Transporting consignments can become timid, especially when there are complexities in rules for getting the sanctions. So, want to know how it works? Have Doubts Regarding E-way Bill? Lets have a look then...

What is E-way Bill?

E-WAY bill is the abbreviation of the Electronic Way Bill. This document is known for the uniqueness to generate a unique number for specific consignment/movement of goods from one place to another (specifically one state to another).

The bill is required only when the value of consignment is above RS/- 50,000 under the current GST system.

Generally it is an exclusive bill number created for certain consignment concerning the movement of goods. When the bill is generated a unique number is made available to the supplier, recipient and transporter. The E-way bill must be generated before the goods are dispatched and should include details of the goods, their consignor, recipient and transporter.

GST laws permit any of the parties to a transaction i.e. the consignor or the recipient to generate the E-way bill, provided they are registered. Whether goods are moving on one’s own transportation or hired transportation, by air, rail or road, E-way bill has to be created. Where the goods are meted out over to a transporter for conveyance by road and neither consignor nor the consignee has generated the E-way Bill, the transporter happens to be liable to generate it.

Why is it vital?

One of the significant arguments in favor of the GST was its capability to coalesced India as a marketplace. Information from the Ministry of Road Transport and Highways reveal that a typical transport vehicle in India spends 20 percent of its time in inter-state check points.

Both the GST levies and the E-way bill is to strip off such transit delays, while at the same time capping tax evasion. In addition a single e-way bill for the transfer of goods all over the country was anticipated to save tons of official procedure and evade various interstate clearances for buyers, sellers and transporters.

When Should an E-way Bill be Generated?

E-Way bill should be produced when there is Inter-state & Intra-state movement of goods for:

- Supply of good exceed value of Rs/- 50000

- Supply with an unregistered person/transporter

- It is obligatory even if goods are transferred from one means of transportation to the other.

- A consolidated e-way bill is requisite for multiple consignments.

Persons Authorized to Generate E-way Bill?

The registered person (those who are already registered under GST website): If, the cost of supplies is worth more than Rs 50,000 and is made to or from an enlisted person then, that person or the transporter must generate the bill. The enlisted person or transporter can even elect to generate the e-way bill even if the cost of goods is less than Rs 50,000.

Unregistered person (Suppliers who were not registered on GST website): the unregistered person or transporter may also decide to produce e-way bill. But, if a supply is through an unregistered person to a registered person, the recipient will have to do all the compliances as if he’s the seller.

Transporter: A Transporter can also generate e-way Bill if the Supplier has not generated one.

Set of circumstances when E-Way bill is not necessary

There are various circumstances when there is no requirement of an E-Way bill.

- The form of conveyance is non-motor vehicle

- Transport from Customs port, airport, and air cargo complex or land customs station to Inland Container Depot (ICD) or Container Freight Station (CFS) for authorization by Customs.

- Vacant Cargo containers are being transported

- Transportation of goods from one place to another at a distance less than 20 kms.

- Goods being elated by rail where the Consignor of goods is the Central Government, State Governments or a local authority.

- Goods specified as exempt from E-Way bill requirements in the respective State/Union territory GST Rules.

List of Items Exempt from E-way Bill

Specified things of mass consumption have been kept out from E-way bill. These include:

- Kerosene

- Heating Newspapers

- Khadi

- Raw silk

- Bread

- Indian flag

- Human hair

- aids

- Currency

- Food grains

- Kajal

- Earthen pots

- Books

- Jewellery

- Judicial Cheques

- groceries

- Meat

- Curd

- non-judicial stamp paper

- LPG Municipal waste

- Puja samagri

Wha is the Validity of E-Way Bill?

E-Way bill is applicable for time as mentioned herein, which is established on the distance travelled by the goods. Validity is calculated from the date and time of creation of e-way bill-

- Less than 100kms – Valid from Date & time at which E-way bill is generated for 1 day

- For every extra 100kms – Valid from Date & time at which E-way bill is generated to an extra day for every 100kms or part thereof.

How to create E way Bills on e-way bill Portal?

