List of Services

AFLEO Consultants

DGFT Regional office

- IEC and its modification/Yearly Update/IEC Surrender.

- Revoke IEC from DEL, Suspension, Cancellation etc / Merger/Demerger of IEC’s.

- DGFT Identity card.

- Advance License - Issuance and Redemptions

- Export Promotion Capital Goods (EPCG) License - Issuance and Redemptions

- Duty-Free Import Authorization (DFIA)

- Remission of duties or Taxes on Export Product (RoDTEP)

- Merchandise Export from India Scheme (MEIS).

- Services Export from India Scheme (SEIS).

- Rebate of State and Central Taxes and Levies (RoSCTL)

- Transport and Marketing Assistance (TMA)

- Certificates of origin (COO) - SAPTA, APTA, ISLFTA, GSTP, India-Dubai CEPA etc.

- Import Monitoring System - (Steel Import Monitoring System, Coal Import Monitoring System,Copper/Aluminium Import Monitoring System, Chip Import Monitoring System)

- Deemed Export Benefits – Apply for Refund of TED/DBK/Brand rate Fixation.

- Star Export House Certificate.

- Free Sale & Commerce Certificate, End User Certificate.

- Enforcement cum Adjudication Proceedings at RA Mumbai.

- E-RCMC Certificate from DGFT – APEDA, FIEO, EEPC, PHARMEXCIL, CHEMEXCIL ETC.

- Gems & Jewelry Schemes.

- Application for Interest Equalization Scheme.

- REX Registration.

- Abeyance Cases for IEC’s in DEL.

- FREE SALE AND COMMERCE CERTIFICATE.

- END USER CERTIFICATE.

DGFT HQ, New Delhi

- Norms Fixation - Handling 25+ Norms Fixation cases every month across various Product groups. (Engineering, Pharmaceutical, Chemical, Textiles & Leather, Plastic & Rubber, Food, Sports & Misc. products)

- Policy Relaxation Committee (PRC Matters) - Proudly representing 20+ cases every month.

- EPCG Committee Approvals - Handling 10+ complex cases every month.

- Permission for Restricted/Negative list of Import Items & Export Items - Experience in Handling 100+ cases till date.

- Registration Certificates for Export & Import Items.

- SCOMET Licenses.

- TRQ (Tariff Rate Quotas)

- Appeal Matters under FTP.

Custom Related Services

- AA/EPCG/DFIA License Registration.

- Bond & Bank Guarantee (BG) Cancellation of EPCG/Advance License.

- ICEGATE Registration.

- Refund under Section 74.

- Pending Duty Drawback from Customs.

- Factory stuffing– Self-sealing permission. [FSP]

- Pending IGST Refund from Customs.

- Removal of IEC from Alert list of Customs.

- GST Services – Refund of ITC from GST.

- Authorized Economic Operator (AEO T1, T2 & T3) certification.

- Reply & Follow-up of Customs Notices if any.

- GST Services – Refund of GST for Service Exporters.

- AD Code/IFSC Registration.

- SIIB Matters (Special Investigation and Intelligence Branch)

- SVB Matters.

- Registration Procedures for First time Importers/ Exporters

- DPD/DPE Registration.

Other Certification:

- All Types of Digital Signature Certificates.

- Health Certificate for Export Products

- EPR Certification for Producers, Importers and Brand owners.

- Phytosanitory Certificate.

- BIS Certification.

- Banking & RBI related liaison for Exporters & Importers.

AFLEO logistics

- Sea Cargo Consolidation – Import & Export

- Sea Freight Forwarding - Import & Export

- Air freight - Import & Export

- Land freight

- Warehousing

- Customs clearance

- Insurance

AFLEO Global

- Buying of scrips - MEIS / SEIS / RoDTEP / RoSCTL / DFIA

- Selling of scrips - MEIS / SEIS / RoDTEP / RoSCTL / DFIA

Find our brochure for more details:

1. What is the Interest Equalisation Scheme for Exporters and Why it was Introduced?

Exporters have always complained that the loan facilities available to them in India come with much higher interest rates compared to other foreign countries where their competitors operate. Due to these higher interest rates, they were unable to avail of credit/loan facilities, which made it difficult for them to execute export orders.

