List of Services

AFLEO Consultants

DGFT Regional office

- IEC and its modification/Yearly Update/IEC Surrender.

- Revoke IEC from DEL, Suspension, Cancellation etc / Merger/Demerger of IEC’s.

- DGFT Identity card.

- Advance License - Issuance and Redemptions

- Export Promotion Capital Goods (EPCG) License - Issuance and Redemptions

- Duty-Free Import Authorization (DFIA)

- Remission of duties or Taxes on Export Product (RoDTEP)

- Merchandise Export from India Scheme (MEIS).

- Services Export from India Scheme (SEIS).

- Rebate of State and Central Taxes and Levies (RoSCTL)

- Transport and Marketing Assistance (TMA)

- Certificates of origin (COO) - SAPTA, APTA, ISLFTA, GSTP, India-Dubai CEPA etc.

- Import Monitoring System - (Steel Import Monitoring System, Coal Import Monitoring System,Copper/Aluminium Import Monitoring System, Chip Import Monitoring System)

- Deemed Export Benefits – Apply for Refund of TED/DBK/Brand rate Fixation.

- Star Export House Certificate.

- Free Sale & Commerce Certificate, End User Certificate.

- Enforcement cum Adjudication Proceedings at RA Mumbai.

- E-RCMC Certificate from DGFT – APEDA, FIEO, EEPC, PHARMEXCIL, CHEMEXCIL ETC.

- Gems & Jewelry Schemes.

- Application for Interest Equalization Scheme.

- REX Registration.

- Abeyance Cases for IEC’s in DEL.

- FREE SALE AND COMMERCE CERTIFICATE.

- END USER CERTIFICATE.

DGFT HQ, New Delhi

- Norms Fixation - Handling 25+ Norms Fixation cases every month across various Product groups. (Engineering, Pharmaceutical, Chemical, Textiles & Leather, Plastic & Rubber, Food, Sports & Misc. products)

- Policy Relaxation Committee (PRC Matters) - Proudly representing 20+ cases every month.

- EPCG Committee Approvals - Handling 10+ complex cases every month.

- Permission for Restricted/Negative list of Import Items & Export Items - Experience in Handling 100+ cases till date.

- Registration Certificates for Export & Import Items.

- SCOMET Licenses.

- TRQ (Tariff Rate Quotas)

- Appeal Matters under FTP.

Custom Related Services

- AA/EPCG/DFIA License Registration.

- Bond & Bank Guarantee (BG) Cancellation of EPCG/Advance License.

- ICEGATE Registration.

- Refund under Section 74.

- Pending Duty Drawback from Customs.

- Factory stuffing– Self-sealing permission. [FSP]

- Pending IGST Refund from Customs.

- Removal of IEC from Alert list of Customs.

- GST Services – Refund of ITC from GST.

- Authorized Economic Operator (AEO T1, T2 & T3) certification.

- Reply & Follow-up of Customs Notices if any.

- GST Services – Refund of GST for Service Exporters.

- AD Code/IFSC Registration.

- SIIB Matters (Special Investigation and Intelligence Branch)

- SVB Matters.

- Registration Procedures for First time Importers/ Exporters

- DPD/DPE Registration.

Other Certification:

- All Types of Digital Signature Certificates.

- Health Certificate for Export Products

- EPR Certification for Producers, Importers and Brand owners.

- Phytosanitory Certificate.

- BIS Certification.

- Banking & RBI related liaison for Exporters & Importers.

AFLEO logistics

- Sea Cargo Consolidation – Import & Export

- Sea Freight Forwarding - Import & Export

- Air freight - Import & Export

- Land freight

- Warehousing

- Customs clearance

- Insurance

AFLEO Global

- Buying of scrips - MEIS / SEIS / RoDTEP / RoSCTL / DFIA

- Selling of scrips - MEIS / SEIS / RoDTEP / RoSCTL / DFIA

Find our brochure for more details:

1. Overview / RCMC Full form

You are probably searching for RCMC (RCMC Full form - Registration Cum Membership Certificate) details on the internet because you have just started or want to start your new Export-Import Business or you are working for a New Export Startup Company. Let us tell you that you have taken a great step and we at Afleo Group sincerely hope that your new venture will be a great success.

