List of services

AFLEO Consultants

DGFT Regional office

- IEC and its modification/Yearly Update/IEC Surrender.

- Revoke IEC from DEL, Suspension, Cancellation etc / Merger/Demerger of IEC’s.

- DGFT Identity card.

- Advance License - Issuance and Redemptions

- Export Promotion Capital Goods (EPCG) License - Issuance and Redemptions

- Duty-Free Import Authorization (DFIA)

- Remission of duties or Taxes on Export Product (RoDTEP)

- Merchandise Export from India Scheme (MEIS).

- Services Export from India Scheme (SEIS).

- Rebate of State and Central Taxes and Levies (RoSCTL)

- Transport and Marketing Assistance (TMA)

- Certificates of origin (COO) - SAPTA, APTA, ISLFTA, GSTP, India-Dubai CEPA etc.

- Import Monitoring System - (Steel Import Monitoring System, Coal Import Monitoring System,Copper/Aluminium Import Monitoring System, Chip Import Monitoring System)

- Deemed Export Benefits – Apply for Refund of TED/DBK/Brand rate Fixation.

- Star Export House Certificate.

- Free Sale & Commerce Certificate, End User Certificate.

- Enforcement cum Adjudication Proceedings at RA Mumbai.

- E-RCMC Certificate from DGFT – APEDA, FIEO, EEPC, PHARMEXCIL, CHEMEXCIL ETC.

- Gems & Jewelry Schemes.

- Application for Interest Equalization Scheme.

- REX Registration.

- Abeyance Cases for IEC’s in DEL.

- FREE SALE AND COMMERCE CERTIFICATE.

- END USER CERTIFICATE.

DGFT HQ, New Delhi

- Norms Fixation - Handling 25+ Norms Fixation cases every month across various Product groups. (Engineering, Pharmaceutical, Chemical, Textiles & Leather, Plastic & Rubber, Food, Sports & Misc. products)

- Policy Relaxation Committee (PRC Matters) - Proudly representing 20+ cases every month.

- EPCG Committee Approvals - Handling 10+ complex cases every month.

- Permission for Restricted/Negative list of Import Items & Export Items - Experience in Handling 100+ cases till date.

- Registration Certificates for Export & Import Items.

- SCOMET Licenses.

- TRQ (Tariff Rate Quotas)

- Appeal Matters under FTP.

Custom Related Services

- AA/EPCG/DFIA License Registration.

- Bond & Bank Guarantee (BG) Cancellation of EPCG/Advance License.

- ICEGATE Registration.

- Refund under Section 74.

- Pending Duty Drawback from Customs.

- Factory stuffing– Self-sealing permission. [FSP]

- Pending IGST Refund from Customs.

- Removal of IEC from Alert list of Customs.

- GST Services – Refund of ITC from GST.

- Authorized Economic Operator (AEO T1, T2 & T3) certification.

- Reply & Follow-up of Customs Notices if any.

- GST Services – Refund of GST for Service Exporters.

- AD Code/IFSC Registration.

- SIIB Matters (Special Investigation and Intelligence Branch)

- SVB Matters.

- Registration Procedures for First time Importers/ Exporters

- DPD/DPE Registration.

Other Certification:

- All Types of Digital Signature Certificates.

- Health Certificate for Export Products

- EPR Certification for Producers, Importers and Brand owners.

- Phytosanitory Certificate.

- BIS Certification.

- Banking & RBI related liaison for Exporters & Importers.

- Sea Cargo Consolidation – Import & Export

- Sea Freight Forwarding - Import & Export

- Air freight - Import & Export

- Land freight

- Warehousing

- Customs clearance

- Insurance

- Buying of scrips - MEIS / SEIS / RoDTEP / RoSCTL / DFIA

- Selling of scrips - MEIS / SEIS / RoDTEP / RoSCTL / DFIA

Find our brochure for more details:

Preferential CoO under India Australia [ECTA] Agreement

We will discuss about the recently announced India Australia Economic Cooperation and Trade Agreement, widely known as India Australia ECTA.

This agreement covers a variety of topics such as duty free access to Indian export products, cooperation in services, student work visas, opportunities for Indian chefs and yoga instructors, etc.