To solve this problem, the Government introduced the Interest Equalisation Scheme (IES) in 2015. Under this scheme, exporters receive a concession of an additional 2-3% on the normal rate of interest, reducing their effective rate of interest and providing them with a level playing field compared to their foreign competitors.

For example, if an exporter approaches a bank to get a Pre or Post Shipment Credit facility in Rupees, the bank usually charges a normal ROI of 9% to 10%. However, if the exporter is eligible under the IES scheme, they receive a discount/subvention of 2% to 3%. Thus, the exporter’s effective Rate of Interest becomes 6% to 7%.

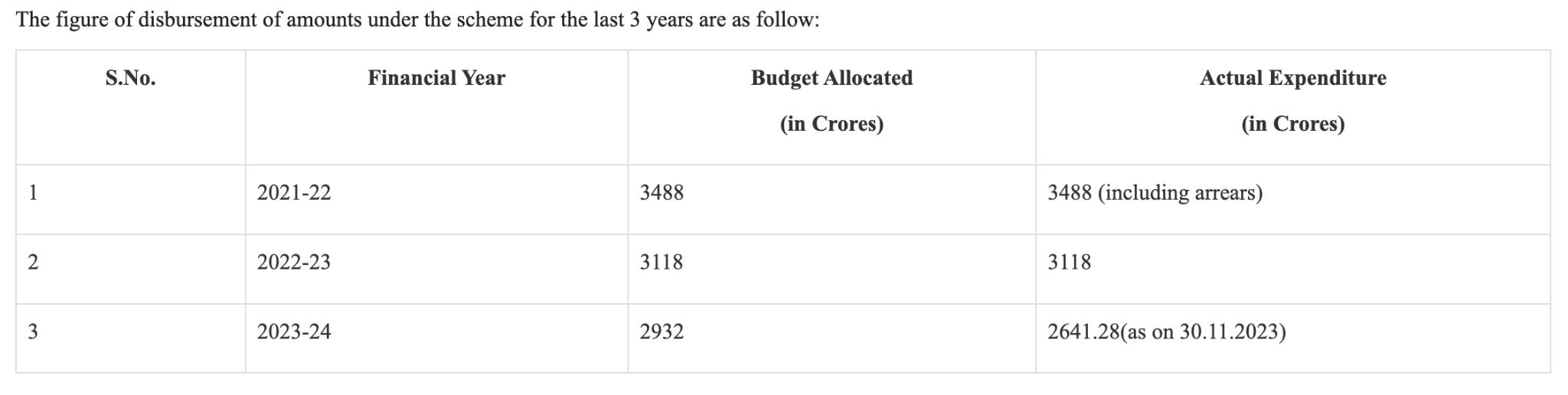

The IES scheme is mainly for labor-intensive sectors. It was launched on April 1, 2015, for five years, but it is still in existence, and the Government has recently extended it until June 30, 2024.The Government allocates an annual budget of approximately Rs.3500 Crores for this scheme. In the image, you can see the Government's spending for the last three years.

Now, the next question in your mind might be which specific exporters are eligible for this scheme and what is the exact discount or subvention provided by the Government. So let us discuss that now.

2. Latest News about Interest Equalization Scheme [IES] for Exporters

- For verification of Manufacturer

- For the verification of products

- To Verify Good Manufacturing Practice (GMP) Compliance

3. Eligible Exporters for Interest Equalisation Scheme

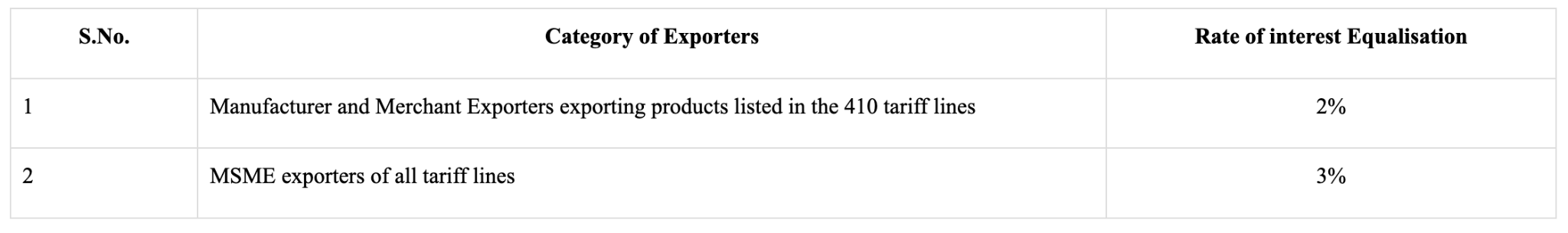

In the image, you can see that for the IES Scheme, eligible exporters are divided into two categories.

