CoO DGFT Registration (Certificate of origin for Exports)

Get Your Certificate of Origin (CoO) Hassle-Free with Our Expert Assistance

✓ Simplified process to obtain your CoO from DGFT without delays

✓ Ensure smooth export transactions with government-authorized certification

✓ Compliance with the latest DGFT guidelines for seamless international trade

✓ Support for both Preferential and Non-Preferential Certificates of Origin

✓ Guidance on document preparation and submission

✓ Fast-track Certificate Issuance for Exporters

✓ CEPA – DUBAI, SAFTA, SAPTA, IND-AUS ECTA, CECA, ISFTA, AIFTA, GSP Etc being handled by our Team

List of Services

AFLEO Consultants DGFT Regional office

- IEC and its modification/Yearly Update/IEC Surrender.

- Revoke IEC from DEL, Suspension, Cancellation etc / Merger/Demerger of IEC’s.

- DGFT Identity card.

- Advance License - Issuance and Redemptions

- Export Promotion Capital Goods (EPCG) License – Issuance and Redemptions

- Duty-Free Import Authorization (DFIA)

- Remission of Duties or Taxes on Export Product (RoDTEP)

- Merchandise Exports from India Scheme (MEIS)

- Services Exports from India Scheme (SEIS)

- Rebate of State and Central Taxes and Levies (RoSCTL)

- Transport and Marketing Assistance (TMA)

- Certificates of Origin (COO) – SAPTA, APTA, ISLFTA, GSTP, India–Dubai CEPA, etc.

- Import Monitoring System (IMS) – Steel IMS, Coal IMS, Copper/Aluminium IMS, Chip IMS

- Deemed Export Benefits – Apply for Refund of TED/DBK/Brand rate Fixation.

- Star Export House Certificate.

- Free Sale & Commerce Certificate, End User Certificate.

- Enforcement cum Adjudication Proceedings at RA Mumbai.

- E-RCMC Certificate from DGFT – APEDA, FIEO, EEPC, PHARMEXCIL, CHEMEXCIL ETC.

- Gems & Jewelry Schemes.

- Application for Interest Equalization Scheme.

- REX Registration.

- FREE SALE AND COMMERCE CERTIFICATE.

- Abeyance Cases for IEC’s in DEL.

- END USER CERTIFICATE.

DGFT HQ, New Delhi

- Norms Fixation - Handling 25+ Norms Fixation cases every month across various Product groups. (Engineering, Pharmaceutical, Chemical, Textiles & Leather, Plastic & Rubber, Food, Sports & Misc. products)

- Policy Relaxation Committee (PRC Matters) - Proudly representing 20+ cases every month.

- EPCG Committee Approvals - Handling 10+ complex cases every month

- Permission for Restricted/Negative list of Import Items & Export Items - Experience in Handling 100+ cases till date.

- Registration Certificates for Export & Import Items.

- SCOMET Licenses.

- TRQ (Tariff Rate Quotas)

- Appeal Matters under FTP.

Custom Related Services

- AA/EPCG/DFIA License Registration.

- Bond & Bank Guarantee (BG) Cancellation of EPCG/Advance License.

- ICEGATE Registration.

- Refund under Section 74.

- Pending Duty Drawback from Customs.

- Factory stuffing– Self-sealing permission. [FSP]

- Pending IGST Refund from Customs.

- Removal of IEC from the Alert list of Customs.

- GST Services – Refund of ITC from GST.

- Authorized Economic Operator (AEO T1, T2 & T3) certification.

- Reply & Follow-up of Customs Notices if any.

- GST Services – Refund of GST for Service Exporters.

- AD Code/IFSC Registration.

- SIIB Matters (Special Investigation and Intelligence Branch)

- SVB Matters.

- Registration Procedures for First-time Importers/ Exporters

- DPD/DPE Registration.

Other Certification:

- All Types of Digital Signature Certificates.

- Health Certificate for Export Products

- EPR Certification for Producers, Importers and Brand owners.

- Phytosanitory Certificate.

- BIS Certification.

- Banking & RBI related liaison for Exporters & Importers.