As per Union Minister Shri Piyush Goyal, It is expected that the current bilateral trade of 31 Billion USD may reach 45 to 50 Billion Dollars in the coming 5 to 6 years.

In this page we will look at this agreement from the perspective of Indian goods exporters and see how this trade agreement can benefit them to expand their business in Australia. You will get all the information in this page like - Is the Agreement beneficial for you? Which products are eligible? What are the rules or origin? How can you apply for CoO under this Free Trade Agreement? Where to apply? What are the documents required? What are the obligations on part of the exporter? Etc. So let’s get started.

1. India Australia Free Trade Agreement Benefits?

We all know that FTA gives preferential tariff access to Indian Export products in the Importing country.

One such FTA is recently announced India-Australia ECTA. Ind-AUS ECTA was signed in April 2022, and has become operational since 29th December 2022.

So why is this FTA so important? - Over 96% of India’s exports to Australia by value will be getting duty free access under the India Australia Economic Cooperation and Trade Agreement immediately from the start date of this agreement. And remaining product lines getting duty free access gradually in the coming 5 years

Most Textiles and Apparel, Some agricultural, fisheries products, leather, footwear, furniture, sports goods, jewellery, machinery, electrical goods, railway wagons, also select pharmaceutical and medical goods will be among the biggest beneficiaries of this trade agreement.

Australia on the other hand is a supplier of raw materials and intermediates, minerals and things like that, which are very useful for the Indian Industry, because if our raw materials are cheaper then the final product is also cost competitive in the world markets. So this agreement is a win-win situation for both the countries.

2. India Australia Free Trade Agreement Products List?

The list of all such products HS code wise is given in ANNEX 2A - Schedule of Australia. The link of this PDF file is shared below -

[Link for ANNEX 2A - Schedule of Australia - https://commerce.gov.in/wp-content/uploads/2022/06/02A-2-Schedule-Australia.pdf]

This list shows HS Code, Product Description, base rate and the Staging category. The Staging category is of two types i.e. A & B5

Staging Category A means there will be 0% Import duty in Australia from 29th December 2022 itself.

Staging Category B5 means there will be 0% Import Duty in Australia at the end of 5 years, and every year the import duty will be reduced in equal installments.

Let us understand this by way of an example, please see the table below -

| HS Code | Description | Base rate | Staging category |

| 6302.12.10 | Curtains | 5% | A |

| 7208.10.00 | FLAT-ROLLED PRODUCTS OF IRON OR NON ALLOY STEEL, -In coils, not further worked than hot-rolled, with patterns in relief | 5% | B5 |

(Example of products with category)

In this table it can be seen that “Curtains”, which currently has an Import duty of 5%, will immediately become 0 from 29th December 2022.

And “Flat rolled products” under chapter 7208 which currently has an Import duty of 5%, will be reduced in equal installments i.e. 4%, 3%, 2% and so on and it will eventually become zero by the end of 5 years.

You will get all the information in the below video like - Is the Agreement beneficial for you? Which products are eligible? What are the rules or origin? How can you apply for CoO under this Free Trade Agreement? Where to apply? What are the documents required? What are the obligations on the part of the exporter? Etc. So Let’s get started.

3. What are the Rules of origin criteria?

So the rules of origin is a very important section. A product will be considered of Indian origin only if 1. It is wholly obtained or Produced in India or 2. Produced entirely in India using non-originating materials [i.e. imported materials]

We will understand each By way of an Example:

Wholly obtained in India means the products that are entirely grown in India or produced using 100% Indian raw materials. A common example of such products would be fruits & vegetables that are grown in India.

So the 1st criteria is pretty simple and clear.

