Export promotion is a strategy for the economic development of a nation wherein the domestically produced goods and services are injected into the international market. Now, to promote these exports, the Government provides various benefits to the Indian traders. The exporters who trade services across nations, the benefits come in the form of rewards like duty credit scrips, which form the basis of the Service Exports from India Scheme (SEIS). Similarly, the exporters of goods receive benefits in the form of incentives under the Merchandise Exports from India Scheme (MEIS). Both the SEIS Scheme and MEIS Scheme thus, form the incentive process of DGFT.

The Government of India provides all these incentives to the exporters in order to give a proper direction, guidance, and encouragement to the service sectors. But why? Well, the service sector forms an integral part of the country’s economy and its development is vital to the growth of the nation as a whole.

The SEIS Scheme (Service Exports from India Scheme) was introduced in the year 2015 which is valid for a period of 5 years until 2020 as per the Foreign Trade Policy of India 2015-2020. Earlier this scheme was named as Served From India Scheme (SFIS). Under the SEIS Scheme, the service exporters residing in India are eligible to claim the benefits.

[In the past few years, India has seen great growth in new businesses with the support of various Government Schemes. Mudra Loan is one of the initiatives of the Indian Government. Read our article “How to get Pradhan Mantri Mudra Yojana (PMMY) Loan“]

Eligibility Criteria under the SEIS Scheme India

There are four modes of delivery of services that one needs to know about before getting an idea about the services that are eligible under the Foreign Trade Policy 2015-2020 to earn rewards under the Service Exports from India Scheme.

- Mode-1: It refers to the cross border trade of services from one country’s territory to the other. For example, a law firm in India sending electronic mail to a client residing in the USA or an Indian teacher sending notes via electronic media to its student based in the USA etc.

- Mode-2: Means consumption of services in abroad. The supply of services from one country to a consumer of the same service residing in another country comes under this Mode. For example, a tourist vacationing in a foreign country.

- Mode-3: This Mode recognizes the commercial presence of services of one country in the territory of another. For example, the establishment of an Indian firm in a foreign country or expansion of an Indian educational institution abroad.

- Mode-4: The presence of natural person of one country providing their service in the territory of another constitutes the fourth mode of delivery of service. Suppose an Indian doctor is practicing in a foreign country, that would be an example of the Mode-4 of delivery of services.

Are all the services under the four modes eligible to enjoy the benefits under the SEIS Scheme? No.

Only the Mode-1 and Mode-2, meaning cross border trade of services and consumption of services abroad, respectively, are eligible for the Government incentives under Service Export from India Scheme.

But that is not all. There are more conditions that a service exporter needs to fulfill in order to be eligible to enjoy the Governmental incentives under SEIS. What are they?

According to the SEIS Scheme, a Company, a LLP or a Partnership Firm providing any kind of service having a minimum of $15,000 net free foreign exchange earnings in the previous financial year are eligible for SEIS Incentives.

Similarly, Individual Service Providers and Sole Proprietorship having a minimum $10,000 net free foreign exchange earnings in the previous financial year are also eligible to earn the rewards under the SEIS.

[If you want to know the complete process of applying under SEIS Scheme read our article on “SEIS Scheme Application Process – Complete Guide (2019)”]

You might earn huge foreign exchange by exporting your services and still not be liable to enjoy the benefits under the export promotion schemes such as these if you do not have an active Importer Exporter Code (IEC) at the time of rendering of services. This is the third and one of the most important conditions required for one service provider to be eligible under SEIS Scheme. You need IEC to claim the advantages under the export assistance schemes like SEIS under the Foreign Trade Policy 2015-2020.

[Exporting Services, but don’t have an IEC yet? Getting IEC code is the first step. Read our article on”How to Apply for IEC Code Online – Step by Step Guide“]

Furthermore, there are various forms in which the service providers can earn foreign exchange which includes donations, income from equity and debt funds, repayment of loans, etc. However, these kinds of foreign exchange earnings aren’t taken into consideration under the Service Export from India Scheme.

If a service provider is also a manufacturer of goods, the export earnings he receives from the distribution of those goods in the foreign market will not be considered under the SEIS Scheme India. Only the net foreign exchange earned due to the services he provides will be considered while he claims the incentives under SEIS.

