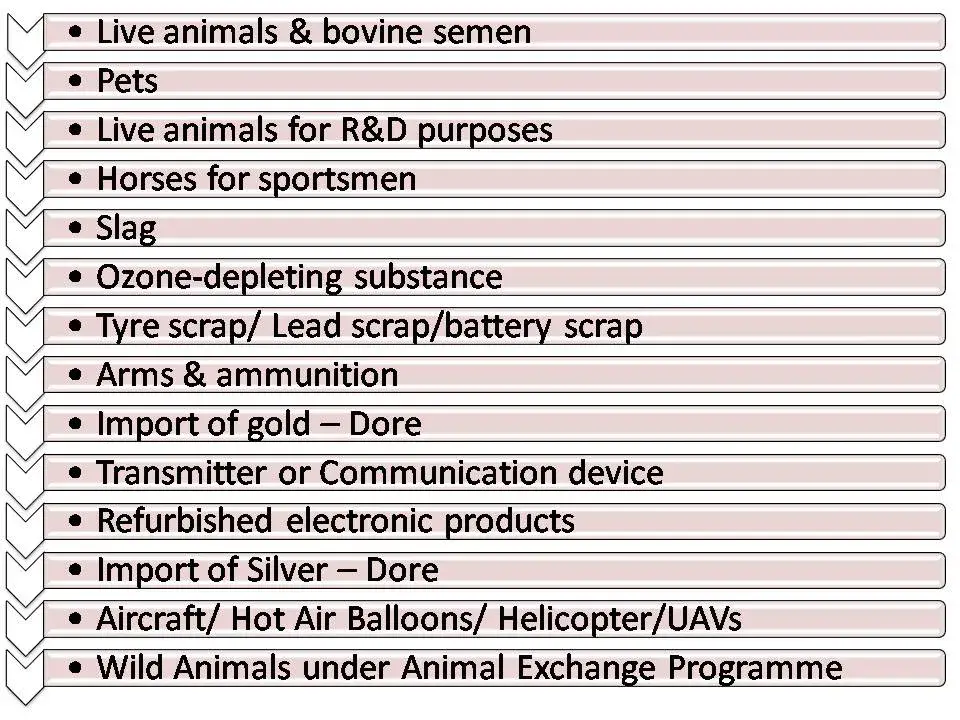

[List of Restricted Items]

Where importer can find the Restrictive items list for Import License?

- Go to DGFT website https://www.dgft.gov.in/

- Go to Regulatory Updates ->Import, Export and SCOMET Policy

- Click on Restricted Items Details: Here importer can find the list of items that are Restricted

What is Restricted Import Authorisation?

The Restricted Import Items are those items that are not freely importable; require the import license/Authorization/permission from DGFT. The restricted items only can be imported after having the Restricted Import License.

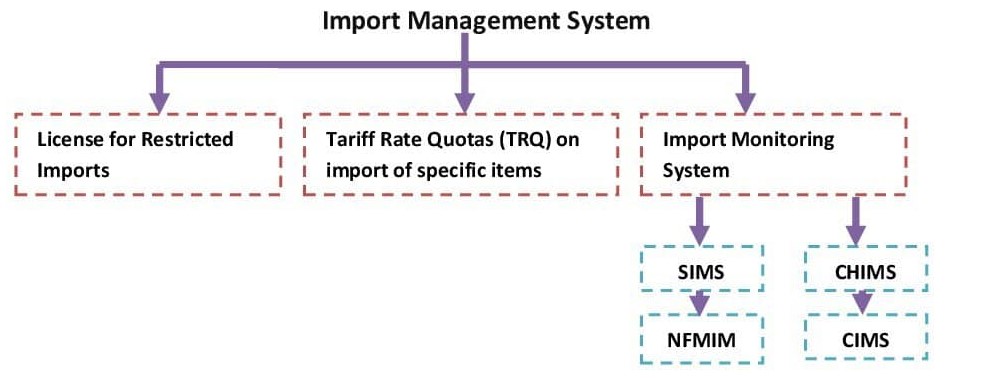

On 23rd March 2021, the Government has introduced the online module to issue the restricted import license under Import Management System. No Manual application would be accepted. The License for restricted items is issued by the DGFT Delhi.