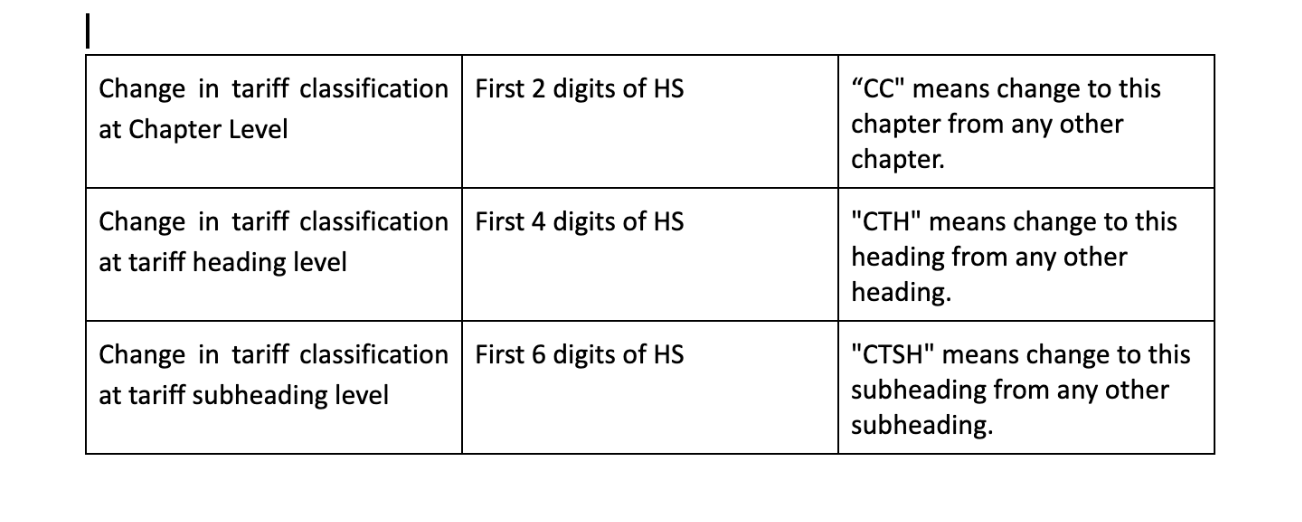

Regarding the 2nd Criteria, a product will be considered as originating from India if it undergoes change in tariff classification at Chapter Level [CC] i.e. First 2 digits of HS / tariff heading level [CTH] i.e. First 4 digits / tariff subheading level [CTSH] i.e. First 6 digits AND/OR it satisfies the QVC [Qualifying Value Content] criteria. This will be explained in detail in the Product Specific rules section.

