What makes your business to become a success overnight? Time and perseverance are the things to appreciate, but creativity and inspiration are the roots for entrepreneurship. Taking your business to the next level and competing with international standards isn’t a bad choice, but worth taking a shot! Before jumping into the battleground make sure you understand the prerequisites.

If you have plans to set up import and export business from India, you need to undergo many procedures and laws for registration and license. Basically, IEC Code is mandatory to start the business and you might be curious to know the Import Export Code fees. Here is a detailed article explaining the Import Export License fees in India.

What is IEC Code (Import Export Code)?

An IEC Code is an alpha-numeric code ( instead of the 10-digit number allotted earlier) which is same as the PAN of an entity. It is issued to an importer or exporter by the regional office of Director General of Foreign Trade (DGFT).

The IEC certificate acts as an important document for your import and export business. This IEC code is an essential element for the global market to support business growth.

IEC registration is permanent registration which is valid for a lifetime. Hence, there will be no hassles for updating, filing, and renewal of IEC registration. It is valid until the business exists or the registration is surrendered.

Import Export License Fees / Cost to get IEC Code in India

- As per the latest notification, IEC code Application fees is Rs 500/- which can be paid online through e-wallets/Net Banking/Credit or Debit Cards. Therefore the Government Fees or Official fees to get IEC Code in India is Rs. 500.

- But what about the professional fees? The IEC Code procedure is carried out by many professionals to make it easier & time-saving process for you. The IEC code fees charged by many online portals/offline Agents is in the range of Rs. 3000-5000; whereas Afleo charges a professional fee of only Rs. 2000/- and guarantees you an IEC Code in 1 day. This is the Lowest Import Export License Cost in the market with a premium service.

- Earlier a Digital Signature Certificate (DSC) was mandatory to apply for IEC Code. It was charged separately around Rs.1000-1500 for 2 years validity. As per the current notification, DSC is not necessary for IEC Application, which means an extra cost of Rs. 1500 is eliminated. It is an important step taken by the Government to ease the IEC Code process.

- Therefore the total Cost to get an IEC Code in India will be Rs. 2860/- only [Rs. 2000 Professional Fees + Rs. 500 Government Fees + Rs. 360 GST on Professional Fees @18%]

[To know the Step by step process for applying an IEC Code and understand how complex & time consuming it can get, Please read our article on “How to apply for IEC Code – Step by Step Guide“]

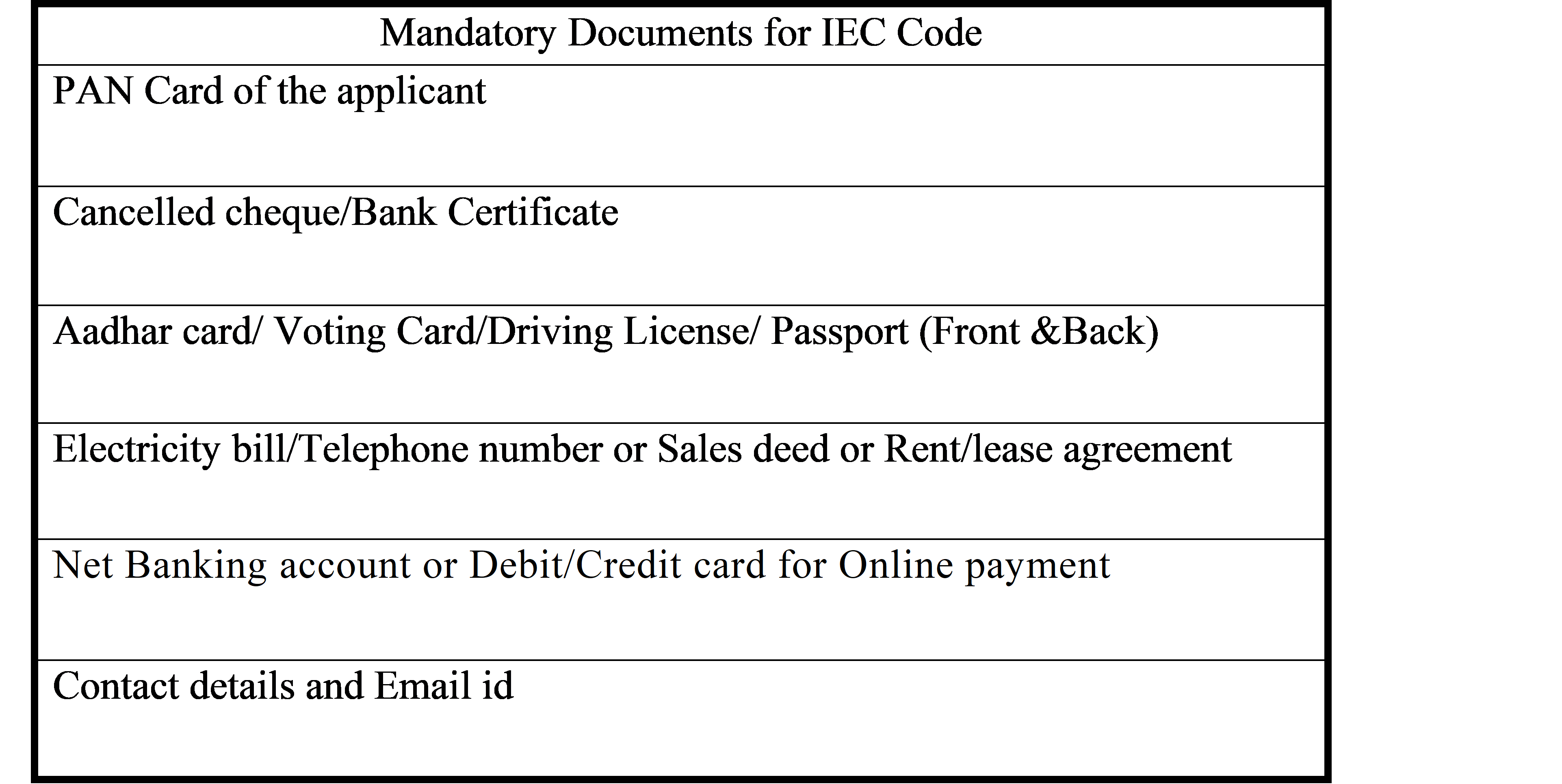

Mandatory Documents for Import Export Code

These are the mandatory documents required for IEC Code for all the entities. Type of Companies/entities such as Proprietor, Partnership, Private limited, HUF, Registered Society, etc has to submit different additional documents required for IEC code.

[To know the entire list of documents according to your entity, read our article on “Documents required for IEC Code – Updated List (2019)” ]

How Afleo can help you?

Afleo.com is one of the leading firms when it comes to Import or Export Consulting. We are very well versed into the mechanisms of DGFT and the schemes that are exercised by them. So, when it comes to applying for IEC license, we can minimize all the confusion and complicated procedures involved.

[Now, if you are planning to start your Export business from India. It is important for you to know that the Government of India gives certain incentives to Exporters. This Export Incentive or subsidy is given in the form of Merchandise Exports from India Scheme (MEIS Scheme). Exporters can get anywhere from 2% to 5% of their Invoice value in the form of Incentives. So want to know more about the scheme or want to know the rate of incentive your export product is eligible for? Find all the details here – “MEIS Scheme“]

Ready to Export After Getting Your IEC Code?Simplify your logistics with our digital freight platform-from customs clearance to real-time shipment tracking.

Please fill the form below to get in touch with us.