India UAE CEPA – Eligibility, Rules of Origin & Procedure to get CoO from DGFT

Table of Contents

India UAE CEPA – Eligibility, Rules of Origin & Procedure to get CoO from DGFT

- ALL ABOUT - INDIA UAE CEPA TRADE AGREEMENT

- 1. Background of FTA Agreements, What is CEPA & Why it is so important for Exports?

- 2. Which sectors or which export products are eligible for concessional duty?

- 3. What are the Rules of origin criteria?

- 4. Products Specific Rules (PSR)

- 5. Minimal process or insufficient operations

- 6. How to apply For CoO under CEPA?

- 7. Who Are We and Why Choose Us

ALL ABOUT - INDIA UAE CEPA TRADE AGREEMENT

In this page we will discuss all the important Points you need to know about the recently announced India-UAE CEPA Trade Agreement.

You will get all the information in this like – Is the Agreement beneficial for you? Which products are eligible? What are the rules or origin? How can you apply for CoO under this Free Trade Agreement? Where to apply? What are the documents required? What are the obligations on the part of the exporter? Etc. Please read the information till the end.

1. Background of FTA Agreements, What is CEPA & Why it is so important for Exports?

We are aware that FTA (Free Trade Agreement) gives preferential tariff access to Indian Export products in the Importing country.

One such FTA is recently announced India UAE CEPA. India UAE CEPA was signed on 18th February 2022, and has become operational since 1st May 2022.

So why is this FTA so important? – Because the UAE is a gateway to Africa, many other gulf countries and Europe & 90% of India’s exports in value terms would immediately become completely duty-free.

So this will be very beneficial for Indian exporters.

2. Which sectors or which export products are eligible for concessional duty?

The list of all such products HS code-wise is given in ANNEX 2B. The link of the PDF file is shared below.

In the list, the majority of the export products are given 0% duty benefit immediately, whereas some products will get 0% duty benefit in a phased manner i.e. after 5 years or 7 years or 10 years.

Watch this short introductory video on the – INDIA UAE CEPA TRADE AGREEMENT

It is very important to understand the rules of origin and Product specific rules before applying – Since this document i.e CoO is as good as a financial instrument and the UAE govt has right to post verification of this Certificate at any given point of time & they may contact Indian authorities if any rules are violated.

3. What are the Rules of origin criteria?

So the rules of Origin are a very important section. A product will be considered of Indian origin only if it is wholly obtained in India or Sufficient Processing or working on the imported materials is made to arrive at the Final product.

We will understand each By way of an Example:

Wholly obtained in India means the products that are entirely grown in India or manufactured using 100% Indian raw materials. A common example of such products would be fruits & vegetables that are grown in India.

So the 1st criteria is pretty simple and clear.

