India has one of the largest textile industries in the world with a huge base of raw materials and a robust manufacturing strength.

The Ministry of Textiles of India has launched a new scheme for the export of Garments and Made-ups under the name “Rebate of State and Central Taxes and Levies” (RoSCTL) on 7th March 2019, thereby marking the discontinuation of the hitherto existing scheme called Rebate of State Levies (RoSL).

The Rebate of State Levies Scheme RoSL (Old Scheme)

The erstwhile scheme RoSL was a mechanism which was undertaken by the Government of India to provide the rebate of only State levies on apparels and made-ups which were exported from India. The scheme like RoSL was for the exports of those garments mentioned in Chapters 61 and 62. However, certain Central and State Taxes were continued to be present in the cost of Export. Therefore to increase the competitiveness of Indian Garments and Made-ups Sector, the Government decided to refund all embedded State and Central taxes and levies and Hence the new Scheme named “Rebate of State and Central Taxes and Levies (RoSCTL)” was introduced by the Government.

RoSCTL – New Scheme

The scheme is in line with the established international principle of zero-rating of all the products which are exported. The Central Government of India will henceforth cater to the rebate of all the State and Central Taxes and Levies. This will be over and above the Duty Drawback Scheme. RoSCTL Scheme will cover export of Garments (basically referring to the goods under Chapter 61 and 62 of All Industry Rates of Drawback) and Made-Ups (these are the goods which fall under Chapter 63 of Schedule of All Industry Rates) at the rates which have been notified and other value caps. The RoSCTL has come into force from the date of its notification and will remain in effect till 31st March 2020.

Now a Question must arise in your mind as to what are the State and Central Levies and Taxes which are yet not refunded by the Government in the Duty Drawback Scheme and covered under RoSCTL Scheme? Have a Look below:

The Rebate of State Taxes and Levies stand for the following:

- The VAT on transportation fuel

- Captive Power

- Mandi Tax

- Electricity Duty

- Farm Sector

- Stamp Duty on all the Export Documents

- SGST which is levied on inputs of production of cotton (raw) like fertilizers, pesticides, etc.

- Any kind of purchases which are made from unregistered dealers

- Inputs which are needed for the Transport Sector

- Coal which is used in the production.

The Rebate of Central Taxes and Levies stand for the following:

- Central Excise Duty on Transportation Fuel

- CGST included on all kinds of paid inputs like pesticides, fertilizers, etc.

- Any kind of purchases which are made from unregistered dealers

- Inputs which are needed for the Transport Sector

- Finally, the CGST and Compensation Cess on Coal which is used for the production of electricity.

