List of Services

AFLEO Consultants

DGFT Regional office

- IEC and its modification/Yearly Update/IEC Surrender.

- Revoke IEC from DEL, Suspension, Cancellation etc / Merger/Demerger of IEC’s.

- DGFT Identity card.

- Advance License - Issuance and Redemptions

- Export Promotion Capital Goods (EPCG) License - Issuance and Redemptions

- Duty-Free Import Authorization (DFIA)

- Remission of duties or Taxes on Export Product (RoDTEP)

- Merchandise Export from India Scheme (MEIS).

- Services Export from India Scheme (SEIS).

- Rebate of State and Central Taxes and Levies (RoSCTL)

- Transport and Marketing Assistance (TMA)

- Certificates of origin (COO) - SAPTA, APTA, ISLFTA, GSTP, India-Dubai CEPA etc.

- Import Monitoring System - (Steel Import Monitoring System, Coal Import Monitoring System,Copper/Aluminium Import Monitoring System, Chip Import Monitoring System)

- Deemed Export Benefits – Apply for Refund of TED/DBK/Brand rate Fixation.

- Star Export House Certificate.

- Free Sale & Commerce Certificate, End User Certificate.

- Enforcement cum Adjudication Proceedings at RA Mumbai.

- E-RCMC Certificate from DGFT – APEDA, FIEO, EEPC, PHARMEXCIL, CHEMEXCIL ETC.

- Gems & Jewelry Schemes.

- Application for Interest Equalization Scheme.

- REX Registration.

- Abeyance Cases for IEC’s in DEL.

- FREE SALE AND COMMERCE CERTIFICATE.

- END USER CERTIFICATE.

DGFT HQ, New Delhi

- Norms Fixation - Handling 25+ Norms Fixation cases every month across various Product groups. (Engineering, Pharmaceutical, Chemical, Textiles & Leather, Plastic & Rubber, Food, Sports & Misc. products)

- Policy Relaxation Committee (PRC Matters) - Proudly representing 20+ cases every month.

- EPCG Committee Approvals - Handling 10+ complex cases every month.

- Permission for Restricted/Negative list of Import Items & Export Items - Experience in Handling 100+ cases till date.

- Registration Certificates for Export & Import Items.

- SCOMET Licenses.

- TRQ (Tariff Rate Quotas)

- Appeal Matters under FTP.

Custom Related Services

- AA/EPCG/DFIA License Registration.

- Bond & Bank Guarantee (BG) Cancellation of EPCG/Advance License.

- ICEGATE Registration.

- Refund under Section 74.

- Pending Duty Drawback from Customs.

- Factory stuffing– Self-sealing permission. [FSP]

- Pending IGST Refund from Customs.

- Removal of IEC from Alert list of Customs.

- GST Services – Refund of ITC from GST.

- Authorized Economic Operator (AEO T1, T2 & T3) certification.

- Reply & Follow-up of Customs Notices if any.

- GST Services – Refund of GST for Service Exporters.

- AD Code/IFSC Registration.

- SIIB Matters (Special Investigation and Intelligence Branch)

- SVB Matters.

- Registration Procedures for First time Importers/ Exporters

- DPD/DPE Registration.

Other Certification:

- All Types of Digital Signature Certificates.

- Health Certificate for Export Products

- EPR Certification for Producers, Importers and Brand owners.

- Phytosanitory Certificate.

- BIS Certification.

- Banking & RBI related liaison for Exporters & Importers.

AFLEO logistics

- Sea Cargo Consolidation – Import & Export

- Sea Freight Forwarding - Import & Export

- Air freight - Import & Export

- Land freight

- Warehousing

- Customs clearance

- Insurance

AFLEO Global

- Buying of scrips - MEIS / SEIS / RoDTEP / RoSCTL / DFIA

- Selling of scrips - MEIS / SEIS / RoDTEP / RoSCTL / DFIA

Find our brochure for more details:

We will see for information about a different topic i.e. Tariff Rate Quota (TRQ) for Imports. This is an interesting topic because everyone is under the impression that they are allotted TRQs only for import of agricultural commodities but it’s not like that. In the recent India-UAE CEPA agreement, you have LLDPE, LDPE, PVC resins, gold, polypropylene, copper wire etc. You can import at concessional duty under TRQ scheme

So on this page, we will understand what TRQ is. Products covered under TRQ of various Free Trade Agreements? What is the application process and other important criteria? So let’s get started.

1. What is Tariff Rate Quota (TRQ)

Under the TRQ scheme, you can import specified products for specified quantities at either nil or reduced import duty.

