The Government of India has launched the Export Promotion Capital Goods Scheme (EPCG Scheme) under the Foreign Trade Policy 2015-20. The main objective of the EPCG Scheme is to provide capital goods to facilitate the production of quality goods and services. Capital goods are the raw materials required for establishing an industry. This Scheme enables Zero Custom Duty on the import of capital goods such as machinery required for the production, pre-production, and post-production of goods. To avail these benefits, the manufacturer or exporter should make an EPCG License Online Application to DGFT.

[Want to get more detailed knowledge about the EPCG Scheme, read the complete guidance article on, "Export Promotion Capital Goods Scheme for Beginners (2020)"]

To avail of these benefits, the Government of India provides a license known as an EPCG license.

Watch this short introductory video on the EPCG Scheme; which explains the complex concept of EPCG in an easy to understand manner. It Explains What is EPCG Scheme and its application process; details about Export obligation & Redemption of EPCG License; entire summary and step by step procedures involved in the EPCG scheme.

Let us now see the complete step by step process for the EPCG license online application procedure at the DGFT website.

[Before moving to the EPCG online application procedure, it is important to know the documents required. Therefore, Get the complete updated list of all the documents required for the EPCG license, read our article on “Complete List of Documents Required for the EPCG License (Updated 2020)“]

EPCG Online Application Procedure

Before starting the application procedure, please note that it is mandatory to have DGFT Digital Signature Certificate (DSC) of the applicant firm. Application for EPCG License has to be submitted online at the DGFT website. Manual application is not allowed.