Rebates under the RoSCTL

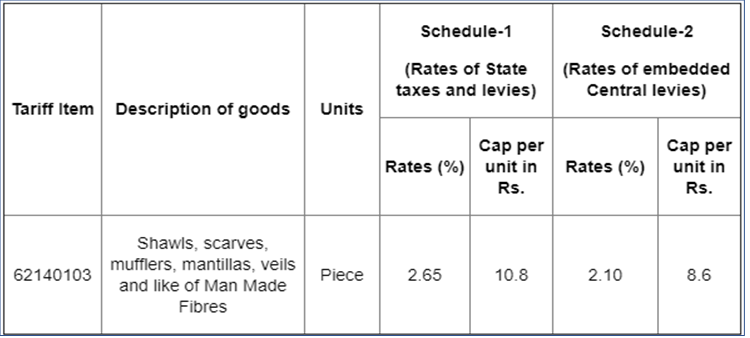

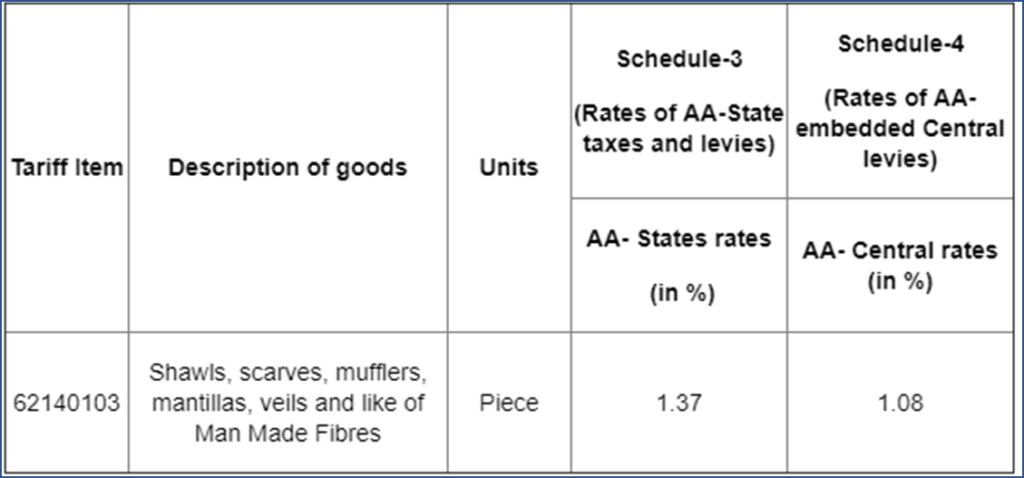

- It must be noted that benefits under old RoSL Scheme were given by the Customs Authority and credited directly to the bank account of the Exporter. However, The benefits under the RoSCTL Scheme are to be given in the form of duty credit scrips similar to scrips issued under the Merchandise Exports from India Scheme (MEIS). The Rates of rebates have been mentioned in four schedules of the notification under which it came into force. These schedules are as follows:

- Schedule-1: It comprises Rates of State taxes and levies.

- Schedule-2: It comprises Rates of Embedded Central levies.

- Schedule-3: It comprises Rates of AA-State taxes and levies.

- Schedule-4: It comprises Rates of AA-Embedded Central levies.

(Note: AA stands for Advance Authorization)

These two schedules are basically for all those exports of apparels where the fabric (which also includes interlining) has been imported duty-free as per the Special Advance Authorization Scheme.

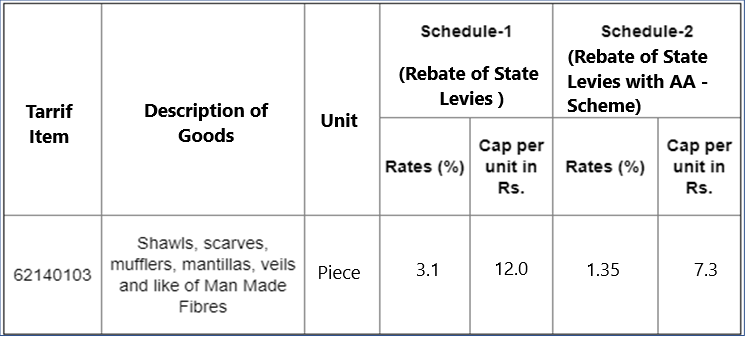

Comparison between Rebates under RoSL and RoSCTL Scheme

The major Difference between the previous Scheme ‘RoSL’ and the new scheme ‘RoSCTL’ is that in RoSL there is no rebate on central taxes and levies.

The below table includes the rate of the old scheme RoSL, compare it with the above table which comprises of the new rate of state and central levies.

As per Image above it can be seen that for Tariff Item 62140103 – Shawls, scarves, mufflers etc. Total Rebate under old RoSL Scheme was 3.1% whereas in the new RoSCTL scheme the total Rebate rate is 2.65 + 2.10 = 4.75%. Similarly, for all the other products rate of rebate have been increased.

Why Afleo?

Afleo team is well versed with the provisions and processes in the revised scheme. The team which is comprised of experts in their own fields will assist you at every step and walk you through the whole process to make your journey easy. We are leading DGFT Consultants in India and can provide services for getting RoSCTL Scheme benefits from DGFT.