AFLEO logistics

- Sea Cargo Consolidation – Import & Export

- Sea Freight Forwarding - Import & Export

- Air freight - Import & Export

- Land freight

- Warehousing

- Customs clearance

- Insurance

AFLEO Global

- Buying of scrips - MEIS / SEIS / RoDTEP / RoSCTL / DFIA

- Selling of scrips - MEIS / SEIS / RoDTEP / RoSCTL / DFIA

Find our brochure for more details:

Table of Contents

CoO DGFT Registration (Certificate of origin for Exports)

- What is a Certificate of Origin for Export? – An Overview

- Latest Updates on CoO DGFT Registration:

- A certificate of Origin is issued by?

- Types of Certificate of Origin(CoO) for Export

- Online Common Digital Platform for issuance of Certificate of origin

- Documents required to obtain Certificate of Origin

- Prior Registration on CoO portal for issuance of certification

- How to apply for a Certificate of Origin / CoO certificate Online? – Procedure to obtain CoO

- Certificate of origin – forms/format of CoO

- How Afleo Consultants can help you to get CoO through a common digital platform?

- FAQ’s

- Why Afleo Consultants?

What is a Certificate of Origin for Export? – An Overview

A Certificate of Origin is an important international trade document or certificate that declares the goods in the export shipment are manufactured or produced in a particular country. It defines the nationality of the products and also has important information regarding the products, country of origin, its destination, etc. The CoO determines whether the goods coming into the country are eligible for import and duty rates have to be charged or not on the products. The Customs officials require the Certificate of Origin (CoO) and commercial invoice for customs clearance procedures. It also serves as a proof of origin for the shipment. Today, exporters can conveniently apply for a certificate of origin online through authorized platforms.

There are two types of Certificate of Origin – Preferential Certificate of Origin & Non-Preferential Certificate of Origin (NP CoO).

Latest Updates on CoO DGFT Registration:

- The Directorate General of Foreign Trade (DGFT) launched the enhanced Certificate of Origin (eCoO) 2.0 system in January 2025 to streamline the certification process for exporters.

- Mandatory electronic filing of Non-Preferential Certificates of Origin via the eCoO 2.0 platform from January 1, 2025.

- Exporters are advised not to accept manually issued Certificates of Origin after the specified deadlines, as such documents will be considered invalid.

- Trade Notice No. 19/2021-2022: The Government of India has extended the Date for Mandatory electronic filing of Non-Preferential Certificate of Origin (CoO) through the Common Digital Platform to 31st October 2021.

- Trade Notice No. 10/2021-2022: Extension of Date for Mandatory electronic filing of Non-Preferential Certificate of Origin (CoO) through the Common Digital Platform to 01st Oct 2021.

- Trade Notice No. 10/2021-2022: Extension of Date for Mandatory electronic filing of Non-Preferential Certificate of Origin (CoO) through the Common Digital Platform to 01st Oct 2021.

[Refer to the image below to have a clear understanding of the information a Certificate of origin contains ]

A certificate of Origin is issued by?

