What is SEIS?

SEIS Scheme is a scheme initiated by DGFT (Directorate General of Foreign Trade) for encouraging exports of services from India. Through this scheme, the government plans to bring about economic development by boosting services related exports from our country. To give you a gist, this scheme basically focusses on service providers who are exporting their services outside India. This article will take you through the SEIS Scheme benefits in India initiated by DGFT.

[If you want an in-depth knowledge of SEIS Scheme read our article on “All about Service Exports From India Scheme – SEIS“]

The SEIS Scheme benefits include 5% to 7% incentives on the service exported outside India. Yes, you read it right, these are incentives provided by the government.

Now you will think 5% to 7% incentive in regards to what? These 5% to 7% are in regards to the net foreign exchange earned during a particular financial year.

Note – Net Foreign Exchange = Gross Earnings of Foreign Exchange minus Total expenses /payment/remittances of Foreign Exchange by the IEC holder, relating to the service sector in the Financial year.

There will be a question in your mind as to in what form will you get this 5% to 7% incentive?

Will it be a cash incentive?

Or

Some benefits in the form of exemptions in the form of customs duty?

Or

Benefits in the form of tax rebates, etc.

The questions coming to your mind will be endless.

Let me answer the above-given questions.

The SEIS Scheme benefits of 5% to 7% will be in the form of Duty Credit Scrips. The Duty Credit Scrips are also recognized as Import Duty Credit.

What is Import Duty Credit or Duty Credit Scrip?

Duty Credit Scrip is a document that allows the entitled holder to pay import custom duties levied on Import of various services and goods. These scrips are government-issued and the issuing department is DGFT. They are issued to exporters of both goods and services.

