To promote the exports in the manufacturing sector Government of India introduced the Export Promotion Capital Goods (EPCG) scheme under foreign trade policy (FTP). Under the EPCG Scheme license is issued to allow duty-free import of capital goods. In turn, the export obligation (EO) is imposed on exporters/manufacturers availing the benefits of the EPCG Scheme.

It is compulsory to fulfill the Export obligation under EPCG License, The DGFT has the right to take action against the license holder who does not fulfill the export obligation in the given period.

[If you are planning to import capital goods/machinery, curious to know all the procedures of issuance and redemption of the license under EPCG Scheme click on – EPCG License Procedure | How to Obtain & Close an EPCG License – Ultimate Guide]

Watch this short introductory video on the EPCG Scheme; which explains the complex concept of EPCG in an easy-to-understand manner. It Explains What is EPCG Scheme and its application process; details about Export obligation & Redemption of EPCG License; the entire summary and step-by-step procedures involved in the EPCG scheme.

Export Obligation under EPCG Scheme

In the EPCG Scheme, the Export Obligation period is of 6 years. The export obligation is equivalent to six times of duty saved on capital goods to be fulfilled in six years from the issuance date of the EPCG License. The export made under Advance Authorisation, DFIA, Drawback, or incentive scheme would be counted for export obligation fulfillment.

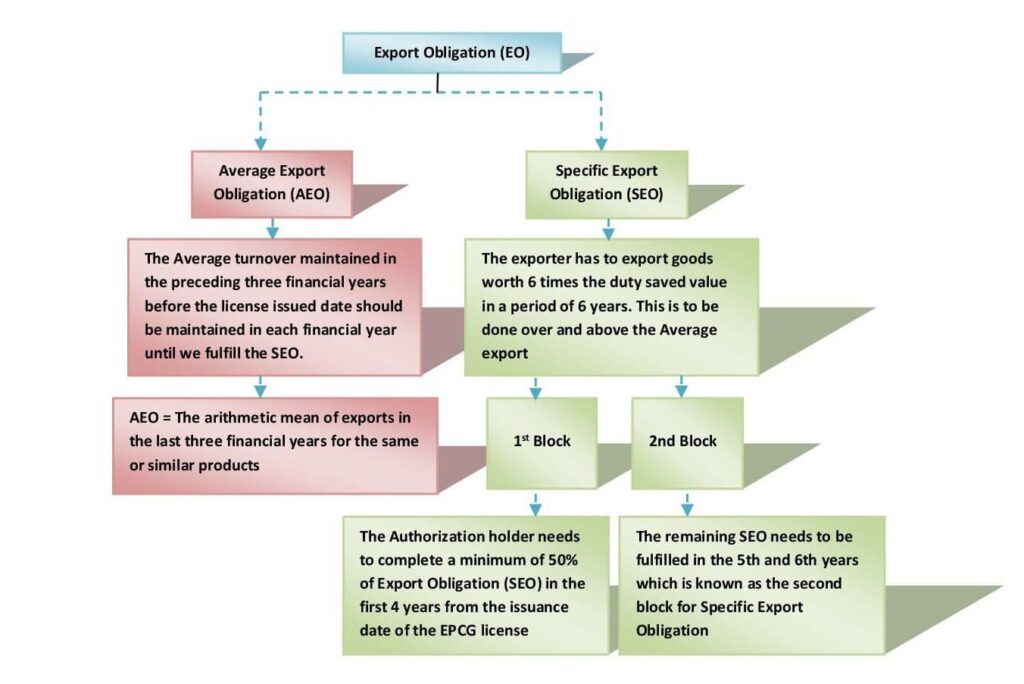

There are two types of export obligation under the EPCG scheme as given in the image, we will understand each one by one below –

Average Export Obligation(AEO)

Under AEO the average turnover of the same & similar goods in the preceding three financial years before the license issued date should be maintained in each financial year until the fulfillment of Specific Export Obligation.