AND/OR

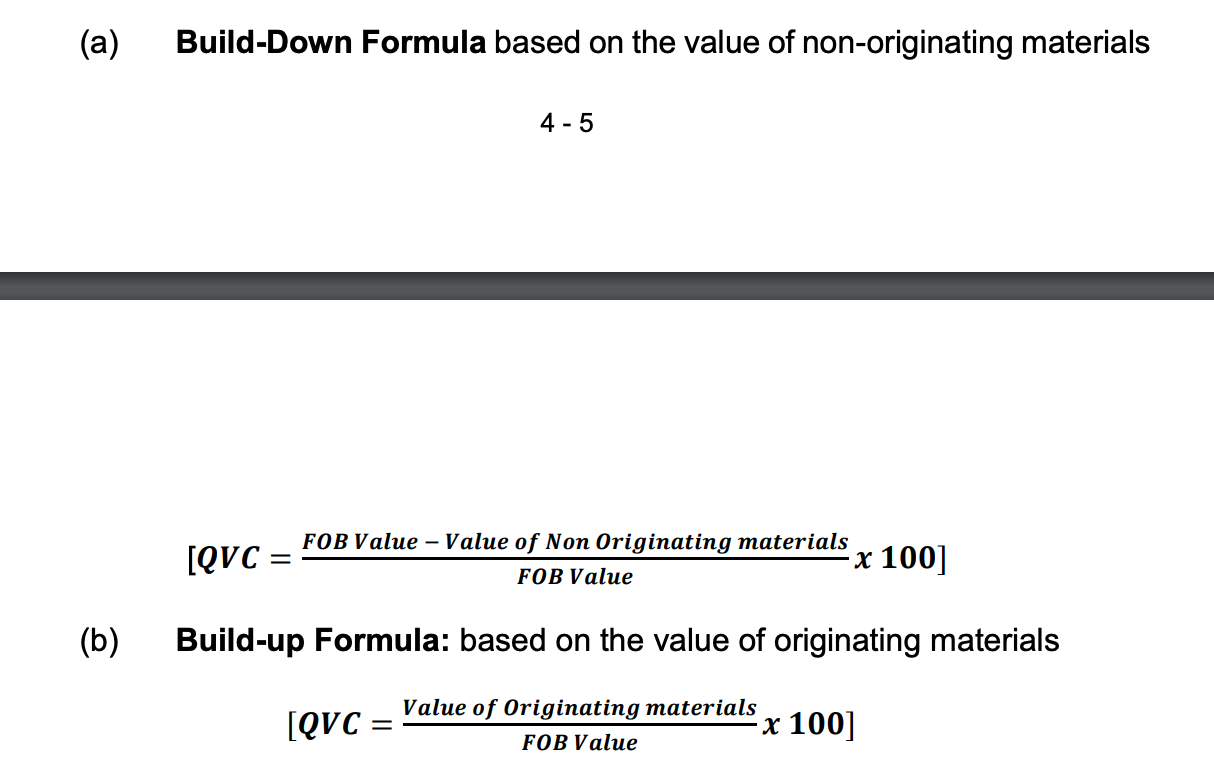

The QVC shall be calculated using one of the following methods:

So, in short if your export product is not wholly obtained, then you need to check the Product specific rules as per Annex 4B and determine if your export product will be eligible for the India Australia ECTA benefit or not.

So next let us discuss the Product specific Rules of origin.

