GST.gov.in is the web portal of the Government of India known as GST Common Portal. GST Common Portal is the implementation of Modi’s vision of One Nation, One tax; where common portal can be considered as a single point of access to all GST related facilities such as GST Registration, filing returns, generating challan, payment of taxes and many other user services. The GST portal is a common and shared IT Infrastructure for Taxpayers.

Similarly, GST portal is supposed to provide all statutory provisions required by the Tax Authority. This includes approval of registration, assessment, refunds, etc. Thus, GST common portal is a system which is accessed by both, the taxable person as well as the tax authorities to comply with their respective liabilities by login with their respective credentials. Finally, GST registration portal is a system which links both, the taxable person and the tax authorities to a common interface.

Login to GST Common Portal

For a taxpayer, GST registration is a prerequisite for log in to the GST common portal. First, a person needs to make an application on GST login page for its registration, once the registration is complete and the person receives its GST number, only then he can log in to the portal.

There are 2 types of GST login available on portal. One, where you login with your username and password i.e GST existing user login and the second where you are logging in to the Portal for the first time i.e GST new user login here, the login credentials are provided by the tax authority through an email.

Let us learn these login processes one by one.

Login to GST Portal (Existing User)

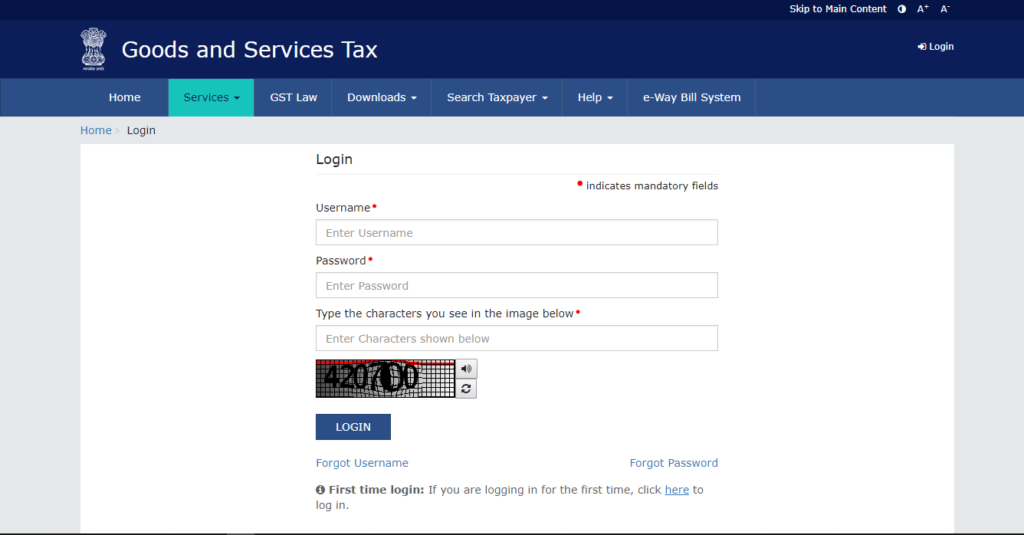

Step 1: For GST portal login, visit www.gst.gov.in login website. Click on the login tab appearing on the GST homepage as highlighted below.

Step 2: After clicking on login tab, the GSTN login page would appear as shown in the screenshot. Fill in the Username, Password and the CAPTCHA code and click on the LOGIN button.

Step 3: The dashboard will be displayed as below.

Login to GST Portal (New User)

Step 1: For Goods and Services tax login, visit gst.gov.in login website. Click on the login tab appearing on the GST homepage as highlighted below.

Step 2: After clicking on the login tab, the GST login page will appear. Click on the link available at the bottom ‘click here’ as highlighted below.

Step 3: The GST New User login page will be displayed. Fill up the GSTIN and Password as received on your registered email address and fill the CAPTCHA code and click on the LOGIN button.

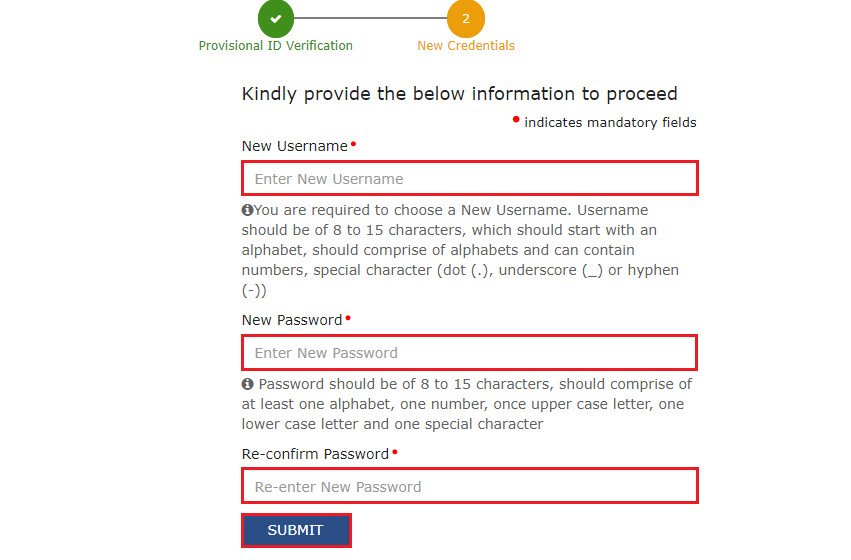

Step 4: The New Credentials page will be displayed. Create the New Username and Password and this username and password will be used for subsequent logins to the GST Portal in the future. At last, click SUBMIT button.

