Authorized Economic Operator (AEO)

✓ End-to-End Support for AEO Registration

We simplify the AEO registration process with complete expert guidance.

✓ Fast-Track AEO Certification Process

Strategic planning to get your AEO certification in minimal time.

✓ Unlock Global Trade Advantages

Accelerate growth with AEO privileges and international recognition.

List of Services

AFLEO Consultants DGFT Regional office

- IEC and its modification/Yearly Update/IEC Surrender.

- Revoke IEC from DEL, Suspension, Cancellation etc / Merger/Demerger of IEC’s.

- DGFT Identity card.

- Advance License - Issuance and Redemptions

- Export Promotion Capital Goods (EPCG) License – Issuance and Redemptions

- Duty-Free Import Authorization (DFIA)

- Remission of Duties or Taxes on Export Product (RoDTEP)

- Merchandise Exports from India Scheme (MEIS)

- Services Exports from India Scheme (SEIS)

- Rebate of State and Central Taxes and Levies (RoSCTL)

- Transport and Marketing Assistance (TMA)

- Certificates of Origin (COO) – SAPTA, APTA, ISLFTA, GSTP, India–Dubai CEPA, etc.

- Import Monitoring System (IMS) – Steel IMS, Coal IMS, Copper/Aluminium IMS, Chip IMS

- Deemed Export Benefits – Apply for Refund of TED/DBK/Brand rate Fixation.

- Star Export House Certificate.

- Free Sale & Commerce Certificate, End User Certificate.

- Enforcement cum Adjudication Proceedings at RA Mumbai.

- E-RCMC Certificate from DGFT – APEDA, FIEO, EEPC, PHARMEXCIL, CHEMEXCIL ETC.

- Gems & Jewelry Schemes.

- Application for Interest Equalization Scheme.

- REX Registration.

- FREE SALE AND COMMERCE CERTIFICATE.

- Abeyance Cases for IEC’s in DEL.

- END USER CERTIFICATE.

DGFT HQ, New Delhi

- Norms Fixation - Handling 25+ Norms Fixation cases every month across various Product groups. (Engineering, Pharmaceutical, Chemical, Textiles & Leather, Plastic & Rubber, Food, Sports & Misc. products)

- Policy Relaxation Committee (PRC Matters) - Proudly representing 20+ cases every month.

- EPCG Committee Approvals - Handling 10+ complex cases every month

- Permission for Restricted/Negative list of Import Items & Export Items - Experience in Handling 100+ cases till date.

- Registration Certificates for Export & Import Items.

- SCOMET Licenses.

- TRQ (Tariff Rate Quotas)

- Appeal Matters under FTP.

Custom Related Services

- AA/EPCG/DFIA License Registration.

- Bond & Bank Guarantee (BG) Cancellation of EPCG/Advance License.

- ICEGATE Registration.

- Refund under Section 74.

- Pending Duty Drawback from Customs.

- Factory stuffing– Self-sealing permission. [FSP]

- Pending IGST Refund from Customs.

- Removal of IEC from the Alert list of Customs.

- GST Services – Refund of ITC from GST.

- Authorized Economic Operator (AEO T1, T2 & T3) certification.

- Reply & Follow-up of Customs Notices if any.

- GST Services – Refund of GST for Service Exporters.

- AD Code/IFSC Registration.

- SIIB Matters (Special Investigation and Intelligence Branch)

- SVB Matters.

- Registration Procedures for First-time Importers/ Exporters

- DPD/DPE Registration.

Other Certification:

- All Types of Digital Signature Certificates.

- Health Certificate for Export Products

- EPR Certification for Producers, Importers and Brand owners.

- Phytosanitory Certificate.

- BIS Certification.

- Banking & RBI related liaison for Exporters & Importers.

