Transport and Marketing Assistance (TMA) scheme is initiated by the Government of India for specified agricultural products, with an aim to provide less expensive means of transportation of goods, referred as freight, which is an integral element of today’s international trade. In accordance with this scheme, the cost of transportation required to export some specific agricultural products has been lowered down. It essentially means that the Freight Cost up to a certain limit will be reimbursed by the Government to make our Agricultural products competitive in the global market.

It also provides assistance for the marketing of agricultural products which help in promoting the brands and help them attain the recognition for Indian agrarian products in the overseas markets.

The TMA Scheme is included in the Foreign Trade Policy (2015-20) and was introduced on 01.03.2019. We have brought to you a complete guide on the Transport and Marketing Assistance (TMA) Scheme which includes eligible/ineligible categories, Important terms and conditions, all the required latest and updated Annexures, documents required for TMA Application along with a step by step Guide of online application procedure under TMA Scheme.

Eligible Products under TMA Scheme

The assistance would be provided to all the products covered under chapters 1 to 24 of the ITC HS, including marine as well as plantation products.

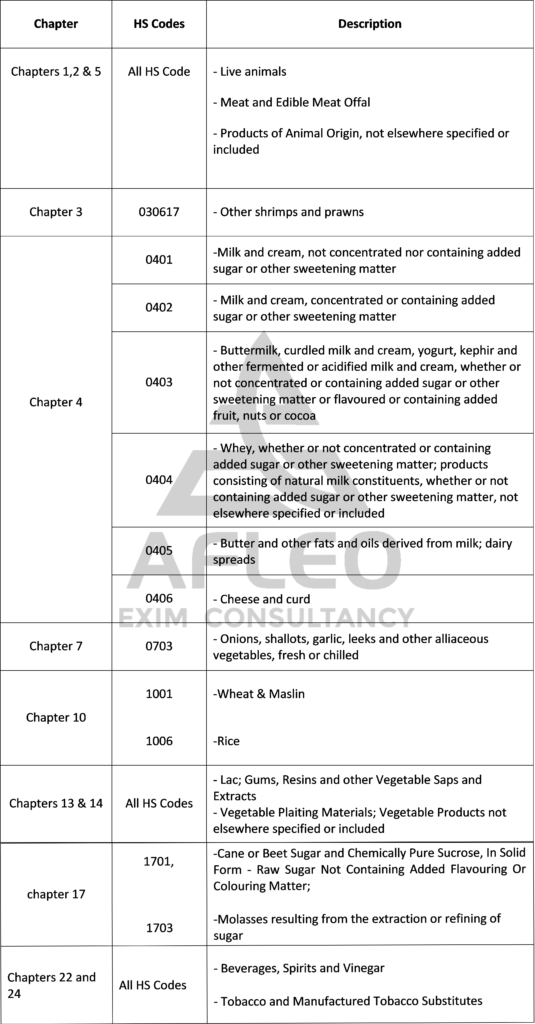

However, some specific products falling under Chapter 1 to 24 would not be covered under the Scheme for assistance. A list of such ineligible products is specified in Annexure (1) given below:

Transport and Marketing Assistance (TMA) scheme Annexure (1)

List of agriculture products not eligible under TMA Scheme

Coverage Under TMA

- The scheme covers all the exporters of eligible agriculture products, who are duly registered with the relevant Export Promotion Council, as per the Foreign Trade Policy. (RCMC)

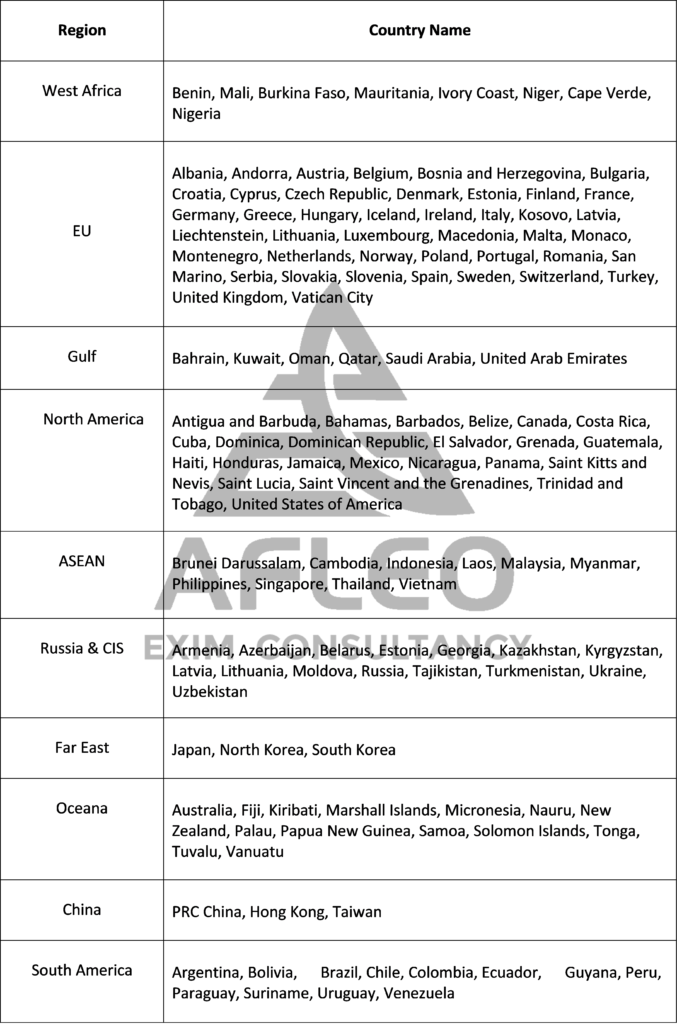

- Export of eligible agricultural products, to certain permissible countries as specified in Annexure (2) will only be covered under the scheme.