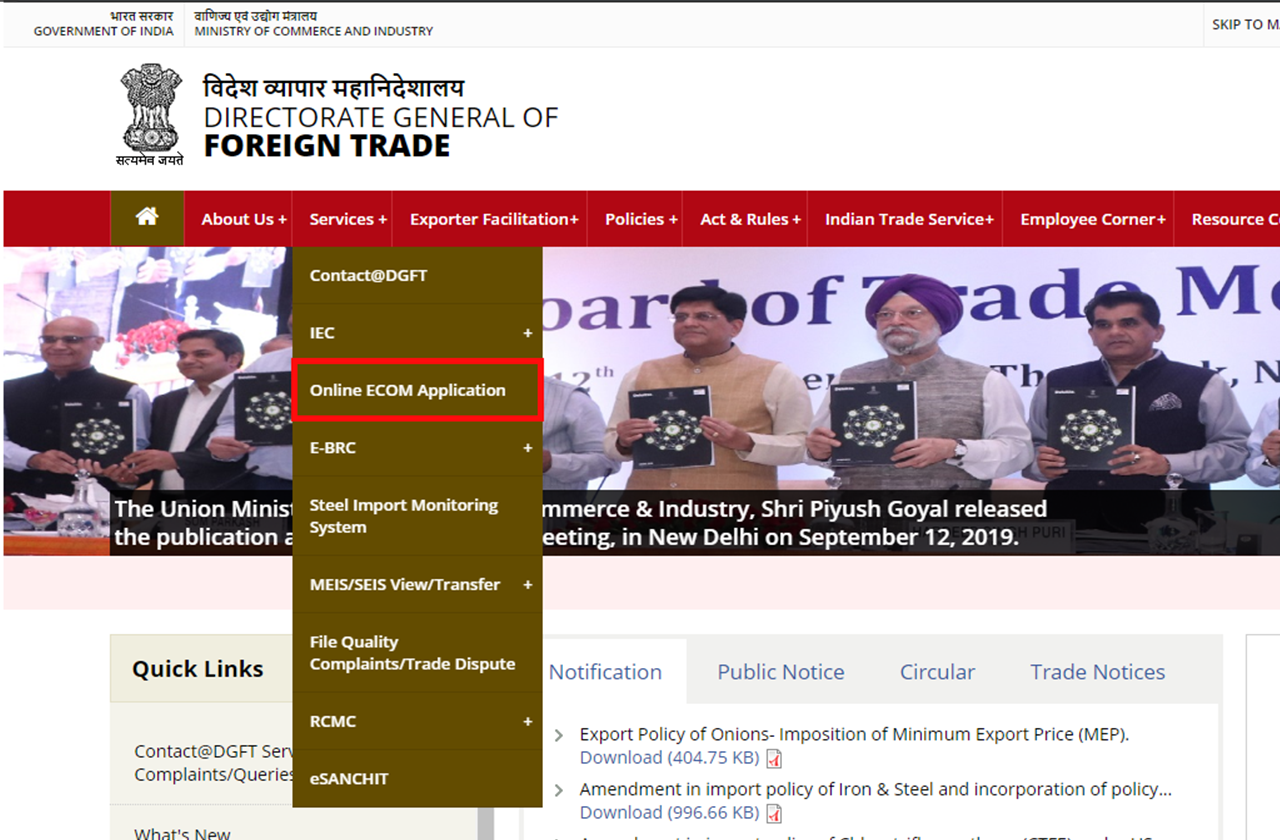

Step 1: Visit the DGFT Official website

Please visit the official website of Government by clicking https://www.dgft.gov.in/

Under the “SERVICES” tab, select “Online ECOM Application”.

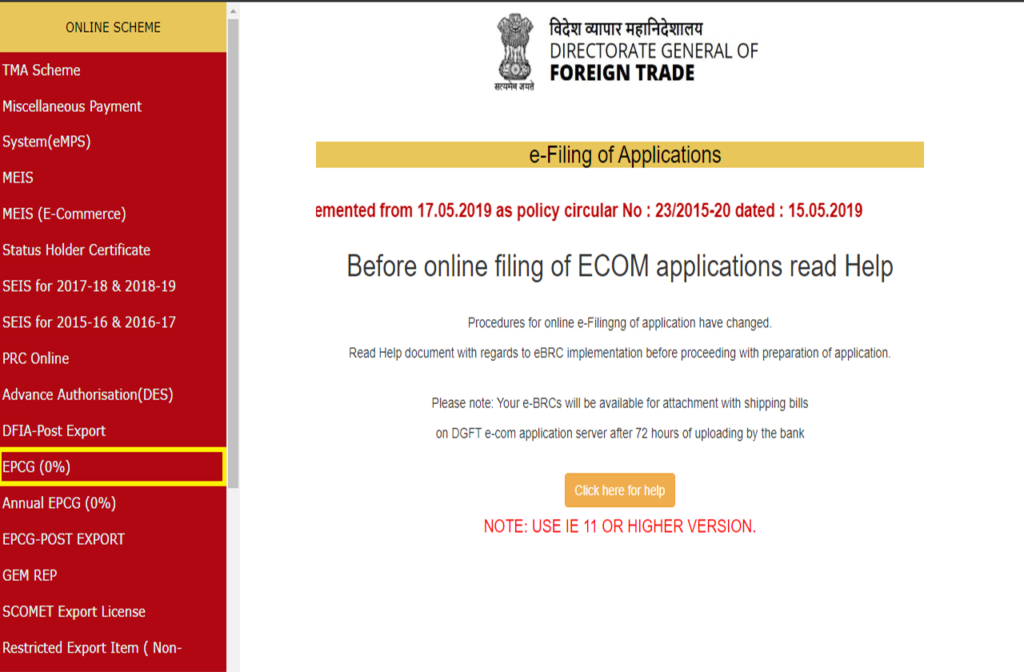

Step 2: Log in with DGFT Digital Signature Certificate

After step 1, You will see the below page on your desktop screen. Select the “EPCG (0%)” option from the left side panel and then login with your DGFT Digital Signature Certificate.

[Have no idea about the DGFT Digital Signature? Read the article for the detailed information about, "What is Digital Signature & how we can get it?"]

