Import and export have been a part of our world since time unknown. Even today if we talk about import and export we can think of many things. Any industrial person will first think about the trade. The second thing that will come to his mind will be the foreign currency. The third thing that should come into your mind should be SEIS.

What is SEIS Scheme?

The SEIS is an abbreviation for Service Exports from India Scheme. Its main aim is to promote services that are exported from India to the rest of the world. So how the government does that? The service exporter receives incentives in the form of Duty Credit Scrips. Duty Credit Scrips can be used to pay customs duties and other duties which are applicable to the central government.

Are you a service exporter from India? Do you want to avail these benefits? Worried about the documentation required? Relax. In this Article, we are going to cover the entire list of documents required to submit your claim under the Services Export from India Scheme (SEIS).

[If you want an in-depth knowledge of SEIS Scheme read our article on “All about Service Exports From India Scheme – SEIS“]

List of documents for SEIS Scheme

- Importer Exporter Code (IEC Code)

- Application form ANF-3B (Aayat Niryat Form)

- CA Certificate

- Statement showing the nexus between Invoices and FIRC’s (Table No 4)

- Write up of Services

- Self – Certified copy of invoice and FIRC’s

- DGFT Digital Signature Certificate (DSC)

- RCMC Copy

- Necessary Declarations.

Importer Exporter Code (IEC Code)

An Import Export Code is an important and necessary SEIS Scheme document for claiming benefits under SEIS. This document is proof that you are an exporter. Without an active IEC, you won’t be able to claim SEIS benefits.

Example: Company XYZ has taken its Importer Exporter Code (IEC Code) on 01.04.2016, then all the Remittances received by the Company after 01.04.2016 will be eligible for claiming rewards under SEIS.

