Understanding e-BRC: A Vital Document for Exporters

An Electronic Bank Realisation Certificate (e-BRC) is an essential digital document for export businesses. Issued by a bank, the e-BRC serves as confirmation that the exporter has received payment from the buyer for the exported goods or services. The details provided in the E-BRC or BRC are important economic indicators and valuable sources of financial information or businesses seeking export incentives under the Foreign Trade Policy (FTP), presenting a valid E-BRC is mandatory, as it acts as proof of payment realization against exports.

We all know what an e-BRC is and how challenging it can be to get it issued by a bank. Banks often delayed uploading the e-BRC, made mistakes, and were frequently understaffed, causing exporters significant difficulties. This resulted in a lot of wasted manpower, time, and cost in following up with banks to close the E BRC for each consignment.

However, with the new Pilot Launch of the Upgraded e-BRC system introduced by DGFT as per Trade Notice No. 33 dated 10th November 2023, exporters can now self certify and issue the E-BRC themselves. Yes, you heard that right. Exporters will no longer need to chase banks and can generate the e-BRC from the comfort of their office.

What is e-BRC and Why is it Important?

The Electronic Bank Realisation Certificate (e-BRC) is an important certificate for exporters, acting as evidence that payment for exported goods or services has been realised. It is an important aspect of Export Documentation and Foreign Trade Policy (FTP) compliance.

For those exporters who are taking advantage of government schemes such as Export Incentives, the Bank Realization Certificate is required. The DGFT Portal captures all e-BRC data, which also serves the purpose of tracking trade inflows for the government to maintain transparency.

An efficient and seamless e-BRC Generation mechanism minimizes compliance requirements and enhances trade operations.

| Feature | Traditional e-BRC System | Upgraded Self-Certification e-BRC System |

|---|---|---|

| Processing Time | Dependent on bank timelines, often delayed | Immediate self-certification by exporters |

| Errors | Banks may make data entry mistakes | Exporters have full control over accuracy |

| Control | Exporters had to rely on banks for issuance | Exporters generate their own e-BRC on DGFT |

| Convenience | Multiple follow-ups required with banks | Done digitally from the DGFT Portal |

| Flexibility | No option to club or split remittances easily | Exporters can club/split IRM Messages to generate e-BRC |

With this shift, exporters are not required to wait for banks and can produce e-BRC on DGFT at the click of a button, saving effort and time.

Step-by-Step Process on How to Generate e-BRC

In order to carry out e-BRC Generation, do the following:

• Login to the DGFT Portal: Access the DGFT e-BRC section and login.

• Go to e-BRC Section: From the "Services" tab, choose e-BRC on DGFT.

• Access IRM Repository: See all IRM Messages uploaded by your bank.

• Link IRM to Shipping Bills Align IRM Messages with corresponding invoices or SOFTEX forms.

• Create e-BRC: Click "Generate e-BRC" and verify the information.

• Track Status and Compliance: If a bank raises a red flag on your Bank Realization Certificate, add more information if required.

By doing this, exporters can conveniently handle their Export Documentation through the DGFT Portal.

Workflow of the New Upgraded e-BRC System

The new upgraded system is based on the Electronic Inward Remittance Messages (IRMs). This means that whenever your bank receives an export remittance amount, it generates an IRM message for that amount.

According to the new system, the bank will electronically upload this IRM message to the DGFT's website. Now, as an exporter, when you log in to the DGFT portal, these IRM messages will be displayed to you. You will then need to link these IRMs with your shipping bills, invoices, SOFTEX, etc., and generate your own e-BRC.

You can also club multiple IRMs and link them to a single shipping bill, meaning you can generate a single e-BRC from multiple IRMs. Additionally, you can split a single IRM into multiple e-BRCs and they can be generated for goods exports, services exports, and deemed exports.

When you self-certify and generate an e-BRC, the data for all these e-BRCs will also be sent to the bank. If the bank has any doubts, they can flag the e-BRC and request additional clarification from you. Another useful feature introduced by DGFT is that if an e-BRC is unutilized after being issued, you can cancel it in case of any mistake made during its generation.

Please refer to the video below to understand the Step by Step process of EBRC Generation on DGFT website. In this video, we will guide you through the LIVE process of how to generate e-BRC using this new method on the DGFT portal.

Implementation Timeline: When Can Exporters Start Using It?

The soft launch of this new system for banks already started on 15th November 2023.

But the question is, when will it start for exporters?

