Hello Friends,

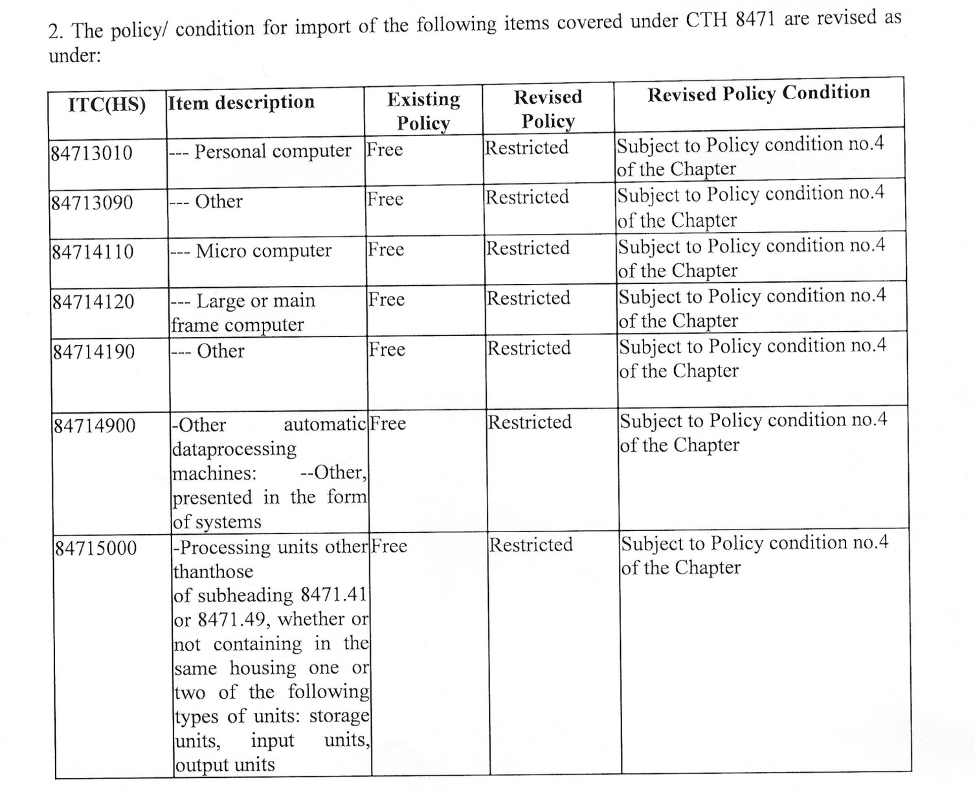

As you may be aware, DGFT has reclassified the import of laptops, tablets, all-in-one personal computers, ultra-small form factor computers, and servers falling under HSN 8741 from “Free” to “Restricted” category. This move has been undertaken to promote domestic manufacturing.

This means that now the import of these products into India will require a “Restricted Import License,” which will be issued by the DGFT Headquarters in New Delhi.

Initially, DGFT had announced this change to take immediate effect, but after significant chaos, it has now been decided to implement it from November 1, 2023. This implies that any imports cleared before October 31 will not require an import license, but shipments arriving from November 1 onwards will need to apply for a Restricted Import License compulsorily.

Exemptions Provided

The following exemptions have been provided for imports:

- Imports of only one unit of laptops, tablets, PCs, etc., through post or courier are exempted from the requirement of a license.

- Exemption is also granted for the import of up to 20 such items per consignment for purposes such as research and development (R&D), testing, benchmarking, evaluation, repair and re-export, and product development. Import without a license is available only for these specified purposes, with the condition that once the purpose is fulfilled, the firm must either destroy the product or re-export it.

- If a product is sent abroad for repair and then re-imported, it will not require a license.

- Additionally, if laptops, tablets, PCs, etc., serve as essential parts of capital goods, they are also permitted for import without a license.

Please refer to the image for a list of products with their 8-digit HSN codes to which these new conditions will apply.