Step 3: Create a New File

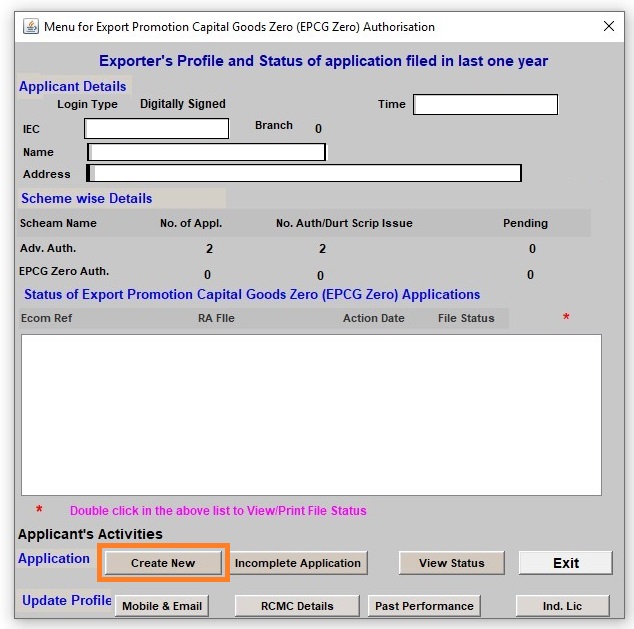

After successful login in with the Digital Signature, a new window will open. This window shows the profile of Exporter along with the status of Advance/EPCG Licenses filed in the last one year.

Find the below image for your reference:-

-

Exporter Profile Window

Since we are applying for a new EPCG Online Application, select the “Create new” button. This command will open a new EPCG application form along with the new File number.

Step 4: Fill initial mandatory details

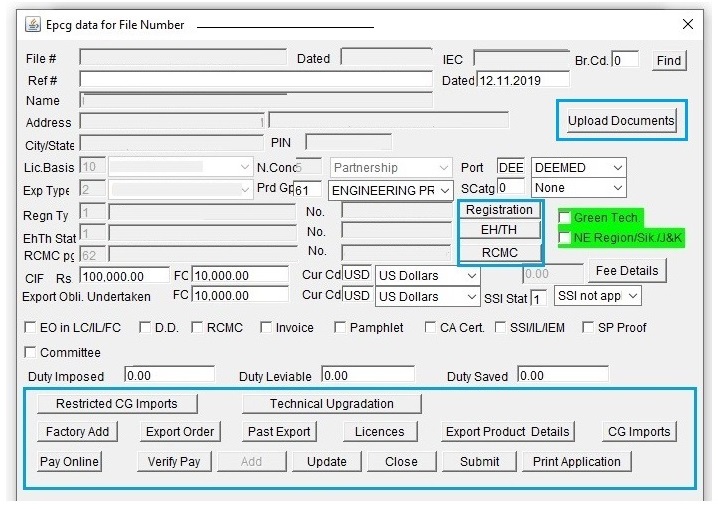

After selecting the “Create New” tab, the main screen for the EPCG online application would appear.

Please find the image below:-

-

EPCG New Application Form

IEC No, Name, Address of the IEC Holder is pre-filled in this application window.

First and foremost you have to select the “PORT”. Select the name of the port where the imported machinery is going to arrive. For Example- Nhava Sheva, Mundra, Bombay Air Cargo, Chennai Sea Port, etc.

NOTE: While applying, once you select the “port of registration” field and submit it, it can’t be changed. So fill the field correctly.

Now select the Exporter Type & Product Group Code from the drop-down option.

Fill up the CIF in Rs, Foreign Currency and US Dollars. CIF value is basically the cost of Imported machinery/capital goods. After filling the details, click on the “Update” tab at the bottom of the window.

NOTE: After filling the details kindly click on the “Update” tab and also update the application form regularly to save the details filled or modifications made by you.

Step 5: Filling Industrial Registration, Export House & RCMC Details

Since EPCG License is issued only to Manufacturer Exporters. The proof of manufacturing/Industry is compulsory. On the middle right side of the application (highlighted in the blue box), you will see all the required tabs covered in this step.

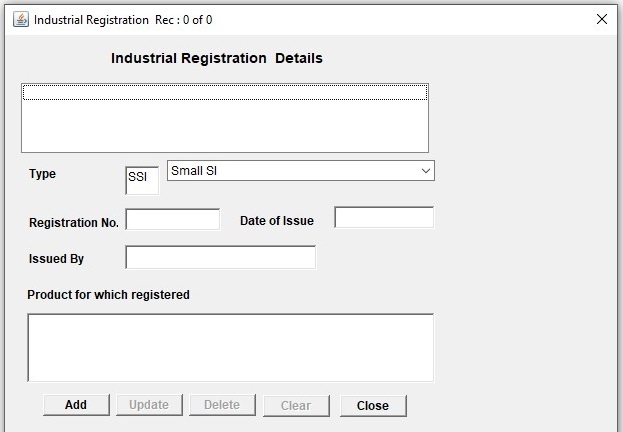

Click on the “Registration” tab. A new screen like below will appear on your desktop.

