The change in GST registration details is required for numerous reasons such as no mention or wrong mention of trade name when original registration was done, subsequent change in the address of the business office, additional business place acquired, wrong mention of the constitution of business, subsequent change in registered email address or mobile number, etc. Such changes do not require the application for new GST number but a simple GST modification process in the original registration itself would suffice.

Types of Modifications

There are two types of amendments in GST registration available on the portal. They have been named as Amendment of Registration Core Fields and Amendment of Registration Non-Core Fields. Let us understand these amendments in detail.

[To all the newbies read our article on "GST Registration Step-by-Step Guide"]

The Core Field Amendments covers the following aspects:

- Any change in name of the business (if there is no change in PAN)

- Change in the place of business

- Addition/Change in Additional Place of Business (Other than a change in State)

- Addition or deletion of Partners or Karta or Managing Directors or Members of Managing Committee of Associations or Board of Trustees or Chief Executive officer or equivalent etc.

It is to be noted that in point (1) above if there is any change in the Permanent Account Number (PAN) then a new GST registration will be required. Hence, if there is a change in the structure of the business, i.e. if a proprietor business is converted into partnership firm or any partnership converted into a private limited company, this will result in the requirement of a new GST registration since there will be a change in the PAN of the business.

The Non-Core Field Amendments includes all fields other than the Core fields. The few examples of non-core fields are details of the authorized signatory, change in the details of promoter or partner or karta, etc. The change in the registered email and registered mobile number are also covered under the non-core field amendments.

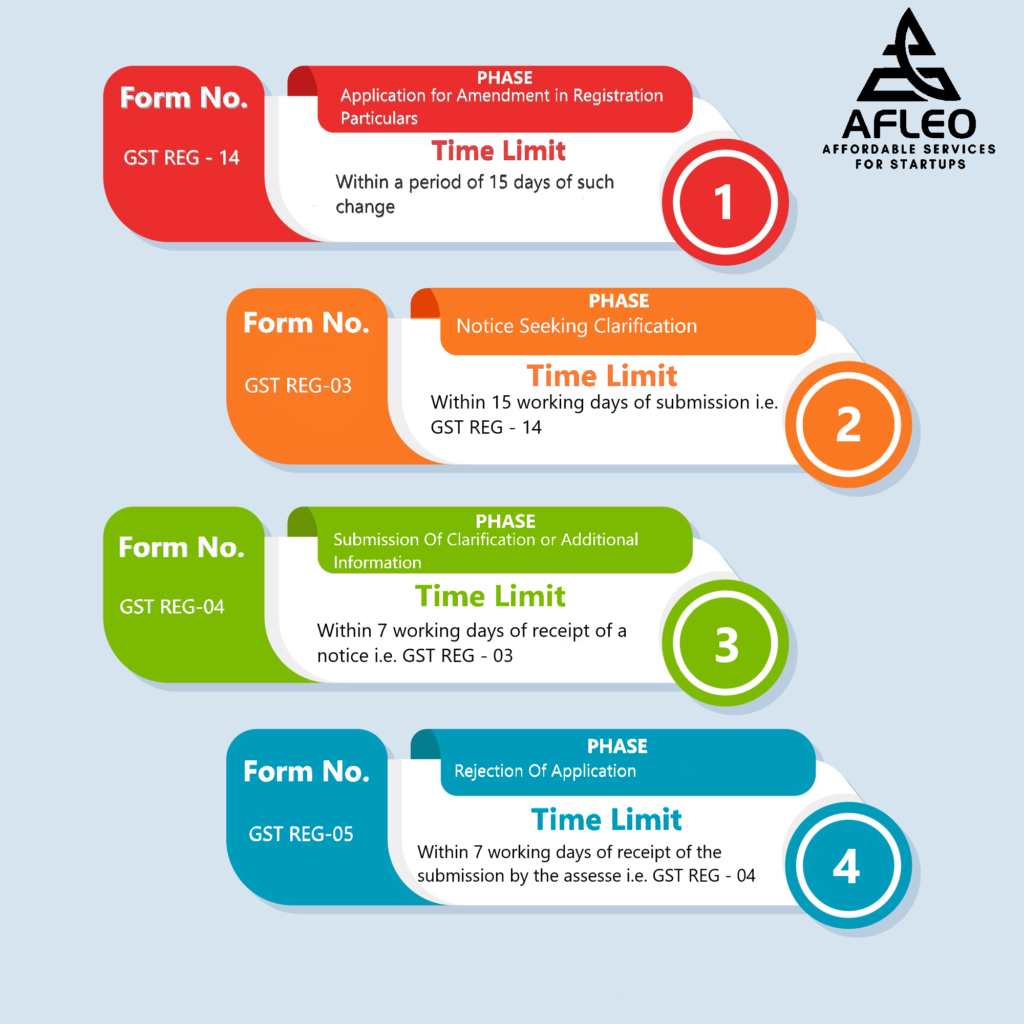

Amendment Procedure

There are different processes for amendment of core fields and non-core fields.

The core field amendments will require the approval of the tax authority. It is necessary to note here, that if a taxpayer has already made an application for amendment of core field and the application is under process, then the taxpayer cannot apply again for any core field amendment until the previous application is disposed of by the relevant jurisdictional authority.

In the case of non-core field amendments, the registration particulars are automatically updated after the submission of the amended information by the registered taxpayer on the portal. It does not require any tax authority approval.

How Afleo Helps?

We, at Afleo, make your GST modification an easy process. Afleo follows the 3 step simple process to modify your GST registration details, which are as follows:

[Before you proceed you need to read our article on "GST Portal Login: 3 Simple Steps"]

Step 1: Obtaining Information and Relevant Documents

In this phase, we collect the details required for making amendment application. These details primarily include ‘reasons’ for amendment and ‘date’ of amendment along with the documentary proof to support the amended details.

Step 2: Making Application

After collecting the requisite information, we will file the application for amendment in form GST REG–14. If any notice is issued asking for additional information or requiring submitting any clarifications then we will notify you the same and submit the clarifications as relevant

Step 3: Amendment Order

Once the amendment order is passed by the tax authority, we will send you the copy of the same.

I hope this article clears all your doubts like: How to change mobile number? How to change authorized signatory in GST? How to change contact details in GST? The biggest question of all how to modify gst registration?

For any more enquires please fill up the below-given form.

You made some decent points there. I seemed on the web for the issue and located most individuals will go together with together with your website.

I am typically to running a blog and i really admire your content. The article has really peaks my interest. I am going to bookmark your site and keep checking for new information.