‘Mumbai: The city of dreams’ is the financial capital of India and is amongst the top 15 wealthiest cities globally. Many people from different parts of India come to Mumbai to fulfill their dreams and achieve new heights because of the opportunities here. Large numbers of new businesses are registered daily in Mumbai because it is witnessing the increasing emerging start-up market and is considered to be one of the major Startup Hubs for the country. Some of the reasons to choose Mumbai for your business are:

- It is the entertainment, commercial and financial capital of the country

- It has talent in abundance

- It is safe for the female to work even in late night shifts

- It has many migrants from all over the country making its culture diverse

- It is home to many big companies, thus giving you an opportunity to meet new people

If you are planning to set up a business in Mumbai, then GST Registration in Mumbai is compulsory by law. GST was adopted to improve the collection of taxes and bind the whole country with a uniform GST tax rate. It follows a 4-tier tax slab rate to levy different tax rate on both necessities and luxury. The said tax slabs are 5%, 12%, 18% and 28%. Before registering for GST, you must know why it is important for you to register under GST and what benefits you can enjoy. The essential benefits of GST are:

- It consolidates all the indirect taxes like excise, VAT, service, sales, and others

- It eliminates the cascading effect

- It is a simple and easy procedure

- It makes Indian goods and services more competitive in the local and international markets

It simplifies the taxation system by applying only three GST components:

- CGST: It is levied by the Central Government on Intrastate supplies of goods and services

- SGST: It is levied by the State Government on Intrastate supplies of goods and services

- IGST: It is levied by both Central and State Government on Inter-state supplies of goods and services

[ For in depth knowledge about GST Components, check out our article on What is IGST, CGST AND SGST? ]

Procedure for GST Registration in Mumbai

Now, here is how online GST registration in Mumbai takes place and avail the benefits.

- Access the GST portal (https://www.gst.gov.in/).

- You can click on ‘Registration’ under Services tab and then go on ‘New Registration.’

- PART A

- Select the ‘taxpayer’ from the drop-down list of ‘I am a.’

- Now fill the form GST REG-01 for new registration by filling details such as a legal name of the business, state, email address, mobile number, and PAN card details.

- For verification of your information, enter the one-time password and click on ‘Proceed’ button.

- To complete the process and move to Part B of the process, you will receive a Temporary Reference Number (TRN) after verification at the last step.

- PART B

- To start with part B, log in with TRN and enter the CAPTCHA code. Complete the OTP verification on email and registered mobile number. You will be redirected to the GST registration page.

- Now submit Business information such as the name of your business, PAN details, a name of the state will be Mumbai as you are registering your business here, date of commencement of business and mention if you have any existing registrations.

- Next, you will have to submit details of up to 10 promoters or partners of the business. In case of proprietorship firm, you will have to submit the details of the proprietor. Following details are required of the promoter: personal details, designation, DIN, PAN card, Aadhar card, and others.

- Now you will have to submit the details of the person whom you have authorized to file GST returns.

- Add the principal place of business, in your case add Mumbai as the principal place. Enter the address details, official contact details, and nature of possession of premises of your principal business.

- Add a place of business, in case you have any, details of goods and services to be supplied and bank account details of the company.

- Upload the required documents based on the type of business you are registering.

- Now click on ‘Save and Continue’ button. Once the application is submitted, you will need to sign it digitally through the digital signature certificate.

- Now click on ‘Submit’ to save your details.

- After submission, you will receive an Application Reference Number (ARN) via email or SMS to confirm your GST registration process in Mumbai.

[Also, read our Article on How to register for GST ? for a complete guide on GST Registration process]

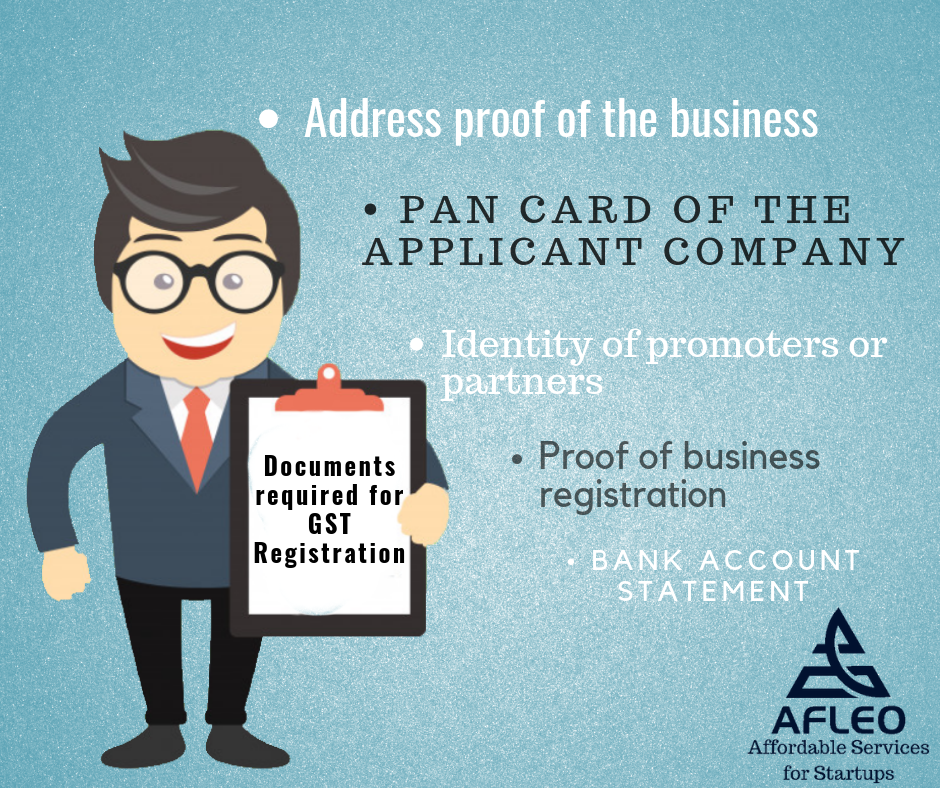

Documents required for GST Registration in Mumbai

Take a look at the documents you will require to upload while registering under GST.

- PAN card of the applicant company

- Partnership deed or incorporation certificate as a proof of business registration.

- To verify the identity of promoters or partners, they need to submit PAN cards, Aadhar cards, Voter Id, etc.

- To verify the address of the business, you can submit any of the following:

- Electricity bill

- Rent or lease agreement

- For SEZ, documents issued by the government

- Bank account statement of the applicant company, firm or individual

Documents required for GST Registration in Mumbai

Details about GST Registration office in Mumbai

Mumbai has 2 GST offices to solve your queries and help you to complete the process quickly. The two offices are located in Mazgaon and Bandra. The dedicated numbers for GST help desk are 022-23760646/158 and 022-26591747/57 for Mazagaon and Bandra respectively. Apart from these offices, based on range and division, there are 270 GST Seva Kendra Centers in Mumbai.

For registering your company under GST, you can choose Afleo.com as we are one of India’s best legal solution providers. If you are planning to register, you have to submit your documents to us, and we will register your business hassle-free. We have a team of professionals which register you in time and guarantees privacy about all your personal and professional details. We have a transparent pricing policy, and thus, we can give you an exact breakdown of your prices and know that we don’t have any hidden fees charges. So, now step forward, focus on your business and leave everything else on us!

If you require more information or have any queries, Please fill below form to get in touch and get your queries solved.