The Application fee and validity of Restricted Import License

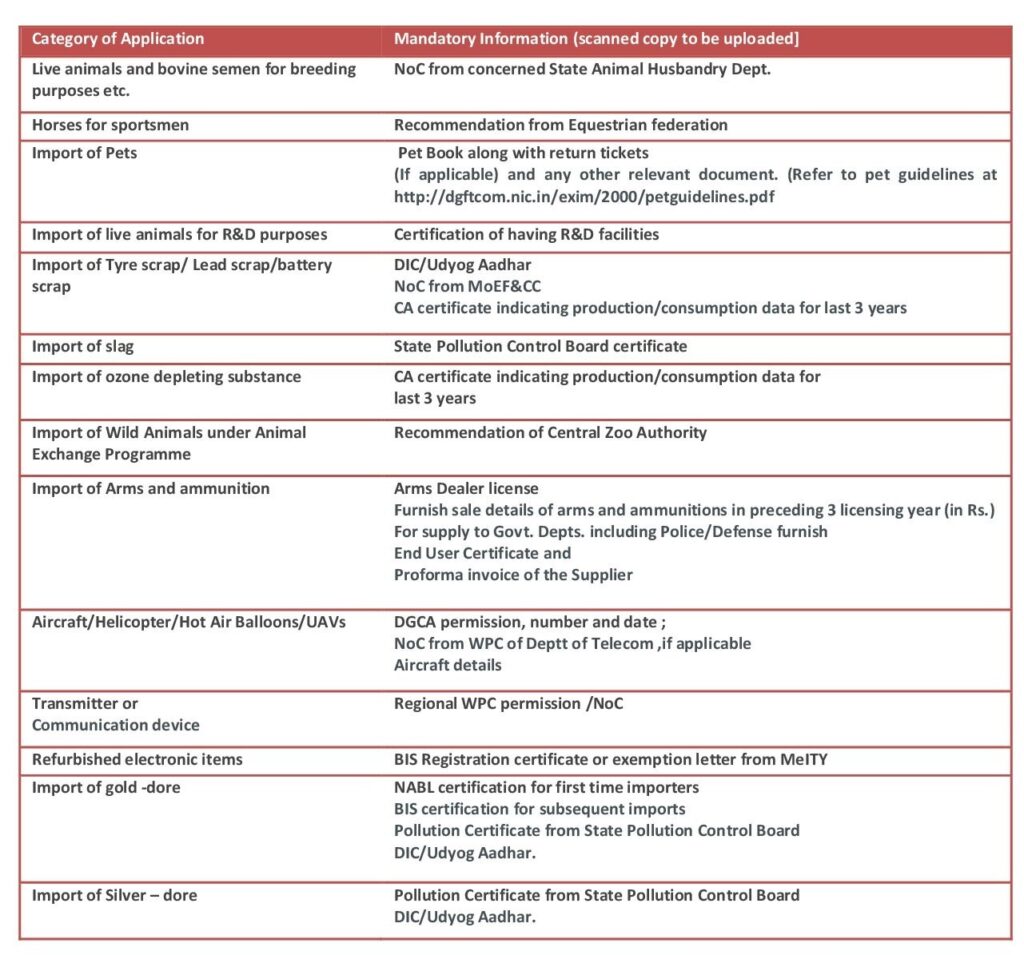

Documents required for application to get Restricted Import License

Documents required for application to get Restricted Import License

- Import-Export License

- MSME Certificate

- Board resolution copy

- Adhar card and Pan card of Authorized Signatory

- Authorization from concern dept.