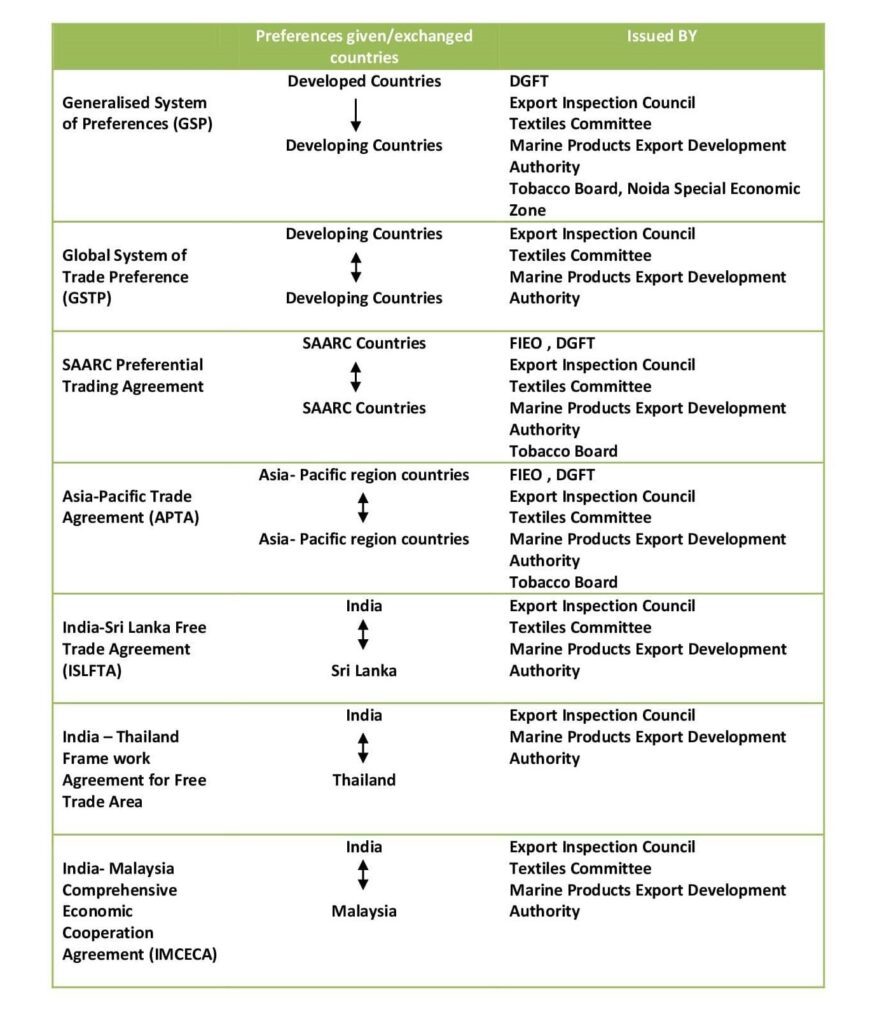

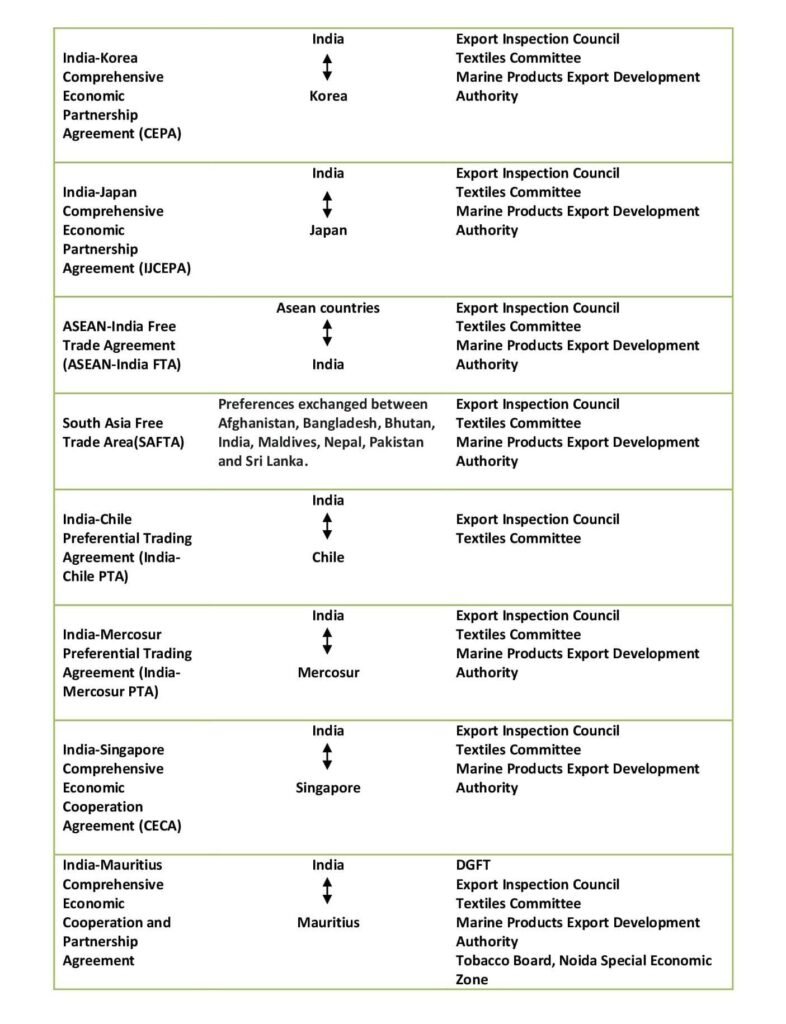

The Government of India has nominated various agencies as the issuing authority to issue the Certificate of Origin. These include Export Promotion Councils, Chambers of Commerce ICC, various trade bodies, and other government-authorized agencies. Many of these agencies are also recognized by international organizations like the International Chamber of Commerce.

Find the list below to check nominated agencies to issue the Preferential and Non – Preferential CoO.

Please watch a short Introductory video on CoO which will explain - What is a Certificate of Origin for exports? Types of Certificate origin, The Application procedure & Documents required to get the Certificate of origin. It will also explain the new online common Digital Platform that was launched by DGFT for the issuance of an online Certificate of origin mandatory from 01.04.2022.

Types of Certificate of Origin(CoO) for Export

As we discussed above there are two types of Certificate of Origin –

- Preferential Certificate of Origin

- Non Preferential Certificate of Origin (NP CoO)

Preferential Certificate of Origin

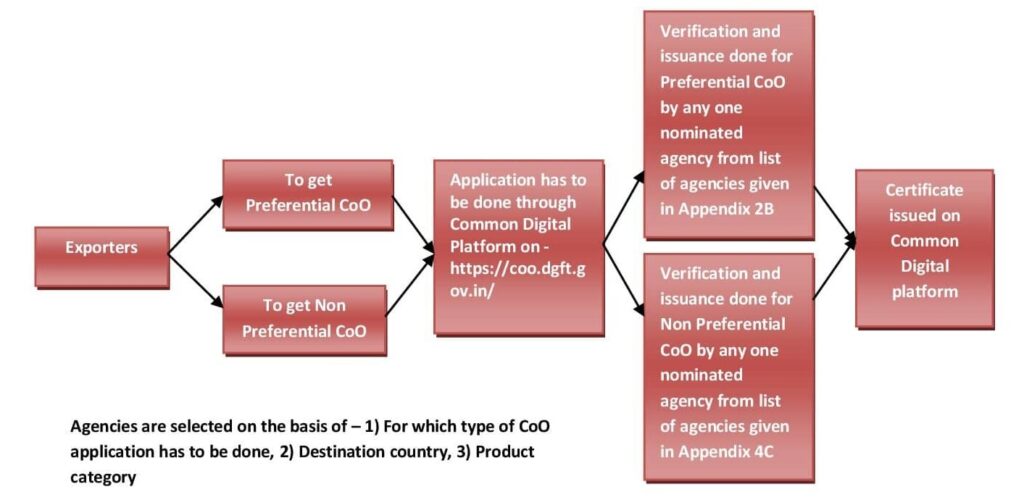

Under this category, a Certificate of Origin is issued in the case of Exports for which India receives tariff preferences. The Preferential Certificate of Origin is required to export to the countries which are involved in following trade agreements. The Government has nominated certain agencies to issue a Preferential Certificate of Origin by applying through the Common Digital platform.

Generalized System of Preferences (GSP)

Under this agreement following developed countries extend tariff concessions to developing countries.

(i) the USA (ii)New Zealand (iii)Belarus (iv)EU (v)Japan (vi)Russia (vii)Canada (viii)Norway (ix)Australia (only to LDCs) (x)Switzerland (xi)Bulgaria

Customs of these countries require Form A certificate of origin duly filled by exporters of beneficiary countries and certified by the authorized agencies.

Global System of Trade Preference (GSTP)

Under GSTP tariff concessions are exchanged among developing countries that have signed agreements. India has exchanged tariff concessions with 12 countries on a limited number of products.

SAARC Preferential Trading Agreement (SAPTA)

SAARC countries namely India, Pakistan, Nepal, Bhutan, Bangladesh, Sri Lanka, and Maldives offering tariff concessions among SAARC countries.