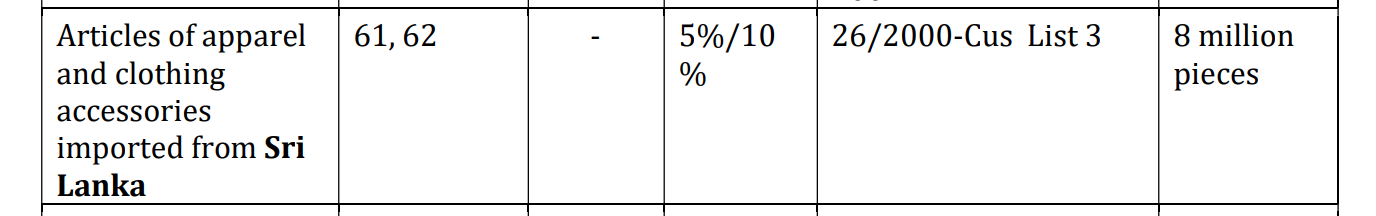

For Example – Apparel and clothing accessories can be imported from Sri Lanka with a duty of 5% up to 8 million pieces. After crossing 8 million pieces for a particular financial year, imports will attract a regular 10% duty.

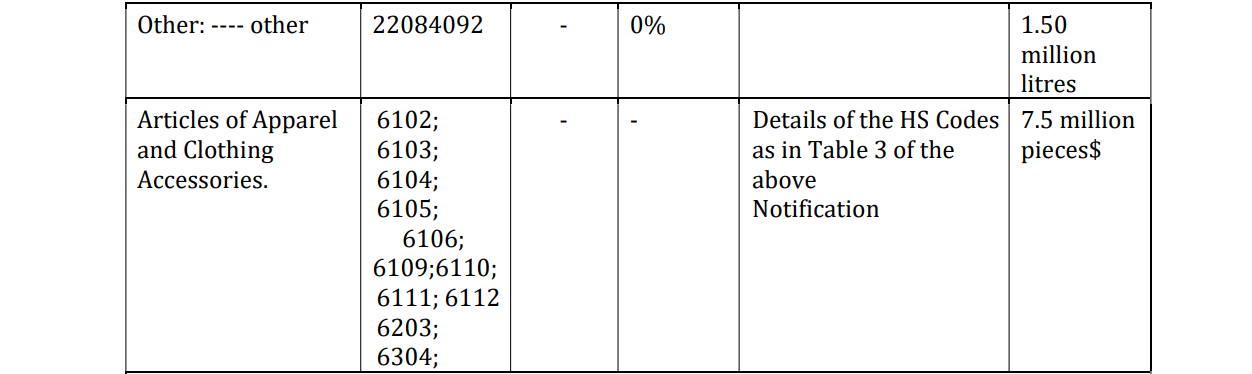

(Example of apparel & clothing accessories of TRQ)

So this is a type of quota for import of 8 million pieces at concessional rate of import duty. That’s why it is called Tariff Rate Quota (TRQ)

In the next section, we will discuss the list of products permitted under various free trade agreements