One more reason for checking this page could be that you are an existing exporter, but due to the latest guidelines, the application process, which was previously manual, has now transitioned to a completely online system. And You may want to understand this new online process better. This Page is suitable for both new and existing exporters.

Now, there might be many questions in your mind as to What is RCMC Certificate? Is it mandatory? What are the benefits? Which council to register with? And Finally what is the registration fees & procedure to apply for RCMC registration. Do not worry, this article of ours is a complete guide on RCMC (Registration cum Membership Certificate) for beginners and it will answer all your questions.

So let’s get started.

2. What is RCMC?

The term RCMC suggests that it is a certificate related to registration or membership.

Now, let's understand with whom you need to obtain this membership. You need to obtain membership with the Export Promotion Councils/Commodity Boards

But what are Export Promotion Councils/Commodity Boards? These are organizations recognized by the government, and their primary role is to promote exports in a specific product category or sector. Currently, there are a total of 39 Export Promotion Councils/Commodity Boards. For example, for agricultural items, there is APEDA, for engineering items, it's the Engineering Export Promotion Council (EEPC), for chemicals, it's CHEMEXCIL, for pharmaceutical items, it's PHARMEXCIL, and so on. Additionally, all these councils have an apex body, which is the Federation of Indian Export Organisations (FIEO). You can find the list of all 39 Export Promotion Councils in Appendix 2T of the Foreign Trade Policy (FTP). The Entire list can be accessed here - List of all Export Promotion Councils [EPC]/ Commodity Boards/ Export Development Authorities]

So, if you become a member or register with any of these 39 councils, it results in the issuance of an RCMC Certificate. It's essential to note that if you register with a local Chamber of Commerce, it is not referred to as an RCMC.

3. Benefits of RCMC Registration

There are several benefits to obtaining RCMC (Registration Cum Membership Certificate) registration, which we will now discuss:

Exposure and Knowledge: RCMC registration provides you with exposure to specific product sectors because these councils operate sector-wise. For new exporters, this exposure can offer valuable product knowledge. If you are facing any hurdles, these councils can provide initial handholding and guidance on export-related procedures and documentation.

Government Liaison: For existing exporters, these councils act as intermediaries between the exporting community and the government. If you need to convey a message, seek clarifications on notifications, or if you are waiting for a particular refund for an extended period, these councils can help you communicate with the government effectively.

Facilitating Trade Events: Export Promotion Councils often organize Buyer-Seller meets and exhibitions. They also share live inquiries and lists of potential buyers who may be interested in your export products. This can be a significant advantage for finding new markets and customers.

MAI and PMS Scheme: RCMC registration opens doors to benefits under schemes like MAI (Market Access Initiative) and PMS (Procurement and Marketing Support). Under these schemes, you can receive reimbursement for a portion of your marketing expenses. For instance, if you attend an exhibition, your airfare, stall costs, registration fees, and more can be subsidized to a significant extent.

Stay Informed: Export Promotion Councils keep you updated with the latest developments in the export business. They send you regular notifications and provide information about policy changes, ensuring that you are well-informed about the industry's evolving landscape.

Overall, RCMC registration offers a range of advantages, from knowledge and exposure to government liaison, facilitating trade events, financial support, and keeping you abreast of the latest industry updates.

4. Is RCMC mandatory for Export?

It's important to note that RCMC (Registration Cum Membership Certificate) is compulsory only for certain products. If your export product does not fall under these specified products, RCMC is not mandatory. This means that your export shipments will not be halted for lacking an RCMC in such cases.

