Contents

Introduction to SEIS

SEIS (Service Export from India Scheme) was launched by the Government of India on 1st April 2015 with a view of promoting export of services from India. Financial Incentives are available ranging from 3-7% of the Net Foreign Exchange earned in a particular Financial Year in the form of Duty Credit Scrips (Import Duty Credit). Service provider having a minimum of USD 15,000 in Net Foreign Exchange earnings in the year of rendering services will be eligible for SEIS. For Individual service providers and Sole Proprietorship, the Net Foreign Exchange earnings criteria would be US$ 10,000 in the year of rendering services.

[If you want an in-depth knowledge of SEIS Scheme read our article on “All about Service Exports From India Scheme – SEIS”]

What is SEZ (Special Economic Zone)?

The Government of India has launched SEZ Policy in April 2000 to provide an Internationally Competitive Environment for Exports. SEZ is a specially earmarked duty-free area which is under unique economic policies which are different from the rest of the country.

SEZ is structured with a goal to create a competitive environment for the exporters to increase the Foreign Direct Investment by Foreign Investors such as International business or Multi-National Company.

Are SEZ units Eligible for SEIS?

SEZ units exporting Services to other Countries are eligible to claim benefits under the SEIS Scheme.

Earlier, SEZ was under the ineligible category for claiming the SEIS Scheme but now according to the latest notification by the Director-General of Foreign Trade (DGFT), SEZ units are Eligible to claim the benefits under the SEIS Scheme.

Check out the Latest Notification Policy Circular No. 1 / 2015-20 dated. 11.06.2015 via Director General of Foreign Trade (DGFT).

[To know the eligibility criteria under SEIS Scheme in details read our article on “Eligible & Ineligible Categories under SEIS Scheme – Complete Guide”]

What are DTA units?

Domestic Tariff Area (DTA) is the area which is inside India but outside of SEZ (Special Economic Zone). DTA units do not get special Economic benefits by the Government of India.

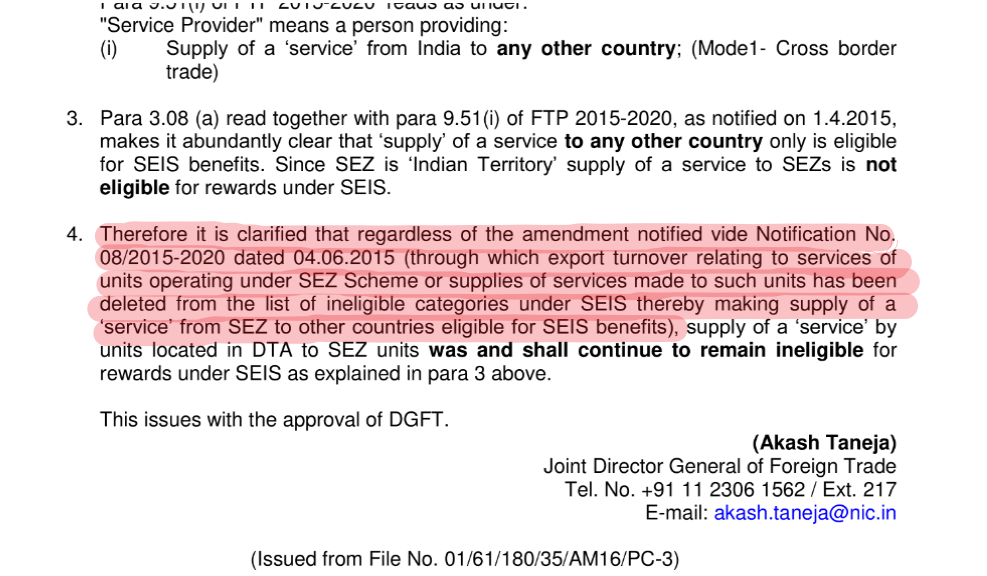

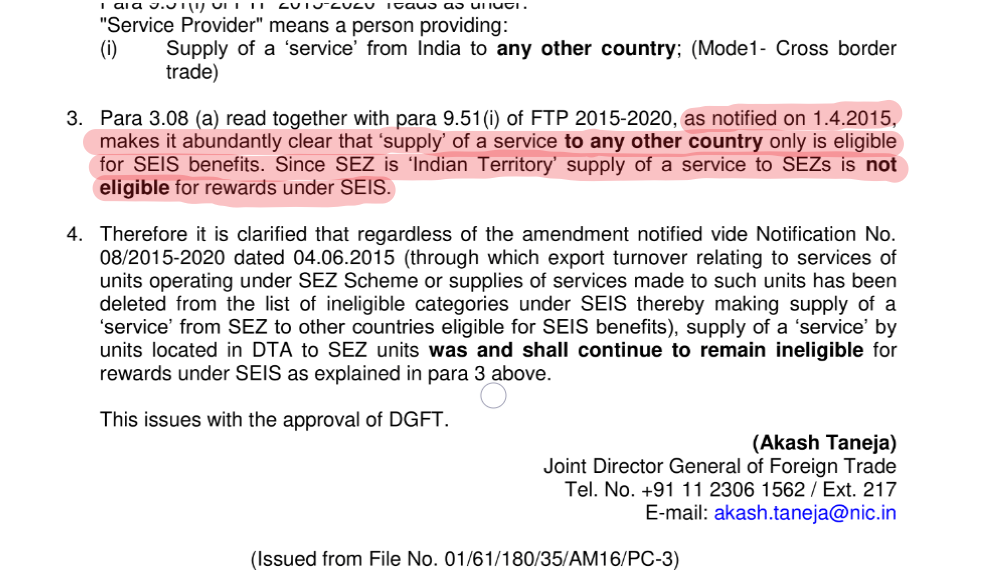

Is supply of a service from DTA unit to SEZ Eligible for SEIS Scheme?

DTA units exporting their Services out of India are eligible for SEIS Scheme.

However, if DTA unit is supplying services to SEZ Unit then it won't be eligible for SEIS Scheme. The reason being that, no Export of Service is done to other Country and hence no foreign exchange has been earned.

Therefore as per above notification, it is pretty much clear that Supply of a Service from SEZ unit to any other country is eligible for SEIS Scheme, whereas the supply of a Service from DTA unit to SEZ is ineligible for applying under SEIS Scheme.

Why Us?

Afleo.com is one of the leading firms when it comes to Import and Export Consulting. We are very well versed into the mechanisms of DGFT and the schemes that are exercised by them. So when it comes to applying for SEIS and all the confusing and complicated procedures you can rely on us completely. Afleo Consultant is a leading SEIS Consultant in India. Please fill the form below to get in touch with us.