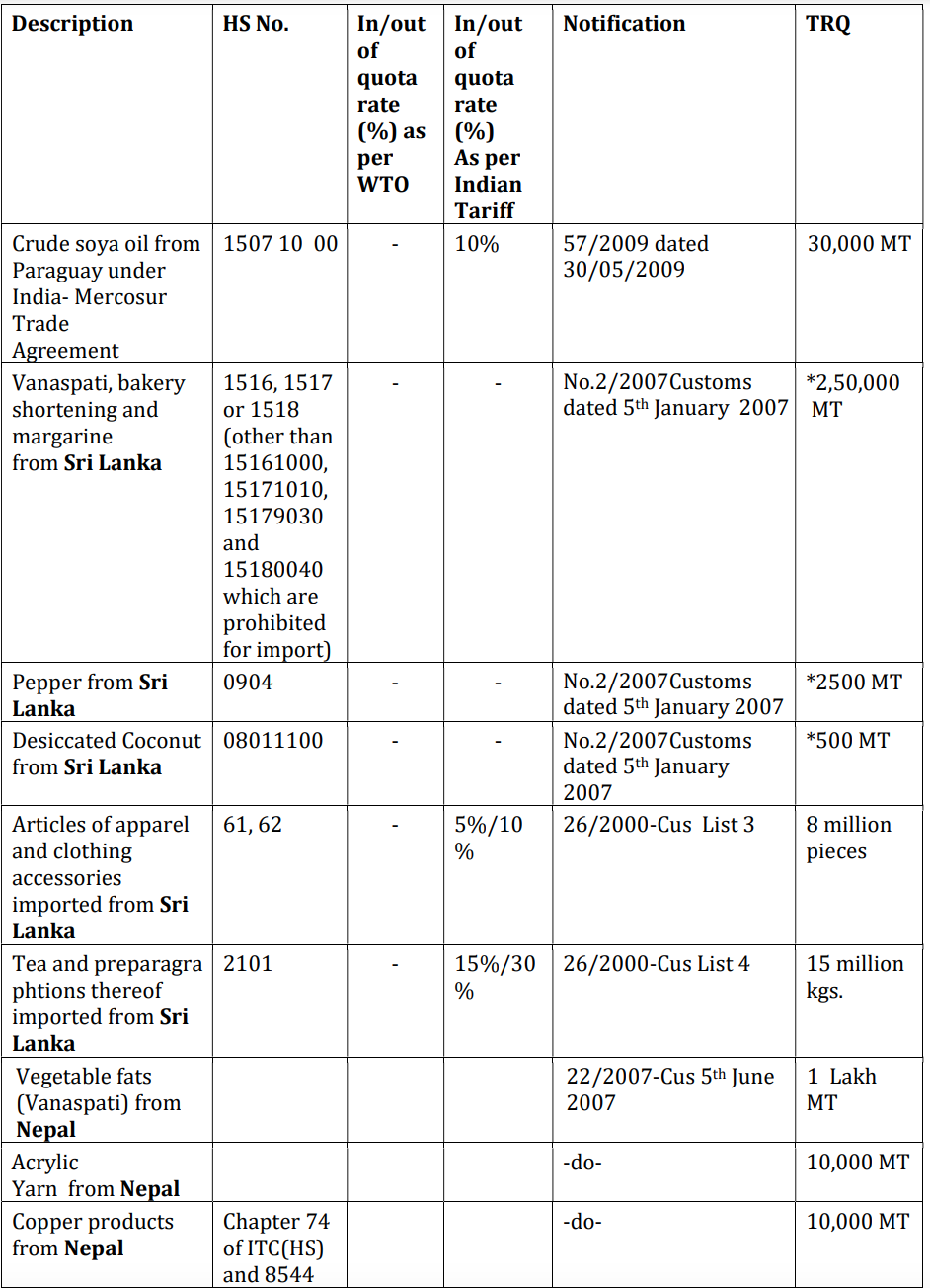

2. Products covered under India-Sri Lanka FTA & other neighboring countries

In the image, you can see the products which are eligible for the TRQ import scheme under trade agreements with Sri Lanka and other neighboring countries. Their quantity is also given against the product for a financial year.

(Products covered under India-Sri Lanka FTA & other neighboring countries)

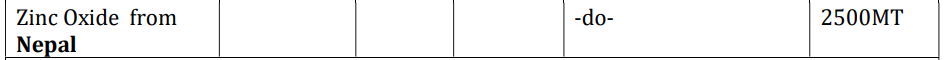

3. Import of Items under TRQ under India-Mauritius CECPA

As you can see in the image, all these items are allowed for import under the Tariff Rate Quota Scheme (TRQ) under the India-Mauritius CECPA.

The allowed quantities are for one Financial Year.

Each TRQ for different FTAs has a customs notification attached to it. For India-Mauritius CECPA TRQ, you are required to comply with Ministry of Finance (Department of Revenue) Notification No. 25/2021-Customs dated March 31, 2021 (as amended from time to time) relating to India-Mauritius CECPA.

Application for TRQ authorization is to be made online on DGFT website with the help of a digital signature and the last date for application for allotment in the next financial year is 28 February of each financial year

At the time of import, the Indian importer has to submit a valid Certificate of Origin for customs clearance, stating that the origin of the goods coming under TRQ is Mauritius and not from any third country.

