For Service exporters who trade services from India to any other nation, the benefits come in the form of the Scheme known as Service Exports from India Scheme (SEIS Scheme). Here we will answer all the queries regarding the SEIS Scheme with practical steps and examples for better understanding.

SEIS SCHEME FAQs LIST

What are service exports?

Understanding Goods exports is simple, i.e. physical supply of goods from India to any other country. But what is export of services? How does it take place? Let us understand that.

In simple words, service exports mean providing services to Foreign Clients and receiving remuneration in freely convertible Foreign Currency. Now providing services to foreign clients can be undertaken in four modes.

Mode 1 – Cross Border Trade – Supply of Service from India to any other Country.

For Example – An Indian Audit firm sending audited accounts to a Foreign Company operating in the UK. [This may be categorised as Export of “Accounting & Auditing services”]

Mode 2 – Consumption Abroad – Supply of a Service from India to the service consumer of any other country (currently) in India.

For example – A Foreign Tourist from USA living in a 5-star hotel in India and paying for accommodation & food in Foreign Currency through International Credit Cards. [This may be categorised as Export of “Hotel Services”]

Mode 3 – Commercial presence – Supply of a Service from India through Commercial presence in any other Country.

For Example – An Indian Company setting up an Office in Dubai and providing Engineering Services to clients based in Dubai. It means the physical presence of an Indian company in Foreign countries.

Mode 4 – Presence of natural persons – Supply of a Service from India through the presence of natural persons in any other Country.

For example – An Indian Doctor performs surgery by visiting the patient based in USA. / An Indian Consultant provides services by visiting his Client in Europe.

Services provided in all the above manners are considered as service exports.

Note: Only Mode 1 & Mode 2 services are eligible for SEIS Benefits.

What is SEIS Scheme?

Service Exports from India Scheme (SEIS Scheme) is a subsidy scheme introduced by the Government of India to incentivize Service Exporters located in India. Its main purpose is to encourage and maximize the export of notified/selected services from India.

Under SEIS Scheme, exporters of selected services are entitled to 5-7% Incentive of the Net Foreign exchange earned in the form of Duty Credit Scrips. These Scrips can be used against Import duty or can be encashed by selling it to any Importer. Therefore it is as good as a cash Incentive scheme.

SEIS Scheme was introduced on 1st April 2015 and is valid for a period of 5 Years till 2020.

[If you want an in-depth knowledge of SEIS Scheme read our article on “All about Service Exports From India Scheme – SEIS“]

Who is eligible for SEIS Scheme?

a. Services rendered in the manner of Mode 1(Cross Border Trade) & Mode 2(Consumption abroad) above are only eligible for the SEIS scheme. Mode 3 and Mode 4 are NOT eligible to claim SEIS Incentive.

b. Service providers of notified services are only eligible for SEIS Scheme. For Example – Software Services exporters are not eligible for SEIS.

c. Service Providers should have an active Import Export Code (IEC Code) at the time of rendering services.

d. A Company, LLP or Partnership should have a minimum of 15,000 USD net free foreign exchange earnings in the year of rendering services to be eligible to apply for SEIS Scheme.

e. Similarly a minimum net free foreign exchange earnings of 10,000 USD for Individuals and sole proprietors.

f. SEZ Units are also eligible for SEIS Scheme. However, EOU, STP, BHTP, EHTP Units are not eligible to claim SEIS benefits.

g. Some eligible services are allowed to accept Indian rupees towards their service charges which shall be deemed to be foreign exchange. A list of such services is given in Appendix 3E.

Do I qualify for SEIS?

If you meet all the above eligibility conditions, then your organization will qualify for SEIS Scheme.

What is ANF 3b?

ANF 3B (Aayat Niryat form) is the Application form for applying under Services Exports from India Scheme (SEIS Scheme). An application in the form of ANF 3B with all necessary documents should be submitted to the jurisdictional DGFT Office for Claiming SEIS benefits. DGFT had issued a revised ANF 3B form on 28th June 2018.

Please find the Latest Application form ANF 3B here – “Application Form ANF 3B“

What is SEIS benefit?

SEIS Benefit is in the range of 3,5 or 7% Incentive of the Net Foreign exchange earned in the form of Duty Credit Scrips.