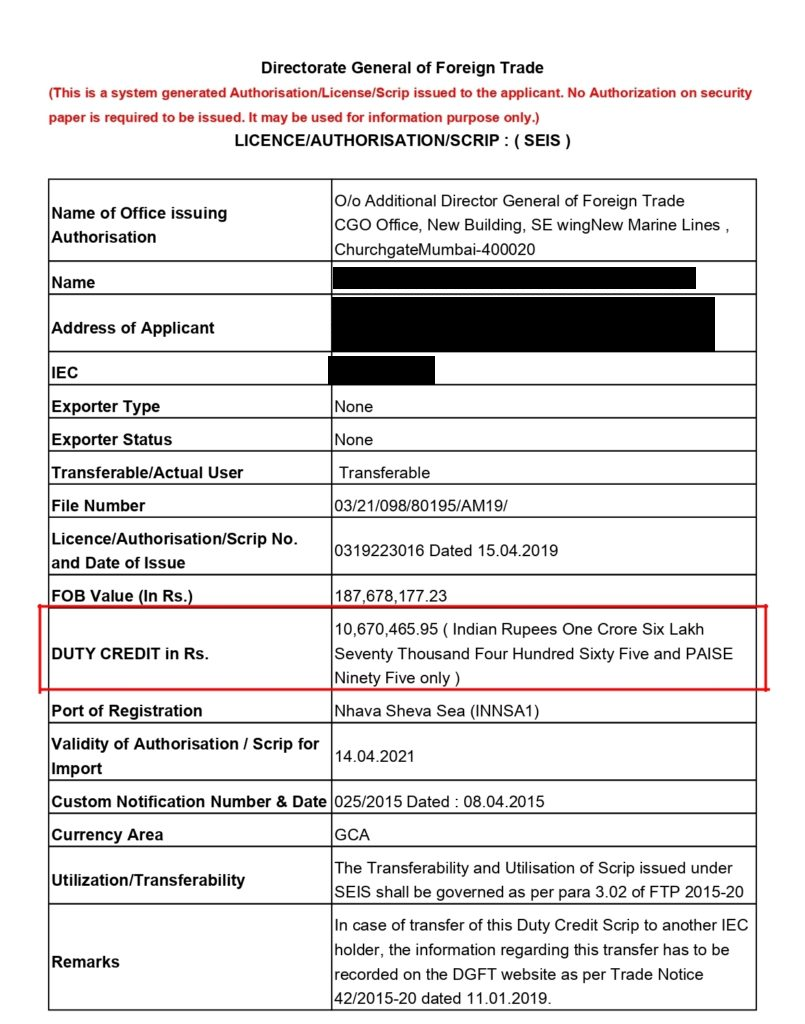

Please find below a Draft/Sample Image of a Duty Credit Scrip issued under SEIS Scheme.

If you look into the above image you will find the value highlighted (DUTY CREDIT in Rs.). This is the actual value of Benefit that You have received from the Government.

The main point here is to give basic knowledge about the Duty Credit Scrips so that you can have a better understanding of its “Freely Transferable Nature”.

What is the significance of the Duty Credit Scrip?

Let us consider Company M/S XYZ. Company is into the export of services and they have applied for SEIS. Hence, they have received a DUTY credit scrip for Rs. 1 Lakh (Say for Example). Now this Company is also into Import of Goods. Therefore they can set-off this Credit of Rs. 1 Lakh against the Basic Customs Duty which is payable to them at Customs during Import of Goods.

In the above Example, Company XYZ is into the Import of Goods. But what will happen to the scrip if the Company is not Importing anything? How will the Import Duty Credit be utilized? How will the scrip be beneficial to the Company?

It is here where we look at the core concept of the Freely Transferable Nature Of Rewards under SEIS.

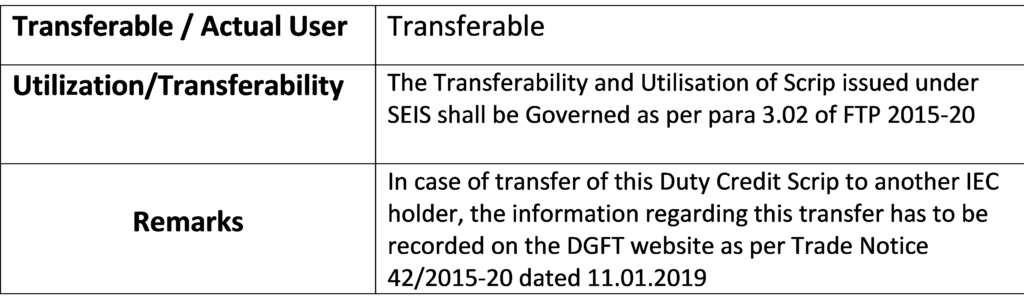

It means that the Duty Credit Scrip is Freely Transferable/Saleable/Tradeable in nature. Therefore it can be sold to any individual who is into Imports of Goods or Services. This freely transferable nature of Scrips is also endorsed on the Duty Credit Scrip itself. PFB below the Cropped Image of Above Duty Credit Scrip.

It shows that the Scrip is Transferable in nature and it does not come with any actual user Condition.

This feature is unique to only SEIS. It wasn’t present in the earlier Served from India Scheme (SFIS).

Therefore to sum it up, Consider an organization Exporting Services worth Rs. 1 crore in a particular FY and gets rewarded duty scrip of value Rs. 5 lakh (let’s assume Rate of Reward @5%). Now, either the holder can use it to import Goods/Services without paying duties up to Rs 5 lakh or sell it out in the market (in case he doesn’t import goods or utilize it) and get money in exchange of duty scrip.

Therefore, it can be said that rewards under SEIS Scheme are as good as cash incentive and all the service providers should take the SEIS Scheme benefits.

[If you want to know the complete process of applying under SEIS Scheme read our article on “SEIS Scheme Application Process – Complete Guide (2019)“]

Why us?

We are a Leading SEIS Consulting Firm in India. Want help to claim the SEIS Scheme benefits? Contact us for free Consultancy.