List of Services

AFLEO Consultants

DGFT Regional office

- IEC and its modification/Yearly Update/IEC Surrender.

- Revoke IEC from DEL, Suspension, Cancellation etc / Merger/Demerger of IEC’s.

- DGFT Identity card.

- Advance License - Issuance and Redemptions

- Export Promotion Capital Goods (EPCG) License - Issuance and Redemptions

- Duty-Free Import Authorization (DFIA)

- Remission of duties or Taxes on Export Product (RoDTEP)

- Merchandise Export from India Scheme (MEIS).

- Services Export from India Scheme (SEIS).

- Rebate of State and Central Taxes and Levies (RoSCTL)

- Transport and Marketing Assistance (TMA)

- Certificates of origin (COO) - SAPTA, APTA, ISLFTA, GSTP, India-Dubai CEPA etc.

- Import Monitoring System - (Steel Import Monitoring System, Coal Import Monitoring System,Copper/Aluminium Import Monitoring System, Chip Import Monitoring System)

- Deemed Export Benefits – Apply for Refund of TED/DBK/Brand rate Fixation.

- Star Export House Certificate.

- Free Sale & Commerce Certificate, End User Certificate.

- Enforcement cum Adjudication Proceedings at RA Mumbai.

- E-RCMC Certificate from DGFT – APEDA, FIEO, EEPC, PHARMEXCIL, CHEMEXCIL ETC.

- Gems & Jewelry Schemes.

- Application for Interest Equalization Scheme.

- REX Registration.

- Abeyance Cases for IEC’s in DEL.

- FREE SALE AND COMMERCE CERTIFICATE.

- END USER CERTIFICATE.

DGFT HQ, New Delhi

- Norms Fixation - Handling 25+ Norms Fixation cases every month across various Product groups. (Engineering, Pharmaceutical, Chemical, Textiles & Leather, Plastic & Rubber, Food, Sports & Misc. products)

- Policy Relaxation Committee (PRC Matters) - Proudly representing 20+ cases every month.

- EPCG Committee Approvals - Handling 10+ complex cases every month.

- Permission for Restricted/Negative list of Import Items & Export Items - Experience in Handling 100+ cases till date.

- Registration Certificates for Export & Import Items.

- SCOMET Licenses.

- TRQ (Tariff Rate Quotas)

- Appeal Matters under FTP.

Custom Related Services

- AA/EPCG/DFIA License Registration.

- Bond & Bank Guarantee (BG) Cancellation of EPCG/Advance License.

- ICEGATE Registration.

- Refund under Section 74.

- Pending Duty Drawback from Customs.

- Factory stuffing– Self-sealing permission. [FSP]

- Pending IGST Refund from Customs.

- Removal of IEC from Alert list of Customs.

- GST Services – Refund of ITC from GST.

- Authorized Economic Operator (AEO T1, T2 & T3) certification.

- Reply & Follow-up of Customs Notices if any.

- GST Services – Refund of GST for Service Exporters.

- AD Code/IFSC Registration.

- SIIB Matters (Special Investigation and Intelligence Branch)

- SVB Matters.

- Registration Procedures for First time Importers/ Exporters

- DPD/DPE Registration.

Other Certification:

- All Types of Digital Signature Certificates.

- Health Certificate for Export Products

- EPR Certification for Producers, Importers and Brand owners.

- Phytosanitory Certificate.

- BIS Certification.

- Banking & RBI related liaison for Exporters & Importers.

AFLEO logistics

- Sea Cargo Consolidation – Import & Export

- Sea Freight Forwarding - Import & Export

- Air freight - Import & Export

- Land freight

- Warehousing

- Customs clearance

- Insurance

AFLEO Global

- Buying of scrips - MEIS / SEIS / RoDTEP / RoSCTL / DFIA

- Selling of scrips - MEIS / SEIS / RoDTEP / RoSCTL / DFIA

Find our brochure for more details:

What is Policy Relaxation? - An Overview

The Policy Relaxation is the exemption from the policy/procedures under the foreign trade policy for Importers and Exporters in India. The Directorate General of foreign trade (DGFT) may in public interest pass such orders or grant such exemption/relaxation or relief on the ground of genuine hardship from any provision of foreign trade policy (FTP) or any procedures. All the cases of policy relaxation are handled by a Policy relaxation committee (PRC), at DGFT New Delhi under the chairmanship of the Directorate General of Foreign Trade.

Online e-PRC system and why it is introduced

The DGFT has introduced an online e-PRC system for seeking policy/procedure relaxations as per the trade notice No. 38/2020-21 dated 15th January 2021. Therefore from 25th January 2021 onwards, all the applications seeking policy or procedure relaxations are mandatorily required to be submitted through the exporter’s dashboard on DGFT Portal. Before the introduction of the online module, the DGFT was receiving an application for seeking policy/procedures relaxation in manual form i.e. in the form of hard copy of prescribed format ANF 2D along with the proof of payment/application fee and other related documents. As a consequence rest of the process also happened in manual mode and took time. So to avoid the delay in the process DGFT has introduced an online Module for the application. The DGFT would not accept any manual application seeking policy/procedures relaxation from 25th January 2021 onwards

Recent Updates

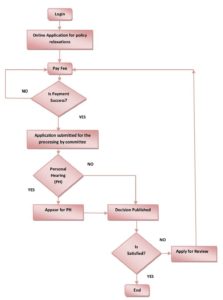

PRC Application Online Procedure

- The Online application shall be filled on the DGFT Website – (https://www.dgft.gov.in/CP/).