For the export of some products, it is mandatory to have an RCMC with their respective EPC’s only, the list of all such products is as below:

- Agricultural Products - Agricultural and Processed Food Products Export Development Authority (APEDA)

- Marine Products – The Marine Products Export Development Authority (MPEDA)

- Coffee Products–Coffee Board of India

- Tea – Tea Board of India

- Spice Products – Spices Board of India

- Leather Products - Council For Leather Exports.

- Jute Products– Jute Board of India.

- Silk Products - Silk Board of India

- Coconut Products - Coconut Board of India

- Coir Products - Coir Board of India

- Rubber Products – Rubber Board of India

- Tobacco Products - Tobacco Board of India

Therefore, RCMC is not mandatory for products that are not listed above. However, we would recommend you to get an RCMC Certificate if you are serious in your export business endeavors.

Also, if you wish to benefit from export promotion schemes like EPCG (Export Promotion Capital Goods), Advance License, DFIA (Duty-Free Import Authorization), RCMC becomes compulsory.

It's also worth mentioning that for claiming benefits under schemes like RoDTEP (Remission of Duties and Taxes on Exported Products) and RoSCTL (Rebate of State and Central Taxes and Levies), RCMC is not mandatory.

There are specific situations in which RCMC is compulsory, such as when applying for an LUT (Letter of Undertaking) Bond for GST purposes with the GST department. Additionally, if you are a merchant exporter and intend to procure goods at 0.1% GST rate from a manufacturer exporter, RCMC is mandatory in such cases.

Please note that RCMC is not required for importers; it is exclusively for exporters.

5. How to select Export Promotion Council/Commodity Board for RCMC Registration?

You might be wondering how to choose which council to obtain an RCMC (Registration Cum Membership Certificate) from, given the numerous councils available. The steps are quite simple:

Reference to Appendix 2T of FTP: Firstly, refer to Appendix 2T of the Foreign Trade Policy (FTP). This appendix contains a list of councils and specifies which products or sectors each council deals with.

Identify Your Main Line of Business: Identify which products fall under the main line of business you are engaged in. Check which council covers those products, and that's the council you should register with.

Multiple Products: If your main line of business is not well-defined or you deal with multiple products based on demand, you don't need to obtain RCMC from each council separately. In such cases, you can register with FIEO (Federation of Indian Export Organisations) and categorize yourself as a multi-product exporter.

Products Not Covered: If your product is not listed in Appendix 2T and is not covered by any council, you can still obtain an RCMC from FIEO.

If you have any doubts about identifying the relevant council for your export product, please feel free to write in the comments section, and we will help you determine the appropriate council.

6. How to get an RCMC Certificate from DGFT online?

Before 2022, the application process for RCMC (Registration Cum Membership Certificate) was manual. If you needed to obtain RCMC from any council, you had to contact them individually. Each of the 39 councils had different application forms, and some required online submissions while others used offline forms. This created a lot of confusion for exporters.