4. Product Specific Rules of Origin

Let us understand these rules by way of 3 Examples

Example 1 –

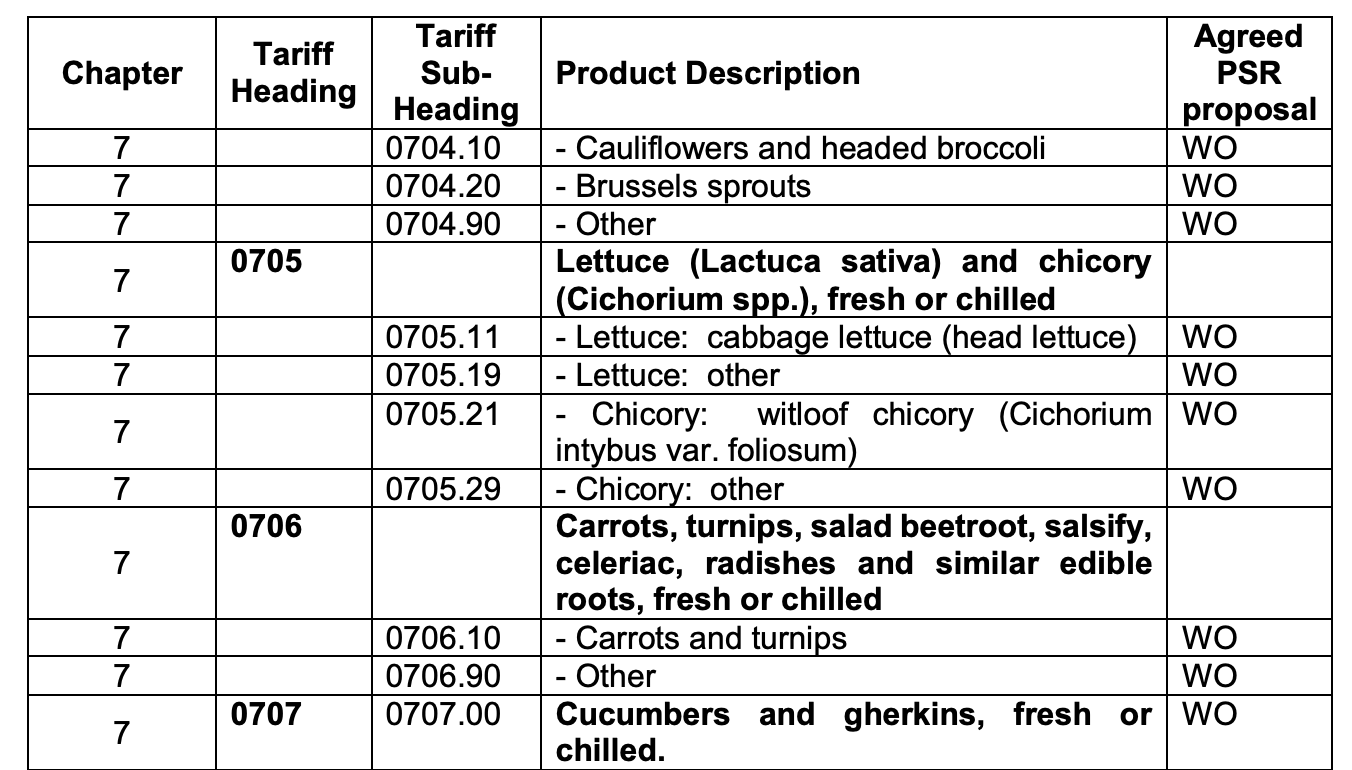

(Example 1 - Product Specific Rules of Origin)

The Image shows that for the above products to qualify for the duty free access benefit, it should be Wholly Obtained [WO] in India.

Example 2 -

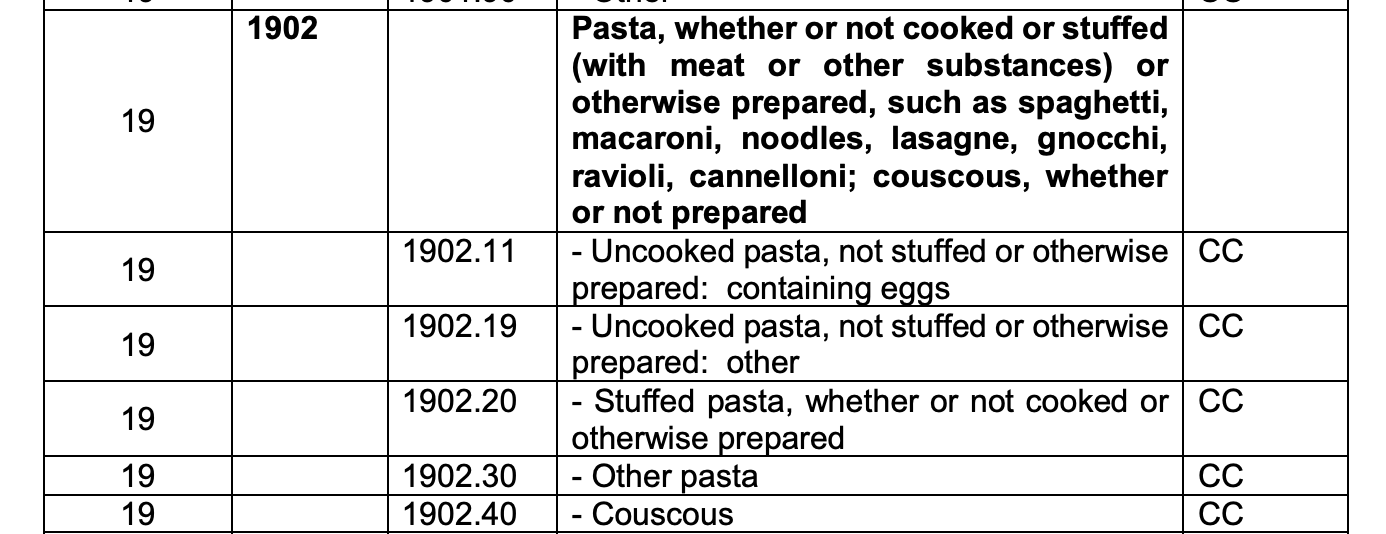

(Example 2 - Product Specific Rules of Origin)

So in this example the export product i.e. Pasta of various types will qualify for the ECTA benefits only if it has undergone a change in CC. It means that all non-originating materials used in the production of the good have undergone a change in tariff classification at the two digit level; i.e. First 2 digits of all imported Raw materials [Non-originating materials] are different from First 2 digits of the final export product.