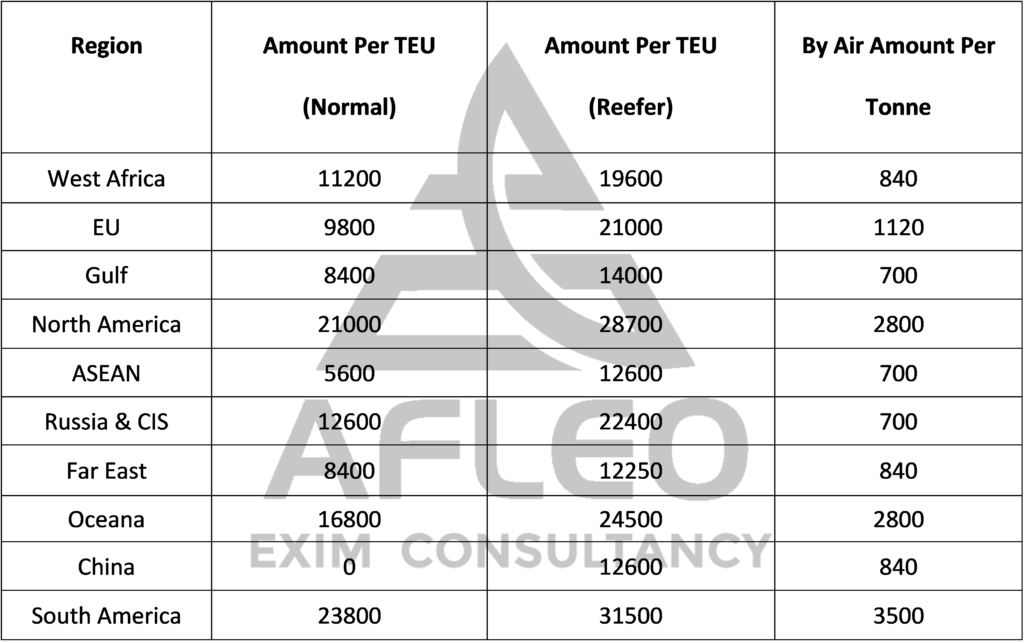

- The scheme covers the freight transportation and the marketing for export through both ways, Air as well by sea (both regular and refrigerated cargo)

- The level of assistance would be different for different regions as per the notification received from time to time. Annexure (2) mentions a list of all the export destinations/countries in each region which are available for assistance under the TMA Scheme & Annexure (3) mentions the rate of assistance provided Country-wise.

Transport and Marketing Assistance (TMA) Scheme Annexure (2)

List of Regions and Export destinations/countries in each region eligible for assistance under TMA are as under:

The assistance is provided as per the rates notified in Annexure 3.

Transport and Marketing Assistance (TMA) Scheme Annexure (3)

Differential rate of assistance under TMA (Amount in Indian Rupees)

Applicability & Conditions covered under TMA Scheme

Applicability under TMA Scheme

It is essential to understand that the scheme would be applicable for only the period specified from time to time. The current permissible period is from 1.3.2019 to 31.3.2020. That means all the Export made within the permissible period will be eligible for TMA scheme.

This one year of aid would make a significant impact over the agriculture markets of specific products.

Important Terms & Conditions under the TMA Scheme

- It covers the Shipping cost based on the freight paid for Twenty-feet Equivalent Unit (TEU) containers.

- The assistance will not be provided for the containers less than the container load (LCL) and also for a vessel which has both, eligible and ineligible cargo.

- TMA will be not applicable where the cargo is shipped in bulk or break-bulk mode. It is important to acknowledge, a forty-foot container will be considered as two TEUs.

- Assistance in the products which are exported through the air would be based on per ton freight charges on the total weight of the cargo. Estimations are based on full ton calculations, fractions are ignored.

- The assistance would only be provided under one condition, that the payment for exports is received in Foreign Exchange through normal banking channels only.

- Only the exports made through EDI ports are permissible under the scheme.

- Assistance under the scheme will be provided in cash through a direct bank transfer as a part of reimbursement of freight paid by the exporter.

- The scheme suggests that in FOB supplies, where no freight is paid by the Indian exporter such exports would not be covered under this scheme.

Categories of export ineligible under TMA Scheme

The below mentioned are the categories to which TMA shall not be applicable:

- Products which are exported from SEZs/EOUs/EHTPs/STPs/BTPs/FTWZs.

- When SEZs/EOUs/EHTPs/STPs/BTPs/FTWZs products are exported through DTA units.

- Export of the goods which are imported and comes under the mentions of paragraph 2.46 of FTP.

- Exports through trans-shipment that is, the exports which originally originated in the third country but have been trans-shipped through India.

- Items which are prohibited from exporting under the Schedule-2 of Export Policy, unless notified otherwise specifically.

- Export products which are obligated by the terms of minimum Export price, unless notified otherwise specifically.

- Export of products through couriers or foreign post offices using the methods of E-Commerce.

So, after knowing the eligibility under the TMA Scheme, let us now look into the documents required and the practical step by step guide (with the screenshots) for applying online under the TMA Scheme.

Documents required for claiming benefit under TMA Scheme

For an online application under the Transport and marketing Assistance (TMA) Scheme, it is essential to know the list of documents needed. Therefore, below is the complete updated list (2020) of all the documents required for the TMA application.

- Import Export Code (IEC Code)

- Registration-Cum-Membership-Certificate (RCMC)

- DGFT Digital Signature

- Shipping Bill Copy

- E-BRC

- Commercial Invoice

- Bill of Lading, in case of Shipment by Sea

- Airway Bill, in case of Shipment by Air

- TMA Application Form- ANF- 7 (Part- A & Part- B)

- Certificate of Chartered Accountant (C.A.)/ Cost and Works Accountant (ICWA)/ Company Secretary (C.S) as per Annexure A to ANF- 7(A)A

- Pre-receipt

Now, lets us discuss each document required in detail.

Import Export Code (IEC Code)

A registered Exporter can only apply under the TMA Scheme. Hence, it required valid IEC Code issued by the DGFT. It is one of the critical documents needed for the application under the TMA Scheme.Registration-Cum-Membership-Certificate (RCMC)

RCMC is (Registration-Cum-Membership Certificate) which is issued by different Export Promotion Councils. Registration under Export Promotion Council (EPC) is mandatory to claim benefits under the TMA scheme. In the case of agricultural products, registration under APEDA Council is compulsory.DGFT Digital Signature

Since application under TMA Scheme is fully online. DGFT Digital Signature is compulsory to digitally sign the application and submit it online.

Shipping Bill

A Shipping Bill is an important document given by the customs authorities for the clearance of goods. To fill the details of the exported product (HSN Code, Product Name, Invoice Details, FOB Value, Freight, and Quantity) in the online application require shipping bill copy.

E-BRC (Electronic Bank Realization Certificate)

An Export Transaction is complete only if the payment is realized against the goods exported. E-BRC is a proof of payment realization issued by banks to the exporters. Without E-BRC, we cannot take TMA benefits.