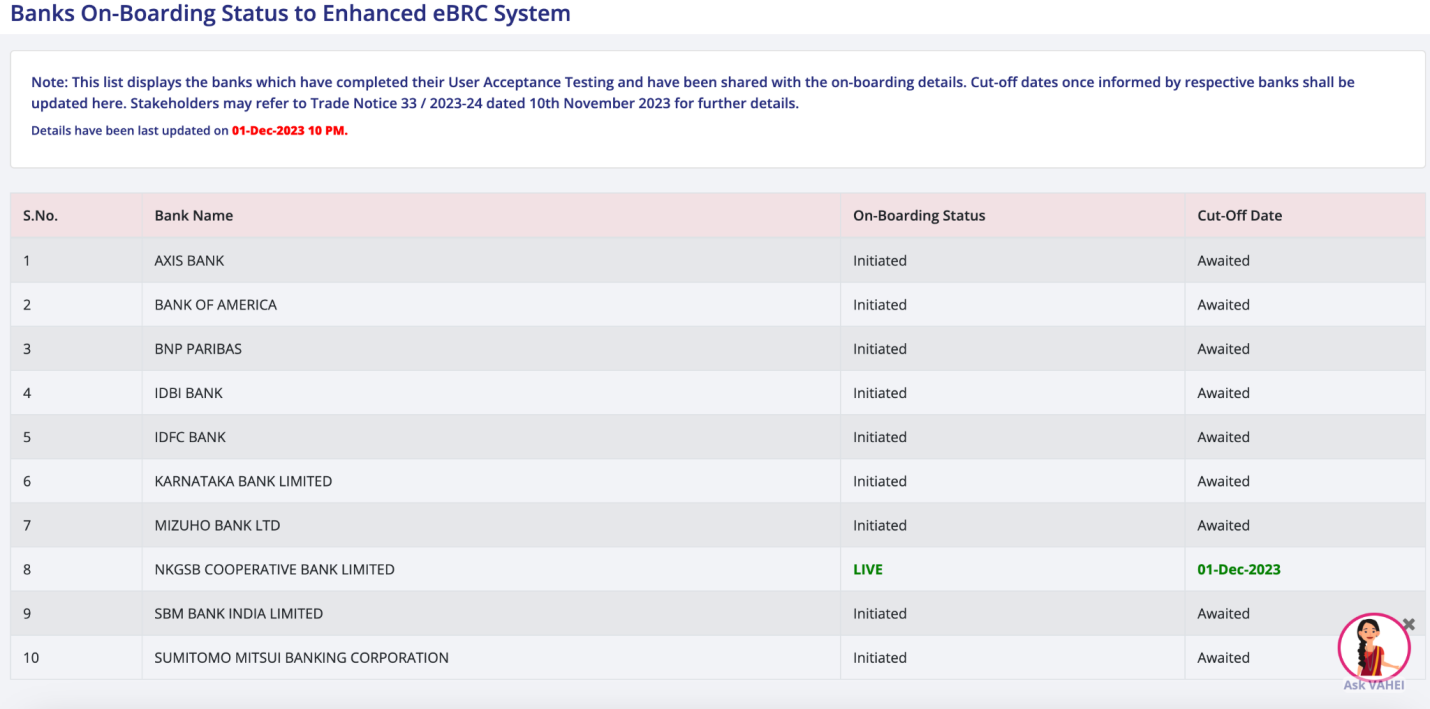

For exporters, the start date will depend on which bank they use. As per the Trade Notice, after completing the onboarding process, each bank will provide its cut-off date. After this cut-off date, banks will start uploading IRMs to the DGFT website.

As soon as banks begin uploading IRMs to the DGFT website, exporters can also start self-certifying and generating e-BRCs. So exporters will need to monitor the cut-off dates provided by their banks, which can be done via the DGFT website. Moreover, exporters should first select the e-BRC service on the DGFT website, and then select "Banks Onboarding / Cut-off Dates."

Upon selection, a screen will appear, as shown in the image.

You can see in the image that NKGSB Cooperative Bank Limited is already in Live status and, as of 1st December 2023, it has been electronically transmitting all its IRMs to the DGFT website.

This means that for exporters using this bank's services, if their inward remittance is received after 1st December 2023, they will need to self-certify and issue their e-BRC. For remittances received before 1st December 2023, the bank will generate the e-BRC using the traditional method.

So, in short, if the IRM is received after the cut-off date, the exporter will self-certify and generate the e-BRC. If the IRM is received before the cut-off date, the bank will issue the e-BRC through the earlier traditional method.

