In this blog, we will discuss an important aspect of export trade, which is IGST (Integrated Goods and Services Tax) Refund from Customs. Understanding GST (Goods and Services Tax) refund in export trade is crucial for both new exporters and existing ones.

As you may know, there are two ways to execute an export shipment: “Without payment of Duty, i.e., Under Bond or Letter of Undertaking [LUT]” and the other is “With payment of Duty, i.e., IGST.”

Since exports are zero-rated under GST, both methods entitle you to GST refunds. In the first method, you receive a refund of the unutilized input tax credit (ITC) from the GST Department. In the second method, you are eligible for a refund of the IGST paid amount from the Customs Department.

In this blog, we will focus on the refund process under the second method, i.e., IGST Refund from Customs. We will provide a brief overview of this method, discuss the procedure to obtain IGST Refund, address potential mistakes made by exporters and how to rectify them, explore how to track the IGST Refund status, and finally, discuss a crucial clause related to IGST refund that many exporters may not be aware of. Please read the blog until the end for a comprehensive understanding. Let’s get started!

Export on Payment of Duty – Method 2 – Brief Explanation

As we discussed earlier, there are two types of methods for executing export shipments. The second type is “Export with Payment of Duty, i.e., on Payment of IGST.” Let’s understand this type through an example.

For example, if the cost of your exported goods is 20 lakhs, and IGST is applicable at 18%, which amounts to 3 lakh 60 thousand. When you file your GSTR 3B return, you need to make this payment either by utilizing your accumulated Input Tax Credit (ITC) or in cash.

Once you have paid the IGST of 3 lakh 60 thousand, you are eligible for a refund from Customs, and this refund is directly credited to your bank account. We will discuss this procedure in detail in the next section.

Generally, businesses with higher export supplies compared to domestic supplies accumulate ITC, and these businesses should opt for the second method to ensure that the accumulated ITC is refunded to them in cash directly into their bank account.

How to Claim IGST Refund?

Now, you might have several doubts in your mind regarding where to file the refund claim application, what documents are required, why is the IGST refund coming from Customs instead of the GST Department, etc.

The answer to this is that the IGST refund is processed through an automated system, and there is no need to file a separate application. Your Shipping Bill itself serves as the application for the refund. This is because you are receiving the IGST refund due to the export activity, and once you file the Shipping Bill, it is confirmed that the goods are being exported.

Watch the below video in Hindi in which we will briefly explain the second method, i.e., IGST Refund from Customs. Then, we will discuss the procedure to obtain IGST Refund, possible mistakes made by exporters and how to rectify them, how to track IGST Refund status, and finally, an important clause related to IGST refund that many exporters may not be aware of.

Understanding IGST Refund Mechanism

Now, let’s understand how the automated system for IGST Refund works.

When you execute an export shipment, a Shipping Bill is filed with Customs. All details from the Shipping Bill, such as SB No, Date, Invoice No., Date, Invoice Value, IGST Paid amount, Port code, etc., are saved in the Customs ICEGATE database.

Then, when you enter all the export supply details in GSTR 1/Table 6A, such as SB No, Date, Invoice No., Date, Invoice Value, IGST Paid amount, Port Code, etc., all this information is stored in the GSTN database.

Subsequently, when you file GSTR 3/3B and pay the IGST amount, GSTN transmits this information to the ICEGATE Database. The ICEGATE Database then matches its information with the data received from GSTN at the invoice level. If all the details perfectly match or validate, an IGST Refund Scroll is generated. Otherwise, it shows an error. We will discuss different types of errors and how to solve them in the next section of the blog.

For IGST Refund to be processed automatically, three important conditions must be met:

- The Export Shipping Bill should be filed with Customs.

- The EGM (Export General Manifest) for the Shipping Bill should be filed.

- A valid return in GSTR 3 or 3B should be filed.

[If You are also an Importer and have still not applied for EPR Registration and are confused whether your Company requires it or not, Please check our blog on this, which also explains the entire process of Registration on CPCB Portal – Who needs EPR registration and What is the Process?]

If IGST Refund Pending for some Shipping Bills? – How to Identify & solve errors?

Now, in many cases, exporters either make mistakes in return filing or in filing the Shipping Bill, leading to a mismatch between GSTN Return details and Customs Shipping bill details. Consequently, the refund gets stuck.