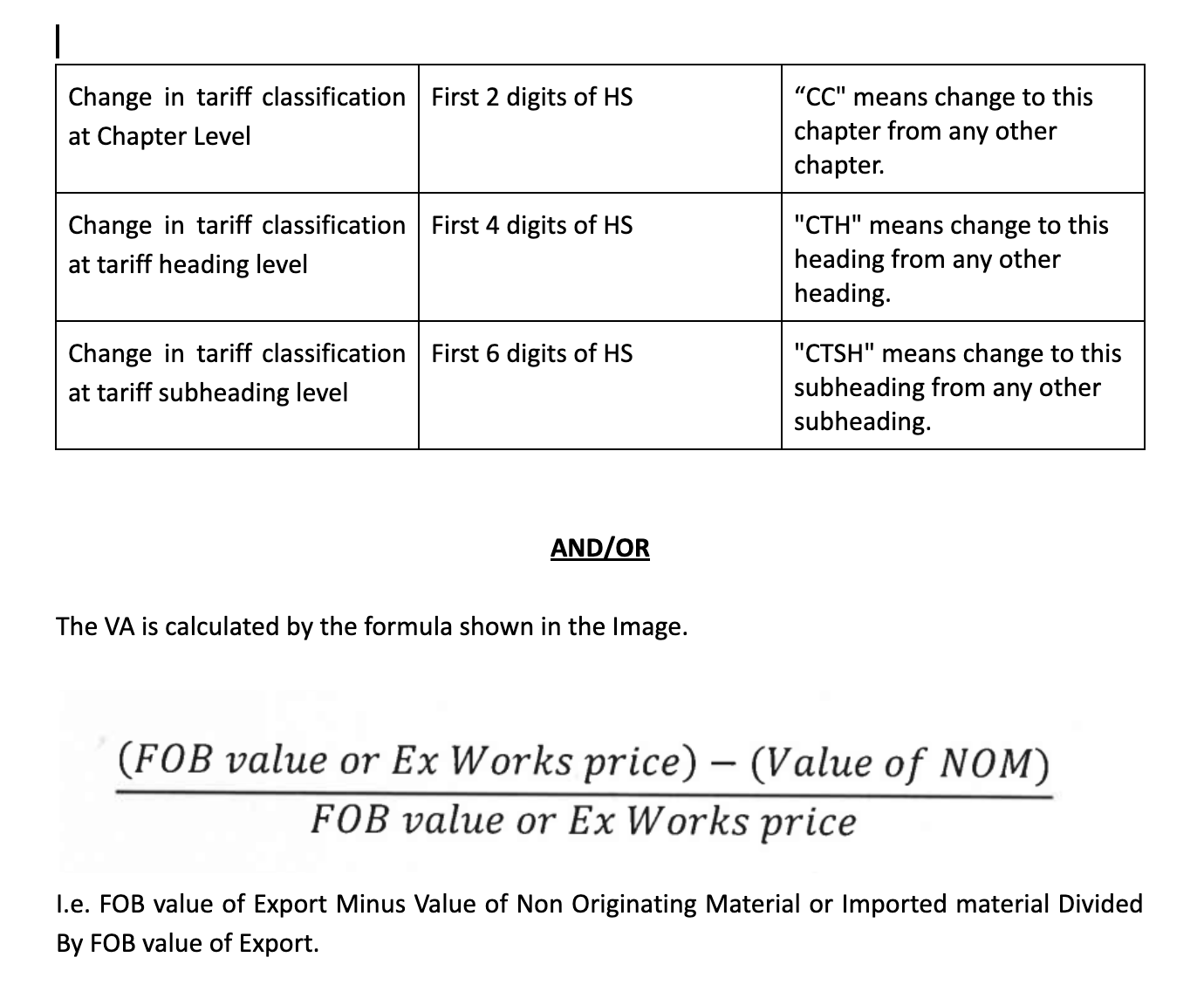

Regarding the 2nd Criteria, a product will be considered sufficiently processed if it undergoes change in tariff classification at Chapter Level i.e. First 2 digits of HS/tariff heading level i.e. First 4 digits/tariff subheading level i.e. First 6 digits AND/OR it satisfies the Value addition criteria. This will be explained in detail in the Product Specific Rules section.

(formula to calculate VA)

4. Products Specific Rules (PSR)

Let us understand these rules by way of 3 Examples.