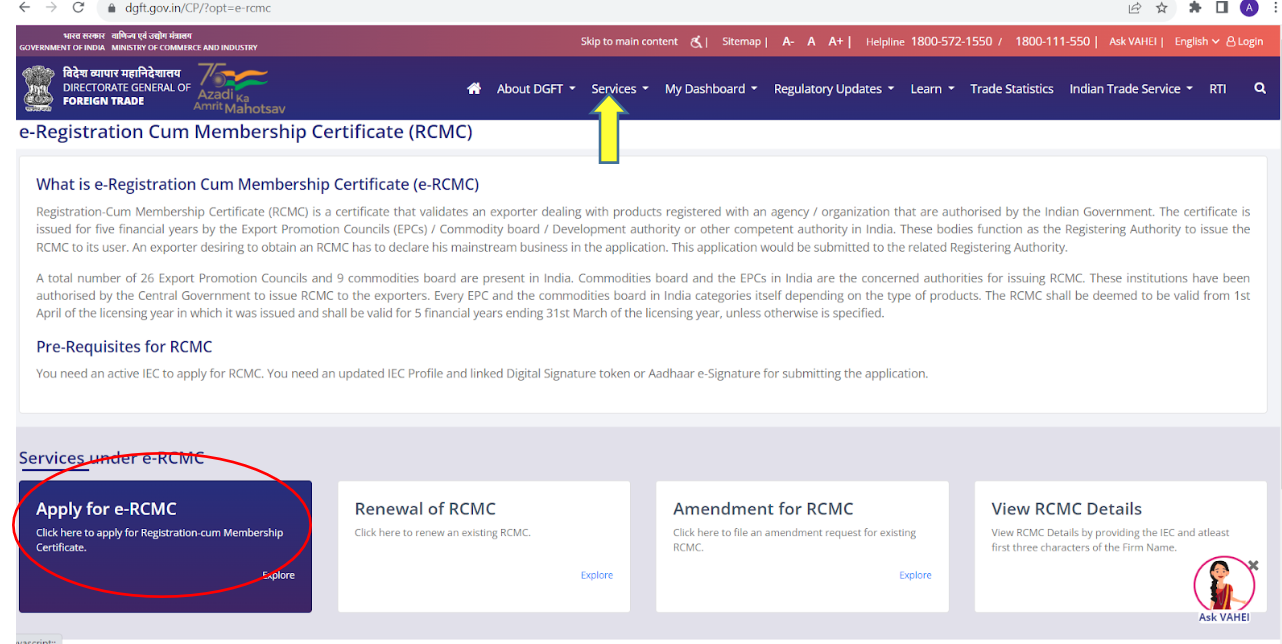

However, to facilitate ease of doing business, the application process for RCMC has been streamlined. Now, if you want to obtain RCMC from any council, you can do so through the DGFT (Directorate General of Foreign Trade) website. There is a standardized application form where you select the council and proceed.

7. Documents required for RCMC Registration

Here are the basic documents required for an RCMC application:

- DGFT Digital Signature (DSC) or application can also be submitted using Aadhar OTP.

- Application Form.

- Business Registration Proof – GST, Udyam Aadhar (MSME).

- Import-Export Code (IEC).

- Company PAN Card or PAN Card of the Proprietor.

- The preceding year’s or the last 3 years' export turnover figures certified by a Chartered Accountant (CA).

- In the case of no exports, a NIL certificate should be obtained.

If you want to understand the step-by-step procedure for the RCMC application, please scroll further to our next section where we have divided the entire online application process into easy-to-follow screenshots.

8. E-RCMC Registration Online Process - Step by Step Guide

Step 1 - Visit DGFT website [https://www.dgft.gov.in/CP/]

Under Services Tab select “E-RCMC” and then click on “Apply for E-RCMC”

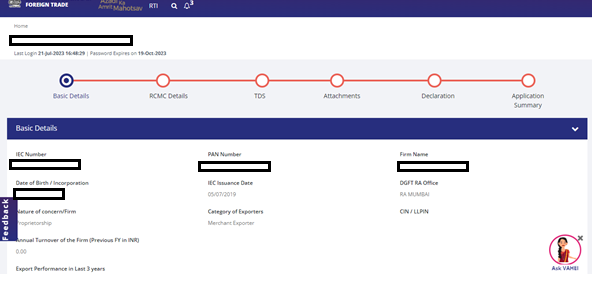

Step 2 - Login with DGFT Id and Password.

Post Login, the Main screen of RCMC will open, in which the Details are to be filled as per the main sections. The main sections are as follows: Basic Details, RCMC Details, TDS, Attachments, Declaration, Application Summary.

So as per the Image all the basic details has to be filled first, In case you have any previous RCMC, then all the details will be autofilled.