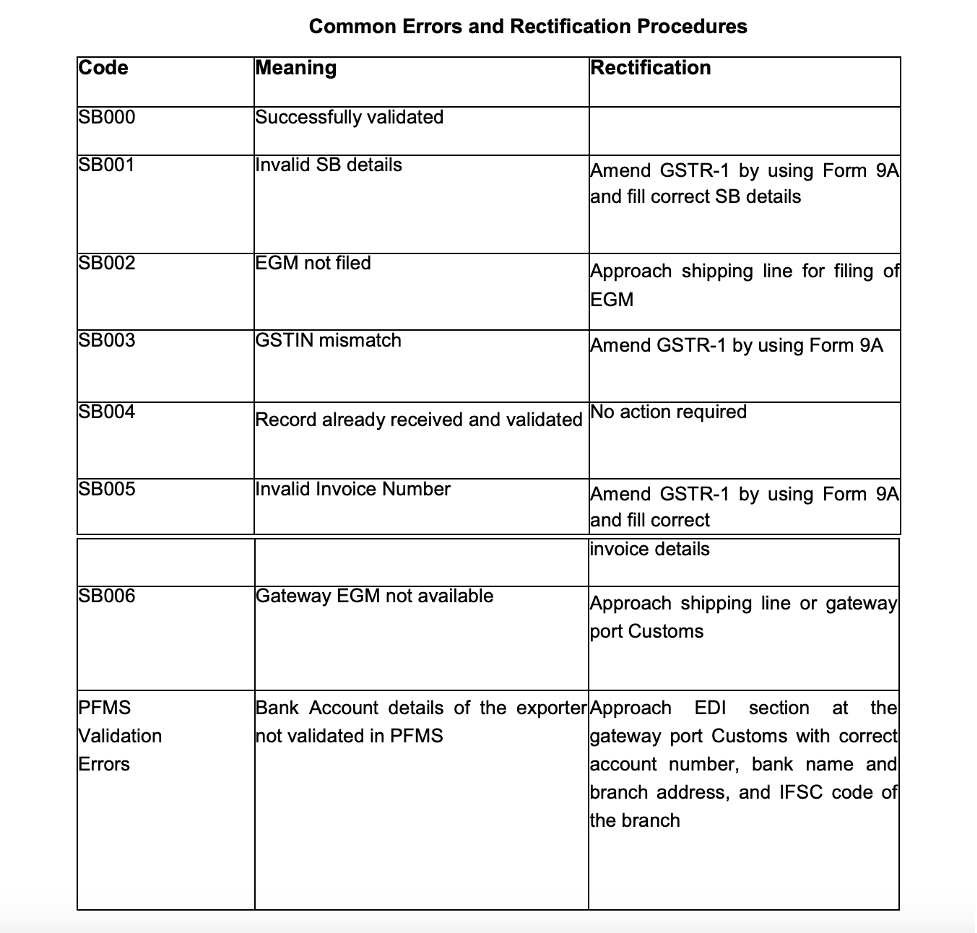

In the image, you can see a list of all error codes, what these errors mean, and how to solve them.

Here, SB000 means all is OK, and you should receive the refund. The most common error is SB005, often caused by exporters using different invoices for GST and Customs purposes due to a lack of knowledge. This results in a mismatch between the Invoice No. transmitted by GSTN and the Invoice No. in Shipping Bills, triggering the SB005 error.

In some cases, even after SB000, the refund might get stuck due to two primary reasons. First, there may be an alert on the IEC in Customs, and second, there may be a PFMS validation error.

I hope the table is easy to understand and take action. In the next section, we will discuss another major reason that may cause the refund to get stuck and how you can resolve it.

Non Transmission of Shipping Bill from GSTN

Another major problem causing the delay in IGST Refund is the non-transmission of Shipping Bill details from GSTN to ICEGATE. In this case, GSTN does not transmit the details, making it impossible for matching and delaying the refund process.