Commercial Invoice

The commercial Invoice is a legal document issued by the exporter (seller) to the importer (Buyer) in a foreign transaction.RCMC is (Registration-Cum-Membership Certificate)Bill of Lading(In case of shipment by Sea) A bill of lading is a document issued by a consignor to a Shipper.

Bill of Lading (In case of Shipment by Sea)

A Bill of Lading is a document issued by a consignor to a Shipper. It contains details like the type and quantity of goods, destination of goods, etc. There are specific details to be filled in the online application like Container No, Container Type (2oft & 4oft), the number of products. Bill of lading can be used to get all this information.Air-way Bill (In case of Shipment by Air)

In the case of air shipments, an air waybill is issued. An airline company issues the air waybill, which is evidence for transporting the goods. Airway bill is required to fill the details like air waybill no, quantity (per Ton) in the online application.

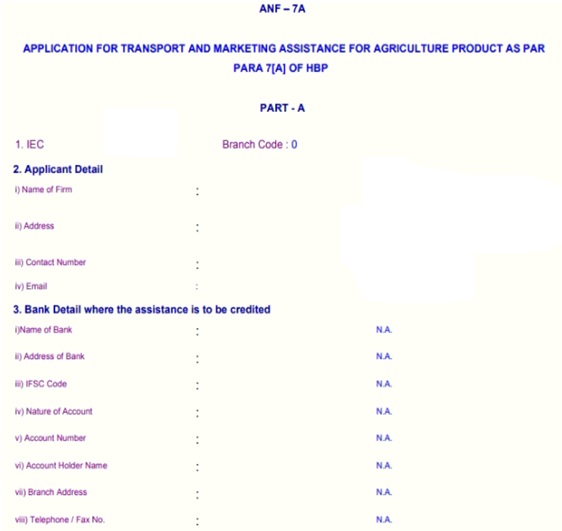

TMA Application form – ANF – 7 (Part-A & Part -B)

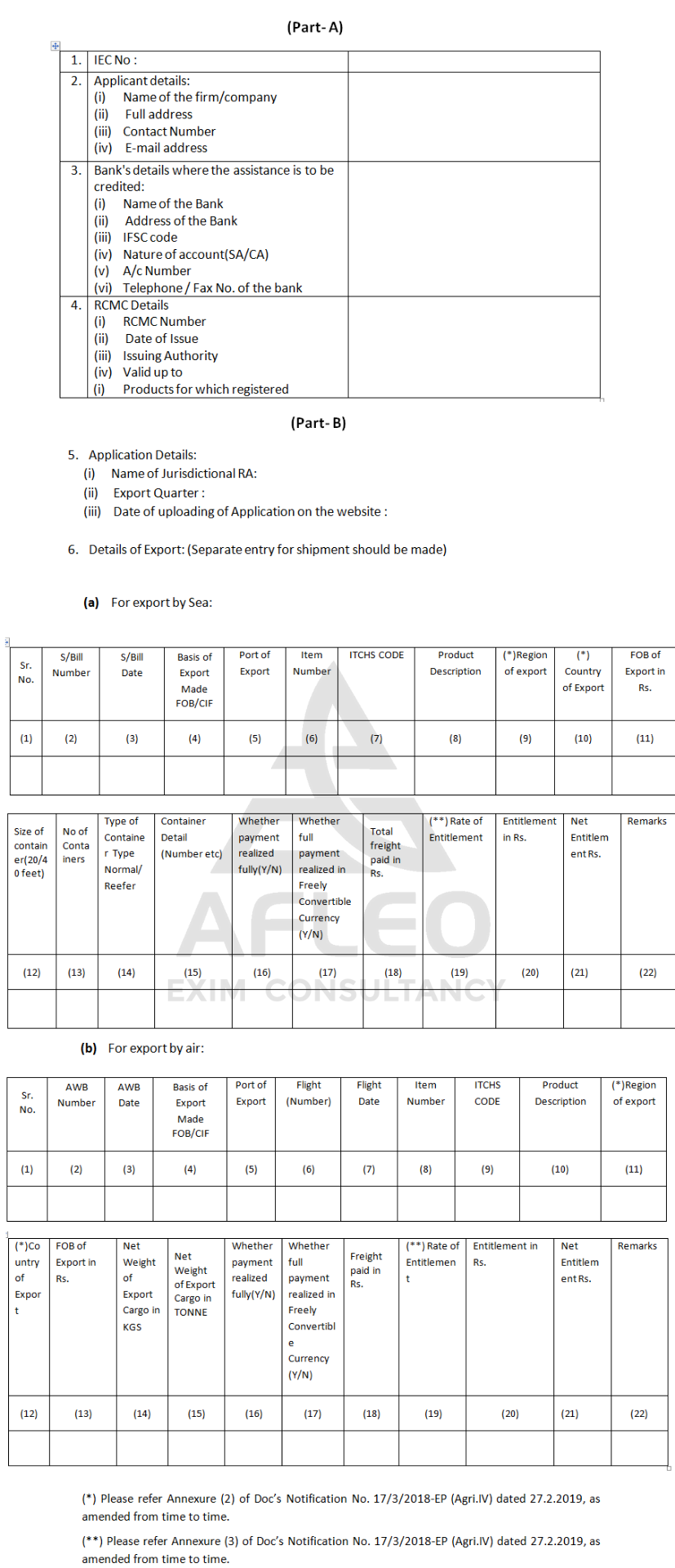

After submitting an online application on the DGFT site, we have to submit a manual request in DGFT. To submit the manual application, we have to prepare ANF-7 (Part-A & Part-B).Please find below the steps to fill the Part-A & Part-B of the TMA application form explained along with images for better understanding.

Step 1: ANF-7 (Part A)

A: IEC No (Import Export Code No)- Fill the 10 Digit IEC Code issued by the DGFT.B: Fill the applicant details like Name, Address, Contact Number, and Email Address.

C: Fill the bank details. Make sure to give the correct bank details where the assistance is to be credited.

D:RCMC details. Fill the RCMC details like RCMC number, Date of Issue, Issuing Authority, etc.

Step 2: ANF-7 (Part B)

Fill the bank details. Make sure to give the correct bank details where the assistance is to credited.

A: Application DetailsFill the Application details as mention below.

- Name of jurisdictional RA: Name of DGFT Regional office where the application is made.