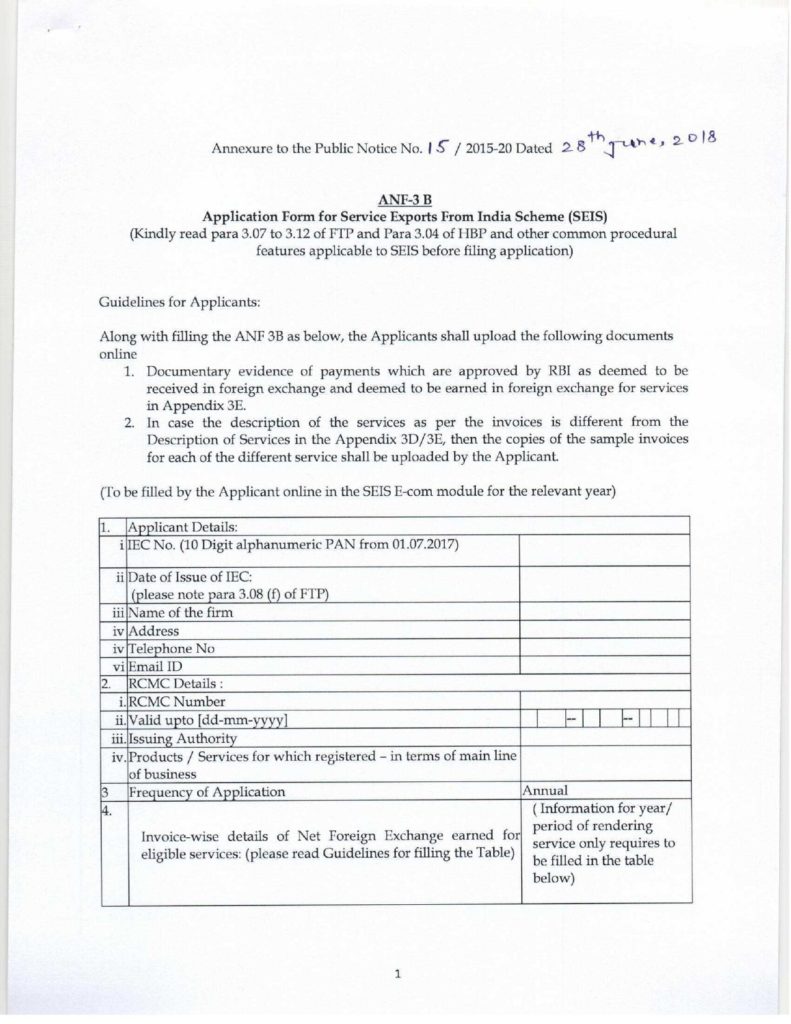

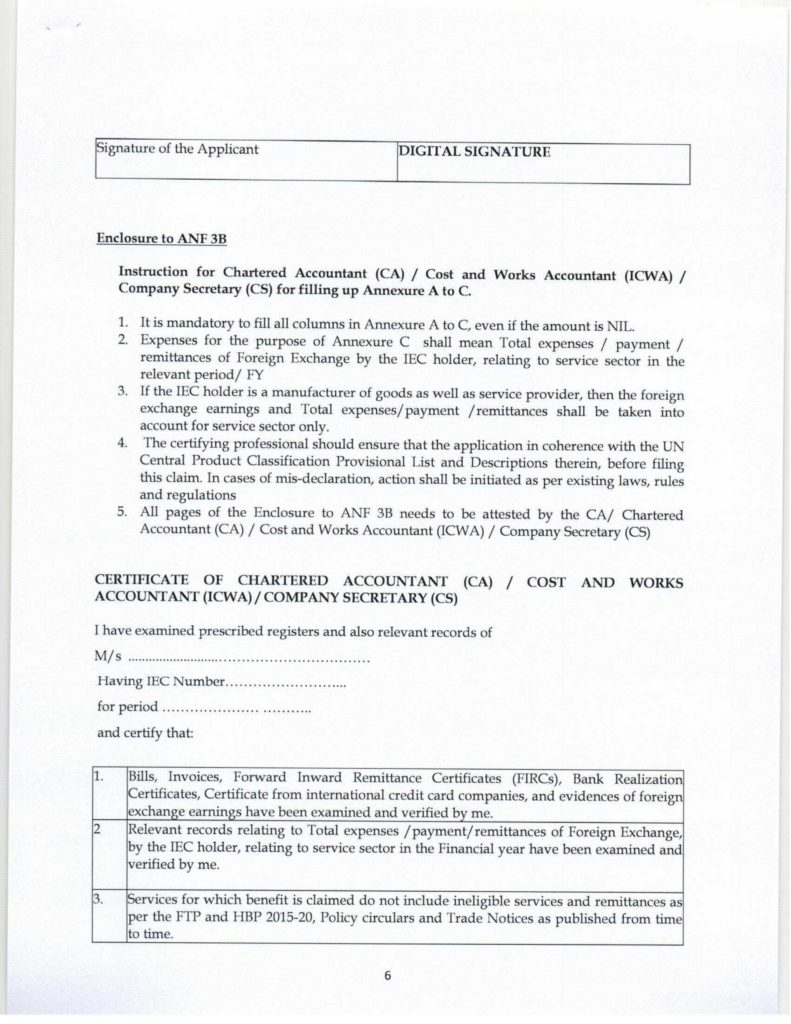

Application form ANF-3B

The above-given image is the 1st page of the ANF 3B form which mandatory while applying under SEIS Scheme. Let us see what the first page of the form holds.

The first page gives an overview of the applicants as to what documents will be required. Any reader going through the form will get to know all the guidelines stated in the form.

There are two main documents required here:

- Documentary evidence of Foreign exchange earnings.

- Invoices raised for services given.

Apart from that 1st page asks for other basic information of the applicant like name of the firm, address, telephone number, email id, RCMC details etc.

Note: Frequency of Application is by default “Annual”.

