The RoDTEP Scheme was approved by the Union Cabinet on 13th March 2020 and it came into effect from 1st January 2021. The exporters can get the refund of embedded central, state, and local duties or taxes that were not getting refunded under any of the existing schemes under the RoDTEP Scheme.

The scheme was operationalized w.e.f. 01.01.2021, and initially only capturing the RoDTEP scheme in the shipping bills were enabled and the approximate benefit amount was captured as per drawback processing.

The government has notified the benefit rates on eligible items on 17.08.2021 as per notification No. 19/2015-20.

Now that the RoDTEP rate structure has been notified, the following changes also have been done in the system to avail of the benefits as per the latest advisory.

The logic for the Benefits calculation would be:-

The benefits would be calculated on a value equal to the declared export FOB value of the said goods or up to 1.5 times the market price of the said goods, whichever is less

Benefit Calculation and Processing of shipping bills filed between 01/01/2021 to 01.10.2021:-

For the RoDTEP claims captured in the shipping bills filed between 01.01.2021 to 01.10.2021 the benefit would be updated in the system. It would be calculated on the basis of the logic given above.

Benefit calculation and processing for the shipping bills filed on or after 01.10.2021:-

The benefits would be calculated as per the rates notified by the Government. The RoDTEP claims would be processed either by the officer or facilitated by RMS and after processing, the shipping bill will be available for the generation of the scroll.

Scroll Generation under RoDTEP:-

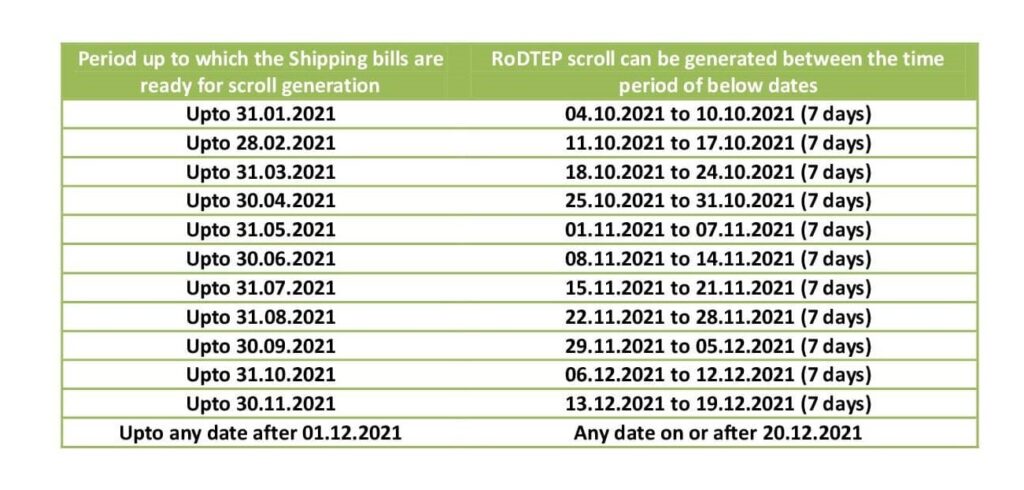

- The RoDTEP scrolls would be generated on FIFO (First in first out) basis w.e.f. 01/01/2021.

- Officers would verify the correctness of the scroll amounts.

- To avoid the overloading of the system due to the processing of backlog since 01.01.2021, the scroll generation would be enabled in a staggered manner in periods beginning from 01.01.2021.

- Allowing one week time for each customs location for generating scrolls for one month as per the schedule mentioned as given below.

- This is also being done for equitable distribution of benefit as the quantum of benefit is limited to budgetary grants and is not unlimited.

Once the scroll would be generated, claiming process has to be done to get the RoDTEP License/scrip through the ICEGate portal.

Get in touch with us for more clarification on How to proceed with availing of the benefits under the RoDTEP scheme.