The first category includes large-scale manufacturers and merchant exporters. They receive a 2% rate of interest equalization only for exporting products listed in the 410 tariff lines. You can find the list of 410 tariff lines from the link provided below - [https://content.dgft.gov.in/Website/HS_Code_Mappin.pdf]. The sectors covered in this list include Articles of Iron/Steel, Auto components/Parts, Fabrics, Handicraft Items, Industrial Machinery, Tools, Food Processing/Food Items, Leather Goods, Sports Goods, etc.

The first category includes large-scale manufacturers and merchant exporters. They receive a 2% rate of interest equalization only for exporting products listed in the 410 tariff lines. You can find the list of 410 tariff lines from the link provided below - [https://content.dgft.gov.in/Website/HS_Code_Mappin.pdf]. The sectors covered in this list include Articles of Iron/Steel, Auto components/Parts, Fabrics, Handicraft Items, Industrial Machinery, Tools, Food Processing/Food Items, Leather Goods, Sports Goods, etc.

Please note that not all products in these sectors are covered. Only selected HS Codes within these sectors are included, which you can refer to in the list.

The second category consists of all MSME Manufacturer Exporters. They receive a 3% rate of interest equalization, and there are no restrictions on the products exported. This means that MSME exporters dealing in any product will get a 3% discount on their normal ROI.

Watch the below Video in Hindi which explains what the Interest Equalisation Scheme for Exporters actually is, why it was introduced, how exporters can benefit from it, who is eligible for this scheme, the application procedure, required documents, and some important FAQs to clear common confusions and doubts in the industry.

4. How to apply and claim benefits under Interest Equalisation Scheme [IES]?

You receive the benefit of the IES Scheme directly from the bank. When you approach the bank for a Pre or Post Shipment Rupee Credit facility and you are eligible for the IES Scheme, the bank applies the discount and charges you the net ROI.