(Import of Items under TRQ under India-Mauritius CECPA)

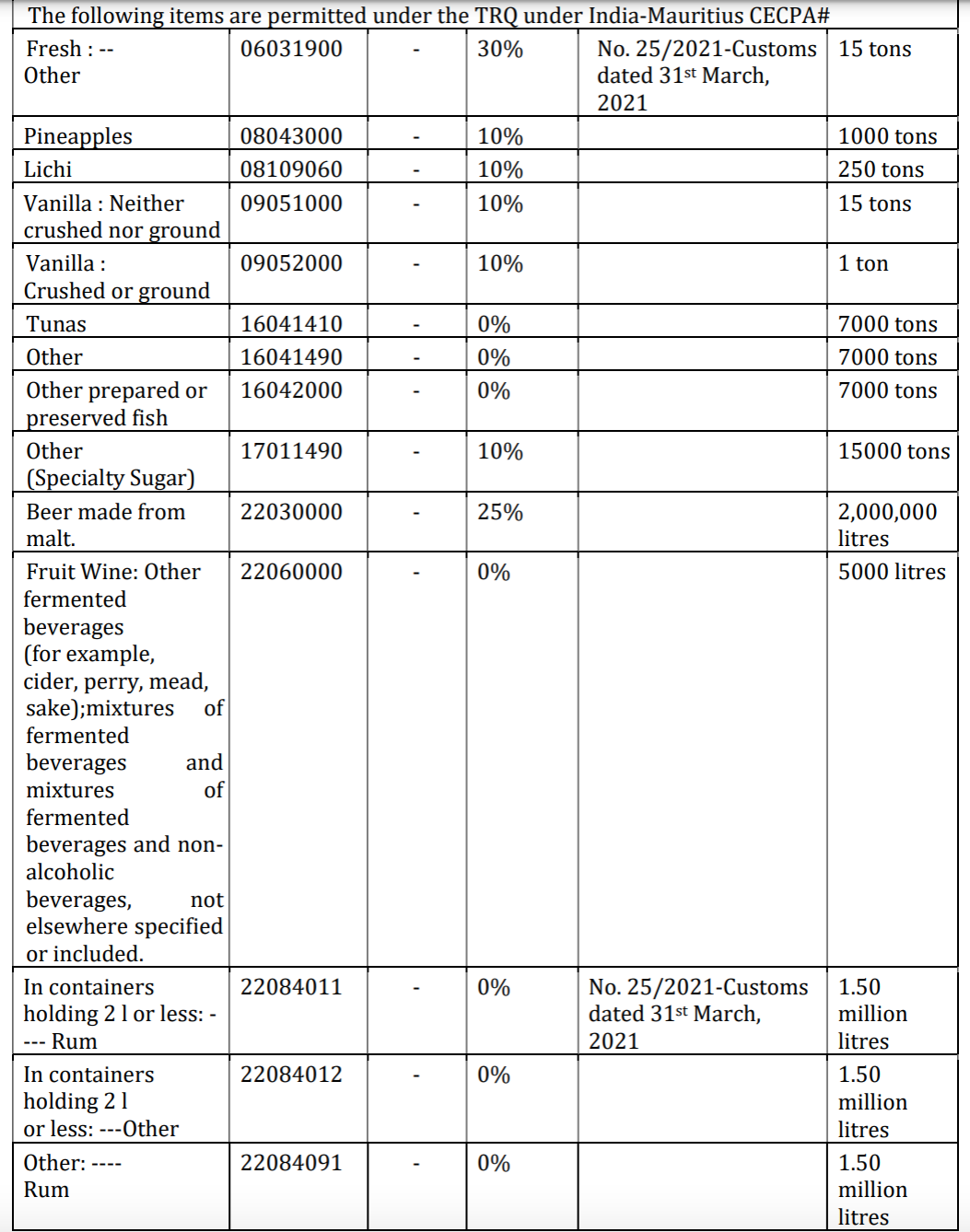

4. Import of Items under Tariff Rate Quota (TRQ) under India-UAE CEPA

| Sr. No. | HS Codes | Item Description | Current Rate of Import Duty | Effective rate of Duty under TRQ | Total Quantities allowed |

| 1 | 39011010 39011020 39011090 |

LLDPE (95% or more) / LDPE / Other Polyethylene | 7.5% | Tariff Reduction of 50% in 5 years [i.e. Every Year 0.5% Duty will be decreased and effective duty at the end of 5 years will be 3.75% till 10th Year. | 1st Year - 45000 MT 2nd Year - 50500MT 3rd Year - 56000 MT 4th Year - 61500 MT 5th Year - 67500 MT 6th Year - 86300 MT 7th Year -105000MT 8th Year -105000MT 9th Year -105000MT 10th Year -105000MT |

| 2 | 39012000 | Polyethylene having a specific gravity of 0.94 or more | 7.5% | Tariff Reduction of 50% in 5 years [i.e. Every Year 0.5% Duty will be decreased and effective duty at the end of 5 years will be 3.75% till 10th Year. | First Year allowed Qty - 150000 MT. Thereafter gradual increase in allowed Qty each year. Maximum Qty allowed till 10th Year - 285000 MT |