List of Concerned Departments providing permission to import restricted items

“Welcome to our informative video on understanding Restricted Import Licenses for Laptops, Tablets, and Personal Computers (PCs) according to DGFT regulations. Get ready to understand all the important information you should know!

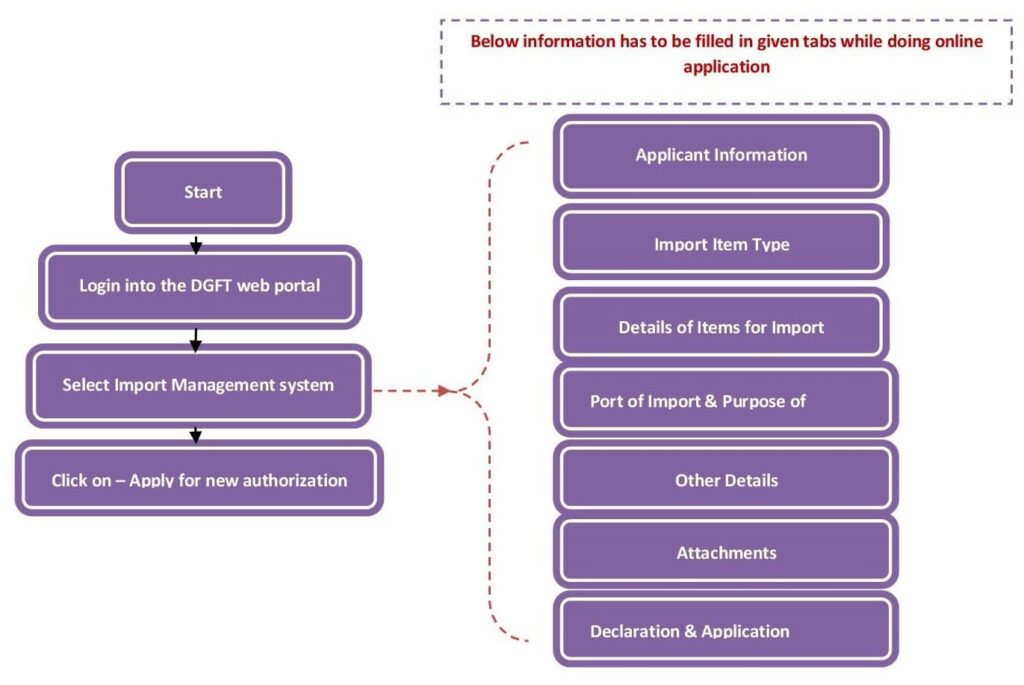

Application Procedure for Restricted Imports authorization

- The Application required to be done online on DGFT Portal after the prior registration.

- Visit the DGFT Portal – https://www.dgft.gov.in/CP/.

- Do login with valid credentials.

- Select Import Management System from services.

- Click on Restricted Imports.

- Click on Apply for Revalidation of Restricted Imports authorization.

- Fill all the details and upload the necessary documents.

- After filling all the details, submit the application.

- After a successful application, the Restricted Import License would be issued by DGFT Delhi.

Important Points regarding the online application

- Multiple restricted products can be imported under a single Restricted Imports authorization.

- Bulk Upload for uploading of export items –

- The new feature for bulk uploading has been introduced in the new system, the format would be given on portal, all the import details has to be filled in excel that required to be uploaded in import details section.

Amendment of Restricted Imports License

- The Restricted Import License holders are permitted to amend the license, new items can be added, and the quantity and CIF value can be decreased or increased, UOM (Unit of Measure) can be changed. Amendment of an issued License is only allowed until its import validity period. The basic application fee is Rs 200 required to be paid. If the CIF value would be increased the application fee will also increase.

Revalidation of Restricted Import License

- Revalidation is permitted for Restricted Import Authorization application fee of Rs 500 required to be paid online for revalidation.

- Procedure for the revalidation –

- Visit the DGFT Portal – https://www.dgft.gov.in/CP/.