The e-waybill (EWB) portal provides a trouble-free gateway to produce e-Way bills

E-way bills in EWB-01 can be created by any one of two methods:

- On the Web

- Via SMS

Complete Process to Generate E-Way Bill (EWB-01) online:

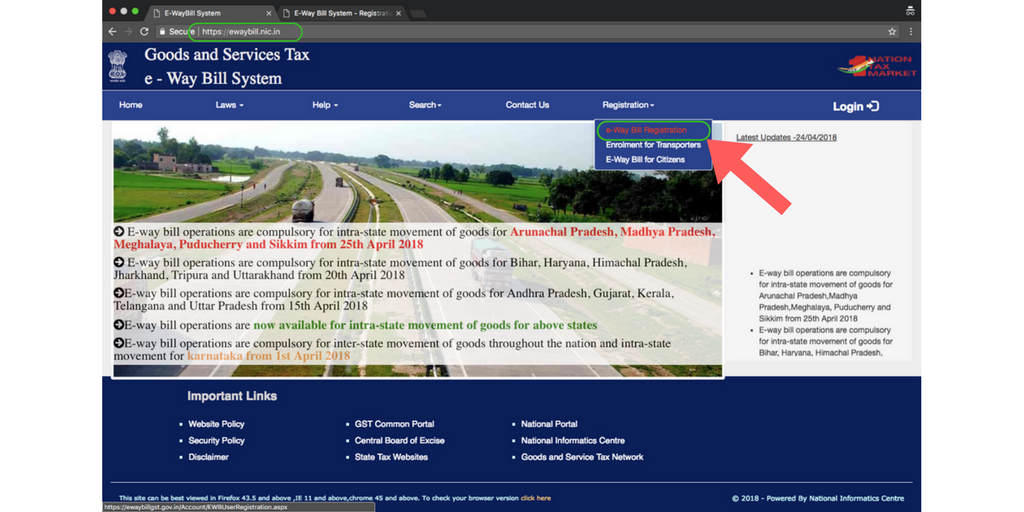

- Visit the e-Way bill portal, (http: ewaybill.nic.in).

- Now Click on e-Way Bill Registration for registration on e-Way portal.

- You will be directed to a new window which looks like the screen below:

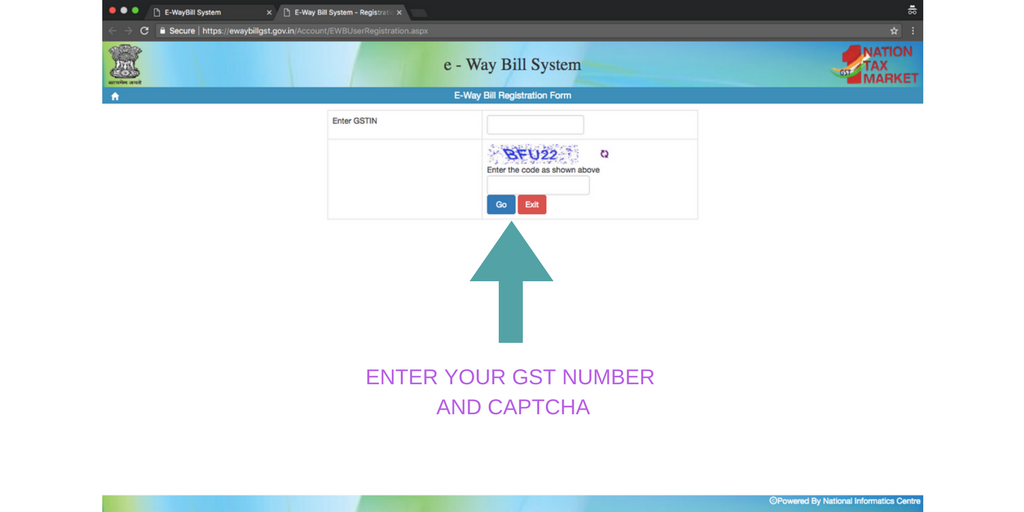

- Enter GSTIN No of concerned registered person or registered Transporters and CAPTCHA and press enter. You will be directed to new window where all the details related to GSTIN will directly be uploaded, just press send OTP in the new window, you will get a one-time password on your phone, enter the password in the field required and you will be successfully verified.