AFLEO logistics

- Sea Cargo Consolidation – Import & Export

- Sea Freight Forwarding - Import & Export

- Air freight - Import & Export

- Land freight

- Warehousing

- Customs clearance

- Insurance

AFLEO Global

- Buying of scrips - MEIS / SEIS / RoDTEP / RoSCTL / DFIA

- Selling of scrips - MEIS / SEIS / RoDTEP / RoSCTL / DFIA

Find our brochure for more details:

Table of Contents

Authorized Economic Operator (AEO)

- What is AEO: Full Form and Meaning

- Latest Updates

- History and Origin of AEO Programs

- AEO Certification in India: Facts and Figures

- Mutual Recognition of AEO Certification Across Countries

- An Overview

- Why we need AEO Certification??

- Types of AEO Certifications: T1, T2, T3, LO Explained

- Who can apply for AEO? AEO Eligibility Criteria.

- Simplified Eligibility Criteria for MSMEs to get AEO Certifications

- Minimum Import – Export Documents requirement

- Relaxations in business activities period

- Time Limit for processing the Application

- Reduced Documentation for MSMEs to get AEO T1 and T2

- Relaxations in the legal and financial compliance period

- Relaxation in Furnishing of Bank Guarantee (BG)

- Authorized Economic Operator (AEO) Certification Benefits

- Documents required for AEO Certification

- What is the AEO Registration Procedure?

- Where to Apply for AEO Certification in India? (Portal Guide)

- How to maintain the AEO Status to avoid status cancellation?

- Who is not entitled?

- FAQ’s

- Who Are We and how we can help you?

What is AEO: Full Form and Meaning

AEO means Authorized Economic Operator. It is a broad consensus certification by the customs agencies that they award to companies exhibiting good compliance, safe operations, and trustworthiness in the supply chain throughout the world. AEO-certified companies are low-risk companies and receive fast-track customs clearance, fewer checks, and other trade facilitation benefits. The concept helps achieve smoother cross-border trade with high-security standards.

Latest Updates

- CBIC Notifies Customs (On – Arrival Movement for Storage and Clearance at Authorised Importer Premises) Regulations, 2025 for AEO T2 & T3 Importers.

- Centre accords AEO status to gem and jewellery sector

The Centre has extended Authorised Economic Operator (AEO) status to the gem and jewellery sector, aiming to boost ease of doing business by streamlining export operations and reducing costs under the WCO SAFE Framework.

- Circular No. 35/2015-20 dated 23.04.2020:

Extensions in Import Validity period and Export obligation period in Advance Authorisations/DFIA notified due to COVID-19 Pandemic.

- Notification No. 57/2015-20 dated 31.03.2020:

As per the above Notification, “Imports against Advance Authorisations for physical exports are exempted from Integrated Tax and Compensation Cess up to 31.03.2020” is extended up to 31.03.2021.

History and Origin of AEO Programs

The AEO program was born with the World Customs Organization (WCO) in 2005 with its SAFE Framework of Standards. It was created as a reaction to increasing global interest in supply chain security, particularly in the aftermath of the 9/11 attacks. The proposal was to recognize reliable players within the global supply chain and reward them with measures such as trade facilitation. With time, AEO schemes have been implemented by numerous countries and have become an integral part of safe and effective international

AEO Certification in India: Facts and Figures

India’s AEO programme is administered by the Central Board of Indirect Taxes and Customs (CBIC). Since it started, thousands of organizations across sectors have been certified under categories of AEO-T1, T2, T3, and LO. The certified businesses now process much of India’s import and export trade. Reduced port dwell times, lower cost of compliance, and enhanced competitiveness of trade have resulted from certification.

As on 30.04.2025, The total number of AEO’s registered under Different Categories are as follows:

AEO T1 – 3480 Companies Registered.

AEO T2 – 1191 Companies Registered.

AEO T3 – 212 Companies Registered.

AEO LO – 940 Logistics Operators Registered.

Mutual Recognition of AEO Certification Across Countries

One of the foremost benefits of AEO T2 & T3 certification is Mutual Recognition Agreements (MRAs) among countries. MRAs make it possible for one country to recognize the AEO status bestowed upon it by another country and ease and quicken customs procedures all over the globe. This implies that after a company becomes AEO-certified in India, it can have simplified procedures in nations with an MRA with India, resulting in cost savings, faster shipments, and greater global confidence. This global acknowledgment reinforces supply chain security standards across participating nations.

