The very first step in the GST compliance is to register for GST. All the provisions of the GST Act apply to a person only after he gets himself registered on the GST Common Portal. The purpose of this article is to provide you with the step by step guide for GST Registration Procedure. For New GST Registration, it is to be noted that the GST Registration Form, GST REG – 01 is divided into two parts, i.e. Part A and Part B. The steps for registration will thus be divided accordingly.

[If you want to learn about GST, before applying, we recommend you to go through this Article What is CGST, SGST & IGST?]

PART A of the Registration Application Form

Step 1: Log on to the GST Portal

Log on to the GST Portal (www.gst.gov.in). Click on Services>Registration>New Registration option

An alternative way to apply for new registration is to click on Register Now as highlighted in the below picture.

Step 2: Click On New Registration and fill details

Part A of the registration form is displayed. Click on the New Registration. Here the applicant has to select the Type of Taxpayer, select the State and the District for which the registration is to be taken and enter the Legal Name of the Business and the Permanent Account Number (PAN). Fill up the Email Address and Mobile Number of the Authorized Signatory. Enter the captcha code and click on the Proceed button.

Step 3: Verify OTP

The Verify OTP page is displayed as below. Enter the OTPs received on the email address and mobile number field respectively (both the OTPs would be different). Click the Proceed button.

Step 4: Generate Temporary Reference Number

The system will generate Temporary Reference Number (TRN). The TRN will be received on the registered email address and phone number too. Click the Proceed button.

Step 5: Select The TRN Number

The page will be displayed as below. Alternatively, click on Services>Registration>New Registration option and select the TRN button to get the same page as below.

Enter the TRN generated in the previous step. Enter the captcha code and click on the Proceed button.

Step 6: Verify OTP

The Verify OTP page will be displayed. Enter the mobile/email OTP received and click on Proceed.

PART B of the Registration Application Form

Step 7: Check My Saved Application

The page will be displayed as below. Under the Action column, click on the edit icon as highlighted in the below picture

Step 8: Fill Application Form

The application form will be displayed wherein the different tabs are to be filled up with relevant information. The details are required relating to business, promoter or partners, authorized signatory, and representative, principal and additional places of business, goods, and services to be provided, bank accounts, state-specific information and at the last verification page is to be filled up. Click each tab to fill in the details and attach the relevant documents as required.

Step 9: Submitting The Application

After filling all the details in the relevant tabs, go to verification tab. Select the verification checkbox and enter details in authorized signatory and place field. Submit the application using Digital Signature Certificate (DSC) or E-Signature or EVC.

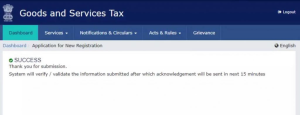

Step 10: Success and Application Reference Number (ARN Number)

After submitting the application, a SUCCESS message will be displayed and the Application Reference Number (ARN) will be received on the registered email address and mobile number.

Once the application is submitted, the jurisdictional officer will verify the information and give approval for the registration or ask for further details as required. On approval by the officer, intimation will be sent to the applicant on the registered email address and the mobile number specifying the login credentials. This is how to get GST number online.

[Also Learn How to generate E-way Bills under GST]

So if you are busy and want to save time, Afleo will help you to apply GST Online at an affordable price of Rs. 1499/- only and will also give you Free guidance about various provisions of this complex GST system.

So get started, fill-up this form and we will get back to you super fast.