Chip Import Monitoring System(CHIMS)

List of Services

AFLEO Consultants DGFT Regional office

- IEC and its modification/Yearly Update/IEC Surrender.

- Revoke IEC from DEL, Suspension, Cancellation etc / Merger/Demerger of IEC’s.

- DGFT Identity card.

- Advance License - Issuance and Redemptions

- Export Promotion Capital Goods (EPCG) License – Issuance and Redemptions

- Duty-Free Import Authorization (DFIA)

- Remission of Duties or Taxes on Export Product (RoDTEP)

- Merchandise Exports from India Scheme (MEIS)

- Services Exports from India Scheme (SEIS)

- Rebate of State and Central Taxes and Levies (RoSCTL)

- Transport and Marketing Assistance (TMA)

- Certificates of Origin (COO) – SAPTA, APTA, ISLFTA, GSTP, India–Dubai CEPA, etc.

- Import Monitoring System (IMS) – Steel IMS, Coal IMS, Copper/Aluminium IMS, Chip IMS

- Deemed Export Benefits – Apply for Refund of TED/DBK/Brand rate Fixation.

- Star Export House Certificate.

- Free Sale & Commerce Certificate, End User Certificate.

- Enforcement cum Adjudication Proceedings at RA Mumbai.

- E-RCMC Certificate from DGFT – APEDA, FIEO, EEPC, PHARMEXCIL, CHEMEXCIL ETC.

- Gems & Jewelry Schemes.

- Application for Interest Equalization Scheme.

- REX Registration.

- FREE SALE AND COMMERCE CERTIFICATE.

- Abeyance Cases for IEC’s in DEL.

- END USER CERTIFICATE.

DGFT HQ, New Delhi

- Norms Fixation - Handling 25+ Norms Fixation cases every month across various Product groups. (Engineering, Pharmaceutical, Chemical, Textiles & Leather, Plastic & Rubber, Food, Sports & Misc. products)

- Policy Relaxation Committee (PRC Matters) - Proudly representing 20+ cases every month.

- EPCG Committee Approvals - Handling 10+ complex cases every month

- Permission for Restricted/Negative list of Import Items & Export Items - Experience in Handling 100+ cases till date.

- Registration Certificates for Export & Import Items.

- SCOMET Licenses.

- TRQ (Tariff Rate Quotas)

- Appeal Matters under FTP.

Custom Related Services

- AA/EPCG/DFIA License Registration.

- Bond & Bank Guarantee (BG) Cancellation of EPCG/Advance License.

- ICEGATE Registration.

- Refund under Section 74.

- Pending Duty Drawback from Customs.

- Factory stuffing– Self-sealing permission. [FSP]

- Pending IGST Refund from Customs.

- Removal of IEC from the Alert list of Customs.

- GST Services – Refund of ITC from GST.

- Authorized Economic Operator (AEO T1, T2 & T3) certification.

- Reply & Follow-up of Customs Notices if any.

- GST Services – Refund of GST for Service Exporters.

- AD Code/IFSC Registration.

- SIIB Matters (Special Investigation and Intelligence Branch)

- SVB Matters.

- Registration Procedures for First-time Importers/ Exporters

- DPD/DPE Registration.

Other Certification:

- All Types of Digital Signature Certificates.

- Health Certificate for Export Products

- EPR Certification for Producers, Importers and Brand owners.

- Phytosanitory Certificate.

- BIS Certification.

- Banking & RBI related liaison for Exporters & Importers.

AFLEO logistics

- Sea Cargo Consolidation – Import & Export

- Sea Freight Forwarding - Import & Export

- Air freight - Import & Export

- Land freight

- Warehousing

- Customs clearance

- Insurance

AFLEO Global

- Buying of scrips - MEIS / SEIS / RoDTEP / RoSCTL / DFIA

- Selling of scrips - MEIS / SEIS / RoDTEP / RoSCTL / DFIA

Find our brochure for more details:

Table of Contents

Chip Import Monitoring System(CHIMS)

- Overview

- Latest Updates

- Objective of CHIMS

- Fee Requirement and Validity of registration numbers under CHIMS

- Documents/Details required to get registration number under CHIMS

- Procedure to get the Registration number/License under CHIMS

- Modification/Cancellation of Registration number/license under CHIMS

- How you can help you to get the registration number under CHIMS?