Step 3 - Fill RCMC Details

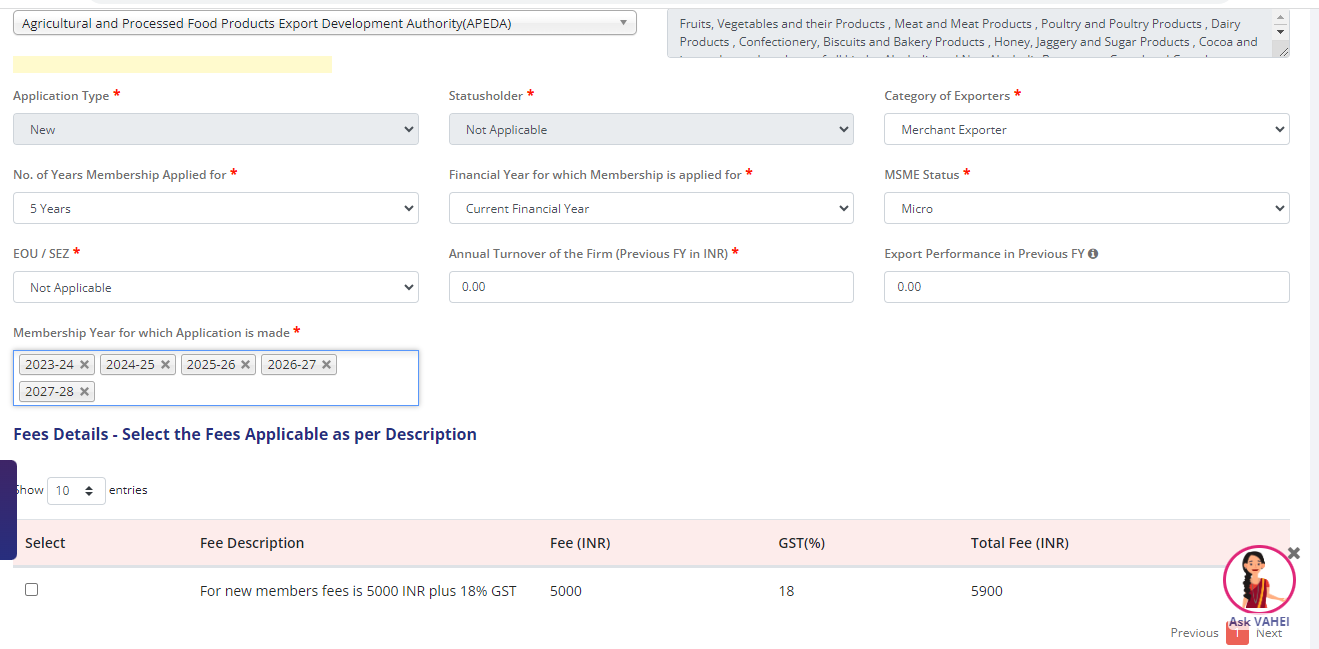

This is a very important section. Here you have to select the Council of which you need RCMC. Then describe the main line of business, Provide the no. of years for which RCMC required, select the Fee structure relevant to your organization.

Also other information like complete list of products/services in which the company is dealing, Details of Authorised representative of the company, website of the company, Countries in which exports takes place etc. is to be provided.

Step 4 - Upload Attachments, Approve the Declaration and Submit the Application

In this step you need to upload the required documents as discussed earlier, sign the declaration and submit the final application.

There are two options for submitting the application, one is through Digital Signature [DSC] and other is through Aadhar E-sign [OTP].