An Overview

The Authorized Economic Operator (AEO) is the status certification granted to an economic operator AEO after fulfilling certain eligibility criteria.

In 2001 the US terror attack 9/11 has made the World Customs Organization WCO realize that the international supply chain could be used for terror activities and need to be secured. In 2005 the WCO created the SAFE Framework of Standards (FoS) to Secure the international supply chain which includes the AEO.

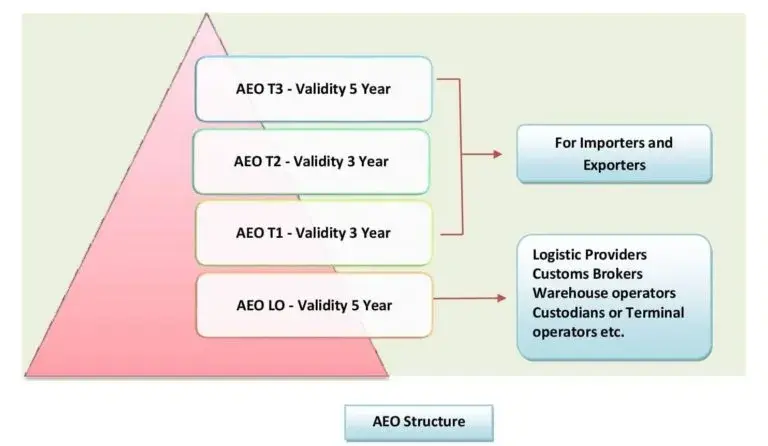

Indian AEO Programme was launched by the Government on 23rd August 2011 and aims to enhance international supply chain security and facilitate the movement of legitimate goods. There are three-tier AEO Programme ie AEO T1, AEO T2, AEO T3 for importers and exporters in increasing degree of benefits and single-tier AEO LO for Logistics Providers, Custodians or Terminal Operators, Customs Brokers and Warehouse Operators.

[Refer to the below image to get a complete idea about the AEO structure and the validity of each AEO Tier]

Why we need AEO Certification??

If you are a business owner, you would always need some form of recognition to showcase your authenticity and reliability. The recognition could be in the form of licenses, awards of honor, or even certificates. An Authorized Economic Operator (AEO) is one such certification that signifies a business’s authority and trustability in global trade. Getting this certificate endows business owners with a wide range of benefits and conveniences. Many exporters aim to obtain AEO status to improve customs processing times and enjoy reduced inspections at borders.

Types of AEO Certifications: T1, T2, T3, LO Explained

India’s AEO scheme has varying levels of certifications depending on the type of role the applicant plays in the supply chain:

AEO-T1: Importers and exporters with minimal documents & no factory inspection. Grants fundamental benefits and demands self-declaration and minimal checks for compliance.

AEO-T2: Importers and exporters who have a thorough verification process & involves factory inspection by Customs authorities. Grants additional benefits such as delayed payment of duty, less number of inspections, priority clearance & mutual recognition agreements [MRA]

AEO-T3: The highest certification level, which is awarded to organizations with robust internal control regimes and a compliance record. Provides maximum trade facilitation measures.

AEO-LO: For logistics operators like transporters, custodians, terminal operators, and customs brokers. Emphasizes security and reliability while dealing with goods in transit.

Who can apply for AEO? AEO Eligibility Criteria.

Generally, those businesses that are involved in the International supply chain and happen to undertake customs-related activity in the country are eligible for AEO Certification.

The size of the business does not matter. The industries that are eligible for AEO Certification include exporters, importers, logistics providers, custodians or terminal operators, warehouse owners, and customs house agents. AEO certification is not required for organizations that are not involved in customs-related work. Businesses trading with the United States may also benefit from MRAs if they hold AEO status.