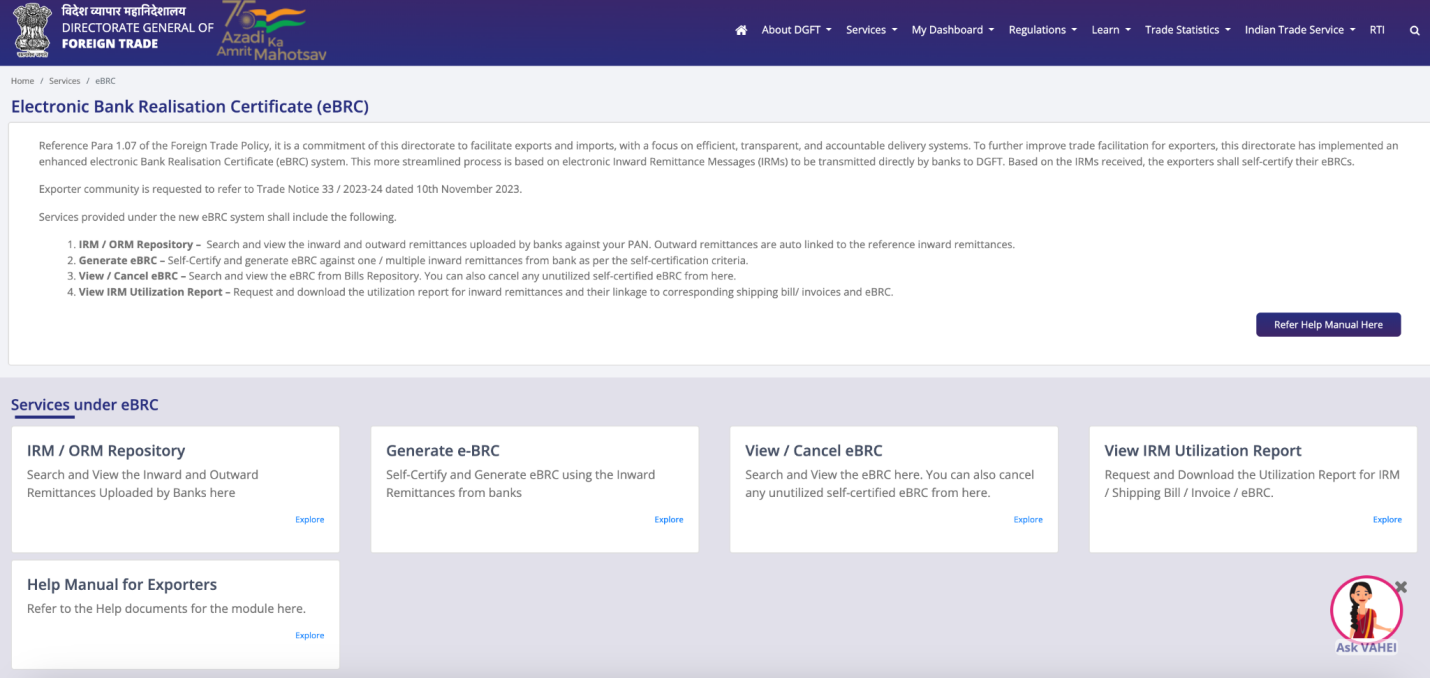

Where and How to Access the e-BRC Generation System

To self-certify and generate the e-BRC according to the new system, you will need to go to the DGFT website. Under the "Services" tab, select the last option, which is "e-BRC."

A screen will open, as shown in the image.

- Here, you can see there are various options available. The first option is the IRM Repository, where you will find details of all the IRMs transmitted by the banks.

- The second option is Generate e-BRC, where you can generate an e-BRC using the available IRMs.

- Then, there are options to View/Cancel unutilized self-certified e-BRC, View IRM Utilization Report, etc.