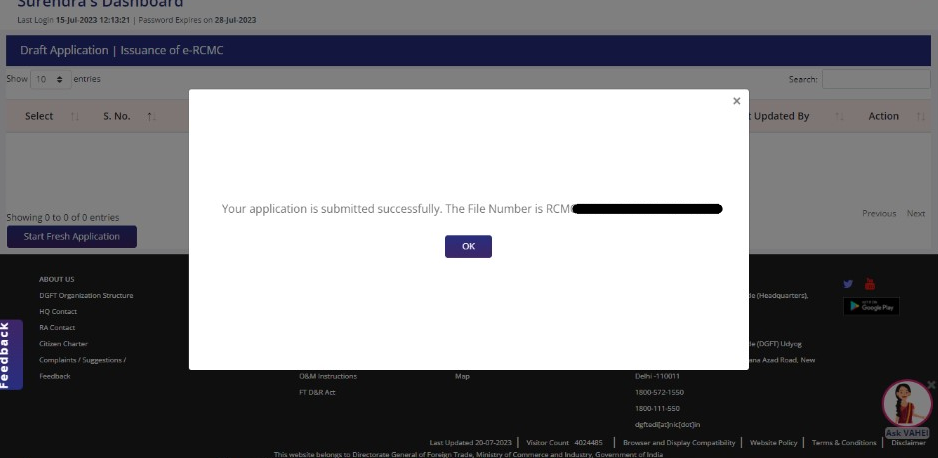

Once Final submission is done, you will be shown a image like below:

After the successful completion of the application, you should receive your RCMC Certificate within 3 to 4 working days. The tracking of the application status can be done from the DGFT portal dashboard.

9. RCMC Registration Fees

The RCMC (Registration Cum Membership Certificate) registration fees or charges vary from council to council. In the image, you can see the minimum membership charges for five main councils. These charges can increase based on the export turnover of the company. Therefore, the fees can range from as low as 5 to 6 thousand rupees to as high as 50 to 60 thousand rupees.

RCMC REGISTRATION FEES OF BELOW MENTIONED EXPORT PROMOTION COUNCILS:

| EPC NAME | FRESH RCMC MINIMUM Membership Fees | Conditions |

| 1.FIEO | Rs. 7000 (Annual Term Fees)+1000(One Time Admission Fees)+18% GST = Rs. 9440/- | RCMC Membership Fees changes/increases as per category/MSME Status and Export Turnover of the Entity. |

| 2.APEDA | Rs. 5999/- (5 Years Validity) | NA

|

| 3.EEPC | Yearly Membership Subscription(New)- Rs.6500/-+Admission Fees-2000/-] +18%GST = Rs. 10,030.00/- | RCMC Membership Fees changes/increases as per category/MSME Status and Export Turnover of the Entity, Based on your CA Certified Last 3 Financial year Total Export Turnover in INR. |

| 4.CHEMEXCIL | Yearly Membership Subscription(New)- Rs.6500/-+ Entry Fee for New Fresh Members] +18%GST | RCMC Membership Fees changes/increases as per category/MSME Status and Export Turnover of the Entity, Based on your CA Certified Last 3 Financial year Total Export Turnover in INR. |

| 5.PHARMEXCIL | For NEW RCMC Membership Fee Rs. 12000 + one-time admission fee Rs 6000 +18% GST (for Merchant Exporter and Service provider) = Rs. 21,240.00/- (As per Category Of Exporter depends Membership fees) | Based on your CA Certified Last 3 Financial year Total Export Turnover in INR.

We have to select the slab of Membership Fees as per our category/MSME Status and Export Turnover. *Drug License is required for this Council mandatory. |

Some councils charge fees based on the export turnover, while others do not. RCMC Certificates can be obtained with validity for 1 year, 2 years, 3 years, or 5 years. If you opt for 3 or 5 years of validity and make the payment in a single installment, councils generally offer some discounts.

One important thing to note is that the validity of the RCMC is on a financial year (FY) basis, meaning it expires on March 31st. For example, if you obtain an annual membership in September 2023, it will expire on March 31, 2024, and you will need to renew it thereafter.

10. RCMC Renewal / Amendment in RCMC

Membership for RCMC is granted for the period from April to March of each financial year. This means that if you apply for RCMC in December of a particular year, your annual RCMC will be valid until the following 30th March only. You will need to renew the RCMC again starting from April to continue your membership for the next financial year.

This Process of RCMC Renewal also happens online on the DGFT website, where you can select the Council of your choice, pay the requisite fees and renew your RCMC membership.