2nd Page:

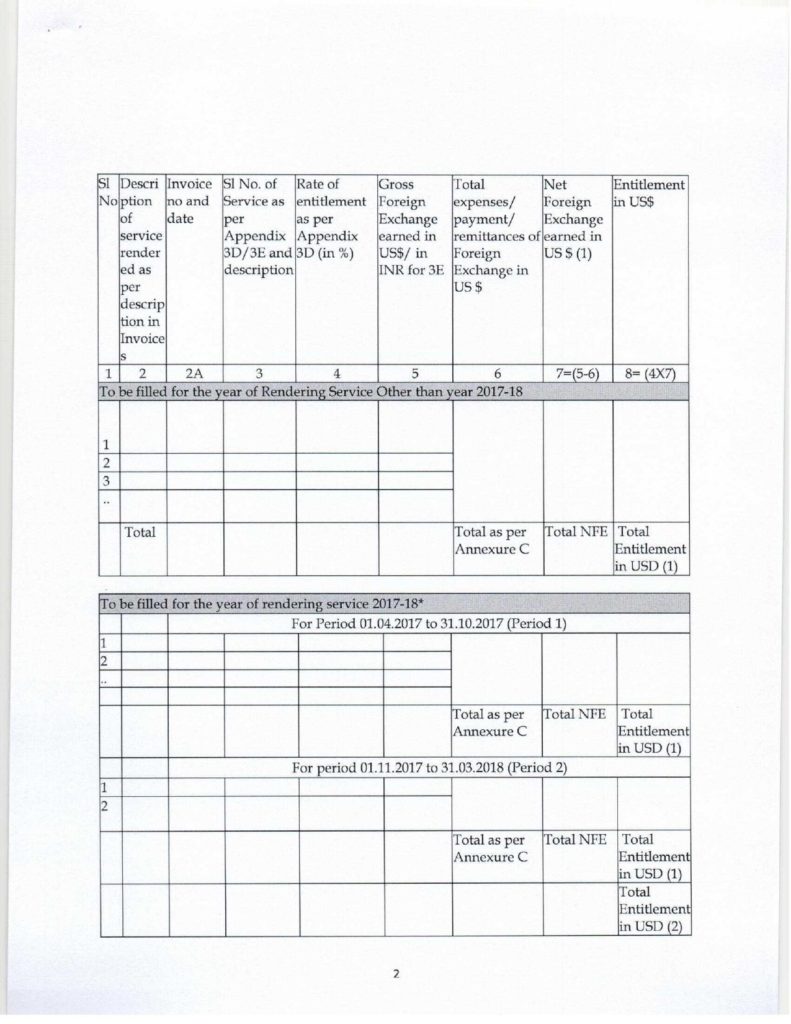

The 2nd page is very important as this page will provide a few important things. This page basically contains a table. In this table, you have to fill out ‘Invoice wise details of the Net foreign exchange earned for eligible services.’

3rd Page:

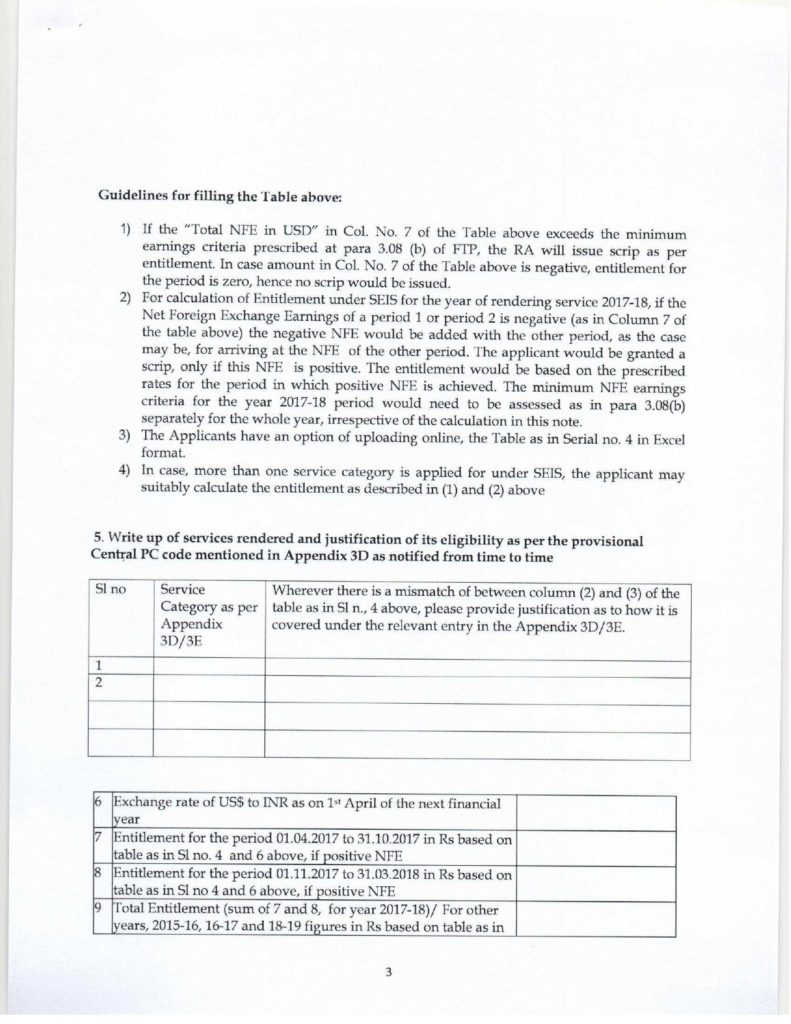

This page describes the guidelines for filling the table given on page number 2 and the write up of services rendered as according to appendix 3D. After filing the table at Sr No. 4 you will arrive at ‘Total Entitlement in USD’. End of the form will show ‘Final Entitlement in Rs’. This will be your claim value. Last Page of form is shown below:

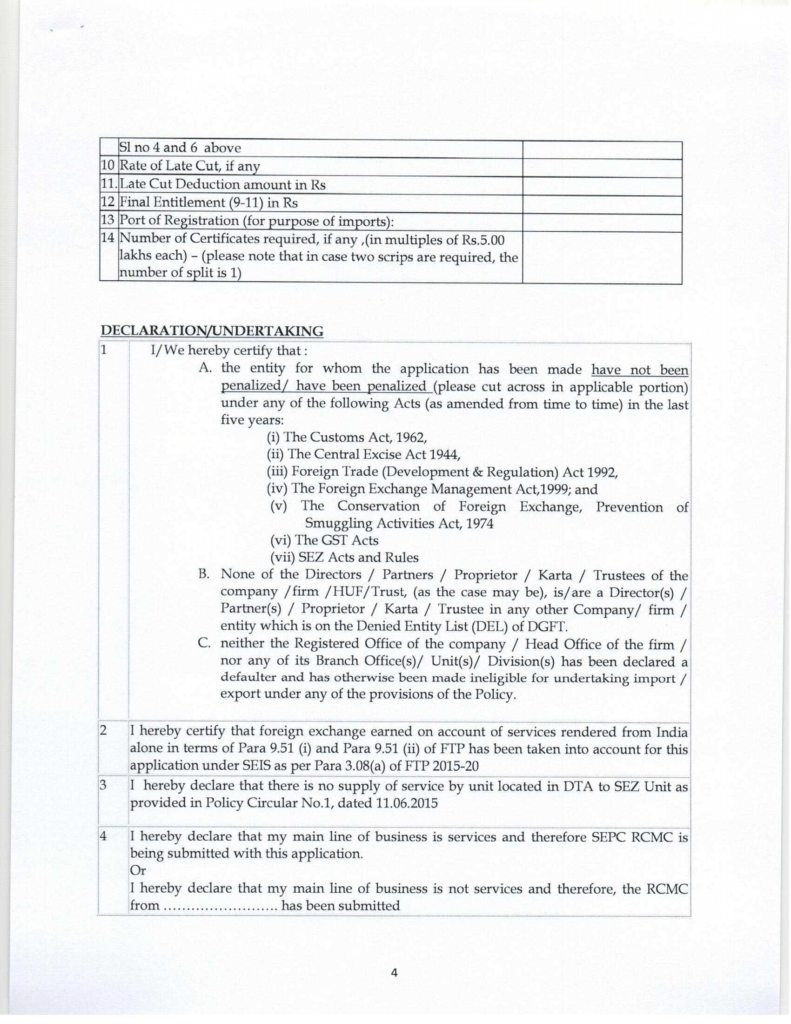

4th Page:

Enclosure to ANF 3B (CA Certificate)