Asia-Pacific Trade Agreement (APTA)

APTA offers liberalization of tariff and non-tariff barriers in order to expand trade in goods in the Economic and Social Commission for Asia and the Pacific region. Presently Bangladesh, Sri Lanka, South Korea, India, and China are exchanging tariff concessions under APTA.

India-Sri Lanka Free Trade Agreement (ISLFTA)

This FTA is signed between India and Sri Lanka which offers tariff concession by the Governments of both countries.

India – Thailand Framework Agreement for Free Trade Area

India and Thailand have signed this agreement for imports on items of Early Harvest Scheme only to those products which satisfy Rules of Origin criteria.

India- Malaysia Comprehensive Economic Cooperation Agreement (IMCECA)

This Comprehensive Economic Cooperation Agreement is in between the Government of India and Malaysia with effect from 1st July 2011.

India-Japan Comprehensive Economic Partnership Agreement (IJCEPA)

The Government of India and the Government of Japan have signed the agreement to increase investment opportunities and strengthen protection for investments and investment activities between the Countries

India-Korea Comprehensive Economic Partnership Agreement (CEPA)

The Government of India and the Republic of Korea have signed this agreement to liberalize and facilitate trade in goods and services and expand investment between the countries. Under such agreements, a Certificate of Origin serves as a declaration that the exported goods meet specific origin criteria, such as being substantially transformed in the exporting country.

There are various other trade agreements are there that have signed by India with other countries, list has been shared below giving complete information.

[Please refer to the summary table of trade agreements, signed between two or more countries to offer tariff concession and designated agencies that are nominated to issue Preferential CoO under these agreements.]

Non Preferential Certificate of Origin (NP CoO)

The Government of India has also nominated various agencies to issue Non-Preferential CoO. The Exporters having a Non-Preferential Certificate of Origin for their shipment have no right to ask for preferential tariffs.

The certificate is used to declare that the goods are wholly obtained in India or sufficiently processed to meet origin criteria, even though it doesn’t qualify for preferential treatment.

The applicant wishing to get the Non-Preferential Certificate of Origin can apply to any agency authorized to issue NP CoO by the Government through the Common Digital Platform.

This document helps verify that the products originating from India comply with the importing country’s customs requirements.

If any agency desire to enlist them in the list of nominated agencies t in Appendix–4C may submit their application as per Annexure I to Appendix 4C to the concerned RA / DGFT.

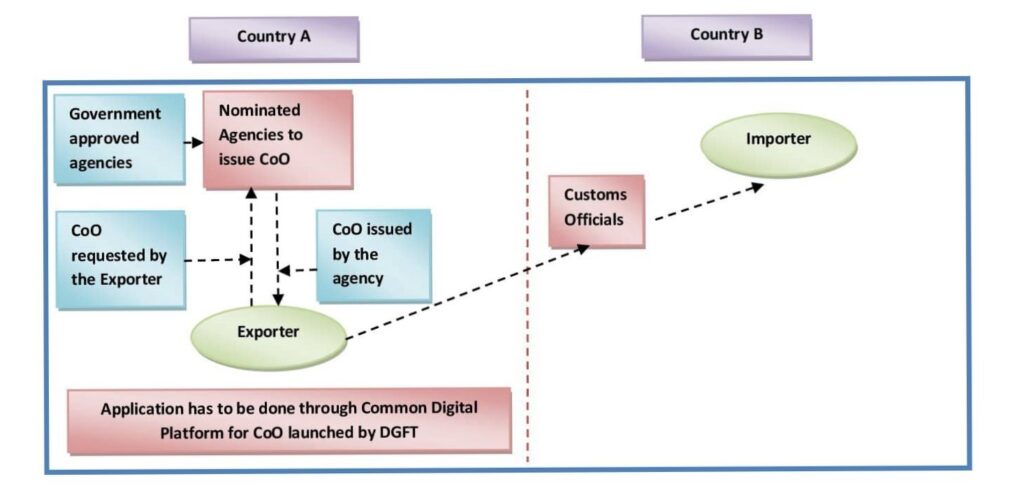

Online Common Digital Platform for issuance of Certificate of origin

With increasing concerns about fraud and the need of improving the security of the international supply chain, the Government has launched one Common platform to obtain Certificates of origin. The platform would provide an electronic, paperless, contactless common platform to issue the certificate by saving time and cost for exporters.