The below image shows the criteria to get AEO certification –

The application of AEO does not cover a group of companies but only the applicant’s legal entity. The business should be based in India. The applicant should have business activities for at least three financial years preceding the date of application (This condition can be waived off by the AEO Programme Manager). AEO status applies only to the legal entity in its personal capacity. Not on its client importers and exporters who will need to apply separately for the status. The AEO certification is open to small and medium enterprises as well; whose shipping bill or bill of entry is a minimum of 25 during the last financial year.

To apply for an AEO certificate, the following documents will be required

- A certificate of registration issued by the Registrar of the company.

- Details of places or locations, where goods are being handled.

- Proof of business that it has its own accounts.

Simplified Eligibility Criteria for MSMEs to get AEO Certifications

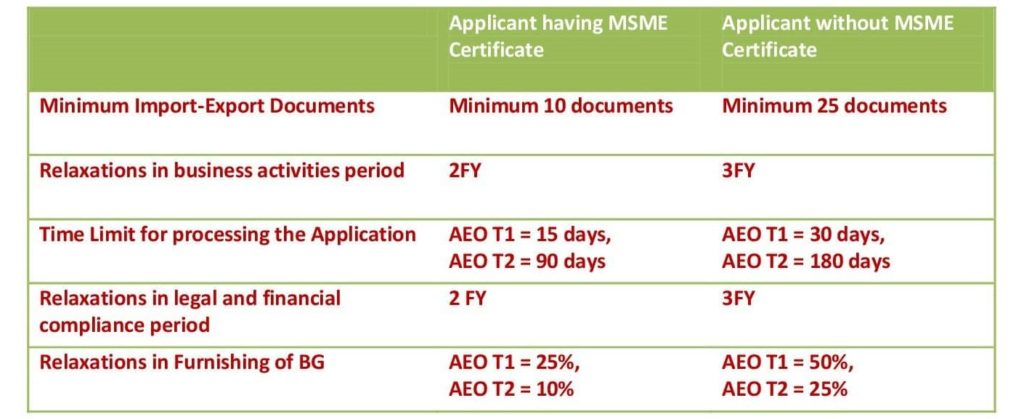

In line with Aatma Nirbhar Bharat Abhiyan to support MSMEs against the challenges due to Covid – 19 Pandemic, the CBIC has analyzed the difficulties faced by all MSMEs to get the AEO certification. The board has decided to relax the entire compliance and security requirements for MSMEs.

An applicant having the MSME certificate from inline- Ministry is eligible to get the below relaxations for granting the AEO certificate. After the AEO approval, MSME must ensure to maintain their active MSME status during the validity of AEO certification.

Minimum Import – Export Documents requirement

The minimum Documents requirement has been relaxed to 10 from 25 documents during the last financial year to get the AEO Certification, subjected to handle at least 5 Documents in each half-year period of the preceding financial year.

Relaxations in business activities period

The requirement to have business activities for at least three financial years before the date of application has been relaxed to two financial years for the Applicant having MSME certificate and wish to get AEO accreditation.

Time Limit for processing the Application

- The Time Limit for processing of MSME AEO T1 application has been reduced to 15 working days (Which is presently one month).

- The Time Limit for processing the MSME AEO T2 application has been reduced to three months (Which is presently six months).

Reduced Documentation for MSMEs to get AEO T1 and T2

All the MSMEs are now required to submit only two annexures for AEO T1 and three annexures for AEO T2 to get the AEO accreditation.

Following are the two common annexures for AEO T1 and AEO T2

- MSME Annexure 1 (General Compliance)

- MSME Annexure 2 (Legal, Managing Commercial Records, and Financial Solvency Compliance)

The third annexure for AEO T2 is MSME annexure 3 (Safety and Security Requirements). These are designed to fulfill the reduced documentation requirement for AEO accreditation of MSMEs.

Relaxations in the legal and financial compliance period

The legal and financial compliance period has been reduced from the last three financial years to the last two financial years to be eligible to get the certification.

Relaxation in Furnishing of Bank Guarantee (BG)

For MSME AEO T1

The benefit of relaxation in the furnishing of BG for MSME AEO T1 has been relaxed to 25% to 50%.