- Now choose a user name and password for login to E-WAY bill website.

- Now Login to e-way bill system. Insert the Username, password then Click on ‘Login’

- Insert the fields on the screen that appears and Click on ‘Submit’.

- After your application is processed, e-way bill in Form EWB-01 with a unique 12 digit number is created.

- Print and carry the e-way bill for moving the goods in the selected mode of transport.

How to register for SMS facility?

- Go on E-way bill system or click on https://ewaybill.nic.in/

- Login to e-waybill portal by using user name and password, Click on ‘Registration’ shown on the left side of the dashboard and select ‘For SMS’ from the drop-down.

- The mobile number recorded for the GSTIN gets partially displayed. Snap on ‘Send OTP’. Enter the OTP generated and click on ‘Verify OTP’.

In this way, You will be successfully registered to create Eway Bills via SMS.

How to create E-WAY bill using SMS facility?

I. For Supplier

1. Write the command given in bold in the body of sms and change it according to the needs and parameters (The list explaining below code words is given below)

EWBG TranType RecGSTIN DelPinCode InvNo InvDate TotalValue HSNCode ApprDist Vehicle

**NOTE: Space should be given after each word as shown above.

Explanation of Parameters:

· EWBG (Use it as it is)–Generate Key Word for e-Way Bill

· TranType - Transaction Type – Refer to the Code list below

- OSUP – Outward Supply

- OEXP – Outward Export

- OJOB – Outward Job Work

- OSCD – Outward SKD/CKD

- ORNK – Outward Recipient Not Known

- OFOU – Outward For Own Use

- OEOF – Outward Exhibitions & Fairs

- OLNS – Outward Line Sales

- OOTH – Outward Others

- ISUP – Inward Supply

- IIMP – Inward Import

- ISCD – Inward SKD/CKD

- IJWR – Inward Job Work Returns

- ISLR – Inward Sales Returns

- IEOF – Inward Exhibitions & Fairs

- IOTH – Inward Other

· RecGSTIN - Recipient’s GSTIN(15 digit number) as provided by GST (If its not there, then select URP for ‘UnRegistered Person’)

· DelPinCode – The PIN Code of Place of Delivery of Goods (Fixed 6 digit)

· InvNo – The Invoice Number or Bill Number of supplier of goods (15 digit alphanumeric with allowed special character)

· InvDate - The Invoice Date or Bill Date of supplier of goods

· TotalValue - Total Value of goods (15 numeric value with 2 decimal value) as per Invoice/Bill document

· HSNCode - HSN Code of the first Commodity

· ApprDist – The Approximate distance in KMs between the consignor and the consignee (Supplier & Recipient)

· Vehicle – The Vehicle Number in which the goods are being transported.

2. Send the code to the number 77382 99899

3. The E-way bill will be sent to your registered mobile number in the following pattern “Eway bill generated successfully. E-Way Bill No: __________ and date is _______”

II. For Transporter

1. Write the command given below in bold in the body of sms and change it according to the needs and parameters (The list explaining the below code words is same as given for supplier above)

EWBG TranType RecGSTIN DelPinCode InvNo InvDate TotalValue HSNCode ApprDist Vehicle

2. Send the code to the number 77382 99899

3. The E-way bill will be sent to your registered mobile number in the following pattern “Eway bill generated successfully. E-Way Bill No: __________ and date is _______”

Documents required for generating e-Way Bill

- Invoice/ Bill of Supply/ Challan linked to the consignment

- If the goods are being Transport by road then Transporter ID or Vehicle number

- If the goods are being carried from one place to another by rail, air, or ship then Transporter ID, Transport document number, and date on the document.

GST E-Way Bill Format

The E-Way Bill set-up in GST consists of 2 parts – Part A and Part B.

The Part A of the Bill in the details of consignment, usually the invoice details has to be mentioned. In Part B of Form, the vehicle number in which goods are elated needs to be state, which will be filed by the transporter.