Also Amendment in RCMC is possible. Changes in address and director details or Changes in Export Products List are possible in the RCMC (Registration Cum Membership Certificate). If there are changes in these details, the exporter should submit a request for amendment online on the DGFT Portal within a month of such changes taking place. This ensures that the RCMC reflects accurate and up-to-date information related to the exporter's address/directorship and other important details.

11. Who are We and How can we Help you?

At Afleo Group, we take pride in being India's leading consultants for all DGFT and Customs documentation and liaisoning work.

To date, we have assisted over 1000 companies in smoothly and hassle-free RCMC (Registration Cum Membership Certificate) registration through various councils and commodity boards. We also offer services for RCMC certificate renewal and any type of amendment.

If you have any requirements or inquiries, please do not hesitate to get in touch with our team. We are here to assist you.

If you are unsure about which council's RCMC to obtain for your products, please write your query in the comments section, and we will provide you with the name of the relevant council. Feel free to comment now.

Latest update:

31st July, 2023 - Public Notice No. 23/2023 - Amendment under Appendix 2T (List of Export Promotion Councils/Commodity Boards/Export Development Authorities) of Appendices and ANFs of FTP 2023: AYUSH Export Promotion Council (AYUSHEXCIL) has been included in the Appendix 2T of FTP, 2023 for issuing RCMC for specified items, with immediate effect. Accordingly, the products falling under jurisdiction of CHEMEXCIL & PHARMEXCIL have been revised and their contact details have been updated.

FAQ’s

RCMC stands for Registration cum Membership Certificate. It is a Certificate issued by Export Promotion Councils or Commodity Boards in India, certifying an exporter's registration and membership with the respective Agencies. Govt has created these Councils and Commodity boards with a view to promote exports.

RCMC is required for exporters in India because it allows you to avail various benefits, incentives, and concessions provided by the government to promote exports. It also signifies your compliance with export regulations. Please note that RCMC is not required for Importers.