- Why Afleo Consultants?

- FAQ’s

Overview

The Government of India has started tracking the import of various products in the country by making import registration mandatory to the importers. The Government made import registration compulsory for a host of electronic integrated circuits (ITC HS Codes: 85423100, 85423900, 85423200, 85429000, 85423300) under the chip imports monitoring system (CHIMS).

The registration under CHIMS would be available from 1st October 2021. The registration window is open under CHIMS for applying till the time of import shipment arrives but it has not to be done earlier than 60th Day.

The Legal action would be taken on-chip importers who are failing to register under CHIMS in advance or found to furnish wrong data in the online system. The Ministry of Electronics will monitor the information of chip imports provided by the importers under CHIMS.

Latest Updates

- As per the Notification No. 05/2015-2020 Dated 10th May 2021 :

Import of Integrated Circuits (ITC HS Codes: 85423100, 85423900, 85423200, 85429000, 85423300) shall require compulsory registration under the Chip Import Monitoring System (CHIMS) as per DGFT Notification.

Objective of CHIMS

The objective of introducing the CHIMS is to enable the Government of India to maintain and update constantly a database containing the advance information of the following products imported in India.

Hence, Under the CHIMs chip importers are required to submit the advance information in the online system for the import of the above products to obtain the Registration Number or CHIMS License by paying the registration fee.

The data received through the CHIMs help the Government in effective policy formulations and implementations regarding steel imports.

The Data would be published by the Ministry of Electronics on the CHIMS portal.

Fee Requirement and Validity of registration numbers under CHIMS

A registration fee of Rs 1 per thousand subject to a minimum of Rs.100/− and maximum of Rs 500/- on aggregate CIF value of imports will need to be paid through electronic mode in the online system for each registration number.

Registration number/CHIMS License is valid for 75 days after approval.

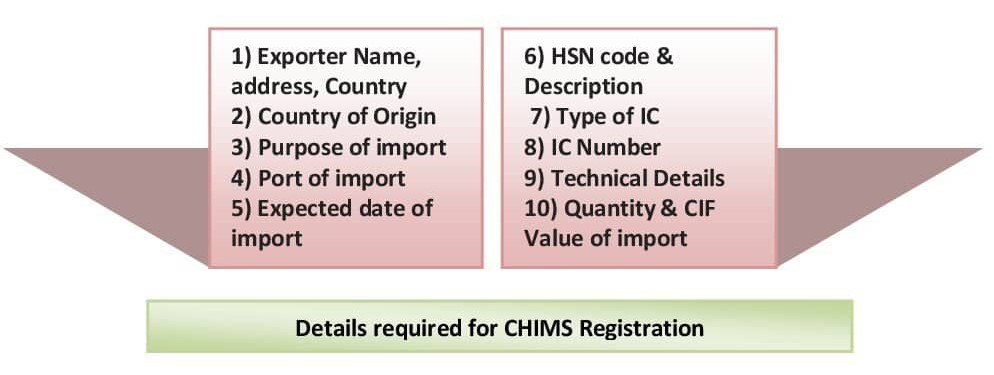

Documents/Details required to get registration number under CHIMS

To get the registration number /CHIMS license there are various documents/data have to be kept ready in hand.

The Documents such as Digital signature certificate, active IEC copy required with the following import & item details –

Procedure to get the Registration number/License under CHIMS

- Step 1: The online application has to be done on – https://imports.gov.in/IMS/index

- Step 2: Select Chips Import Monitoring System under Ministry of Electronics.

- Step 3: Click on apply for new registration number.

- Step 4: Start filling with the required details shared above.

- Step 5: Accept the terms and conditions on the declaration tab.

- Step 6: Submit the application after paying the registration fee.