- Export Quarter: As you know that TMA application is made every quarter. Mention the correct quarter period here. For example. Jan to March 2020.

- Date of uploading an application on the website

Fill the details of Export made by Sea & Air separately. All the details to be filled starting from Column No.1 to Column No. 22. Make sure to make separate entries for each shipment ie fill details shipping Bill number wise.

Sea Shipment – Details in Column No. 9 & 10 is to be filled as per Annexure 2, and Column No. 19 to be filled as per Annexure 3.

Air Shipment – Details in Column No. 11 & 12 is to be filled as per Annexure 3. and Column No. 19 to be filled as per Annexure 3.

Find below image of ANF-7 (Part A & Part-B) for your reference

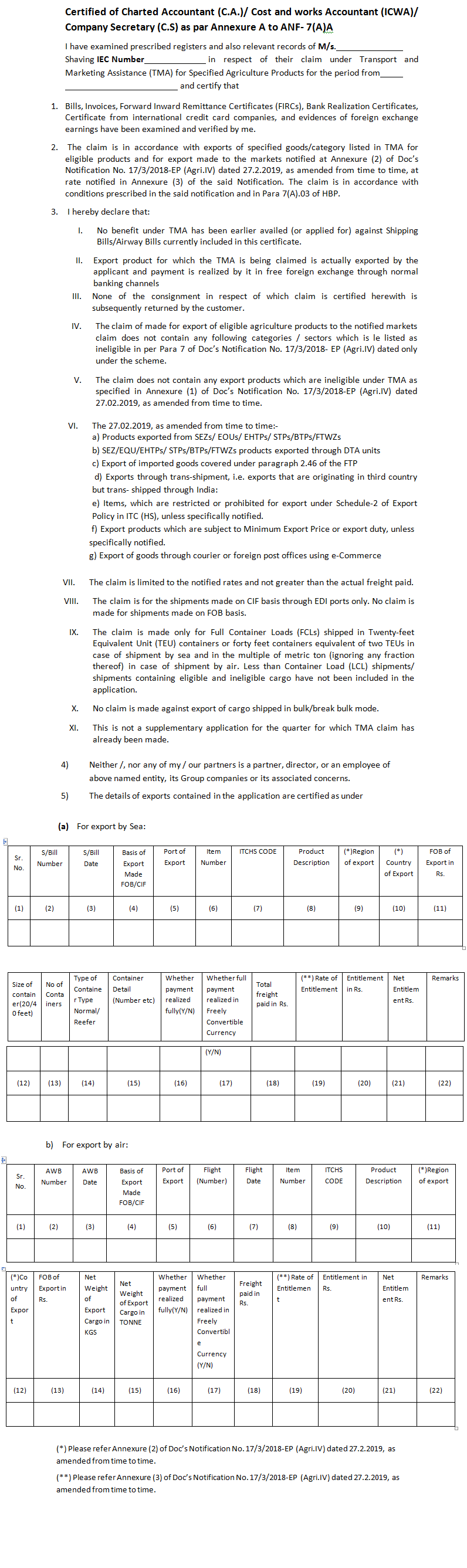

Certificate of Chartered Accountant (C.A.)/ Cost and Works Accountant (ICWA)/ Company Secretary (C.S) as per Annexure A to ANF- 7(A)A

In TMA Application, the Charted Accountant certificate is the most essential documents to confirm the exported product details. To fill the details like the name of the company, IEC No, and the period from when you have taken benefit. Also, fill the correct information of export made by Sea & Air.

Below are some essential points are given in the certificate as follows.

- No benefit under TMA has been earlier availed (or applied for) against Shipping Bills/Airway Bills currently included in this certificate.

- Export product for which the TMA is being claimed is actually exported by the applicant and payment is realized by it in free foreign exchange through normal banking channels

- None of the consignment in respect of which claim is certified herewith is subsequently returned by the customer.

- None of the Export products for which claim if filed falls under ineligible categories/sector under the TMA scheme.

- No claim is made against the export of cargo shipped in bulk/breakbulk mode.

Find below Image of Certificate of Chartered Accountant for your reference

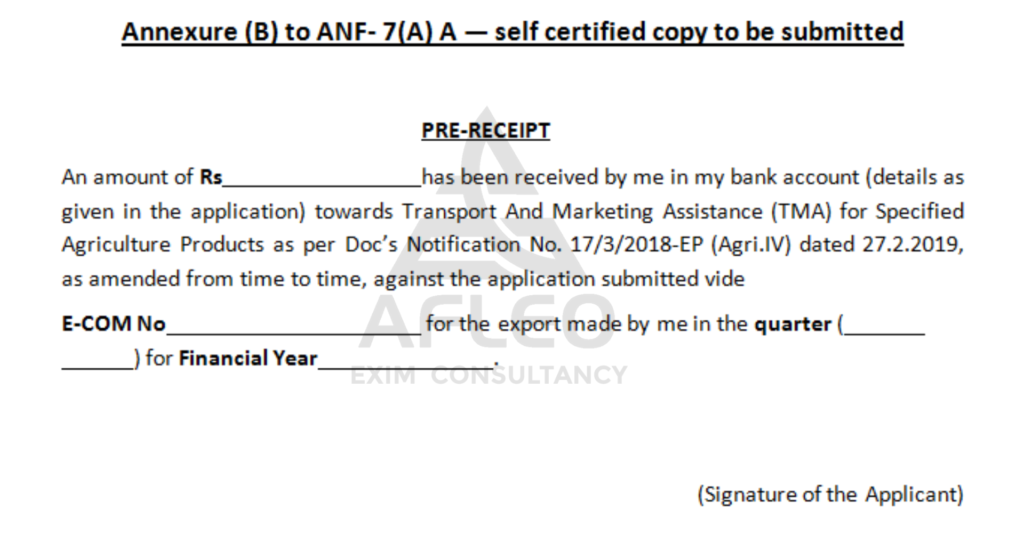

Pre-receipt

Pre-receipt is the receipt of the amount that will be received by the DGFT. In the pre-receipt fill the details like Claim Amount, E-Com No, Period & Financial Year for claiming the benefit.

Find the below image of pre-receipt for your reference.