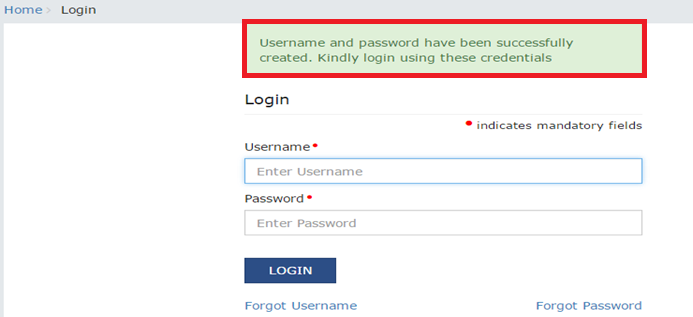

Step 5: A message will be displayed that the username and password have been successfully created. Now, you can login to the GST Portal.

Services accessible from GST Portal

The GST Common Portal login offers a variety of services to the taxpayers such as registration, return filing, refunds, advance ruling and many other user services. Here, we will discuss some of the important services available on GST Portal.

GST Registration

Registering on GST Portal is a simple online process where one needs to make registration application and submit the required documents. Once the application is approved by the department, GST Number is issued to the applicant within 3 working days.

Amendment in GST Registration

The amendment in the GST registration may be required due to various factors arising in the normal course of business. The registered taxpayer shall file an application in Form GST REG-14 along with the documents relating to such change on the GST Portal.

Cancellation of GST Registration

The cancellation of GST Registration simply means surrendering your GST number. Now, the taxpayer will not require to comply with the GST provisions. The application for cancellation is made in form GST REG-16.

Opt for Composition Scheme/Levy

The registered person can opt for Composition Scheme under GST by filing the form GST CMP-01 (for users who migrate to GST) or form GST CMP-02 (new registered person).

Opt out of Composition Scheme/Levy

The person registered as Composition Dealer under GST can opt out of the composition scheme by filing the form GST CMP-04.

Letter of Undertaking (LUT)

LUT is to be furnished on the GST Portal for the export of goods or services, if such export is to be made without payment of IGST. LUT is submitted in form GST RFD-11.

Application for Refund of excess tax paid

The refund process under GST is completely online and it involves minimal documentation. The excess GST paid can be claimed by making an application in form GST RFD-01

E-way Bill

The E-way Bill, short form for electronic waybill, is a document to be generated online for transportation of goods under GST, whether intra-state or interstate, if the value of the goods to be transported exceeds Rs.50000. A link is available on the GST Common Portal which directs to e-way bill portal.

Search Taxpayer

This service is available on the GST portal whereby one can identify the taxpayer by its GST Number.

Grievance/Complaints

This service is available on GST portal which can be used by both, the registered person as well as an unregistered person to file a complaint. One can even track the status of complaint filed.

New Services added to the GST Portal

Contact Details of Tax Authorities

This service is available to taxpayers on GST Portal under the User Services tab. The taxpayers can click on the link which will direct them to a page where the contact details of the tax officials are available

Advance Ruling

It is a concept where a person can make an application to the Advance Ruling Authority to seek clarification on matters relating to GST Law. The application is to be submitted in form GST ARA-01 along with the prescribed fees.

Common issues faced when logging to GST Portal and Solutions

Forgot Username

The option is available on the GST portal from where you can retrieve your username. You need to click on the Login Tab>Forgot Username>Provide your GST Number>Generate OTP (OTP will be received at your registered email address and registered mobile number)>Enter OTP>Submit. The Username will be received at your registered email address.

Forgot Password/Change Password

There is an option available on the GST portal, where you can reset your password. You need to click on Login Tab>Forgot Password>Provide your Username>Generate OTP (OTP will be received at your registered email address and registered mobile number)>Enter OTP>Continue>Provide new password>Submit. Now you can use the newly generated password to log into the GST Portal.

Access Denied Error

There are times when ‘Access Denied’ error shows up after logging to GST Portal. The solution for this error could be the use of Internet Explorer to login instead of other browsers, since GST Portal has compatibility issues with Google Chrome and Mozilla Firefox. Other solution is to change the password by using ‘forgot password’ link. After resetting the password, re-login to GST portal, the problem will be solved.

We at Afleo would love to help you. For any queries related to GST Return filing or GST Registration, Please fill below form to get in touch.