For MSME AEO T2

The benefit of relaxation in the furnishing of BG for MSME AEO T2 has been relaxed to 10% to 25%.

Visit the custom website to know more about the relaxation given to MSMEs – Click Here

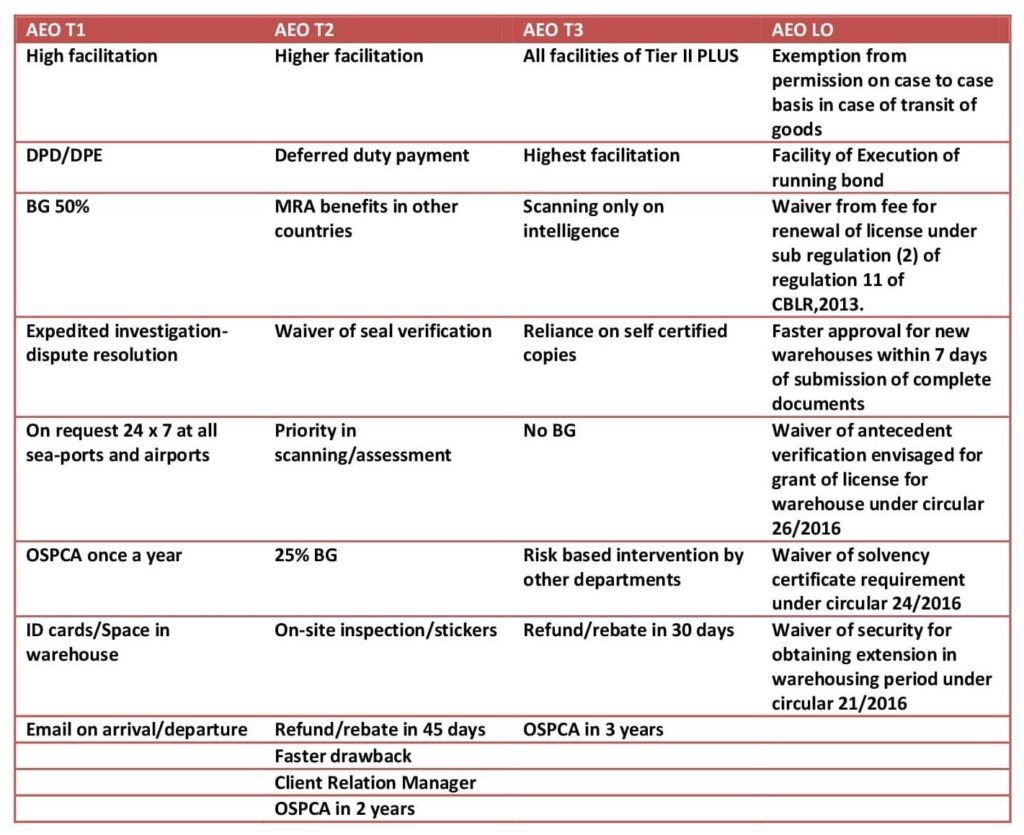

Authorized Economic Operator (AEO) Certification Benefits

Getting your business AEO Certified can help you experience an unprecedented level of trade freedom. It grants you several import/export benefits; the benefits get greater as you go up the certification tiers. The benefits of each tier are given below in the tabular form.

Note: Another Important benefit for AEO status Holders is the Self-Ratification Advance Authorisation Scheme. This Scheme is only available to AEO Status Holders. Under this Scheme, Exporters who are availing benefits of Advance Authorisation can get Advance License on Self Declaration and Self Ratification basis.