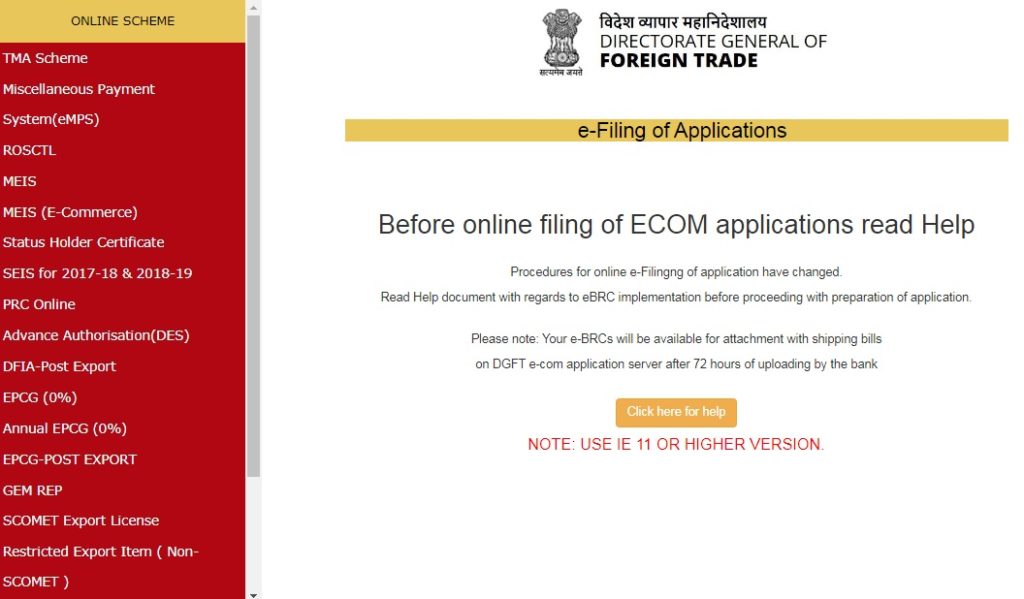

How to apply for TMA Scheme – Stey by Step TMA Scheme Online Application Guide

Now that we have learned about the documents required for TMA Application, the next step is to make an online application for the same. Since the schemes new, many people don’t know about it, hence the online application process may be a little complicated and confusing.To make the process easy to understand, we have broken the entire application process for Transport and Marketing Assistance Scheme (TMA Scheme) into 14 steps with screenshot images for better understanding.

Step 1: Visit the DGFT website

- Please visit the DGFT website at https://www.dgft.gov.in

- Select the tab services- online E-Com application

Step 2: Click on TMA Services

- Select the tab – TMA Scheme for the login page.

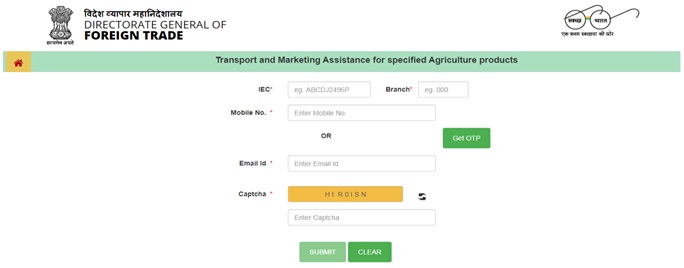

Step 3: Fill the details & click on Submit button

- After clicking on the TMA Scheme, the login page like the one shown below will appear.

- Fill the IEC Number, Branch Code, Mobile Number, Email-ID details.

- Press OTP button- OTP will be sent to your mobile number or Email ID.

- Insert the OTP & Captcha and Submit the details.

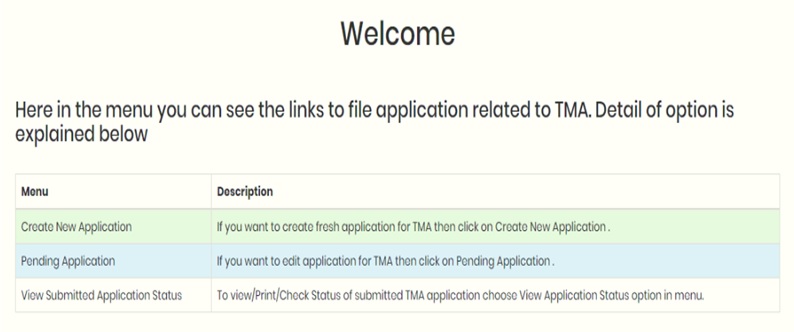

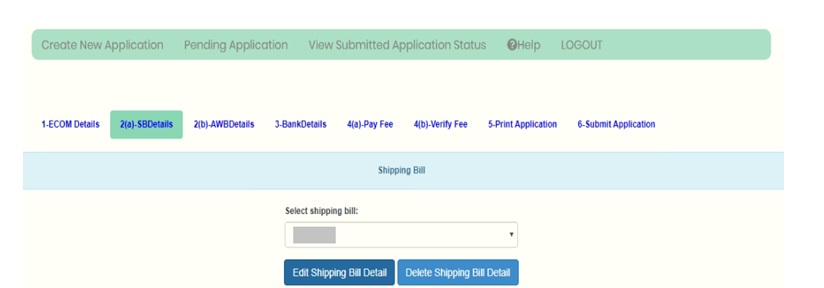

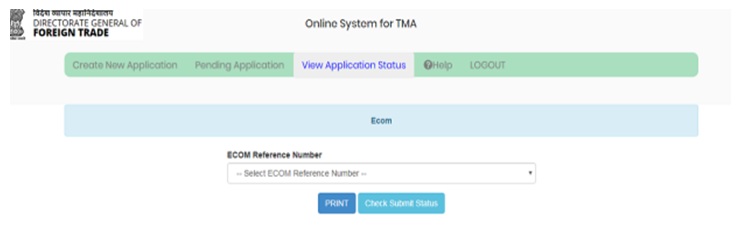

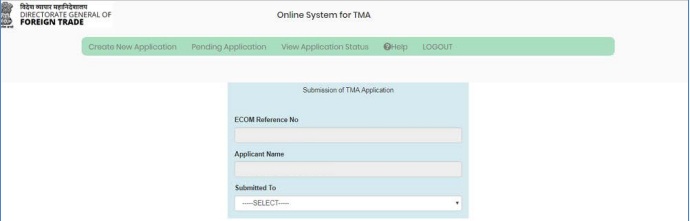

Step 4: Create New Application/ Pending Applications/ Submitted Application Status

- Click on “Create New Application” for creating a New Application.