Select the Registration type from the drop-down menu (Menu will consist of SSI, MSME, Industrial License, Industrial Entrepreneurs Memorandum (IEM), etc.). Enter the Registration Number, Date of issue, Issuing Authority & Products for which registration is given. Once inserted, click on the add button. Then update and close the window.

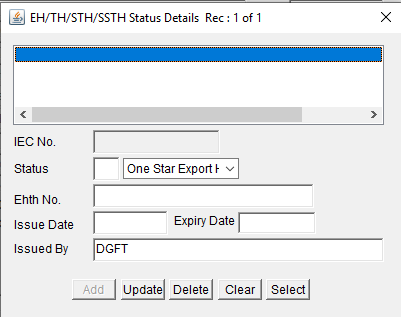

The next step is to fill the Star Export House details. If your firm is given a status of Star Export House from DGFT, please click the “EH/TH” tab and fill the necessary details. If you do not have the Star Export House status, then ignore it.

[Read more about Star Export House, by referencing the article on "Star Export House Certificate and its eligibility criteria"]

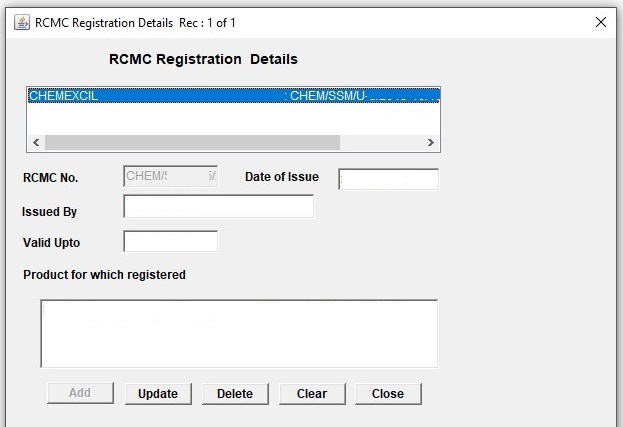

The next step is to fill the RCMC details. Registration with any Export Promotion Council (EPC) is a must to avail of the benefits of the EPCG Scheme. Click on the “RCMC” tab, fill the required information like RCMC No, Date of Issue, Issuing Authority, Valid up to & products for which it is registered. Once inserted, click on the Add button. You can also use the Update or Delete option if you want to modify the earlier details.

NOTE: The RCMC should be valid at the time of applying for an EPCG License.

After successfully filling these details, click on the Update tab to save changes.

Find the below image for your reference:-

Now, move on to the tabs at the bottom of the main dialogue box.

- Restricted CG import- This is to be filled if the capital machinery is falling under the restricted import list.

- Technical Up gradation- This section is not mandatory.

- Export Order – Again this is not mandatory.

- Licenses – In this section, details of all the previously obtained EPCG Licenses if any needs to be submitted. % of EO fulfilled also has to be indicated against each License.

Let’s discuss other sections, which are more important, in detail.

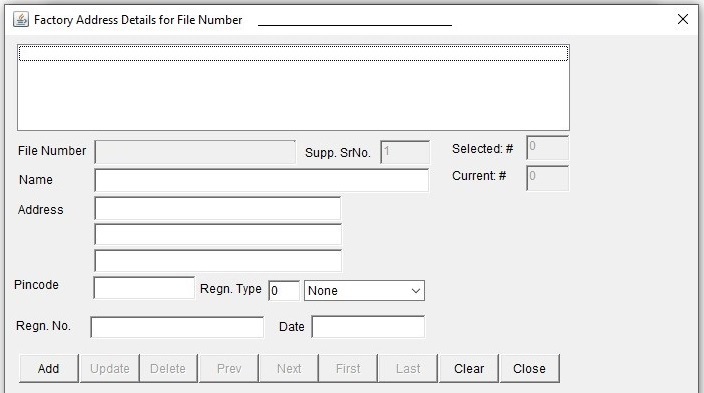

Step 6: Fill the Factory Address

Select the “Factory Add” option on the main page. A new screen like below will appear.