Therefore in cases where SION (Standard Input Output Norms) / Valid ad-hoc Norms for an Export Product are not fixed or where SION has been notified but the exporter intends to use additional inputs in the manufacturing process, there is no need to approach the Norms Committee for Fixation of Norms. Exporters can Redeem the Advance License on Self Ratification basis. The above Scheme is as per para 4.07 A of FTP 2015-20

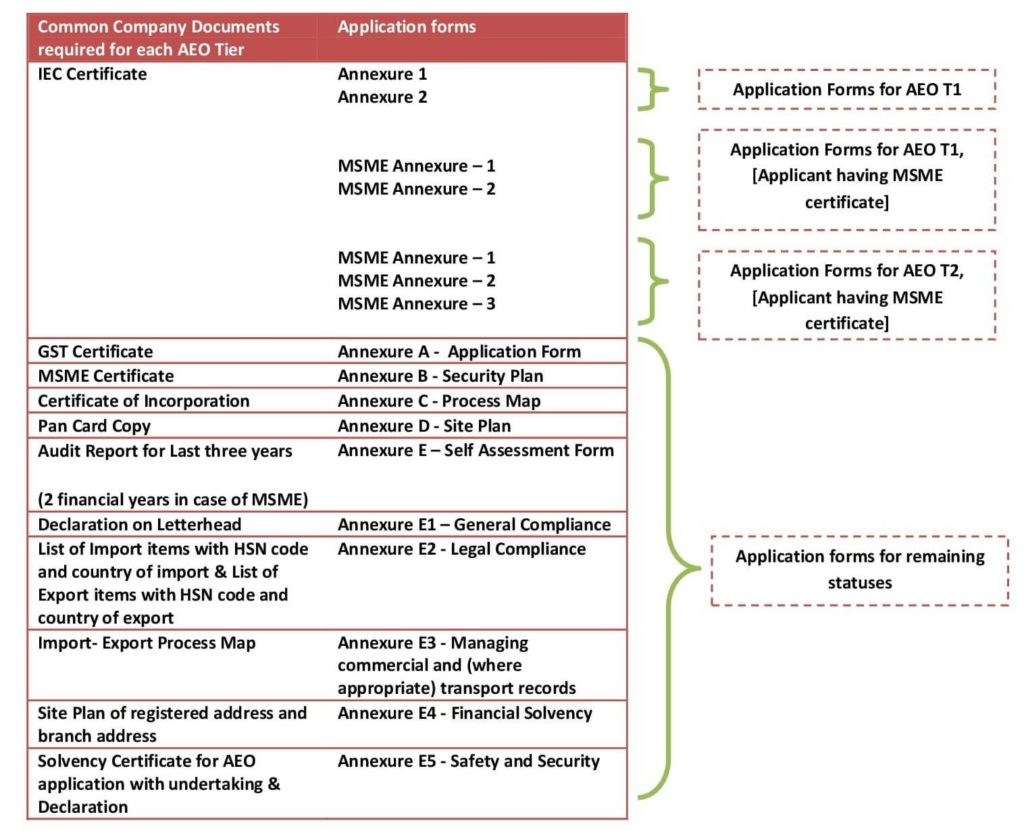

Documents required for AEO Certification

Proper and right documentation makes the AEO certification process easy and organized also saves the time spent on the processing time. Proper documentation makes it easy for the AEO Programme team to review the application, hence it plays a vital role in AEO Procedure.

Find the list of Company documents and Application forms for the AEO Application under each tier.