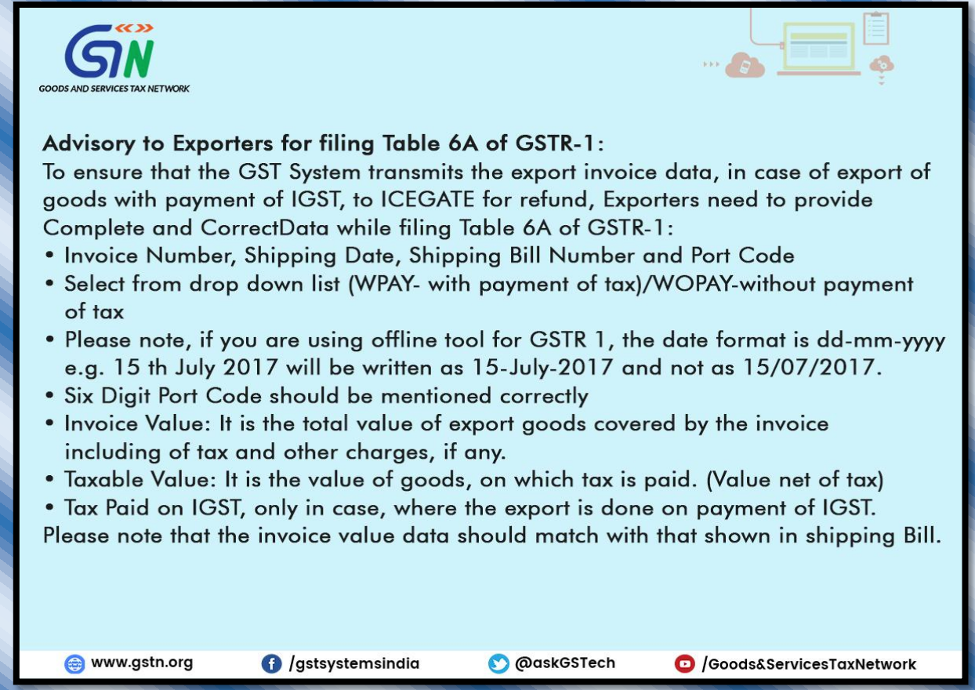

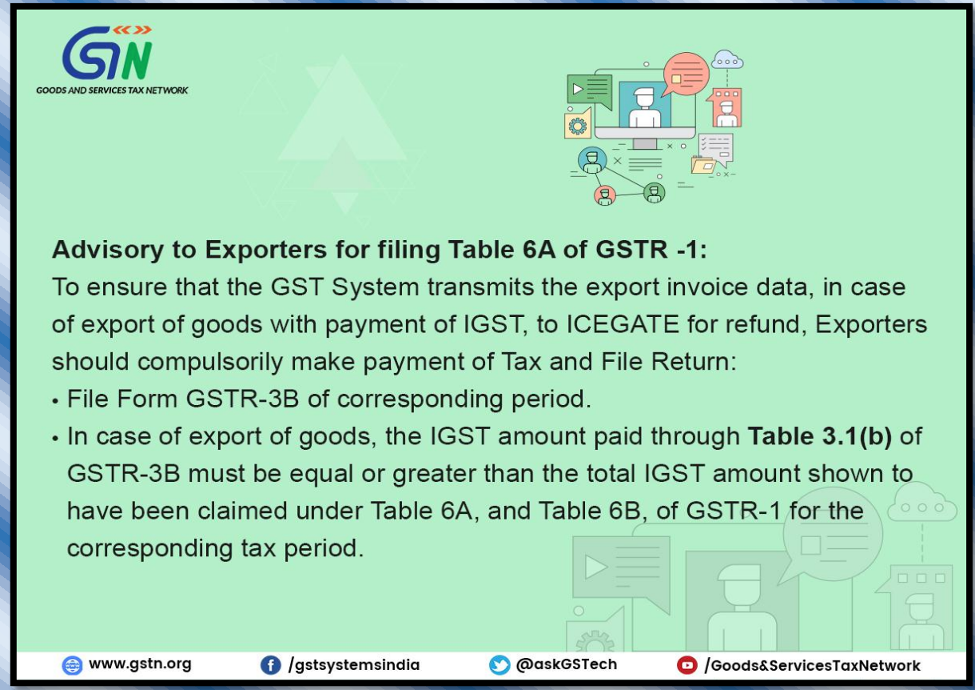

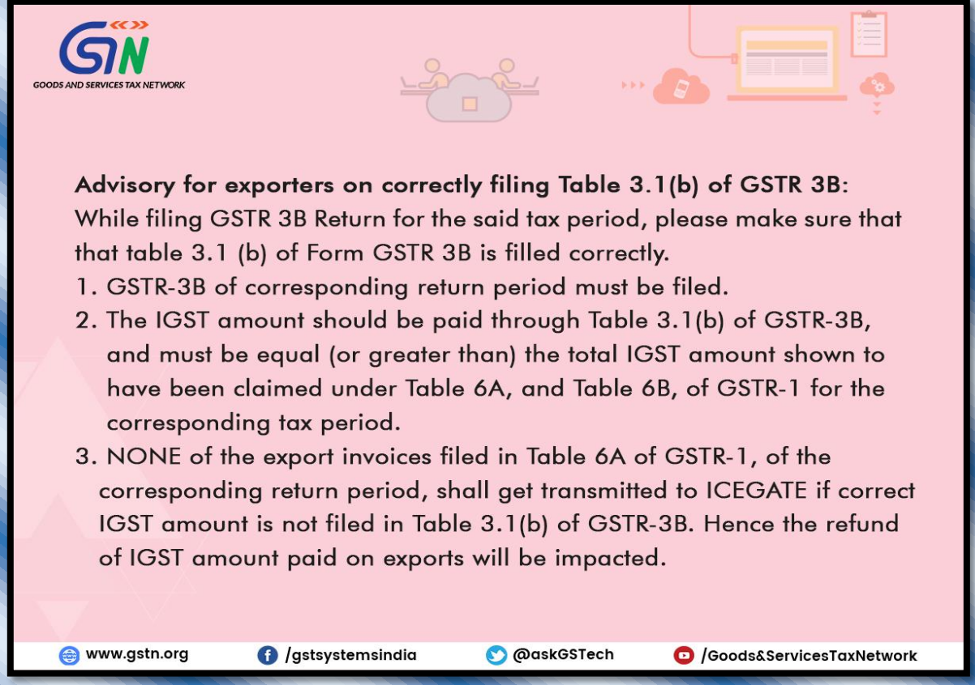

Please note that the reason for non-transmission of shipping bills is solely an error in filing the returns. You can see an advisory on the screen that will guide you in filing the returns correctly.

The most common errors are discrepancies between GSTR1/Table 6A and GSTR 3B details. This could be due to incomplete details for all invoices in Table 6A or not updating all invoices in Table 6A.

Another common error could be that the IGST paid under Table 3.1(b) of GSTR 3B is less than the total IGST claimed in Table 6A of GSTR1 for the same period. The claimed amount cannot exceed the actual IGST paid amount.

Please carefully check all these advisories and ensure there are no mistakes in return filing.

[Not sure whether your company is taking all the Export incentives notified by the Govt? – Refer to our article on “18 latest Export promotion schemes/Export Incentives in India“]

How to Track IGST Refund Status?

So, the next question that may arise is how will you know what errors exist and whether Shipping bill details have been transmitted or not?

The first step is to log in to the ICEGATE website and check the IGST validation status. This will display any errors that exist, and you will need to take necessary actions to resolve those errors.

If your shipping bill details are not displayed on ICEGATE, then you should log in to the GST Portal. Under the Refunds section, select the option “Track status of Invoice Data to be shared with ICEGATE.”

Here, you will find a list of all failed invoices that have not been transmitted from GSTN, along with their reasons. You must take necessary actions to resolve them.

Important Clause for IGST Refund on Export of Goods