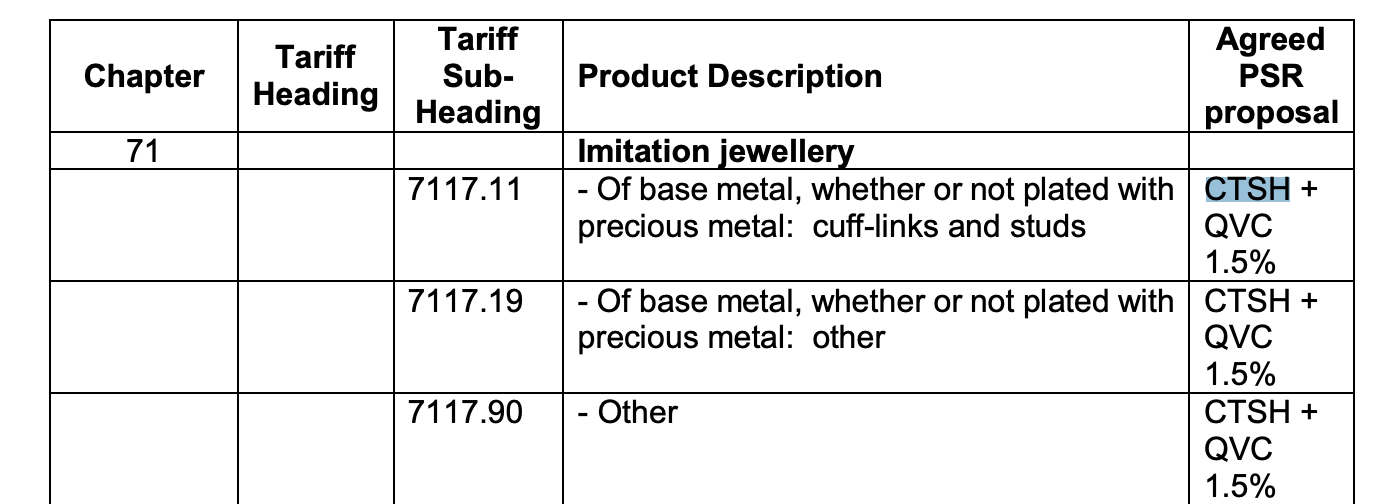

Example 3 -

(Example 3 - Product Specific Rules of Origin)

So in this example the export product i.e. Imitation Jewellery will qualify for the ECTA benefit if it satisfies both the criteria’s i.e. CTSH + QVC 1.5% i.e. First 6 digits of all imported Raw materials [Non-originating materials] are different from First 6 digits of the final export product AND QVC of not less than 1.5% using the build-up method or build-down method.