| 3 | 39014010 39014090 39019000 39021000 39023000 39029000 |

LLDPE (less than 95%) / Other Ethylene -alpha olefin copolymers /Polypropylene etc. | 7.5% | Tariff Reduction of 50% in 5 years [i.e. Every Year 0.5% Duty will be decreased and effective duty at the end of 5 years will be 3.75% till 10th Year | For each HSN Code, Different Quantities allowed. Please refer to Para 2.92 of HBP 2023. |

| 4 | 39041000 39041020 39041090 39042100 39043010 39043090 39046910 39049010 39049090 |

PVC Resins / Other Poly vinyl Chloride / Poly(vinyl derivatives) / Chlorinated poly vinyl chloride (CPVC) etc. | 10% & 7.5% | Tariff Reduction of 50% in 5 years [i.e. Where current duty is 10%, each year 1% decreases and at the end of 5 years will be 5% till 10th year. | TR (Cumulative Annual TRQ of 60,000 MT) |

| 5 | 71081100 71081200 71081300 |

Non-monetary gold | 10% | TR (Tariff concession/relief of 1% in absolute percentage terms over the applied rate) | First Year allowed Qty - 120 Tonnes. Thereafter gradual increase in allowed Qty each year. Maximum Qty allowed till 10th Year - 200 Tonnes |

| 6 | 71131910 71131920 71131930 71131940 |

Articles of Jewellery of gold | 20% | Each Year 1% Decrease, Minimum Duty 15% | First Year allowed Qty - 2100 KG. Thereafter gradual increase in allowed Qty each year. Maximum Qty allowed till 10th Year - 2500 KG |

| 7 | 74081110 74081190 |

Copper weld wire / Other wires of refined copper [> 6mm] | 5% | Each Year 1% Decrease, 0% after 5 years till 10th Year. | TEP over 5 years (TRQ of 150% of 3 years moving average volume) starting with 85000 MT in 1st Year |

| 8 | 74081910 74081920 74081990 |

Copper weld wire / Other wires of refined copper [< 6mm] | 5% | Each Year 1% Decrease, 0% after 5 years till 10th Year. | TEP over 5 years (TRQ of 150% of 3 years moving average volume) starting with 270 MT in 1st Year |

(Import of Items under Tariff Rate Quota (TRQ) under India-UAE CEPA)

The tariff rate quota allotted under the India-Dubai CEPA trade agreement does not include agricultural items.

In the image, you can see that many new items have been added in India Dubai CEPA except agricultural items. For example - LLDPE / Polypropylene / PVC resins / Gold / Gold articles / Copper wire etc.

In the image, we have explained in a simple way which products are eligible, what is the current import duty, and what will be the duty concession of TRQ and what is the cap of quantities.

The last date of application for TRQ under India Dubai CEPA is 28 February of the previous financial year. That is, the last date for the financial year 23-24 was 28 February 2023.

TRQ application is mandatorily filed online on the DGFT website with the help of a digital signature.

One important thing here is that the Indian importer has to submit the Certificate of Origin from UAE authorities at the time of customs clearance.