By default, File Number is present in the form. Fill the Name, Address & Pin code of the firm. Select the Registration Type from the drop-down menu. Click the add button for the update. If you have to add multiple addresses, select the clear button and start adding.

NOTE: The factory address should be the same as mentioned in the Manufacturing License.

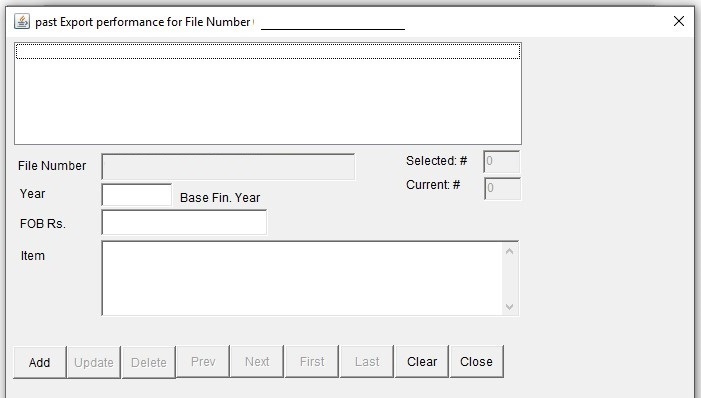

Step 7: Fill Past Export Performance

This section is important to be filled to calculate the Average Export Obligation of the applicant. You have to fill the Export performance details of the Last 3 years. For example, if you are applying for EPCG License in FY 2020-21, then details of the last 3 FY’s are to be filled. Indicate the FOB value of Export in Rs. and the Items Exported.

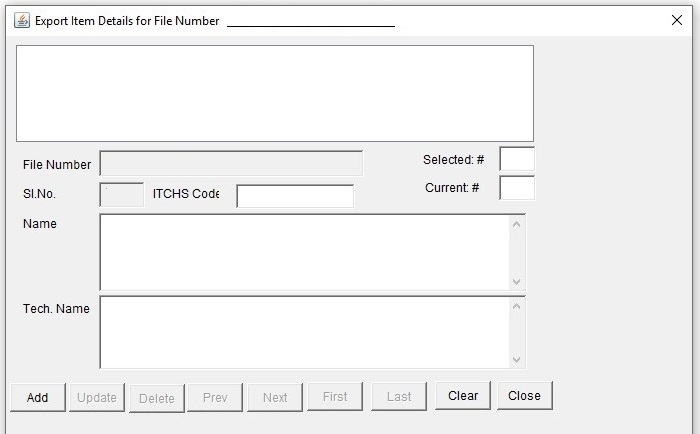

Step 8: Fill the Export Item Details

Enter the details of export items by selecting the “Export Product Details” tab. A dialogue box like below will appear on the desktop screen.

As you are aware that Specific export obligation under EPCG License is to be fulfilled by exporting the products made out of the machinery imported. Specific Export Obligation is equaled to 6 times the duty saved value in 6 Years.

In this section, you have to enter the details of all those export items which can be made using the imported Capital goods/machinery. One can add as many Export Items as necessary by selecting the Clear button. Export of only such added products would be counted for calculating the Specific Export Obligation.

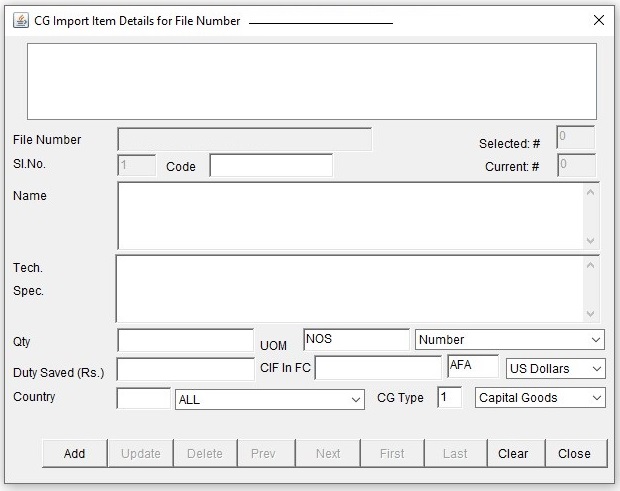

Step 9: Fill the details of “Capital Goods” to be imported

This is the main dialogue box in the entire EPCG Online Application procedure. Here you have to add the details of the capital goods/machinery that you are intending to import or procure indigenously under the EPCG scheme.