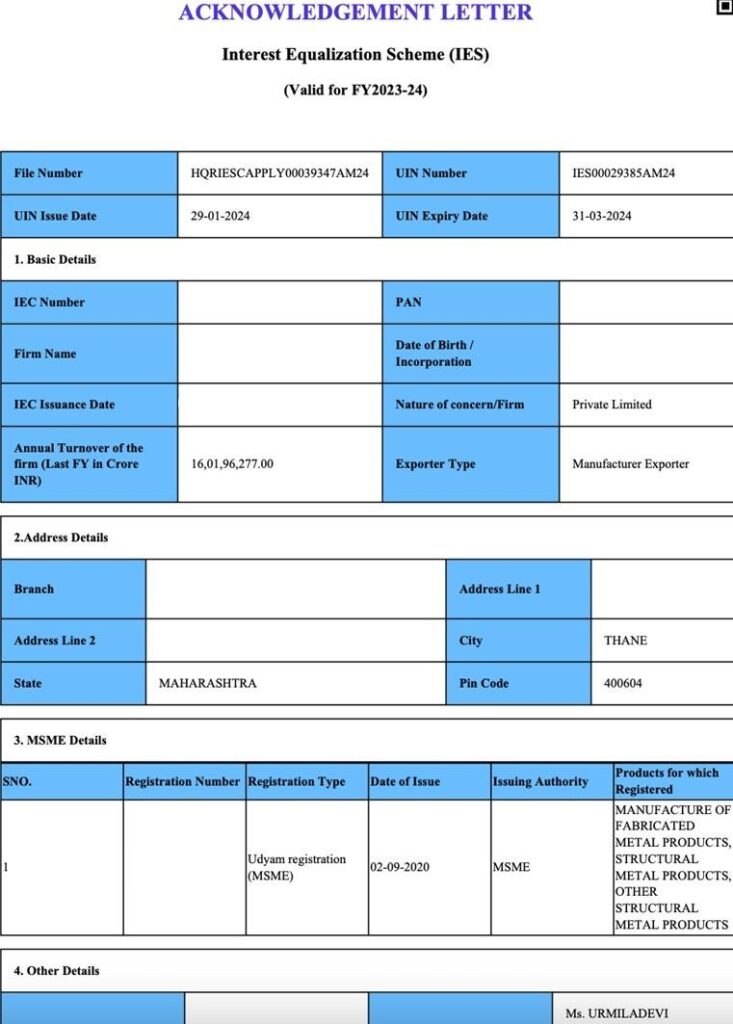

It is important to note that to avail the benefit of the IES Scheme, you need to provide the bank with a UIN Number (i.e., Unique IES Identification Number). You get this UIN Number from the DGFT (Directorate General of Foreign Trade).

In the image, you can see a sample copy of the UIN Acknowledgement letter for your reference to understand what it actually looks like.

To obtain a UIN number, you need to apply online on the DGFT portal using either a Digital Signature or Aadhar OTP method.

While filling out the form, you need to provide basic details about your organization, such as export products, HSN Codes, country of export, number of employees in the organization, etc. You also need to upload a copy of the loan sanction letter and the export order as attachments.

Please note that if you are availing facilities from different banks, you will need a separate UIN number for each bank.

The validity of the UIN is for 1 year or until the end of the financial year, whichever is earlier.

The government fee for each UIN application is Rs.200.

![Interest Equalisation Scheme [IES]](https://afleo.com/wp-content/uploads/2024/12/af-4-1024x576.jpg)

5. How We Can Assist You in Availing Benefits under the Interest Equalisation Scheme (IES)

The Interest Equalisation Scheme is a very important scheme for exporters, and all MSMEs should take advantage of it. Under this scheme, the government spends around 3,000 to 3,500 Crores every year, which is a substantial amount.

At Afleo Group, we have helped thousands of companies generate UIN numbers so that they can easily benefit from the IES scheme through their banks. Please get in touch with us for any of your requirements.

Here is how we can help you secure the IES benefits –

- We help you with the registration process for the Interest Equalisation Scheme. We navigate you through the paperwork and application process and ensure you meet all the prerequisites.

- With our expert guidance, your chances of securing the UIN are higher. We help you curb mistakes and complete the process quickly.

- Once the UIN is ready, we also help you complete the formalities with the bank. With our guidance, you secure the funding needed for your business.

6. Why Afleo Group?

We aim to provide highly reliable services at the most competitive costs to exporters under one roof.

Social Media Presence: We strive to grow our relationships with our clients by staying active on social networking sites, keeping them updated on the latest notifications, circulars, and amendments in foreign trade policies.

24/7 Telephonic Service: We believe in offering prompt and efficient services to our clients who cannot wait until the morning to resolve an issue. We are just a phone call away—clients can call or drop an email, and we will try to reach them as soon as possible.

FAQ's

You do not need to generate a separate UIN for each loan disbursement. One UIN for a particular bank will be valid for the entire financial year.

Yes, there is a cap. Initially, there was no cap in this scheme. However, starting from FY 23-24, you can avail a maximum benefit of 10 crores per IEC Code on an annual basis. According to the latest notification, for the quarter starting from 01.04.2024 to 30.06.2024, an additional cap of 2.5 crores per IEC has been introduced.

No, once the UIN letter is generated, it cannot be amended. In such a case, you will need to apply for a new UIN.

The UIN required for the IES benefit remains valid for one year from the date of registration.

No, if you wish to receive the advantages of Interest Equalisation Scheme, then you must register with DGFT, i.e. Director General of Foreign Trade.

One primary limitation of IES is that it is fund-limited. This means there is a threshold on the benefits an exporter can avail of. Also, this scheme primarily focuses on labour-intensive sectors and is not effective for sectors with relatively lower profit margins.

Fill the below form to get in touch with us

Our Office

BLDG 7, Meter Cabin B, Flat No. 201, 2nd floor, Goverdhan Nagar, Mulund, Mumbai 400080, Maharashtra

Drop a Line

You may contact us by filling in this form any time you need professional support.