- Click on the “Pending Application” tab to update the existing pending application.

- Click on the “View Submitted Application Status” tab to check the status of the already submitted TMA application.

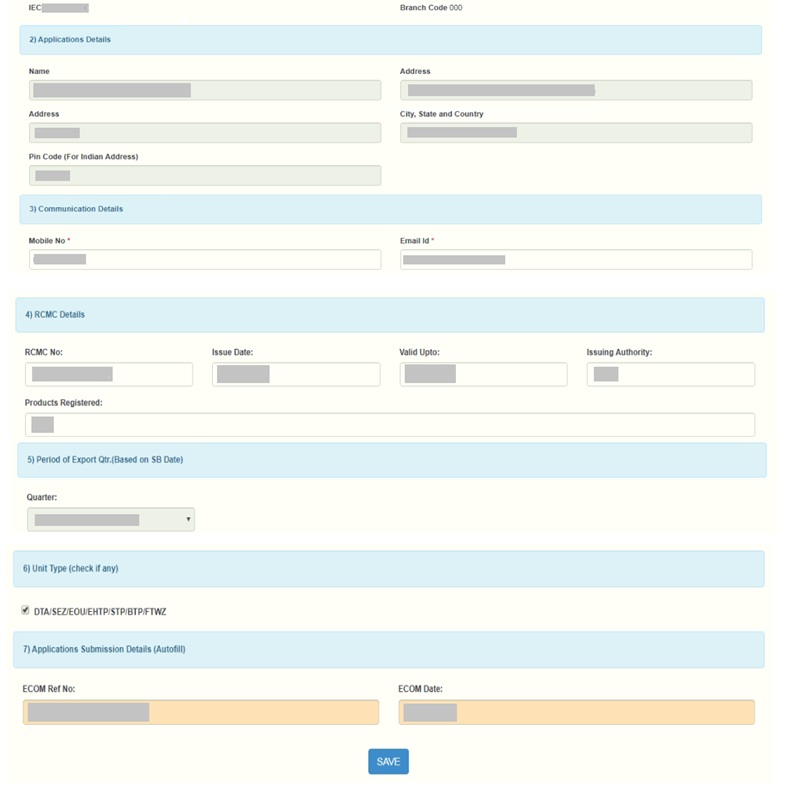

Step 5: Fill the necessary details for a new application

- After clicking on create a New Application, the below screen will appear.

- On the 1st and 2nd section insert details like IEC No, Branch Code, Firm name will not be editable. Details are auto-filled per IEC.

- Mobile Number and Email Id are editable.

- RCMC details will also be displayed automatically. In case details are not correct user can modify it.

- Select the quarter for which application needs to be created.

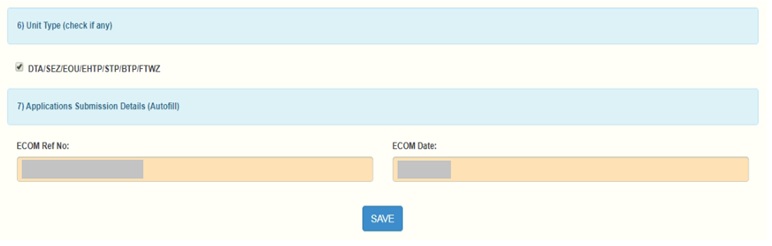

- Check the Unit Type (Check if any)- (DTA/SEZ/EOU/EHTP/STP/BTP/FTWZ). Click on the icon if the export is made from any one unit type.

- ECOM number and ECOM date will be automatically generated.

- Press the save button to save the ECOM details.

Step 6: Fill the shipping bill details

- Fill the details for each shipment bill like S/Bill Number, S/Bill Date, Port of Export, Region of Export, Country of Export.

- Shipment Type (CIF/C&F) based. (Yes or No).

- Save the shipping bill.

- Add a new S/Bill by using the “Add New S/Bill” button.

- To change existing details click on “View Existing Shipping Bill”.

- After clicking View existing S/Bill, below two options will appear.

- Edit Shipping Bill details.

- Delete Shipping Bill Details. However, be careful while deleting the Shipping bill because it will delete the container details and the items from the application.

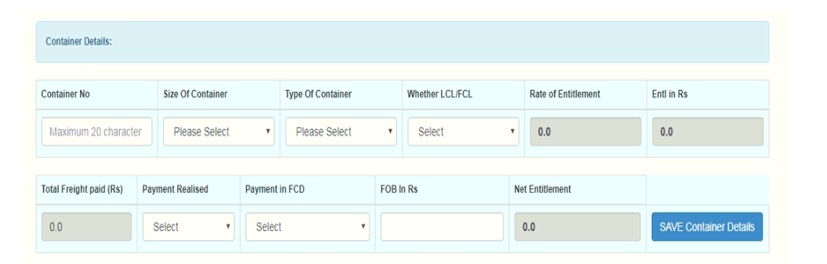

Step 7: Fill the Export details if shipping is done by sea

- Below S/B details. Fill the container details for that shipping bill like container No, Size of the Container (20ft or 40ft), Type of Container (Normal/Reefer), whether (LCL/FCL).

- Click on Payment realised fully. (Yes/No).

- Payment realised in FCD. (Yes/NO).

- Fill the FOB amount realised in INR.

- Click on Save Container details.

- Net Entitlement amount shows the container wise total entitlement amount.

- After Saving the container details below screen will appear.

- Edit/ Delete the S/Bill container details.

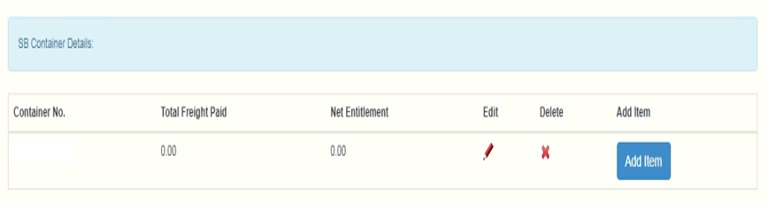

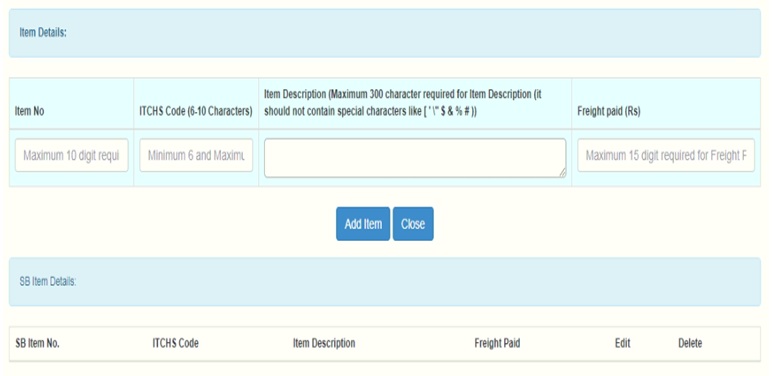

- Click on “Add Item” to add item HSN Code/Item Description.