Enter the Item Name, Technical Specification and Quantity of Capital Goods to be imported. Select the UOM accurately. Enter the Duty saved value in Rs., CIF value in Foreign Currency & Country from which machine is imported. Also, select the CG type from the drop-down menu. Select the Add button for updating.

NOTE: All the details provided in this dialogue box should exactly match with the Purchase order. In case of mismatch, there will be a problem in clearing the machinery duty-free under the EPCG scheme.

The Duty Saved Value mentioned here will automatically be captured on the main dialogue box.

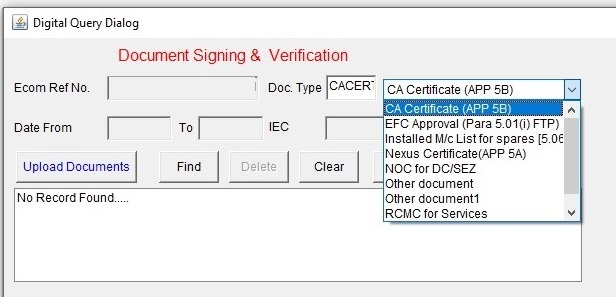

Step 10: Online Uploading of Documents

Select the “Upload Documents” tab on the main dialogue box. A screen will appear like the image below shown:

As per the Digital initiative of the Government of India, uploading documents is mandatory. Here you have to upload the signed copy of CA Certificate (Appendix 5B) & CE Certificate/Nexus Certificate (Appendix 5A)

You can find more details about the CA Certificate (Appendix 5B) & CE Certificate/Nexus Certificate (Appendix 5A) here.

At this step, we have filled all the details required & also uploaded all the necessary documents required for the EPCG License Application Online. The entire process will be completed in the next two steps and you can submit the EPCG license Online application form to DGFT.

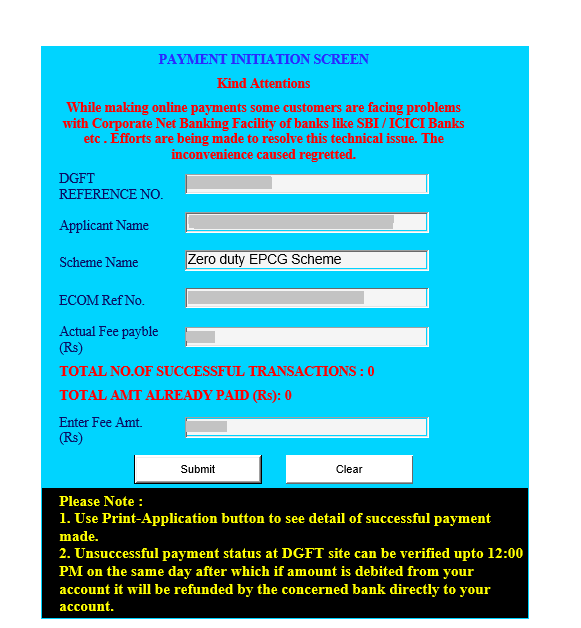

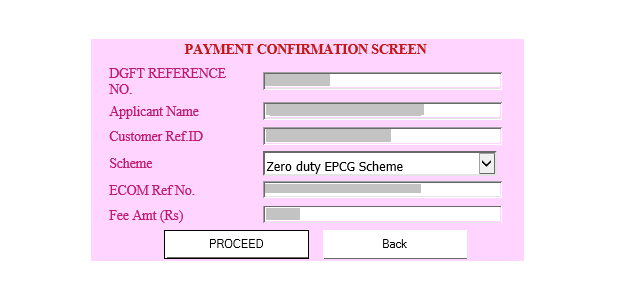

Step 11: Pay Online

Government Fees which are equal to 0.1% of the Duty saved value is to be paid using the preferable mode of payment. Please note that the application for the EPCG License will be rejected if the mandatory fees are not paid.