- The application should be filled as per the form ANF-2D on DGFT Portal.

- An applicant is requested to fill all the mandatory fields marked with an asterisk sign.

- Login into the DGFT portal with the help of user ID and password (Received after Linking IEC of the company).

- Click on Policy Relaxation Committee from the Services and apply for a fresh Application form “Apply for PRC Committee”

- Fill in all the details and upload the necessary documents.

- After filling in the Applicant Details & fill in the Personal Hearing Details.

- Select ‘Yes’ or ‘No’ to apply for Personal Hearing (PH).

- Pay the fee Rs 2000/- for fresh application as per Appendix 2K & Rs 5000/- for review application.

- The applicant can track the status of the submitted application in the Submitted application from My Dashboard.

PRC Application Procedure – Flowchart

[Policy Relaxation Committee (PRC) DGFT Online Application Procedure]

Please view the essential video regarding the Policy Relaxation Committee.

In this video, we will discuss the various types of policy relaxation cases in which exporters have requested policy relaxation from the PRC Committee, as well as the documentation required and the method for filing an application. Please watch till the end.

Type of cases discussed at the Policy Relaxations committee (PRC) DGFT

We have listed few examples of the policy relaxation cases in which exporters have requested the PRC Committee for the policy relaxation:

- To Allow MEIS Benefits against time-barred shipping bills.

- Grant of Duty credit scrip under MEIS Scheme wherein shipping bills have “N” in the scheme reward column.

- 2nd Export obligation (EO) Extension under Advance Authorization Scheme if the 50% EO criteria not fulfilled.

- Extension in Export Obligation (EO) after the expiry of both the extensions.

- Relaxation to claim SEIS scheme for the 2nd time for the same FY if some invoices missed to be claimed.

- Relaxation for missing out on the condition of export fulfillment within 6 months from the date of import against Advance Authorization under Appendix 4J.

- To allow MEIS Benefits for the shipping bills against which e-BRC has been received late from the banker.

- Import of 2nd hand capital goods under the EPCG Scheme.

- Relaxation of Pre-import condition of Advance Authorization, etc.

Who are we and How can we help you?

At Afleo Consultants, we are India’s No. 1 DGFT Consultants. We study your entire business process and guide you for all the eligible export benefits in India that your Company can claim. Our only motto is to get maximum export incentives for our clients within the policy framework.

<p>At Afleo Consultants, we are India’s No. 1 DGFT Consultants. We study your entire business process and guide you for all the eligible export benefits in India that your Company can claim. Our only motto is to get maximum export incentives for our clients within the policy framework.

We have our own team of DGFT experts who assists genuine exporters and importers in making request/plea to Policy relaxation committee (PRC), DGFT New Delhi for relaxation of certain provisions of policy/procedures on the ground that there is a genuine hardship to the exporters/importers.

We do the analysis of the PRC cases and perform the following tasks –

- Online applications are done by our experts.

- Evaluate the demands raised by the policy relaxation committee.

- As per the PRC demands prepare the replies.

- Attend the personal hearings if required.

- Represent cases effectively on merits.

We have a PAN India presence.

We would appreciate your comments and views on the above topic.

FAQ's

The Policy Relaxation is the exemption from the policy/procedures under the foreign trade policy for Importers and Exporters in India.

DGFT introduced a new module (online e-PRC System) under Trade Notice No. 38/2020-21 dated 15th January, 2021.

Personal Hearing is not mandatory for the applicant.

If you feel one of the members should be present in-person to explain and elaborate on the PRC

request, then you may apply for the PRC with PH.

Policy Relaxation application notification goes on Email ID and Mobile Number registered under IEC

and the applicant

You may apply any number of times for the review application.

No, there is no provision of refund .

Importer/Exporter can access the new e-PRC module at https://dgft.gov.in -› Services Policy Relaxation Committee.

No, You cannot submit the application without DSC.

Any authorized representative of importer/exporter can appear for PH.

Why Afleo Consultants?

- We are the team of highly qualified & experienced professionals having sufficient expertise over the years in the field of DGFT Consultancy Services.

- We only have the goal of providing very reliable services with the most competitive cost to the exporters under one roof.

- We keep updating our clients with regular policy amendments, all the upcoming rules, and regulations in foreign trade policy.

- We have a separate team for follow up with DGFT and have a great understanding of the working of DGFT office, which helps us in obtaining MEIS licenses without delay.

Fill the below form to get in touch with us

Our Office

Unit No. 207, Centrum IT Park, Wagle Estate, Thane West, Mumbai, Maharashtra 400604

Drop a Line

You may contact us by filling in this form any time you need professional support.