CBIC introduced a new sub-rule, i.e., Rule 96B, on March 23, 2020.

According to this rule, if you do not realize foreign currency on an export shipment within the time period prescribed by RBI under FEMA (which was 9 months and, due to COVID, extended to 15 months), then you must repay the IGST amount with interest within 30 days of the expiry of the said period. The interest rate is set at 18% per year.

This is a crucial clause regarding IGST Refund and is also applicable to the refund of unutilized ITC.

Need Help with Exporting Goods and IGST Refunds?

Our digital freight platform makes export logistics and tracking easier, ensuring smoother shipping and better customs handling to help you claim IGST refunds quickly.

Who are We and why choose Us for Pending IGST Refund Cases?

If your refund is stuck for any Shipping Bill, please reach out to us. With our extensive experience in GST and Customs, we have successfully assisted exporters in obtaining IGST refunds for over 5,000+ Shipping Bills, totaling in crores, to date.

Before concluding the blog, I would like to provide some information about Afleo Group. Afleo Group is a specialized company catering to all Export & Import needs. We offer DGFT & Customs Consultancy services, specializing in Freight forwarding, and also engage in the buying/selling of RoDTEP/RoSCTL/DFIA licenses.

We have assisted numerous new exporters/importers in initiating and executing their export/import shipments. Our expertise spans DGFT, Customs, Banking, Logistics, Export Incentives, Legal assistance, and more. Please feel free to contact us directly via phone [+91-9321890890] or email [info@kevalshah74.svaomega.com] for any inquiries.

Have any doubts? Please fill the form below to get in touch with us.

[ninja_form id=12]