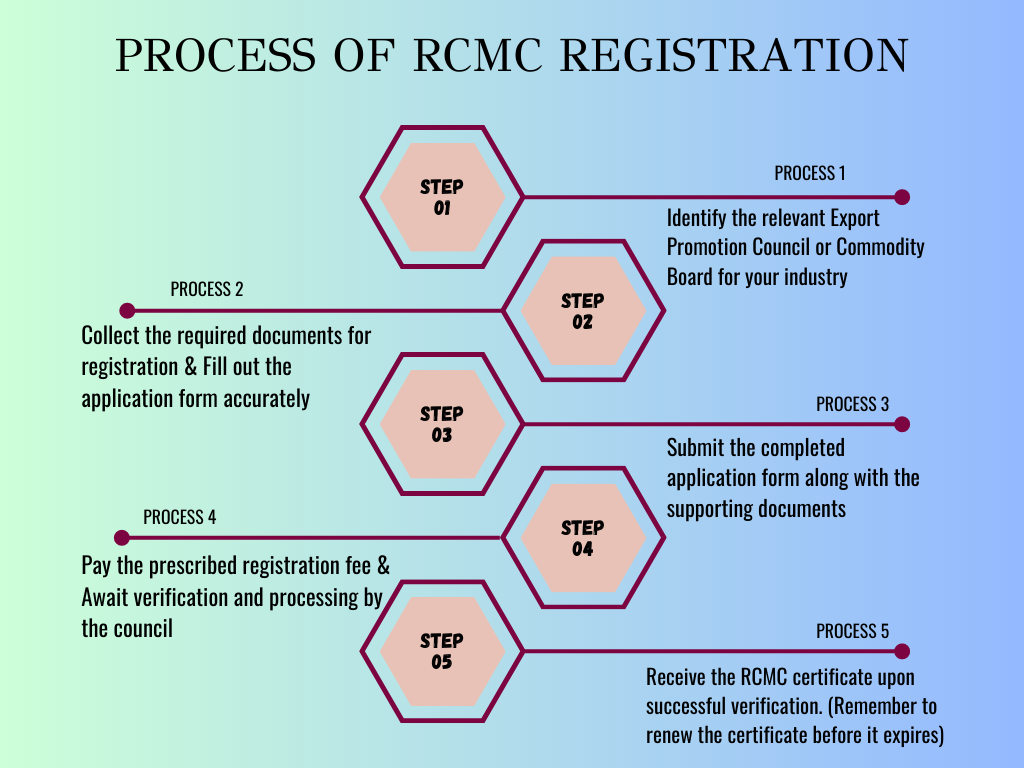

To get an RCMC, you need to apply online on the DGFT website with your Login Id and password. It is a common misconception that there is a separate RCMC Portal, but in reality the online application happens on the DGFT Portal only. First you need to identify the relevant Export Promotion Council or Commodity Board for your industry. Collect the required documents, fill out the application form, submit the application along with supporting documents, and pay the registration fee. The council will verify your application and issue the RCMC upon successful verification.

The documents required for RCMC registration typically include business registration proof, PAN card, Import-Export Code (IEC), address proof, CA Certificate for turnover, and any other documents specified by the council.

The validity period of an RCMC varies and is mentioned on the certificate. While applying for RCMC, you have an option to choose the validity like 1 year, 2 year, 3 years or 5 years. It is important to keep track of the expiration date and initiate the renewal process before it expires.

To renew your RCMC, you do not have to approach the Councils directly. You have to submit an online application on the DGFT portal. Gather all the necessary documents, fill out the renewal form, attach updated documents, submit the form along with the renewal fee, and undergo the council's verification process. Once approved, you will receive the renewed RCMC with an extended validity period.

Yes, there is no separate portal for RCMC. The application is to be done on the DGFT website only. Also no need to contact Councils separately.

No, RCMC is issued in your name and cannot be transferred to another exporter. If there are changes in ownership, a fresh application may be required or amendment is also possible in RCMC.

It is important to renew your RCMC before it expires. If it expires, you may face difficulties in availing benefits and concessions or any other export activity which requires RCMC.

No, Certificates issued by all the Export Promotion Councils/Commodity Boards/ Export Development Authorities are known as RCMC Certificates only. However as per the mainline of the business i.e. the products that the companies deal in, selection of council is important.

With the exception of certain products, it is not mandatory. But having an RCMC is highly recommended as it provides benefits, incentives, and ensures compliance with regulations, which can enhance your export activities.

Yes, RCMC signifies your membership in an Export Promotion Council or Commodity Board relevant to your industry.

IEC is a mandatory requirement for exporters in India. You need an IEC to apply for RCMC as it shows your eligibility for engaging in import-export activities.

The registration and renewal fees vary depending on the Export Promotion Council or Commodity Board. The specific fee structure can be obtained from the respective council.

Yes, there are specific benefits and incentives available for MSMEs through RCMC. These can include financial assistance, export promotion schemes, and access to international markets. One such scheme is the Procurement and Marketing Scheme [PMS]

If there are changes in your business details, such as address or ownership, you should apply online on the DGFT website for an Amendment in RCMC. Fill the form and upload relevant documents to support your amendment request.

The list of Export Promotion Councils and Commodity Boards can be found on the website of DGFT under Appendix 2T.

You can find contact information for the Export Promotion Council or Commodity Board on their respective websites or reach out to them through their provided contact details for any queries regarding RCMC.

Yes, there is a specific Council for service exporters. You should select Services Exports Promotion Council [SEPC] while filing the online application

Yes, if you export goods from different industries, you may apply for multiple RCMCs corresponding to each industry or alternatively You can apply only with FIEO under Multi Product Category.

Fill the below form to get in touch with us

Our Office

Unit No. 207, Centrum IT Park, Wagle Estate, Thane West, Mumbai, Maharashtra 400604

Drop a Line

You may contact us by filling in this form any time you need professional support.