- After clicking on “Add item” below screen will appear.

- On Item details insert the details like Item Number, ITC HSN Code, Product Description, Freight Paid in INR.

- Press the Add button to add the details.

- You can add multiple items if required.

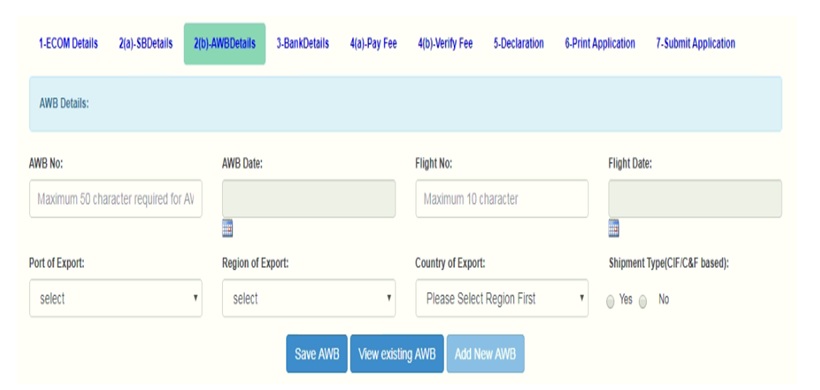

Step 8: Fill the Air Way Bill (AWB) details for Air Shipments

- Insert the details like AWB No, AWM Date, Flight No, Flight Date.

- Select the Port of Export, Region of Export, Country of Export.

- Select the Shipment Type (CIF BAsed) (Yes/No).

- After filling the details click on Save AWB button.

- Click on View Existing AWB to Edit and Delete the AWB Details.

- Click on Add New AWM to add multiple new AWB details.

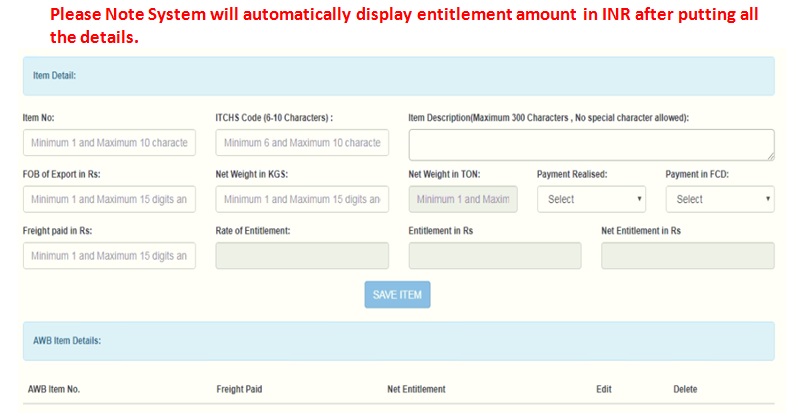

Step 9: Fill the Item Detail in Air Way Bill (AWB)

- Enter the Item Details like Item Number, ITC HS Code, Item Description, FOB of Export in Rs, Net Weight in KGs

- Enter the details as Payment realised. Select (Yes/No), Payment in FCD. (Select Yes/No)

- Enter the amount of Freight Paid in INR.

- Press the Save button.

- Click on View Existing Item Details to Edit or Delete the Item Details.

- You can add multiple items if required.

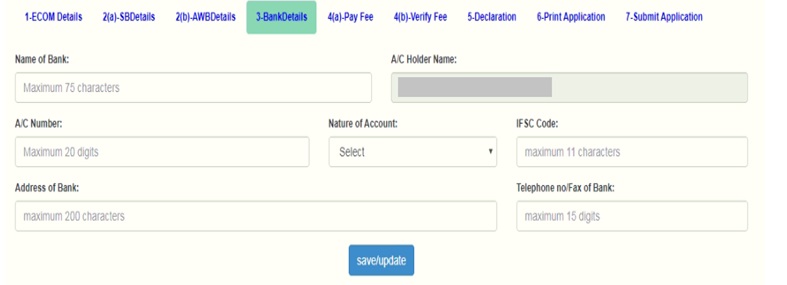

Step 10: Fill the Bank Details

- After Filling the AWB Details click on the bank details tab.

- Enter the details like Bank Name, Account Number, Account Holder Name, Nature of Account, IFSC Code, Address of Bank, Telephone Number.

- Click the “Save & Update” Button.

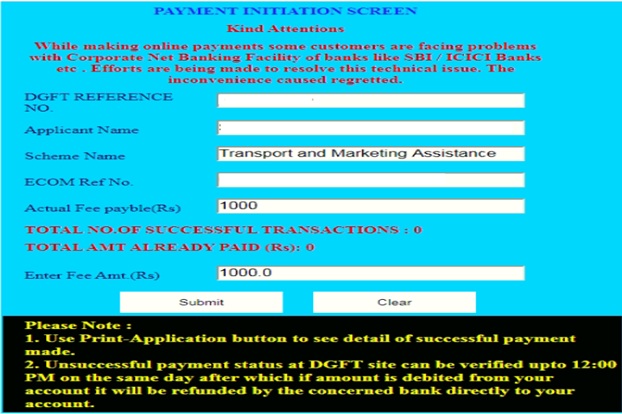

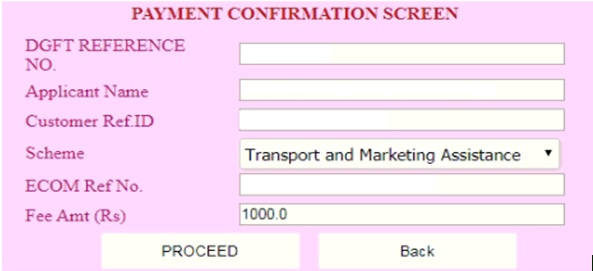

Step 11: Pay Online Fee

- Rs. 1000/- is the Government application fees for TMA Scheme.