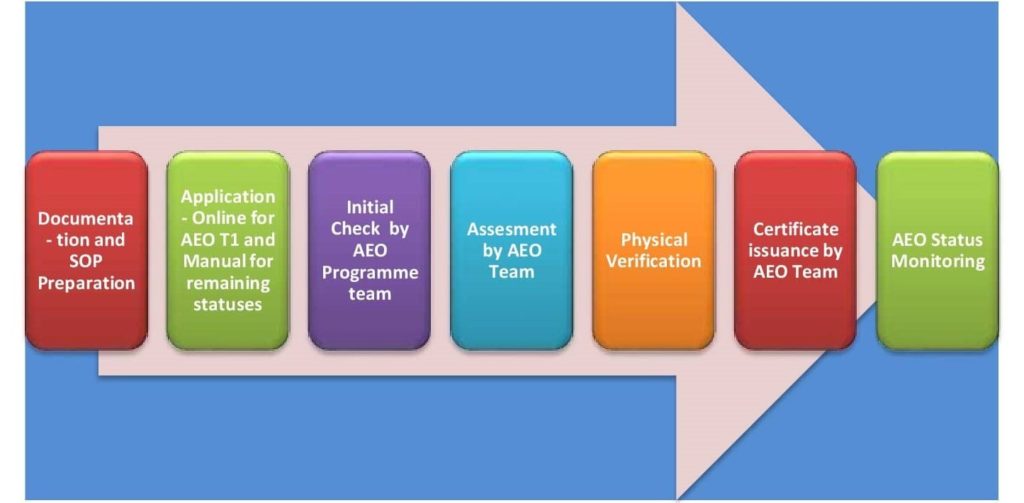

What is the AEO Registration Procedure?

- Error-free documentation is important to obtain the AEO status to avoid application rejection by the AEO Programme team. AEO Application forms and other company documents need to be attached with the SOPs.

- Standard Operating Procedures(SOPs) are prepared to provide required information regarding the procedure followed in the organization to manage the following:-

- Procedures for administering the commercial records connected to exports/imports?

- Procedure to ensure the protection of your computerized record system from unauthorized access?

- Procedure for back-up, recovery, archiving, and retrieval of your business records.

- There are two modes for the AEO application procedure:-

- Online Application – Application for AEO T1 can be done online on AEO Website – https://aeoindia.gov.in/

- Manual Application – Manual applications need to be done to get the status for the remaining tiers.

- The AEO Programme Manager will not process the incomplete AEO application or if the information filled in the application doesn’t match the documents attached. This has to be informed to the applicant within 30 days of application receipt.

- Physical verification is performed by the Custom team to grant AEO T2, AEO LO to verify the claims made in the application regarding fulfillment of AEO eligibility criteria are in place or not.

- AEO Certificate/Status issued by the AEO team after checking the eligibility of the applicant and document verification for AEO T1 and document plus Physical verification for remaining statuses.

- After AEO Certification issuance it has to be maintained by the firm, like if any changes made in the firm having AEO certificate need to be informed to the AEO Programme team.

Where to Apply for AEO Certification in India? (Portal Guide)

Indian businesses can avail AEO certification from the ICEGATE Portal (https://www.icegate.gov.in), run by CBIC. The portal offers a step-by-step guide to applying, downloadable forms, and checklists for varying levels of certification. Registration on ICEGATE, submission of documents, verification (subject to certificate type), and continued compliance are necessary for applicants to remain as AEOs. The system also aligns with the Framework of Standards to Secure and Facilitate Global Trade, promoting safer and more efficient cross-border operations.

How to maintain the AEO Status to avoid status cancellation?

It is a necessary step to maintain the AEO certification once you have received the AEO status. Maintenance of status is an essential part to get the maximum benefits out of the AEO Scheme.

AEO Certificate holder shall stick to the standard which has been set for them by the AEO Programme team as the AEO holder considered to be the secure trader and a reliable trading partner. To maintain the status any changes made in the company has to be informed to the AEO Programme team and the changes shall include the following –

- Changes in the person responsible for custom.

- Changes in the accounting and computing system.

- Changes in the location in the international supply chain.

- Changes in the business name or address.

- Changes in the nature of business.

- Changes in the legal entity.

The changes shall be notified to the AEO Programme Team as soon as they are made or at least within 14 days of the changes made. If there is an error made by the employee of the company in the CRM system related to the supply, the correction needs to be done immediately and the same should be corrected in the CRM system and the AEO Programme Team. Team. Ensuring compliance helps maintain high levels of security and facilitation within the supply chain.

The AEO status will not get affected if the AEO team has

- 1) Examined the reason for errors.

- 2) Taken appropriate remedial action to prevent a recurrence.

Who is not entitled?

Businesses that are not engaged in customs-related work/activities may not apply for AEO certification. Thus Banks, insurance companies, consultants, and the rest of the business organization may not apply for AEO certification, as it is not of any use to them. This is because such entities are not part of the active movement of goods within the customs process.