Once the details for the payment is filled, click the submit button, you will be redirected to the payment confirmation page. Here, you have to confirm the mention details and the amount of fees. Click the proceed button and you will be redirected to the payment gateway and make the payment.

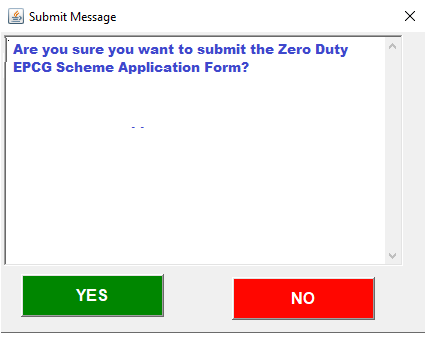

Step 12: Submit the Application

Submit the application to the relevant DGFT office.

The process for EPCG License online application completed here. After submission Please contact the DGFT office for the status of the File.

We hope that the procedure for how to apply for EPCG License Online is now clear.

Why us?

Afleo Consultants is a leading Import Export consulting firm (DGFT Consultants) that offers services related to EPCG License – Issuance and Redemption, Services Export from India Scheme (SEIS), Merchandise Export From India Scheme (MEIS), DFIA – Issuance and Transferability, Advance License Application & Redemptions, SION fixation/revision & obtaining a license from DGFT. We are a leading EPCG Consultant having a client base across India.

In case you have any doubts regarding the above Article, Please fill the below form to get in touch with us.

На нашем сайте вы можете купить товары от Gucci. На платформе представлены модели этого легендарного бренда, которые отличаются уникальным дизайном и качеством. Погрузитесь в широкий ассортимент Gucci с выгодными условиями.

Fendi: стильная одежда от Gucci

Excellent read, I just passed this onto a colleague who was doing some research on that. And he just bought me lunch as I found it for him smile So let me rephrase that: Thanks for lunch!

На этом ресурсе вы можете ознакомиться с полезной информацией о лечении депрессии у пожилых людей. Здесь собраны советы и обзоры методов борьбы с данным заболеванием.

http://klausreichmann.de/doku.php?id=%D0%94%D0%B5%D0%BF%D1%80%D0%B5%D1%81%D1%81%D0%B8%D1%8F%20%D1%83%20%D0%BF%D0%BE%D0%B6%D0%B8%D0%BB%D1%8B%D1%85

На данном сайте вы сможете узнать полезную информацию о витаминах для поддержания здоровья мозга. Также здесь представлены рекомендации специалистов по выбору эффективных добавок и способах улучшения когнитивных функций.

https://andy3qt0z.qowap.com/91477113/5-основных-элементов-для-витамины-для-мозга

Appreciating the time and energy you put into your website and detailed information you offer. It’s great to come across a blog every once in a while that isn’t the same old rehashed material. Wonderful read! I’ve bookmarked your site and I’m adding your RSS feeds to my Google account.

На данном сайте вы сможете найти подробную информацию о лекарственном средстве Ципралекс. Вы узнаете здесь сведения о показаниях, дозировке и вероятных побочных эффектах.

http://gosstractor.auio.xyz/category/website/wgI2vZFhZf5rbhFqBTP7G0CD1

На данном сайте можно найти информацией о телешоу “Однажды в сказке”, развитии событий и ключевых персонажах. однажды в сказке смотреть Здесь представлены подробные материалы о производстве шоу, актерах и фактах из-за кулис.

Центр “Эмпатия” оказывает комплексную поддержку в области ментального здоровья.

Здесь принимают квалифицированные психологи и психотерапевты, которые помогут с любыми трудностями.

В “Эмпатии” применяют современные методики терапии и индивидуальный подход.

Центр помогает при стрессах, панических атаках и других проблемах.

Если вы ищете комфортное место для решения психологических проблем, “Эмпатия” — отличный выбор.

weseoco.site