- After clicking on “Pay Fee” below screen will appear.

- Check the details like Applicant Name, E-Com Ref No.

- Once check, click on “Submit” Button to pay online fees.

- After pressing the “Submit” button, the payment confirmation screen will appear.

- Click Proceed Button.

- After pressing the “Proceed” button, the exporter is allowed to make payment using the following option:

- Pay Fee by using Credit Card

- Pay Fee by using Debit Card

- Pay Fee by Debit card Plus ATM Pin

- Pay Fee by using Internet Banking

Make the payment by selecting any one option.

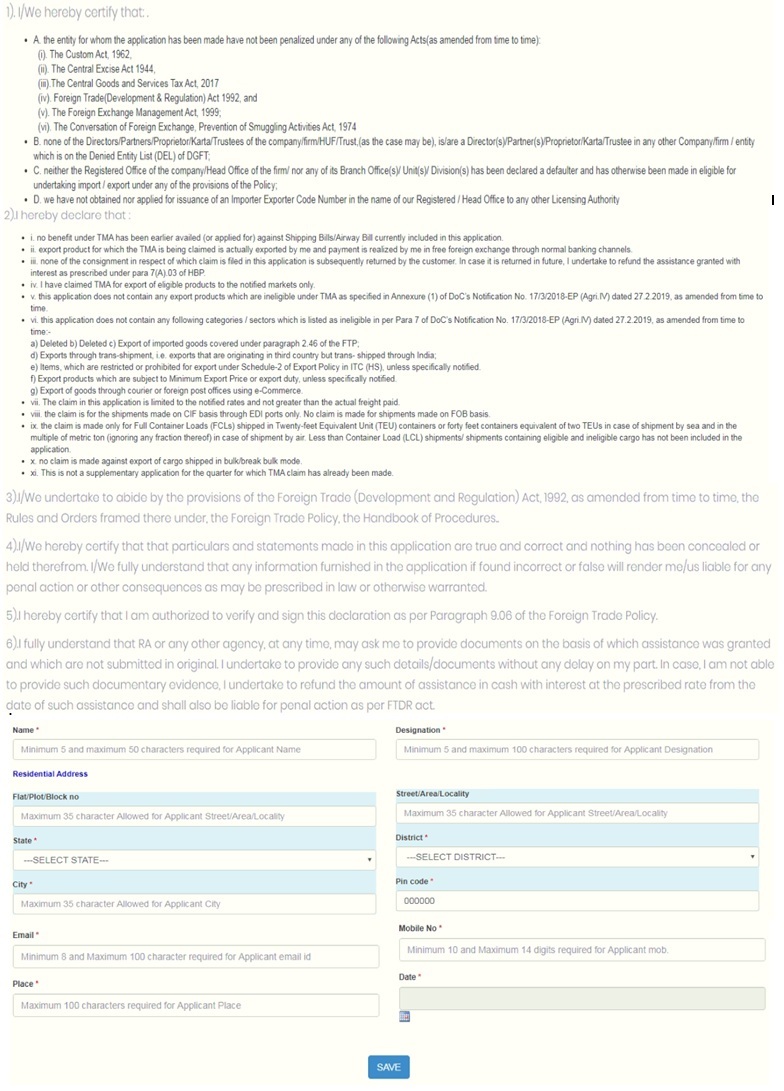

Step 12: Fill the Declaration Form

- Click on the Declaration & fill details like Name, the designation the applicant, Residential address, Office address, place, and date.

- Read the instructions carefully.

- Press the “Save” button.

- Filled details marked (*) are mandatory.

Step 13: Select the Print Application

- To take the print of the application, click on the “Print Application” option.

- Select the E-Com number & Click on the Print application option.

- After the Click print application below screen will appear.

- Check all the details mentioned in print application.

- Below is the sample 1st page of the print application form for the reference.

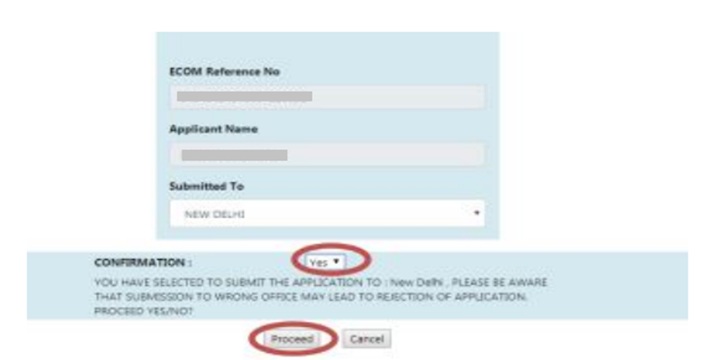

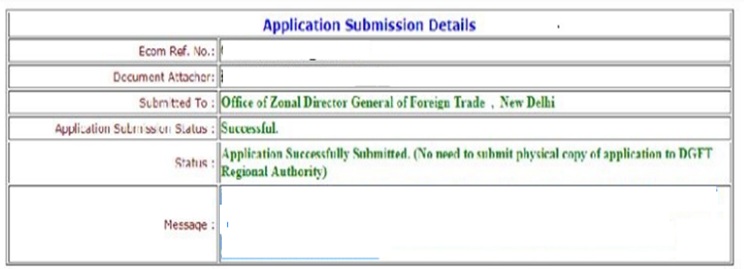

Step 14: Submit the Final Application

- To submit the final application, please click on the “Submit Application” option.

- Before submitting, please check that the Application fee is paid successfully, or else your application will not be submitted.

- Also, check the E-Com reference number.

- Select your jurisdictional DGFT RA office to submit the application.

After checking the details, give the confirmation (YES) to proceed further.

After the confirmation, the application will be submitted finally and a File No. and the Key No. will be generated. The online application process for TMA Scheme is completed here. Now the next step will be DGFT Officers will check the application and grant the benefits under TMA Scheme.

How Afleo Consultants can help you

Application for Transport and Marketing Assistance (TMA) Scheme should be made to concerned Regional Authority of DGFT on a quarterly basis. The Transport and Marketing Assistance (TMA) application can be complicated, but fortunately, Afleo has a knowledgeable and dedicated staff that can guide you through the entire process. We will take care of the documents and all the application that needs to be done to obtain the benefits. Get in touch and we will be happy to respond to any of your queries.