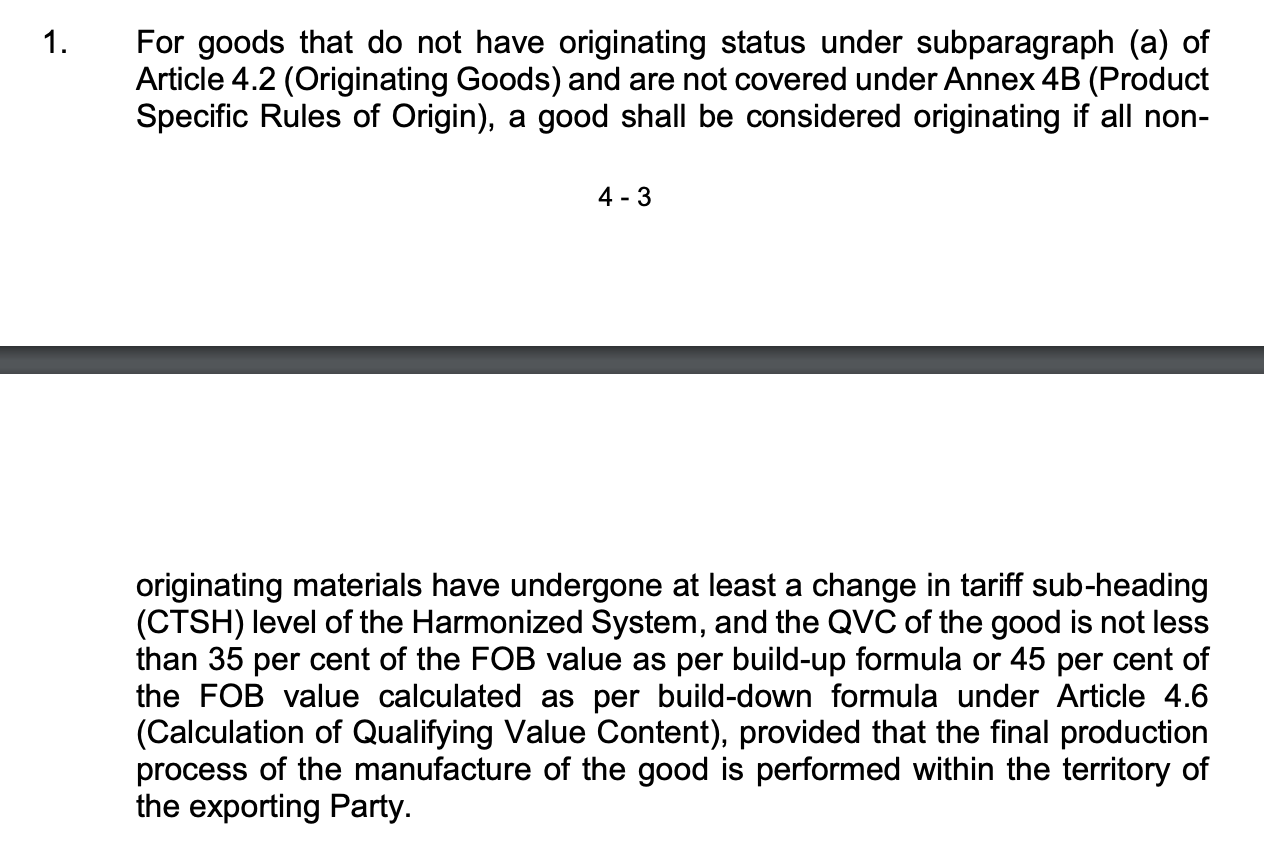

It should be noted that, the PSR of all the products are not notified yet, this will be an ongoing process. So if your export items are not covered under the Product specific rule of origin, then to determine whether the goods are origination from India, a General Rule as per the below Image should be used:

If there are many export items in the Invoice then VA for each export item should be calculated separately. Maybe it is possible that some of your items are not fulfilling the PSR criteria, then in those cases you have to mention that in your documents & ECTA benefits for those products should not be taken.

Also, In order to calculate the QVC value correctly Please refer to Sub para 5, 6, 7 & 8 of Article 4.6 under Chapter 4 - Rules of origin.