FAQ’s

What does AEO stand for?

AEO stands for Authorized Economic Operator is a status/certification granted to an economic operator by AEO Programme team.

What is authorized economic operator program?

An authorized economic operator (AEO) program was introduced by the Government to provide the status certificate to Indian Economic operators.

How do you get AEO certification?

A business entity involved in the International supply chain can obtain the AEO certificate by applying under its AEO program.

Who can apply for AEO status?

All the business entities who are involved in the international supply chain can apply for AEO status.

How to apply for an AEO certificate in India?

There are two ways to apply for an AEO certificate in India – 1) Online mode which is launched for AEO T1 and needs to be done on AEO Portal – https://aeoindia.gov.in/ 2) Manual mode for remaining statuses.

What is AEO Registration Process?

AEO Certification provide International recognization to a business entity involved in the International supply chain with the following major benefits –

Faster trade facilitation.

Shorter Cargo Release Time.

Reduction in bank guarantee.

The facility of 24/7 clearance at all seaports/airports on request.

What are the benefits of AEO certification ?

Yes, there is no separate portal for RCMC. The application is to be done on the DGFT website only. Also no need to contact Councils separately.

What is AEO-T1?

There is a three-tier AEO status for Exporters & Importers under the AEO Programme, which provides a varying and incrementally increasing level of facilitation to the certificate holder. AEO T1 is the first tier and granted on the basis of document verification only and has lesser benefits comparing the remaining AEO tiers.

What is AEO-T2?

AEO T2 is one of three-tier under the AEO programme, and granted to an Importer & Exporter on the basis of Physical verification in addition to Document verification.

What are the Documents required for the AEO application?

All the basic company documents such as IEC, GST Certificate, Certificate of Incorporation, MSME Certificate, additional documents such as Import-Export Process Map, Site Plan, Solvency Certificate, Audit Report, etc are required for AEO Application with the following forms –

Annexures 1 and 2 – For AEO T1

Annexure A to E5 – For AEO T2, AEO T3, AEO LO.

MSME Annexure 1 and 2 – For AEO T1 (Applicant having MSME Certificate)

MSME Annexure 1, 2, and 3 – For AEO T2 (Applicant having MSME Certificate)

What is Solvency Certificate For AEO Application?

It is a legal document that provides information on a firm’s financial stability for a particular Financial Year. It is required by the AEO team to ensure the financial credibility of the firm.

How do you maintain AEO status?

AEO Maintenance should be an essential part of any organization to get the maximum benefits out of the AEO Scheme. After receiving the AEO status, the respective company shall stick to the standard which is set for them as the AEO certificate is considered to be the one that assures.

How do I become an Authorized economic operator?

If a business entity involved in the International supply chain fulfilling the following criteria, can get the AEO Certification and become an Authorized economic operator.

Handled 25 documents (s/B & Bills of Entry) in the last Financial Year.

Should Undertake Customs Related Work.

Be a part of the international supply chain.

AEO can only be given to a legal entity and not a group company.

Have had business activities for three Financial Years (can be waived in deserving cases)..

Who Are We and how we can help you?

- To simplify the process for you, AFLEO CONSULTANTS provides you with guidance and assistance through each step of the procedure.

- At Afleo our multi-disciplinary team assists you for each phase to acquire the AEO certification and act as a “one-stop solution”.

- We work with you to form strategic decisions to get the certification in very little time.

- Our team of experts does the application online in case of AEO T1 and manual application in case of remaining tiers.

- Assist in physical verification.

- Assist in the maintenance of the AEO status.

With so many advantages of possessing an AEO Certification, you can experience faster growth for your business as these privileges will allow you to trade more freely and rapidly. Several countries have already adopted the Authorized Economic Operator Programme as a norm for conducting legitimate import/export and it holds a very positive future by maintaining integral relations in International Trade. As global trade intensifies, customs administration will continue to prioritize trusted and compliant partners like AEO-certified entities.