Example 1 –

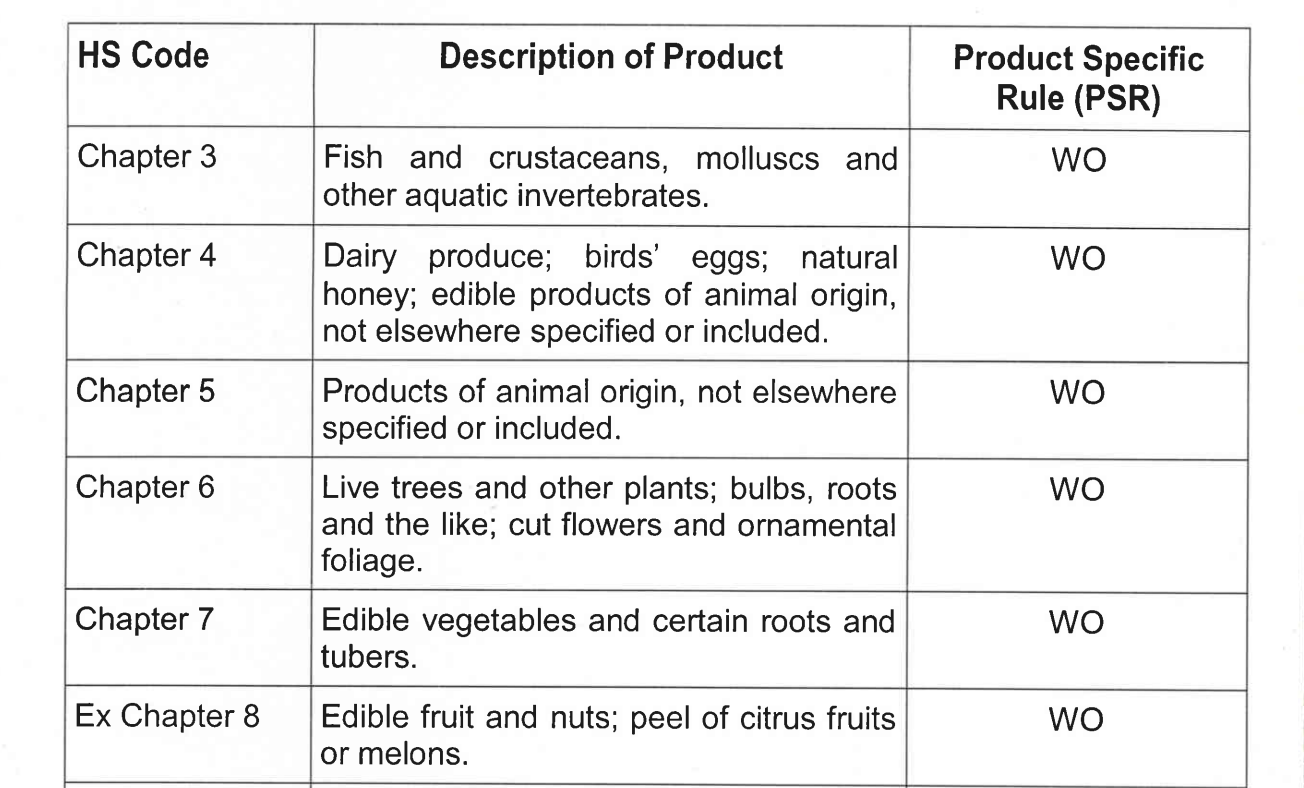

(Example of Product Specific Rules)

The Image shows that for any product under Chapters 3 to 8, to qualify under the CEPA benefits, it should compulsorily be wholly obtained i.e. “WO”

Example 2 –

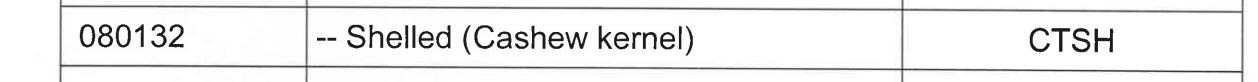

(Example of CTSH)

So in this example the export product i.e. Cashew kernel will qualify for the CEPA benefits only if it has undergone a change in CTSH i.e. Tariff subheading level i.e. First 6 digits of imported Raw material is different from First 6 digits of the final export product.