- Do login with valid credentials.

- Select Import Management System from services.

- Click on Restricted Imports.

- All the details would be auto populated in application form only the “Revalidation details” will be editable.

- Enter the revalidation period and reason for revalidation.

- On the next page attach the required documents, Accept T&C tick the declaration form and submit the file for processing.

What is the EFC and what is the role of EFC in Restricted Import Authorisation?

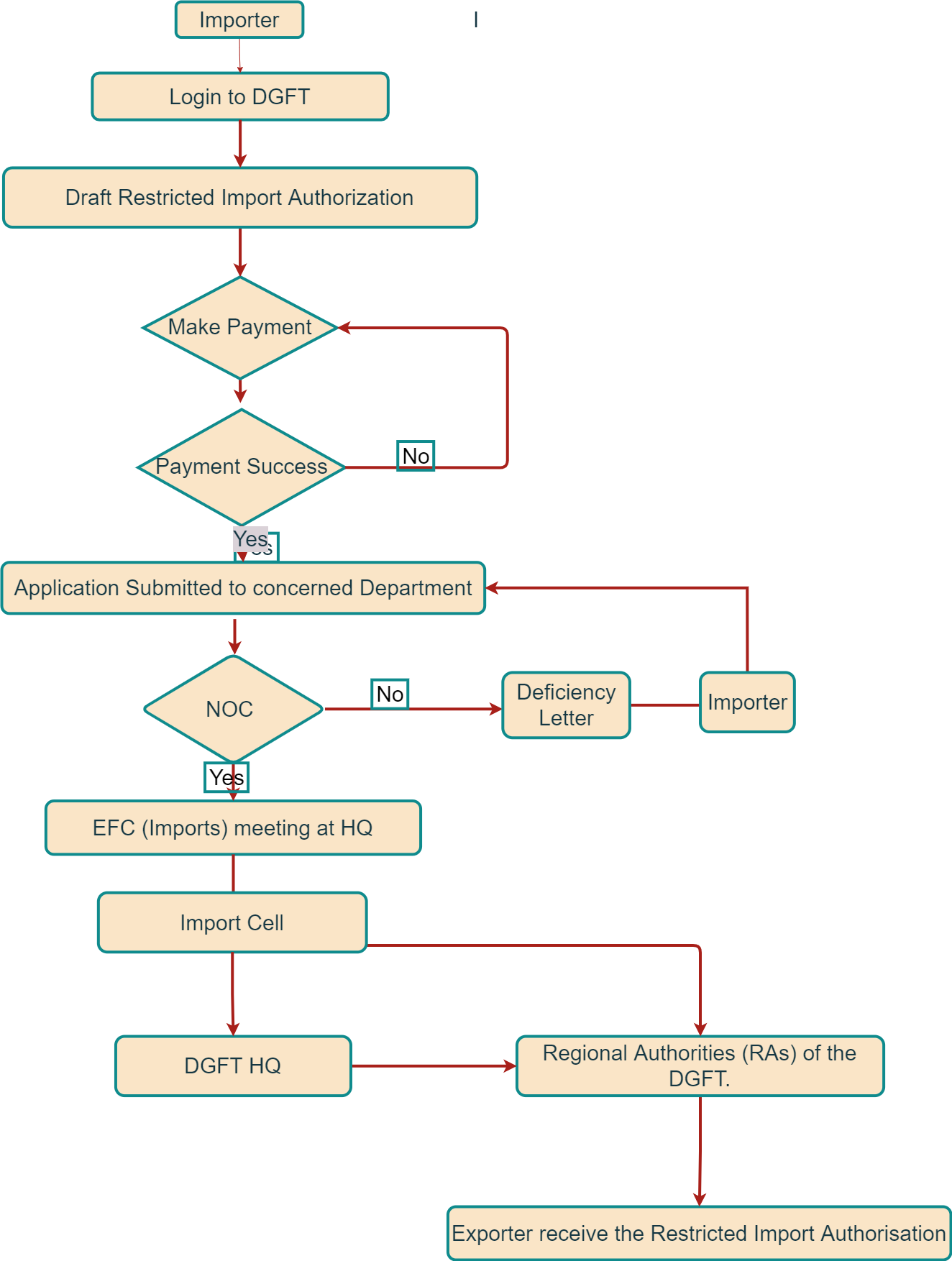

Restricted/Negative items import Authorisation – Flowchart

- See the following flow of Restricted items Import License :