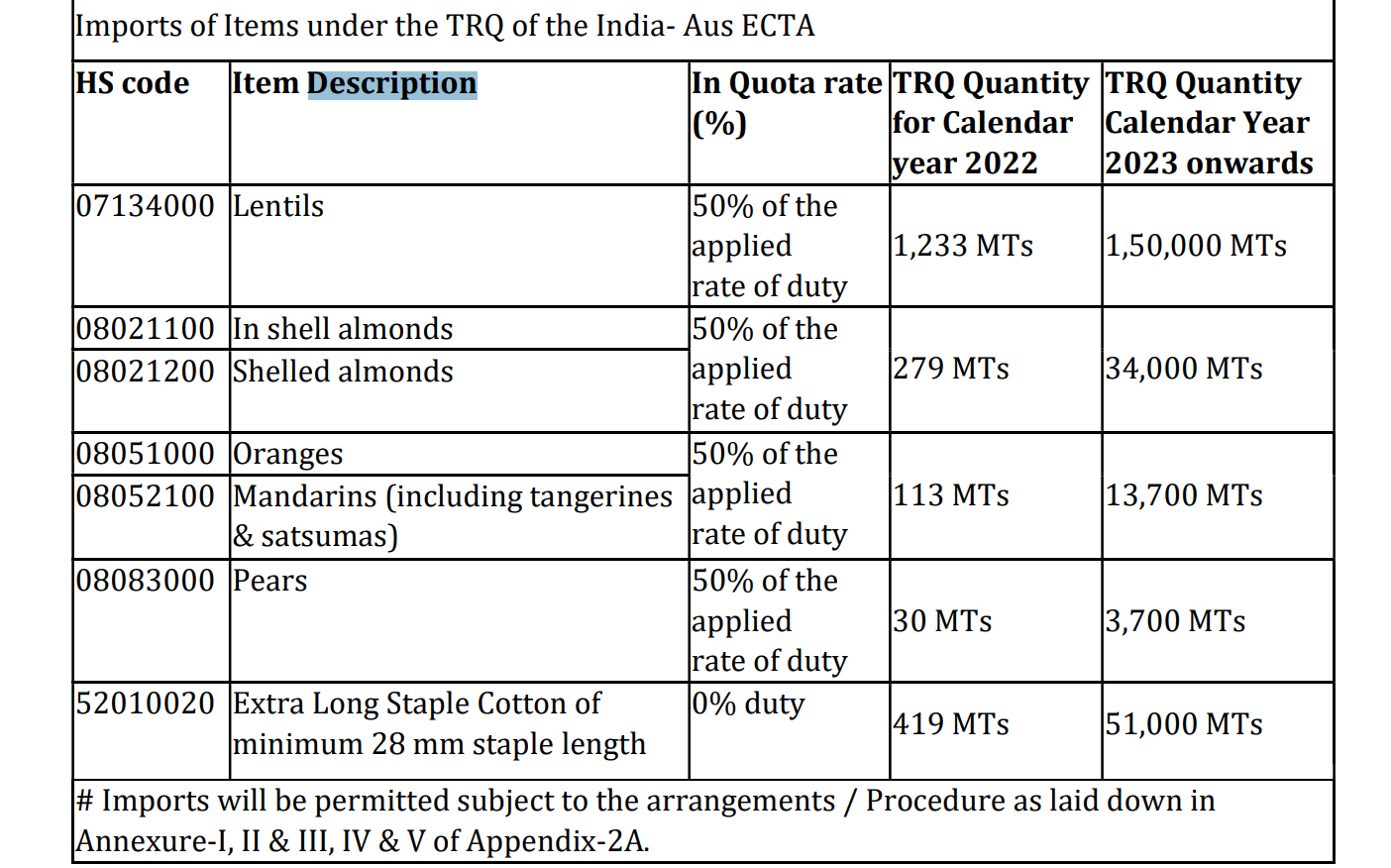

5. Import of Items under TRQ of India-Australia ECTA

(Import of Items under TRQ of India-Australia ECTA)

The Tariff Rate Quota (TRQ) of India-Australia trade agreement covers pulses, almonds, oranges, mandarins, pears, and extra-long staple cotton.

The quota quantity and rate are clearly mentioned in the image which is self-explanatory.

In India-Australia TRQ, Australian government will issue TRQ certificates to Australian exporters and share those certificates with DGFT

Indian importers will also have to apply for TRQ authorization online on the DGFT website. There is no last date for application in this TRQ.

It is important to note here that the India-Australia TRQs are calendar year wise i.e. from 1st January to 31st December and not financial year-wise.

And as there is no last date for application, you can apply anytime throughout the year, but you will be allotted TRQ only if there is a balance quantity.

So we will advise you to apply on the 1st of January of each year.

The TRQ authorization allotted to the Indian importer will be valid for a maximum period of 12 months or till the end of the calendar year of import, whichever is earlier. This means that the clearance process of import should be done within the validity period.

6. Who we are and Why Choose Us

We at Afleo Group, are a team of DGFT & Customs Experts having a rich experience of 10+ Years in Exim Consultancy & International Logistics [Freight Forwarding] and also deal in Buy/Sell RODTEP/ROSCTL/DFIA License With our vast knowledge and experience in this field we can represent your case for all the activities pertaining to the Tariff Rate Quota and get it in a hassle-free manner.

So do get in touch with us for any of your requirements and our team will be happy to help you.

We request you to share this information with your other Industry friends, Trade associations, as this information might help them as well.

Fill the below form to get in touch with us

Our Office

Unit No. 207, Centrum IT Park, Wagle Estate, Thane West, Mumbai, Maharashtra 400604

Drop a Line

You may contact us by filling in this form any time you need professional support.