Additional Exemptions as per Latest Notification

DGFT has issued some additional exemption criteria in its latest notification No. 38 dated October 19, 2023:

- Items manufactured within Special Economic Zones (SEZ) can be freely imported into the Domestic Tariff Area (DTA) without the need for a Restricted Import authorization. However, activities such as re-packing, labeling, refurbishing, testing, and calibration will not be considered as manufacturing activities within SEZs.

- Private entities supplying to the Central or State Governments for defense or security purposes are also exempted from procuring a restricted import license.

- Exemption is granted for the repair, return, or replacement of IT hardware previously sold, as well as for the re-import of such items repaired abroad, on a self-certification basis.

- SEZ units, as well as units operating under the Export Oriented Units (EOU), Software Technology Parks of India (STPI), Electronic Hardware Technology Parks (EHTP), and Biotechnology Parks (BTP), are also exempted from import licensing requirements, provided that the import is solely for captive consumption of the units.

- Import of spares, parts, assemblies, sub-assemblies, and components associated with IT hardware devices is also exempted from the requirement of a license.

Watch the below video in HINDI which explains the new process to import Laptops, Tablets, Personal Computers, Servers etc. into India. It will give you an idea about the Documents required, time frame, exemptions provided etc.

Application Process and Documents required

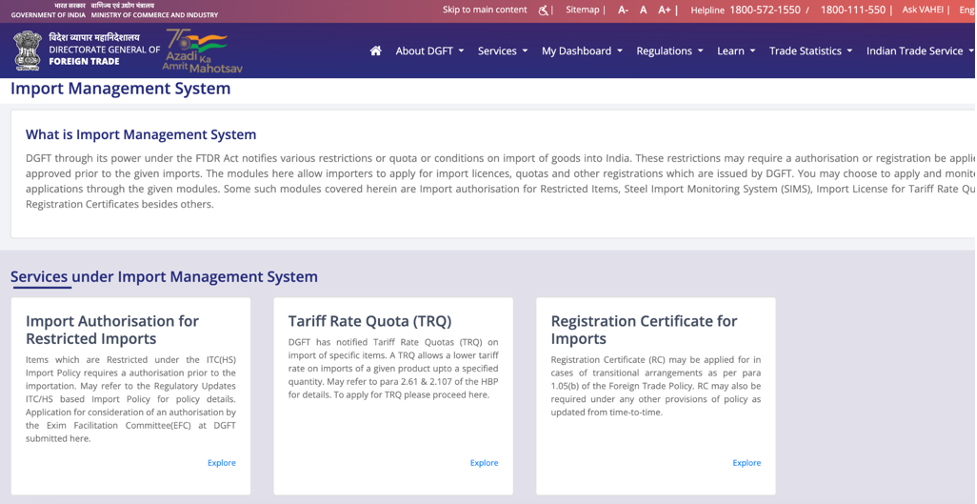

As per the latest Circular No. 06 dated October 19, 2023, the Directorate General of Foreign Trade (DGFT) has introduced the Import Management System for the import of IT hardware.

To initiate the application process, applicants are required to apply online on the DGFT website. According to the provided image, the applicants need to select “Import Authorization for Restricted Imports” under the Import Management System to begin the application process.

When filing the application, you need to provide some basic details:

- Select the item of import and indicate whether it is refurbished or not.

- Specify the country of origin, quantity, and CIF value of the imported item.

- Provide details of items imported under license in the last 3 licensing years.

- Indicate the sales/turnover details for the preceding 3 years.

- Select the port of import and purpose of import, such as for actual use or trading purposes.

It’s important to note that importers can apply for multiple authorizations, and all authorizations will be valid until September 30, 2024. You can modify the quantity of items in your authorization at any given time, but the overall CIF value cannot be changed.

[If You are an Importer and have still not applied for EPR Registration and are confused whether your Company requires it or not, Please check our blog on this, which also explains the entire process of Registration on CPCB Portal – Who needs EPR registration and What is the Process?]

At Afleo Group, we specialize in obtaining Restricted Import Licenses from DGFT, and we can assist you throughout the documentation process and liaison work. Please don’t hesitate to reach out to us for any of your requirements. If you have any doubts or questions, feel free to comment, and our team will be happy to assist you.

Thank you.

Have any doubts? Please fill the form below to get in touch with us.

[ninja_form id=12]