Example 3 –

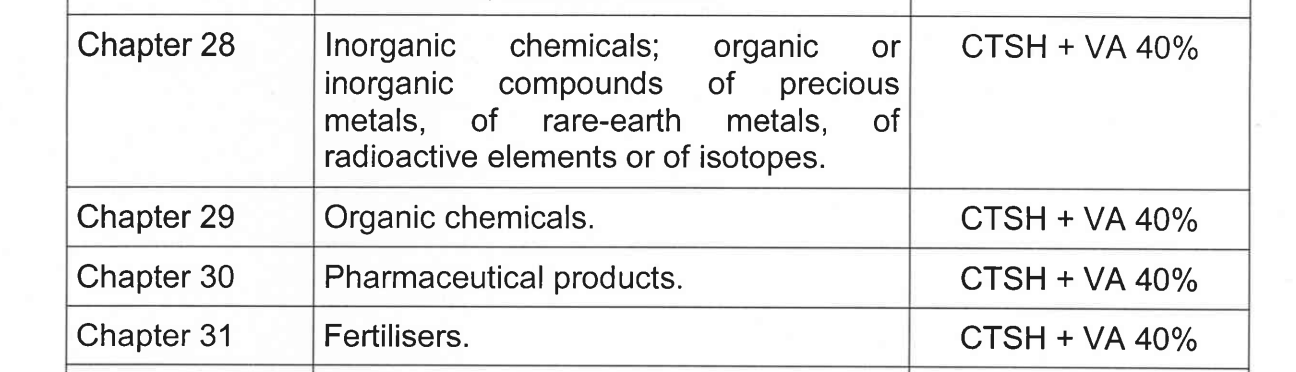

(Example of CEPA benefits under chapters 28 to 31)

The Image shows that for any product under Chapters 28 to 31, to qualify under the CEPA benefits, it should compulsorily maintain both the conditions i.e. CTSH i.e. First 6 digits of imported Raw material should be different from First 6 digits of the final export product + 40% VA should be maintained.

If there are many export items in the Invoice then VA for each export item should be calculated separately. Maybe it is possible that some of your items are not fulfilling the PSR criteria, then in those cases you have to mention that in your documents & CEPA benefits for those products should not be taken.

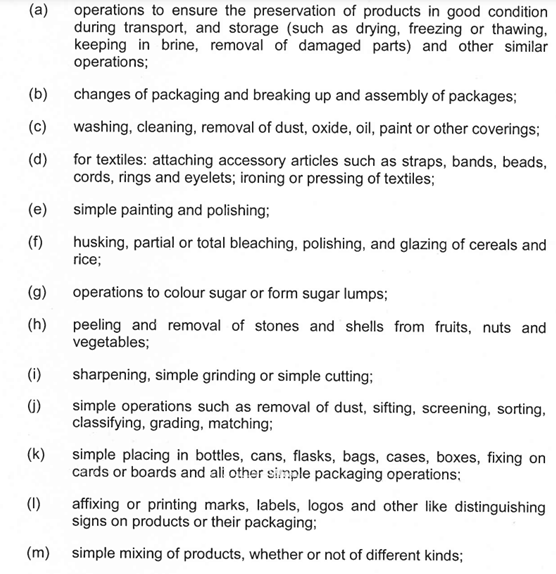

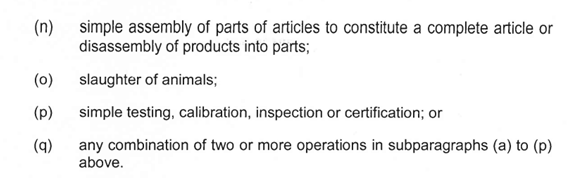

5. Minimal process or insufficient operations

The below Image shows the list of processes that are not allowed. It means that if you are importing something and doing any of the above processes & exporting it, then it won’t qualify for CEPA benefits.

(Processes that are not allowed for CEPA benefits)

6. How to apply For CoO under CEPA?

So the last question would be how and where to apply?

Application for CoO under CEPA is to be done on the CoO common digital platform. It is a compulsory online process.

[To know more about Certificate of Origin for exports, you may refer to our article here –CoO DGFT Registration (Certificate of Origin for Exports)]

The application should be filed within 5 days from the date of export to the nearest Export Inspection agency or DGFT.

A common set of documents required are as follows:

- Digital Signature

- Exports Invoice copy

- Packing List

- Bill of Lading

- Shipping Bill

- Annexure 3A

- Manufacturer’s Declaration.

Once the application is done the CoO is issued within one to two working days.

7. Who Are We and Why Choose Us

We at Afleo Group, are a team of DGFT & Customs Experts having a rich experience of 10+ Years in Exim Consultancy & International Logistics [Freight Forwarding]. With our vast knowledge and experience in this field we can represent your case for all the activities pertaining to the Country of Origin and get it cleared in a hassle-free manner.