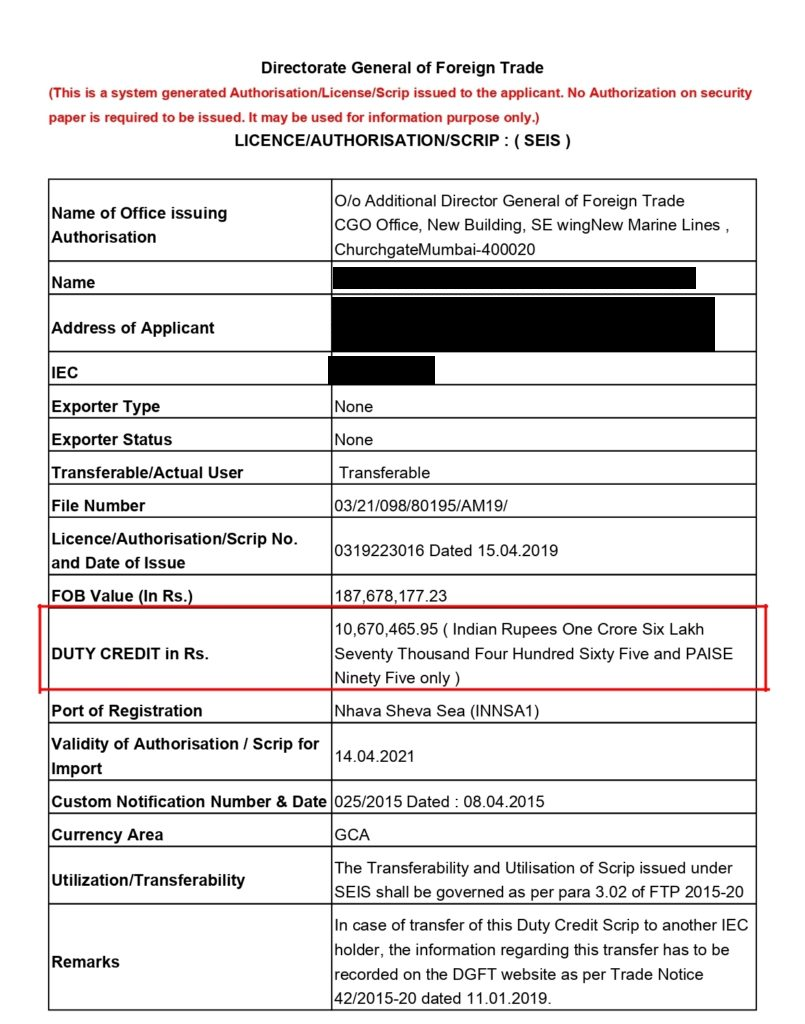

Now a question might arise as to what are Duty Credit Scrips?

Duty Credit Scrip is a document that allows the entitled holder to pay import custom duties levied on the Import of various services and goods. These scrips are government-issued and the issuing department is DGFT. They are issued to exporters of both goods and services.

[To know in detail the benefits and nature of rewards under SEIS Scheme read our article on “SEIS Scheme Benefits in India – All You need to know“]

Please find below a Draft/Sample Image of a Duty Credit Scrip issued under SEIS Scheme.

If you look into the above image you will find the value highlighted (DUTY CREDIT in Rs.). This is the actual value of Benefit that You have received from the Government.

The main point here is to give basic knowledge about the Duty Credit Scrips so that you can have a better understanding of its “Freely Transferable Nature”.

Is RCMC mandatory for SEIS?

Yes, the Registration cum Membership Certificate (RCMC) is mandatory for SEIS scheme.

Another question might arise as to “Is Service Export Promotion Council (SEPC) membership mandatory for SEIS?”

The answer to this is NO. If an IEC Holder is both Service Exporter and Goods Exporter and if it’s main line of business is manufacturing/trading and export of goods, then RCMC from any relevant Export Promotion Council can be submitted. SEPC membership is not compulsory in this case.

However, if an IEC Holder is purely into Service Export Business then SEPC Membership is compulsory.

How SEIS works / How to claim rewards under SEIS Scheme?

Let us understand this by way of an example.

M/S ABC is into Export of Engineering Services from India through Mode 1 for clients across the globe. In FY 2018-19, ABC has generated Invoices worth $50,000 and also received payment against the same.

Since Engineering Services is included in the list of notified services and has a reward of 5%, M/S ABC is eligible to apply for SEIS. Now ABC has to collect all the documents, fill the application form ANF 3B and submit the application to the jurisdictional DGFT office. [Note that SEIS Application can be done on an annual basis only]

The List of documents required for SEIS Scheme is as follows:

- Importer Exporter Code (IEC Code)

- Application form ANF-3B (Aayat Niryat Form)

- CA Certificate

- Statement showing the nexus between Invoices and FIRC’s (Table No 4)

- Write up of Services

- Self – Certified copy of invoice and FIRC’s

- DGFT Digital Signature Certificate (DSC)

- RCMC Copy

- Necessary Declarations.

[To know in-depth detail about the documents required for the SEIS Application and how you can obtain them Read our article “Documents Required for SEIS Scheme Application – Updated List (2019)“]

Once the application is checked by the DGFT and if everything is in place, then DGFT will issue a SEIS Duty Credit Scrip to M/S ABC. That scrip can be encashed by selling it to any Importer.

What is MEIS and SEIS Scheme / What is the difference between SEIS and MEIS?

Export can be made in 2 ways i.e. Export of Goods and Export of services. From the Governments point of view both are equal because both the ways generate employment and bring valuable foreign exchange for our nation. Therefore it is necessary to encourage and maximize the export of both goods and services.

Hence Merchandise Exports from India Scheme (MEIS) is an Incentive scheme for the export of goods. Whereas Services Exports from India Scheme (SEIS) is an Incentive scheme for export of services.

Afleo Consultant is a leading Import Export consulting firm in India. We offer services like Services Export from India Scheme (SEIS), Merchandise Export From India Scheme (MEIS), EPCG License – Issuance and Redemption, DFIA – Issuance and Transferability, Advance License – Issuance and Redemptions, SION fixation/revision & obtaining a license from DGFT. We are a leading SEIS Scheme Consultant having a client base across India.

In case you have any doubt regarding the above Article, Please fill the below form to get in touch with us.