Mentioned below are the details of columns that are needed to be filled:-

- GSTIN of Recipient: Enter the GSTIN no. of the recipient.

- Value of Goods: Enter the delivery value of goods.

- Reason for Transportation: Here select the most appropriate option from the list.

- Invoice or Challan Number: Enter the Invoice of the goods supplied

- HSN Code: Enter the HSN code of goods which are transported.

- Transport Document No. : This specifies Goods Receipt Number, Railway Receipt Number, Airway Bill Number or Bill of Lading Number.

- Place of Delivery: Here enter the Pin Code of the Area where goods are conveyed.

FAQ on Eway Bill:

- Is there a need to register again on the eWay Portal being already registered in GST Portal - Yes. All the enlisted persons under GST need to register on the portal of e-way bill.

- What is TRANSIN or Transporter ID?

TRANSIN or Transporter id is 15 digit exclusive no. produced by EWB system for unregistered transporter, once he enrolls on the system.

- What is the Part-A Slip?

Part-A Slip is a provisional No. generated after entering all the details in PART-A of e-way bill. This will be helpful, while preparing invoice relating to your business transaction.

- What happens if numerous shipments are transported in one vehicle?

The carrier should create a combined E-Way Bill in the Form GST EWB 02 and independently point out the serial number of E-Way Bill for each of it.

- E-Way Bill can be created for delivery of less than INR 50,000 or not? Yes, a registered Person/Transporter can generate an E-Way Bill even though it is not mandatory.

- If the consignor does not generate the E-Way Bill even though the value of consignment is more than Rs/- 50,000, then?

The shipper/transporter has to generate the E-Way Bill in Form GST EWB 01 on the basis of the invoice.

- Will there be any reference number generated on creation of E-Way Bill?

Yes an exclusive E-Way Bill no. called ‘EBN’ will be made accessible to the supplier, the recipient and the transporter.

- What has to be put in GSTIN field, if consignor or consignee does not hold GST Number ?

If the consignor or consignee doesn’t have GSTIN, then person has to select ‘URP’ i.e., Unregistered Person in that GSTIN field.

- What if E-Way Bill is created but goods are not transported?

The Bill can be cancelled by electronic means on the common portal within 24 hours of its creation.

- What if the goods are shifted from one means of transportation to another in the course of transit?

Before shifting the goods to another vehicle and making any further movement of such goods, the transporter needs to revise the details of transference in the E-Way Bill on the common portal.

- Will the E-Way Bill be made accessible for receipt to the receiver of commodities?

Yes, details of the E-Way Bill will be made accessible for the receiver of goods only if he is registered.

- Can the bill be generated or cancelled through SMS?

The service of generation and cancellation of E-Way Bill through SMS is available.

- Can date on e-Way Bill be similar as Invoice Date? E-Way bill date is the date on which the e-way bill is produced. It can be dissimilar from Invoice date.

- What if the recipient of goods does not correspond to the acceptance or rejection within 72 hours?

The receipt would be considered as acknowledged by the recipient if the recipient of goods doesn’t respond to the acceptance or rejection within 72 hours.

- What is the procedure to create e-Way Bill for a Free Sample/Product? - To create an E-way bill for free product, just put in “zero” in the Field of "Quantity" and " Value" and then create e-Way Bill

- Which types of dealings need the e-way bill? - For carrying goods in relation to all types of dealings such as external supply, within the State or interstate, internal supply, within the State.

- Who can stretch the validity of e-way bill? - The transporter who is moving the consignment can extend the validity period.

18. What are the modes of e-way bill generation?

The e-way bill can be produced by the registered person by using:

- Web based system

- Site-to-Site integration

- GSP ( Goods and Services Tax Suvidha Provider)Using SMS based facility

- Android App

We hope this article will be fruitful to you, in case of any doubt or further GST consultation you can reach out to us.

We at AFLEO would love to help you, for further details or in case of any queries regarding the same, Please fill below form.

I blog frequently and I realky appreciate your content.

Your article has really peaked my interest. I’m

going to take a note of your blog and keep checking for new details about

once a week.I opted in for your RSS feed as well.

Feel free to visit my website: Sunny

Comments are closed.