The application has to be done to the nominated agencies by doing an online application on – https://coo.dgft.gov.in/.

- The platform was first made functional for issuance of the preferential certificate of origin in September 2019. Since then various agencies have been added to the list of nominated agencies to get the Certificate of Origin (Preferential CoO).

- As per the Trade Notice No. 48/2020-2021 Dated 25.03.2021 the common Digital platform to issue online CoO on https://coo.dgft.gov.in/ is expanded beyond Preferential Certificate of Origin to facilitate the electronic application of Non-Preferential CoO.

Refer to the below image to understand how the online platform would help exporters to get a Certificate of origin to export from India.

Documents required to obtain Certificate of Origin

The following are the documents required to get a Certificate of origin:

- Shipping bills

- Bill of Lading/Airway bill

- Invoice Copy

- Packing List

Document preparation and gathering all the data needed to obtain a certificate of origin is an important task, and we have a separate team for each job to give our 100% efficiency.

For submission of an online application, DGFT Digital Signature Certificate is also required. We have an in-house team to prepare DGFT DSC to avoid any kind of delay in the process of obtaining CoO.

Prior Registration on CoO portal for issuance of certification

To proceed with the Certificate of Origin online application, prior registration on the CoO portal is mandatory.

Class 2 or Class 3 Digital signature certificate (DSC) shall be required for online registration and application submission, the IEC of the firm needs to be embedded in DSC.

The applicant needs to register on the portal, and the password will be sent to the email and mobile number of the IEC holder. This process ensures that the customer authorizes the use of their credentials securely and officially for CoO transactions.

Steps involved in registration to get CoO –

- Visit on Coo Portal launched by DGFT – https://coo.dgft.gov.in/

- From online services click on Online exporter registration

- Insert DSC before the registration process.

- Enter IEC code, Email id, Mobile number as per updated IEC.

- By using the IEC Profile Management service on the DGFT website, an applicant can update their email on which communication needs to be done.

- Click on Save & Next to proceed with the registration.

- Select “I Agree” and submit the registration request.

- On successful registration, the password would be received on Email id.

- After completing the process go to the log-in screen.

- Login with user name and password.

- The user name would be registered IEC (10 digits alphanumeric/numeric code) and Password – As received in e-mail.

How to apply for a Certificate of Origin / CoO certificate Online? – Procedure to obtain CoO

The application for Certificate of Origin for exports shall be done through the e-COO platform to the nominated/designated issuing agencies. The common platform was launched for issuance of preferential CoO in 2019 and it is working smoothly but for issuance of Non-Preferential CoO it has been upgraded recently, submitting an Application for a Non-Preferential Certificate of origin is not mandatory on this online platform till 31st October 2021 as per the latest notification.

Non Preferential CoO applications directly submitted to the nominated issuing agency is also functional and it may continue up to 31st October 2021or until further orders.

Steps involved to issue the Certificate of origin –

- Login on a Common platform with valid credentials such as IEC number and Password received after registration on the portal.

- The application form to issue CoO will display, fill in all the required details.

- After filling in all the details on the portal digitally signed documents has to be attached

- A digital signature certificate has to be attached for uploading the documents and submitting the application.

- Click on the preview Certificate To view the draft application.

- Make the Payment and submit the application.

- After submission, the applicant will receive an alert on the registered email Id and Mobile number.

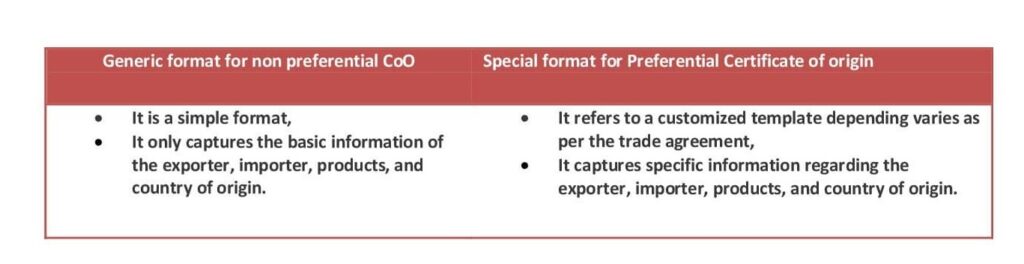

Certificate of origin – forms/format of CoO

The forms/formats of certificate of origin of two types –

1) only one Generic form to issue non-preferential CoO.