The Foreign Trade Policy 2015-2020 clearly defines the Net Foreign Exchange Earnings, which is:

Net Foreign Exchange Earnings = Gross Foreign Exchange Earnings – Total Foreign Exchange Payments/ Remittances/ Expenses bore by the service provider in the financial year.

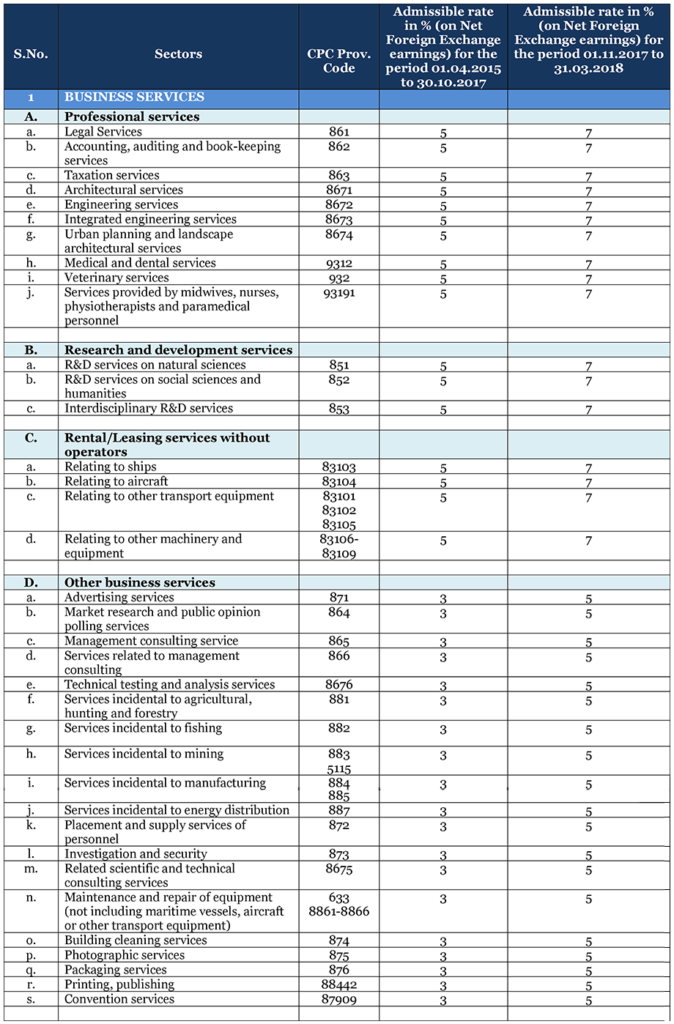

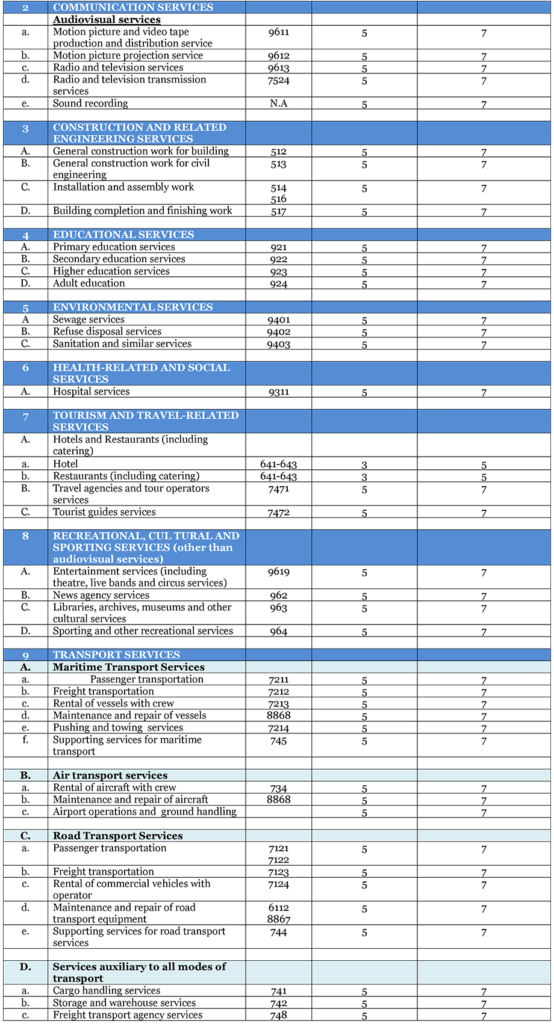

It is important to mention that not all kinds of service exporters are eligible to earn the duty credit scrips and other incentives of the Government. Yes, only the ones listed by the Government will be able to claim the rewards. For example, IT sector is one of the main service exporters but it isn’t eligible under the SEIS Scheme.