Key Rules for e-BRC Generation: What Exporters Must Know

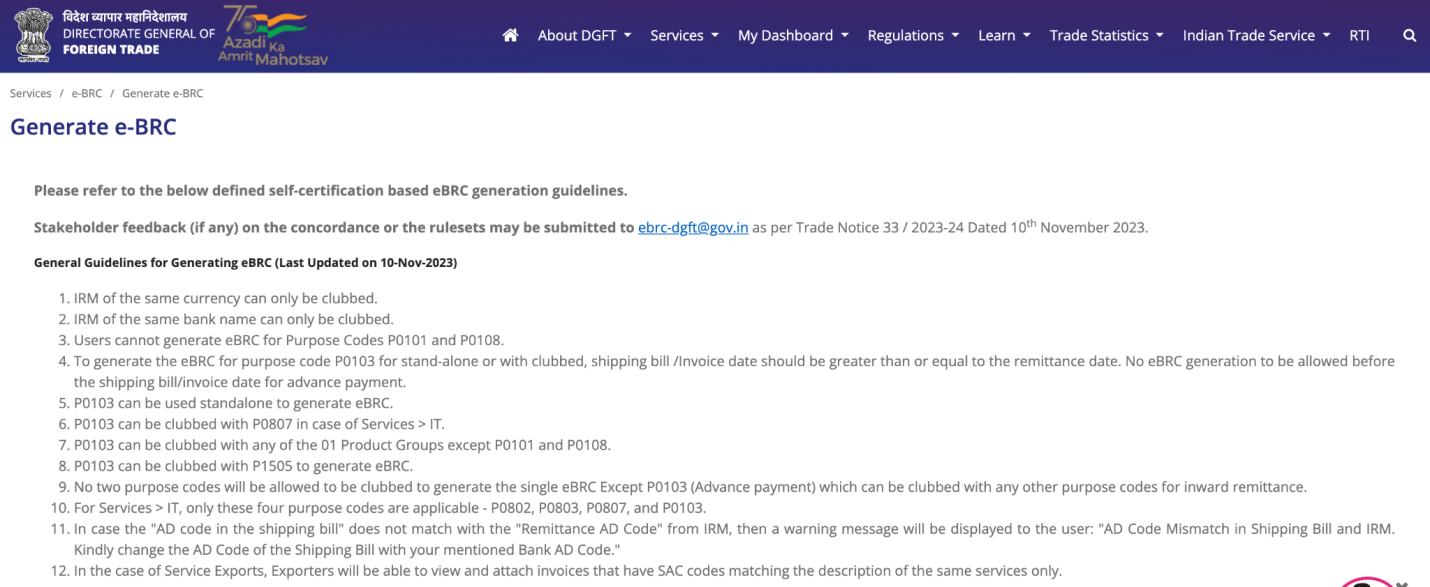

DGFT has specified the e-BRC generation rules in a section, which you can see in the image.

- Exporters should refer to this section regularly.

- Some of the main guidelines include that you can only club IRMs of the same currency, and only IRMs from the same bank can be clubbed together.

- Additionally, detailed guidelines have been provided based on different purpose codes.

- So overall, it is now the responsibility of exporters to generate the e-BRC, and they must ensure that no mistakes are made in this process.

- This is a new system that has been launched, and many more changes will come in the future. If, as an exporter, you wish to share any feedback or difficulties, you should email e-BRC-dgft@gov.in.

[Not sure whether your company is taking all the Export incentives notified by the Govt? – Refer to our article on "18 latest Export promotion schemes/Export Incentives in India"]

Typical Problems and Solutions in Self-Certification e-BRC

Although the new e-BRC Generation process is simpler, exporters might face issues like:

- IRM Messages Not Found on DGFT Portal:

Solution: Make sure your bank has uploaded them as per Trade Notice DGFT.

- Incorrect IRM Data:

Solution: Get correct details corrected from your bank before creating e-BRC.

- Bank Flags a Self-Certified e-BRC:

Solution: Send proper Export Documentation to overcome the flagging.

- Mistakenly Created e-BRC:

Solution: Utilize cancellation option for unused e-BRC on DGFT.

Awareness of these difficulties guarantees easy implementation of Customs Compliance and Foreign Trade Policy.

Legal and Compliance Implications of e-BRC Generation

- Exporters need to adhere to Trade Notice DGFT guidelines while creating Bank Realization Certificate.

- All records need to be preserved for a minimum of five years for audit and Customs Compliance.

- Incorrect e-BRC on DGFT entries can result in Export Incentives delays.

- DGFT can bring new updates, hence exporters need to remain updated on Foreign Trade Policy changes.

How Afleo Group Can Simplify Your e-BRC Process

Afleo Group is a specialized company catering to all Export & Import needs. We provide DGFT & Customs Consultancy services, are specialized in freight forwarding, and also deal in buying/selling of RoDTEP/RoSCTL/DFIA licenses.

We have guided many new exporters and importers from the start, helping them execute their export/import shipments and assisting them with DGFT, Customs, Banking, Logistics, Export Incentives, and Legal matters.

We are currently handling EBRC generation work of more than 500+ Companies, who have outsourced it to us. We can also help you with the Generation of EBRCs. So In case of any requirements Please fill the form below or you can directly Call or Email us.

FAQs on the Upgraded DGFT e-BRC System

Q1: What is the full form of eBRC?

A: eBRC full form is Electronic Bank Realisation Certificate.

Q2: How to generate eBRC if my IRM is missing?

A: Ensure the bank has uploaded it and check the DGFT Portal regularly.

Q3: Are there charges for e-BRC Generation?

A: No, the DGFT e-BRC service is free.

Q4: Can exporters club IRMs from different banks for one e-BRC?

A: No, only IRM Messages from the same bank can be grouped together.

The Future of e-BRC: What’s Next for Exporters?

The latest DGFT e-BRC system brings a much-anticipated shift to Self-Certification e-BRC, reducing delays and improving efficiency. To ensure seamless compliance, exporters must adapt to this Trade Notice DGFT update.

Looking ahead, future enhancements may offer even greater flexibility in e-BRC generation, making export documentation faster and more straightforward.