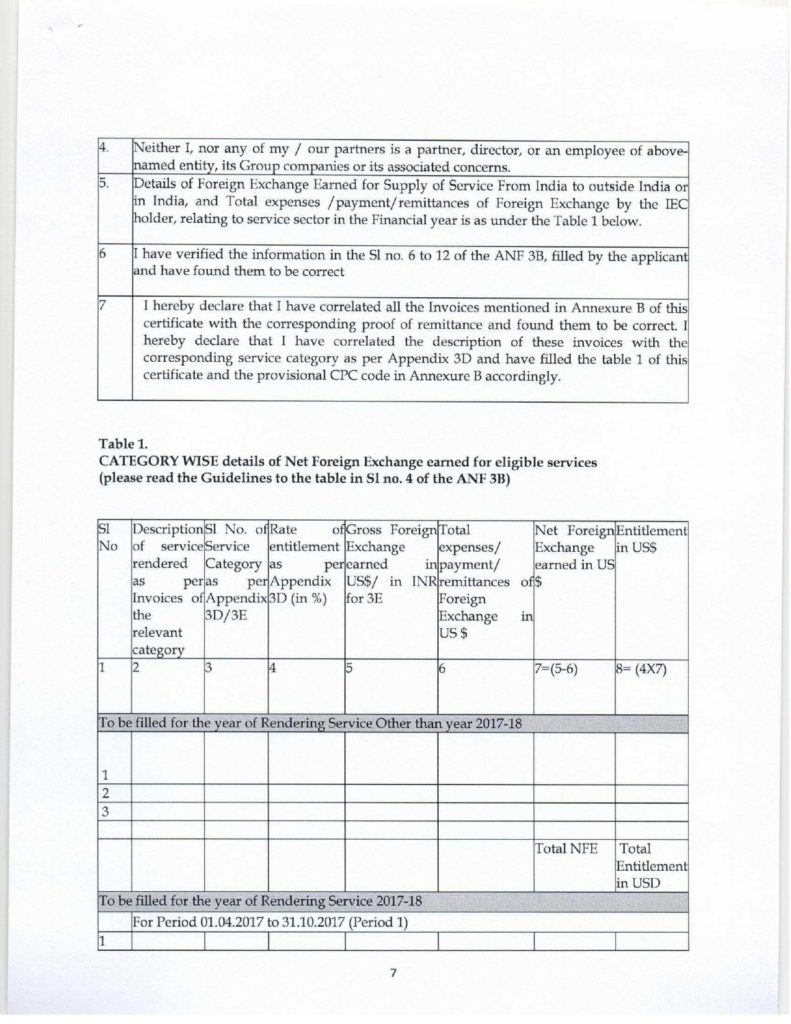

Enclosure to ANF-3B means CA Certificate. This SEIS Document has to be CA certified and to be submitted to the DGFT. It is mainly divided into:

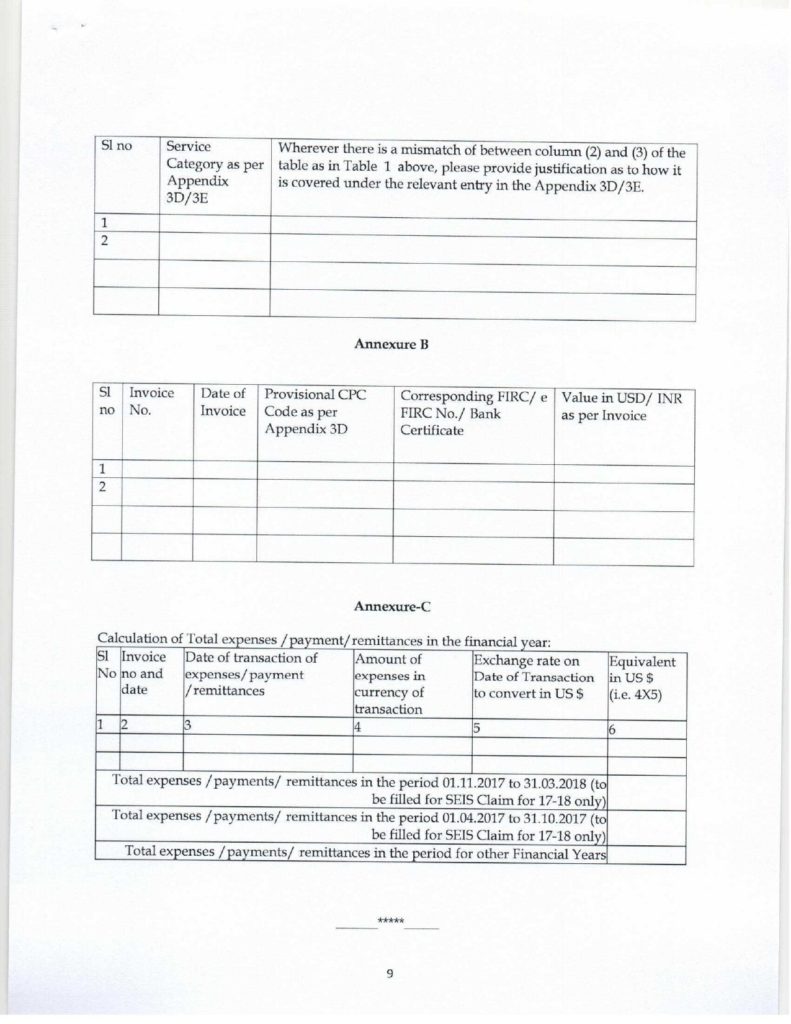

Table 1: Category wise details of the net foreign exchange earned for eligible services.

Annexure A: A write-up of services rendered and justification of its eligibility as per the provisional CPC code as mentioned in Appendix 3D

Annexure B: A mapping of Invoices with corresponding FIRC’s/e-FIRC’s/Bank Certificate.

Annexure C: Calculations of Total Expenses/ payment/remittances in the financial year.

Statement showing the Nexus between the FIRC’s and Invoices (Table No. 4)

FIRC stands for Foreign Inward Remittance Certificate. Let’s say you have provided service for which you have earned some foreign currency. An invoice is raised against the foreign currency earned. So while claiming the benefits under the SEIS scheme you will also require a FIRC. This FIRC contains the following details:

- The invoice number

- The applicable tax details

- Other charges that are applied.

All the above-provided things prove that there is a nexus between the invoices raised and the FIRC’s. After which a statement is prepared which clearly displays the nexus between invoices and FIRC’s

Write Up of Services Rendered

All the services that you are exporting should be informed to the DGFT. This document does that work. In this document, a brief write up describing the services that you are providing is furnished to the DGFT. It is paramount to include the CPC while providing the write-up

Self – Certified copy of Invoices and FIRC’s

A statement showing the nexus between the invoice and FIRC’s is to be submitted. Therefore you need to submit the physical copies of invoice and FIRC’s to support your statement.

DGFT Digital Signature Certificate (DSC)

A Digital Signature Certificate (DSC) for foreign trade is mandatory for filing of online application under SEIS.

Note: DGFT DSC is different from Class 2 and Class 3 types of Digital Signatures.

RCMC

RCMC stands for Registration Cum Membership Certificate which is an important SEIS Document. It is something to be obtained from the Export Promotion Councils.

Now let us see a condition in which the applicant is only into exports of services and not of goods, in this he needs to obtain an RCMC from Service Export Promotional Council (SEPC)

If the applicant is into export of services as well as exports of goods, then RCMC from the relevant council can be considered. In this case, the SEPC Membership is not compulsory.

Relevant Declarations

Relevant Declaration on applicant’s letterhead needs to be submitted stating that “party doesn’t fall under any ineligible category, etc.

[The next step after preparing the documents is going towards the process of applying for the scheme. To know the in detail process check-out our article on “SEIS Scheme Application Process – Complete Guide (2019)“]

Why us?

Afleo.com is a leading Import Export consulting firm in India. We offer services like Merchandise Export From India scheme (MEIS), Services Export from India Scheme (SEIS), EPCG License – Issuance and Redemption, DFIA – Issuance and Transferability, Advance License – Issuance and Redemptions, SION fixation/revision & obtaining a license from DGFT.

In case you have any doubt regarding the above Article, Please fill the below form to get in touch with us.