What is RoDTEP Scheme?

The RoDTEP (Remission of Duties and Taxes on Export Products) came in effect from 1st January 2021 by replacing the earlier scheme MEIS which was not compliant with WTO norms.

The newly launched RoDTEP Scheme is WTO compliant policy, the exporters can get the refund of all embedded duties/taxes on the export goods at local/state/Central level that were not getting refunded under any of the existing schemes to make the export goods cost-competitive in Global Market.

The benefit rates and the application procedure have been released by the Government and it has raised many questions for the exporters, there is demand from many export companies for seeking clarification on the RoDTEP scheme. Hence in this post, we have come up with the latest news and more clarification on RoDTEP Scheme.

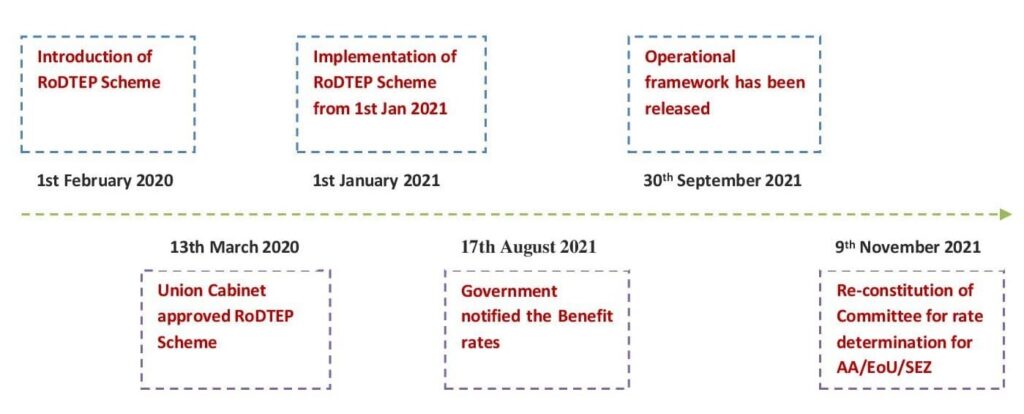

[Please refer to the below image to know when the RoDTEP Scheme was introduced approved and implemented by the Government of India.]

Why RoDTEP scheme was introduced?

The RoDTEP Scheme was introduced in response to international pressure to discontinue its export incentive schemes. The earlier scheme MEIS was not compliant with WTO guidelines and was providing additional benefits of 2% to 7% on the FOB value of eligible exports. A complaint was filed against India at the WTO the USA stating that the benefits given to exporters under the MEIS scheme give undue benefits that are against the WTO norms.

As per the WTO guideline, a country can’t give export subsidies like MEIS if Per capita income is above 1000 US $ and India’s Per Capita Income crossed above 1000 US $ in 2017. India subsequently lost the case at WTO and had to come up with a new WTO compliant scheme to help Indian exporters.

[To Make sure not to lose benefits on any of the past shipments under the MEIS Scheme visit our page by clicking on – “MEIS Scheme“]

RoDTEP Scheme – Latest news

Benefit rates under RoDTEP Scheme

- The rate of benefit has been notified by the DGFT under RoDTEP Scheme for 8555 export products as per Notification No. 19/2015-2020, dated 17th August 2021.

- The RoDTEP Scheme would operate in a budgetary framework for each financial year and a budget of Rs 12,400 Cr has been announced for FY 2021-22, exporters will be given benefits in the range of 0.5 – 4.3 percent with a cap on value per unit on products where it is required.

As per the latest guidelines sectors such as pharmaceuticals, steel, organic and inorganics chemicals have not been included for the benefit under the RoDTEP scheme. As per the commerce secretary, these sectors are performing well which is why they have been kept out for the benefits.

[There are various export categories that are not eligible to avail of the benefits under the RoDTEP Scheme, Please check your products too whether your export goods are eligible or not by visiting our page – RoDTEP Scheme]

Operational Procedure for the RoDTEP Scheme

The scheme was operationalized w.e.f. 01.01.2021, and initially only capturing the RoDTEP scheme in the shipping bills were enabled and the approximate benefit amount was captured as per drawback processing.

- The benefits would be calculated on a value equal to the declared export FOB value of the said goods or up to 1.5 times the market price of the said goods, whichever is less.

- Online application required to be done on ICEGate portal with the help of class 3 Digital signature.

- Prior mandatory registration shall be done on the ICEGate portal, after the registration a RoDTEP Ledger account has to be created on the ICEGate portal where the duty credit scrip would be stored.

- After EGM Filling the scroll would be generated, Scroll generation would be done on FIFO (First in first out) basis w.e.f. 01/01/2021.

- The scroll would be generated in a staggered manner to avoid the overloading of the system since it is pending for a long back.

Re Constitution of RoDTEP Committee

The exporters exporting under Advance Authorization(AA)/EOU/SEZ kept out of the scheme for the benefits. On the demand of industry to include them the Government has reconstituted committee for determination of RoDTEP rates for AA/EOU/SEZ exports.

The new Committee will also prepare the report of recommendations on issues relating to errors/anomalies, with respect to the notified rates for the RoDTEP. The committee will submit the report within 8 months.

The RoDTEP Scheme would operate in a budgetary framework for each financial year, as per the BVR Subhramanyam commerce secretary the scheme would be reviewed regularly items may be included or excluded depending on the situation.

How Afleo can help you to get the RoDTEP License?

We at Afleo Consultants are India’s leading Export Import Consultants, having rich experience of 10+ Years in the domain. We specialize in all the DGFT related matters, Export promotion schemes such as RoDTEP, MEIS, SEIS, Advance License, EPCG, DFIA, AEO certification, Star Export House certification, Duty Drawback, IGST Refund, etc. We comprehend new schemes and all the policies under FTP, realizing the benefits for exporters and importers, turning the policies into a simple form that is easily understandable to our clients.

The RoDTEP Scheme expert would perform the following task for you to avail the benefits under RoDTEP Scheme –

- Guidance would be provided about the declarations that have to be there in shipping bills to avail the benefits under RoDTEP Scheme.

- Assistance would be given in Documentation

- Digital signature Certificate preparation.

- ICEGate registration on the online portal.

- Creation of RoDTEP Credit Ledger account.

- Application on ICEGate to avail of the benefits under RoDTEP.

- Regular follow-up with Custom for the license.

- We complete the entire process in a time-bound manner.

[Not sure whether your company is taking all the Export incentives notified by the Govt? – Refer to our article on “18 latest Export promotion schemes/Export Incentives in India”]

We have a PAN India presence.

We would appreciate your comments and views on the above topic.