2) The forms/formats for the preferential certificate of origin differ from one trade agreement to another, for example, format of CoO under GSP would be Form a Certificate of origin, the format of CoO under ASEAN – India FTA is Form AI Certificate of origin.

How Afleo Consultants can help you to get CoO through a common digital platform?

Obtaining a certificate of origin is a complicated task as it involves various documents and online applications.

Doing the application online on the Digital platform required technical expertise and obtaining the certificate becomes difficult without the proper knowledge and guidance.

Hence we have a separate team of experts who are working dedicatedly to obtaining the CoO for our clients by performing the following task –

- Assistance in Document Preparation.

- Assistance would be given in the online application.

- Obtaining Certificate of Origin through the common digital platform.

FAQ’s

What is meant by the certificate of origin?

Certificate of origin means the Certificate containing the information regarding export country, exports goods, destination countr

What is the certificate of origin?

It is a necessary document required for cross-border trade by many countries under various trade agreements.

What is the certificate of origin in export?

A certificate which contains vital information regarding the item, country of export as well as destination country.

Which countries require a certificate of origin

Any country, which is involved in international trade requires a certificate of origin.

Where do I get a certificate of origin?

It can be obtained from DGFT, other Government nominated agencies, trade bodies, and export promotion councils, etc.

Why a certificate of origin is required?

For the following reasons CoO required –

It helps in determining whether or not particular products are eligible for export from India.

It helps to establish whether the goods are subject to duties and taxes or if they are exempted from the same.

How to get the certificate of origin in India?

For the following reasons CoO required –

It helps in determining whether or not particular products are eligible for export from India.

It helps to establish whether the goods are subject to duties and taxes or if they are exempted from the same.

How to apply for a certificate of origin in India?

Online application has to be done on the Common Digital CoO portal launched by DGFT.

Who issues the certificate of origin?

The Government of India has nominated various agencies to issue the certificate of origin.

Certificate of origin is issued by the government of which country?

The Government of all the countries that have signed trade agreements requires a certificate of origin.

Certificate of origin required for which countries?

Almost all the countries involved in the international supply chain require a certificate of origin.

What are the origin criteria in the certificate of origin?

Origin criteria mean conditions regarding the production of goods that must be fulfilled for the goods to be considered as originating under applicable rules of origin.

How to fill certificate of origin?

The online application has to be filled on a common platform with the help of the following documents –

1) Invoice Copy 2) Shipping Bill 3) Bill of Lading 4) Packing List

Can a Certificate of Origin Reduce Import Duties?

If you’re importing products from countries, which have bilateral or unilateral trade agreements, a Certificate of origin can eliminate or reduce import duties.

The applicant needs to register on the portal, and the password will be sent to the email and mobile number of the IEC holder. This process ensures that the customer authorizes the use of their credentials securely and officially for CoO transactions.

If you’re importing products from countries, which have bilateral or unilateral trade agreements, a Certificate of origin can eliminate or reduce import duties.

How does the Certificate of Origin impact exporters in Mumbai, Navi Mumbai, and Thane?

Exporters from Mumbai, Navi Mumbai, and Thane often need the timely issuance of a Certificate of Origin (CoO) to ensure smooth customs processing. A CoO helps avoid delays and ensures compliance with international trade regulations.

Why Afleo Consultants?

Exporting-Importing goods or services can be a complex and confusing procedure. You need to make sure all the documentation related to export-import is in order and that you have the correct HS codes, to name a few important items.

When you have any such doubts, or if you want assistance with exporting-importing and customs formalities, please contact one of the experts from the Afleo team to be your partner throughout the process.