- Step 7:The registration number/CHIMS license would be generated immediately as the application is submitted on the portal.

Multiple products can be added in one application if exporter, importer, country of origin, port of exportation is the same. For each shipment, the license has to filed. The chip importers only have to enter the registration number and expiry date of the registration number in the bill of entry.

Modification/Cancellation of Registration number/license under CHIMS

Modification of the license under CHIMS is not permitted once the application is submitted on the portal. The draft online application details can be modified from the draft section on the website.

Same for the cancellation, the cancellation of license is not permitted once it is submitted. The draft application can be deleted from the portal.

There is no provision given for the fee refund after the cancellation.

Modification, cancellation, refund of fee post submission can be evaluated in the near future when the CHIMS system would be enhanced.

How you can help you to get the registration number under CHIMS?

Our experts assist you in getting the registration done under CHIMS:

- We assist you in the documentation and guide you about the data which has to be kept ready to get CHIMS registration.

- Assistance would be given in online application under CHIMS on online Portal.

- Coordination with issuing authority if any further clarification has been asked by them.

- Obtaining the registration number from issuing authority in 2-3 working days.

Why Afleo Consultants?

- We are the team of highly qualified & experienced professionals having sufficient expertise over the years in the field of DGFT Consultancy Services.

- We only have the goal of providing very reliable services with the most competitive cost to the exporters under one roof.

- We keep updating our clients with regular policy amendments, all the upcoming rules, and regulations in foreign trade policy.

- We have a separate team for follow up with DGFT and have a great understanding of the working of DGFT office, which helps us in obtaining MEIS licenses without delay.

FAQ’s

What does CHIMS stand for?

CHIMS stands for CHIP IMPORT MONITORING SYSTEM.

Why CHIMS was created?

To provide advance information about the Import of Integrated Circuits in India to the government as well as relevant stakeholders.

Do I need a CHIMS license for each shipment?

Yes, a CHIMS license is required for each shipment/customs entry.

What is the application fee to get the License under CHIMS?

The application fee of Rs. 1 per thousand subjects to a minimum of Rs. 100/- and a maximum of Rs. 500 on the aggregate CIF value of imports required to be paid through the online system for each registration number.

What products are covered?

The products from Chapter 85 [ITC (HS) 85423100, 85423900, 85423200, 85429000, 85423300] are covered under CHIMS.

Do Indian-origin goods processed in a foreign country need a license under CHIMS when re-entering India?

Yes, all the CHIP imports entering the country need licenses under CHIMS.

When to apply for a CHIMS License under the importation process?

The application has to be done prior to submitting the Bill of Entry in customs. It should be filled in between 15 days to 60 days before the expected arrival of the imports into India.

What is the validity of the CHIMS License/Registration number?

The license or the registration number is valid for 75 days.

How can I apply for the License?

Please find the procedure to apply for the CHIMS

- Step 1: The online application has to be done on – https://imports.gov.in/IMS/index

- Step 2: Select Chips Import Monitoring System under Ministry of Electronics.

- Step 3: Click on apply for new registration number.

- Step 4: Start filling with the required details shared above.

- Step 5: Accept the terms and conditions on the declaration tab.

- Step 6: Submit the application after paying the registration fee.

- Step 7:The registration number/CHIMS license would be generated immediately as the application is submitted on the portal.

Can we include multiple products in one license application?

Yes, multiple products can be included in one application; it has the option to add the products.

How long it takes to get the CHIMS License or registration number under CHIMS?

The license/registration number is generated under CHIMS immediately after completing the application and fee payment.

Can I modify my existing CHIMS?

At Present, there is no provision for the modification of the existing CHIMS License.

How do I cancel my CHIMS license/Registration under CHIMS?

The draft application to get the license or registration number can be deleted on the portal, once it is submitted can’t be canceled.

What will happen if I won’t apply under CHIMS being a chip importer and planning to import ICs?

Legal action would be taken including the action under FTDR Act, 1992 for the chip importers who are failing to register under CHIMS in advance or found to furnish wrong data in the online system.