Specific Export Obligation (SEO)

The exporter has to export goods equal to 6 times the duty saved value within 6 years from the issuance date of the EPCG License. The specific export obligation is completed block-wise, 1) 1st block: In the first 4 years after issuance of the license, the exporter has to complete a minimum of 50% of the Export Obligation and 2) 2nd Block: The remaining EO has to be completed in 2nd block i.e. 5th and 6th year from the issuance date of the license.

The EPCG scheme was introduced to increase the exports therefore the Average Export Obligation (AEO) makes sure that the average export is maintained and Specific Export Obligation (SEO) makes sure that there is an increase in exports after machinery installation which was imported under EPCG Scheme.

In some cases, there are possibilities License holders are not able to fulfill the export obligation in the said period due to certain reasons. In this article, we are going to discuss the options available to exporters in case of non-fulfillment of the obligations.

Non-fulfillment of Export Obligation under EPCG Scheme

To fulfill the export obligation (EO) there is six years period given to the license holder, i.e. the export obligation completion has to be monitored for the period of six years. Export obligation fulfillment report has to be submitted to DGFT by 30th April of every year by the license holder. We will understand below the options that are available to the license holder in case of non-fulfillment of EO.

If SEO is not fulfilled

- The EPCG Scheme allows one request for grant of extension in export obligation period of 2 years on payment of composition fee equal to 2% of proportionate duty saved amount.

- If the License holder fails to achieve the export obligation even after the extension of the EO period the company has to pay all the customs duties plus 15% annual interest to customs.

- DGFT may condone a shortfall of up to 5% in SEO arising out of duty saved amount but AEO should be 100%.

If AEO is not fulfilled

- In case if there is a ban on export goods after the issuance of the EPCG License, then the EO is extended automatically according to the ban period. The License holder is not required to maintain AEO for the ban period.

- If the License holder fails to fulfill the AEO in a given period, then he is liable to pay customs duties with 15% interest per year to the customs authority.

- DGFT issues yearly circulars, notifying the list of products for which the global trade has declined by more than 5%. If your HS code of export products falls under the list then you can reduce your AEO by a proportionate % for that year. In such cases, the license holder has to apply for a re-fixation of the Annual Average.

What If AEO is fulfilled but SEO is not?

- If the License holder has fulfilled 100 % AEO but is unable to fulfill SEO, then he is liable to pay proportionate duty saved amount with 15% annual interest.

What If SEO is fulfilled but AEO is not?

- AEO is the first thing that the license holder has to maintain. If AEO is not fulfilled, then DGFT does not check the SEO. They will direct you to pay the entire Duty saved value + Interest.

How Afleo can be the best service provider for EPCG related matters

We at Afleo Consultants are India’s leading Import-Export Consultants, having rich experience of 10+ Years in the same domain. We specialize in all the DGFT and Customs-related matters – Export incentive schemes such as RoDTEP, MEIS, SEIS, Import authorizations such as advance License, EPCG, Status Certification AEO/Star Export House certification, Duty Drawback, etc.

Afleo Consultants is a professional EPCG consulting firm providing the following services under EPCG Scheme –

- Assistance in documentation to get the EPCG License,

- Online application for issuance,

- Modification/Amendment in EPCG License. [For Example addition of export products or services]

- Invalidation / Certificate of supplies for EPCG Authorisation.

- Clubbing of EPCG Authorisation.

- Submission of Installation Certificate to DGFT.

- Application for EOP Extension/Block-wise Extension.

- Handling / Submission of EPCG Committee cases.

- Application for EPCG License redemption

- EPCG License registration at customs/Bond Execution

- Representation with Government authorities for exporters and importers.

- Bond Cancellation at customs

[Not sure whether your company is taking all the Export incentives notified by the Govt? – Refer to our article on “18 latest Export promotion schemes/Export Incentives in India“]

We have a PAN India presence.

We would appreciate your comments and views on the above topic.

[contact-form-7 id=”514″ title=”In Post form”]