So do get in touch with us for any of your requirements and our team will be happy to help you.

We request you to share this information with your other Industry friends, Trade associations, as this information might help them as well.

List of Services

AFLEO Consultants DGFT Regional office

- IEC and its modification/Yearly Update/IEC Surrender.

- Revoke IEC from DEL, Suspension, Cancellation etc / Merger/Demerger of IEC’s.

- DGFT Identity card.

- Advance License - Issuance and Redemptions

- Export Promotion Capital Goods (EPCG) License – Issuance and Redemptions

- Duty-Free Import Authorization (DFIA)

- Remission of Duties or Taxes on Export Product (RoDTEP)

- Merchandise Exports from India Scheme (MEIS)

- Services Exports from India Scheme (SEIS)

- Rebate of State and Central Taxes and Levies (RoSCTL)

- Transport and Marketing Assistance (TMA)

- Certificates of Origin (COO) – SAPTA, APTA, ISLFTA, GSTP, India–Dubai CEPA, etc.

- Import Monitoring System (IMS) – Steel IMS, Coal IMS, Copper/Aluminium IMS, Chip IMS

- Deemed Export Benefits – Apply for Refund of TED/DBK/Brand rate Fixation.

- Star Export House Certificate.

- Free Sale & Commerce Certificate, End User Certificate.

- Enforcement cum Adjudication Proceedings at RA Mumbai.

- E-RCMC Certificate from DGFT – APEDA, FIEO, EEPC, PHARMEXCIL, CHEMEXCIL ETC.

- Gems & Jewelry Schemes.

- Application for Interest Equalization Scheme.

- REX Registration.

- FREE SALE AND COMMERCE CERTIFICATE.

- Abeyance Cases for IEC’s in DEL.

- END USER CERTIFICATE.

DGFT HQ, New Delhi

- Norms Fixation - Handling 25+ Norms Fixation cases every month across various Product groups. (Engineering, Pharmaceutical, Chemical, Textiles & Leather, Plastic & Rubber, Food, Sports & Misc. products)

- Policy Relaxation Committee (PRC Matters) - Proudly representing 20+ cases every month.

- EPCG Committee Approvals - Handling 10+ complex cases every month

- Permission for Restricted/Negative list of Import Items & Export Items - Experience in Handling 100+ cases till date.

- Registration Certificates for Export & Import Items.

- SCOMET Licenses.

- TRQ (Tariff Rate Quotas)

- Appeal Matters under FTP.

Custom Related Services

- AA/EPCG/DFIA License Registration.

- Bond & Bank Guarantee (BG) Cancellation of EPCG/Advance License.

- ICEGATE Registration.

- Refund under Section 74.

- Pending Duty Drawback from Customs.

- Factory stuffing– Self-sealing permission. [FSP]

- Pending IGST Refund from Customs.

- Removal of IEC from the Alert list of Customs.

- GST Services – Refund of ITC from GST.

- Authorized Economic Operator (AEO T1, T2 & T3) certification.

- Reply & Follow-up of Customs Notices if any.

- GST Services – Refund of GST for Service Exporters.

- AD Code/IFSC Registration.

- SIIB Matters (Special Investigation and Intelligence Branch)

- SVB Matters.

- Registration Procedures for First-time Importers/ Exporters

- DPD/DPE Registration.

Other Certification:

- All Types of Digital Signature Certificates.

- Health Certificate for Export Products

- EPR Certification for Producers, Importers and Brand owners.

- Phytosanitory Certificate.

- BIS Certification.

- Banking & RBI related liaison for Exporters & Importers.

AFLEO logistics

- Sea Cargo Consolidation – Import & Export

- Sea Freight Forwarding - Import & Export

- Air freight - Import & Export

- Land freight

- Warehousing

- Customs clearance

- Insurance

AFLEO Global

- Buying of scrips - MEIS / SEIS / RoDTEP / RoSCTL / DFIA

- Selling of scrips - MEIS / SEIS / RoDTEP / RoSCTL / DFIA