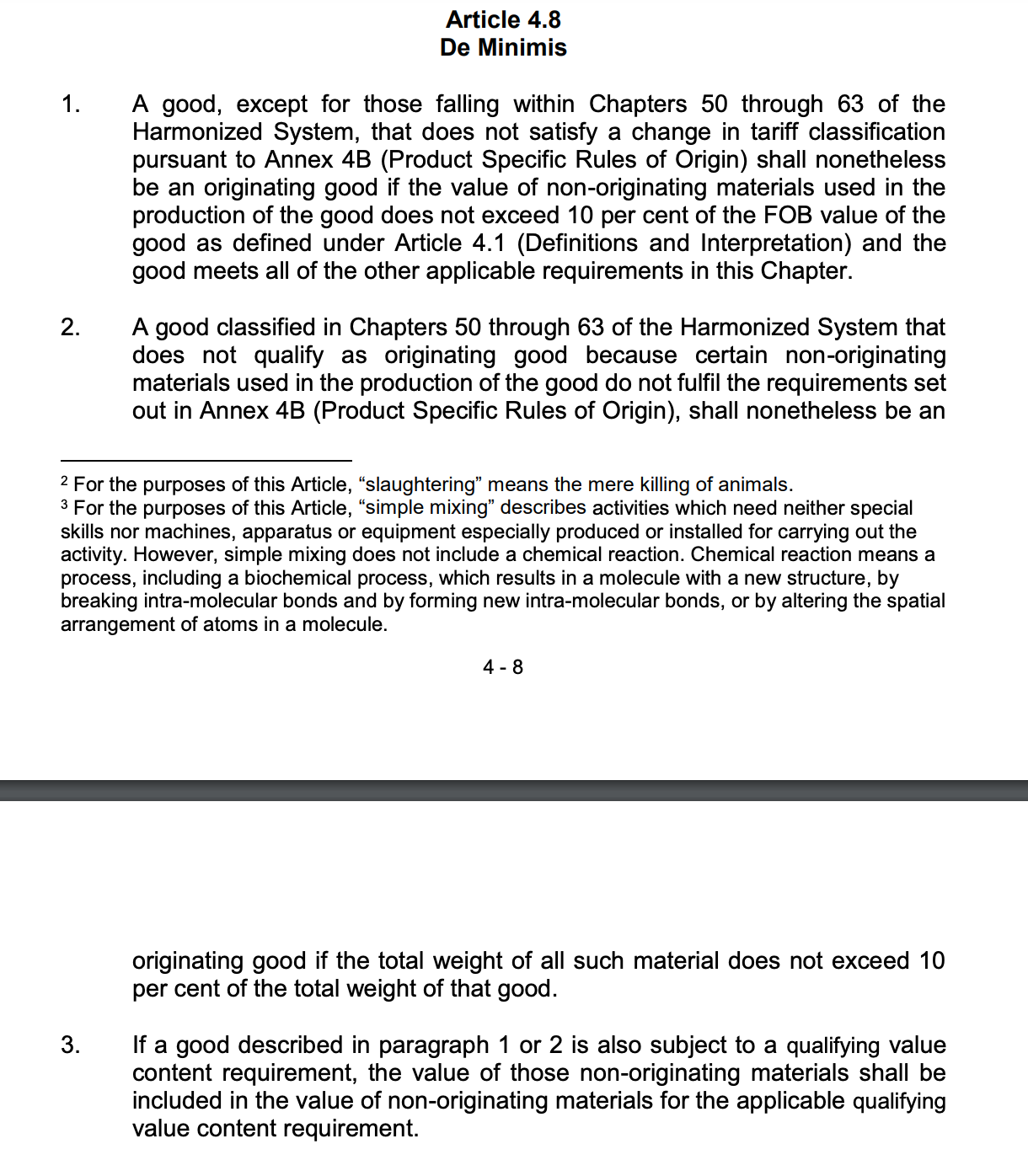

5. Article 4.8 - De Minimis

Now, many times it may happen that, you use 5 to 6 non originating materials to make a final product. But one or two of your non originating materials are not able to satisfy the criteria of change in tariff Classification rule i.e. CC or CTH or CTSH.

In such cases Article 4.8 under Chapter 4 - Rules of origin can be of help. It states that,

For Export Products falling under Chapters except 50 to 63, such goods will be considered as originating if the value of all such non originating materials is less than 10% of the FOB Value of Export Goods.

And for all the Export products falling under Chapters 50 to 63, such goods shall be considered as originating if the total weight of all such non originating material does not exceed 10 percent of the total weight of that export good.

6. How & Where to apply For Certificate of Origin [CoO] under India Australia ECTA - Free Trade Agreement?

Application for CoO under CEPA is to be done on the CoO common digital platform. It is a compulsory online process.

Application should be filed within 5 days from the date of export.

Common set of documents required are:

1. Digital Signature

2. Exports Invoice copy

3. Packing List

4. Bill of Lading

5. Shipping Bill.

Once the application is done the CoO is issued within one to two working days.

7. Who are We and Why Choose Us.

We at Afleo Group, are a team of DGFT & Customs Experts having a rich experience of 10+ Years in Exim Consultancy & International Logistics [Freight Forwarding]. With our vast knowledge and experience in this field we can represent your case for all the activities pertaining to the Country of Origin and get it cleared in a hassle free manner.

So do get in touch with us for any of your requirements and our team will be happy to help you.

Fill the below form to get in touch with us

Insights

- Best free 50 spins no deposit 2024 Web based casinos in the 2024 That have fifty 100 percent free Spins No deposit Bonuses September 16, 2024

- Top 45 Cazinouri Online România 2024, Lista Cazinouri Online September 16, 2024

- Relatif à Casinos Quelque peu Loki 2024 September 16, 2024

- Incentives And you will Writeup on Playhippo September 14, 2024

- PlayHippo Ett trevligt local casino med fantastiskt spelutbud! September 14, 2024

Our Office

Unit No. 207, Centrum IT Park, Wagle Estate, Thane West, Mumbai, Maharashtra 400604

Drop a Line

You may contact us by filling in this form any time you need professional support.