- When the exporter login to the DGFT web portal and applies for Restricted items Imports License by making payment.

- The application is then submitted to the concerned Technical Ministry/ Department seeking their NOC/comments/views.

- If the application is deficient, the deficiency letter will be sent to the applicant firm through email.

- In response to the query, the applicant importer is required to provide necessary documents/clarifications.

- The application is then forwarded to the technical ministry/department for their comments/NOC.

- All pending applications are placed before EXIM Facilitation Committee (EFC) in DGFT for consideration on a case-by-case basis upon receipt of NOC/comments.

- A letter of authorization is prepared by the Import Cell, DGFT(HQ) after an application is approved by the EFC.

- A copy of the authorisation issued to Regional Authorities (RAs) of the DGFT.

- Once permission has been granted by DGFT (Hqrs), the firm must then approach the concerned Regional Authority of DGFT with a copy of the permission letter and the application submitted to DGFT (HQ).

- DGFT’s Regional Authority will issue an import license for Restricted items to the applicants.

[Application Procedure – Flowchart]

How we can assist you to get Restricted Import License?

- We are a team of DGFT experts who can analyze the feasibility of the scheme for the imports.

- We assist our clients in documentation in avoiding the delay in the process.

- After receiving the required documents, we prepare the application and make the online application.

- We coordinate with DGFT and other concerned departments until the issuance of the license.

- We also assist our clients in Amendment /Revalidation of the license.

FAQ’s

What does restricted import mean?

All the import items which are not allowed for import and only permitted after having a restricted import license are known as Restricted import.

Can restricted items be imported?

Yes, it can be imported after having the restricted import license.

How do I get my online import license for restricted items?

The application needs to be done on the DGFT website to get the certificate issued after the issuance of the certificate.

What are the items restricted for import?

The list of items restricted for import is given in restricted items details under Import, Export, and SCOMET Policy on DGFT Portal.

Can I import without import License?

There are various goods that are freely importable and can be imported without a license. Only the import of restricted items required to have an import license

How can I import restricted items in India?

You can import restricted items in India after having the restricted import license.

What are the prerequisites for applying for a Restricted Imports authorization?

The Importer wishes to get Restricted Import Authorization should have a valid IEC number. IEC is required to be linked with the DGFT portal.

Where can we apply for Restricted Imports authorization?

The online application required to be done online on DGFT portal. The license would be issued by DGFT Head quarter.

Can I import multiple products under a single Restricted Imports authorization?

Yes, multiple restricted items can be imported in a single authorization.

What is the validity of a Restricted Imports authorization?

The Validity of restricted import authorization is 18 months from Date of issuance.

Can I Amend the Restricted Imports authorization?

What are the application fees for amendment for Restricted Imports authorization?

What are the application fees for amendment for Restricted Imports authorization?

The basic application fee is Rs 200 required to be paid. If the CIF value would be increased the application fee will also increase.

Why Afleo Consultants?

- We are the team of highly qualified & experienced professionals having sufficient expertise over the years in the field of DGFT Consultancy Services.

- We only have the goal of providing very reliable services with the most competitive cost to the exporters under one roof.

- We keep updating our clients with regular policy amendments, all the upcoming rules, and regulations in foreign trade policy.

- We have a separate team for follow-up with DGFT and have a great understanding of the working of the DGFT office, which helps us in obtaining Restricted Import licenses without delay.