What are Duty Credit Scrips?

Duty Credit Scrips are incentives that are rewarded to the eligible exporters of services residing in India and the rates of these incentives depend on the amount of net foreign exchange they earn due to their trading activities. These rates are usually 3,5 or 7%.

[To know the details of eligible services and SEIS rates read our article on “List of Eligible Services and SEIS Rate of Rewards”]

Further, you can use these scrips for paying off customs duties, service taxes and more. There is a validity period of the duty scrips which is 18 months from the date it was issued.

What’s interesting is these duty scrips are transferable in nature and can be sold from one assessee to the other.

Now, let’s take a look at the rates of rewards for the eligible services:

Sometimes, service exporters wrongly claim rewards which they aren’t eligible for and this leads to mayhem later on.

Benefits under the SEIS Scheme

In order to receive the benefits provided by the Government to the service providers, one needs to file an application to claim the incentives under SEIS Scheme India. You can file the application for the grant of duty credit scrips using your digital signature. You’re required to submit the application form by filling in the Aayat Niryaat Form (ANF) 3B. Moreover, you need to claim the incentives before 12 months from the end of the relevant financial year. [A Claim submitted after 12 months would invite Late-cut/Penalty]

The applicant has the option of choosing a Jurisdictional Regional Officer on the basis of the address present on his Importer Exporter Code. After filing the application for the grant of the duty credit scrips, he needs to submit it to the chosen officer.

[To know in details the benefits and nature of rewards under SEIS Scheme read our article on “SEIS Scheme Benefits in India – All You need to know”]

Procedure for applying under SEIS Scheme India

Now let us look in brief about the application process for SEIS Scheme. For applying to the Scheme you need to ready the following documents.

1) IEC Copy

2) Self-Certified copy of Application Form ANF 3B

3) CA Certificate

4) A valid DGFT DSC

After you have prepared the document, it’s time to go towards the online procedure.

1) Go to www.dgft.gov.in

2) A horizontal tab navigator will be present on the page.

3) Go on Services.

4) In it you will find Online Ecom Application click on it.

A new tab will open your browser. Here now go towards SEIS for 2017-2018 & 2018-2019; SEIS for 2015-2016 & 2016-2017. You will need to attach a DSC and then login with your credentials and then the form will open in front of you.

[If you want an in-depth guide for applying under SEIS Scheme read our article on “SEIS Scheme Application Process – Complete Guide (2019)”]

Case Study

Around 100 multinational companies have been asked to refund the rewards they’ve been wrongly claiming since 2003. The Director General of Foreign Trade has demanded a refund of around ₹5000 crores that the companies have claimed under the export promotion schemes they weren’t eligible for.

Due to the wrong claims, each company has been penalized to pay an amount that ranges from ₹25 to ₹200 crores. This case study is in reference with an earlier scheme for Service Exporters known as “Served from India Scheme (SFIS)”.

To be eligible under the Served from India Scheme (SFIS), the service providing company must be an Indian brand. However, these MNCs were just an expansion of the interests of the foreign brands. Hence, they weren’t entitled to enjoy the incentives provided by the Government. The important thing to note is, this condition has been removed under “Service Export from India Scheme.”

Challenging the notices issued by the DGFT, the Indian head of an MNC said they’ve been seeking the incentives since 2004 and it was a very smooth process for them. As they didn’t support the withdrawal of the benefits provided to them saying they weren’t eligible for the rewards, they’ve decided to oppose the notice.

[To know in-depth detail about the documents required for the SEIS Application and how you can obtain them Read our article ” Documents Required for SEIS Scheme Application – Updated List (2019)“]

This shows that the SEIS Scheme can be quite conflicting and one needs to have a full understanding of the incentives provided by the Government under it, its eligibility criteria and more. In order to do so, you can seek help from our in-house experts by filling the form below.