On 13th of March 2020, The Union Cabinet of India launched RoDTEP Scheme (Remission of Duties and Taxes on Export Products) to boost exports from the country in International Market and replaced MEIS Scheme which was incompliant with DGFT norms. Under RoDTEP Scheme the exporters would get the refund of embedded Central, State, and local duties/taxes which was not refunded under any of the export schemes.

The finance Ministry of India sets up panel to determine the RoDTEP rates which is headed by the Secretary GK Pillai with other two members in committee Mr Y.G. Parande a former chief of Central Board of Indirect Taxes and Customs (CBIC) and Gautam Ray a former chief Commissioner of Customs and Central Excise.

On 31st December 2020, the Finance Ministry of India issued a Press Release to give a quick start to the RoDTEP Scheme from 1st January 2021. As per the Ministry, notified rates under RoDTEP Scheme irrespective of the date of notification, shall apply with effect from 1st January, 2021 to all eligible exports of goods. Exporters will have to declare intention of availing the scheme for each item in shipping bill or bill of export.

We advise all our clients to declare the intent to claim RoDTEP benefits for all export items with effect from 01/01/2021.

Please give the below instruction to your CHA/Agents.

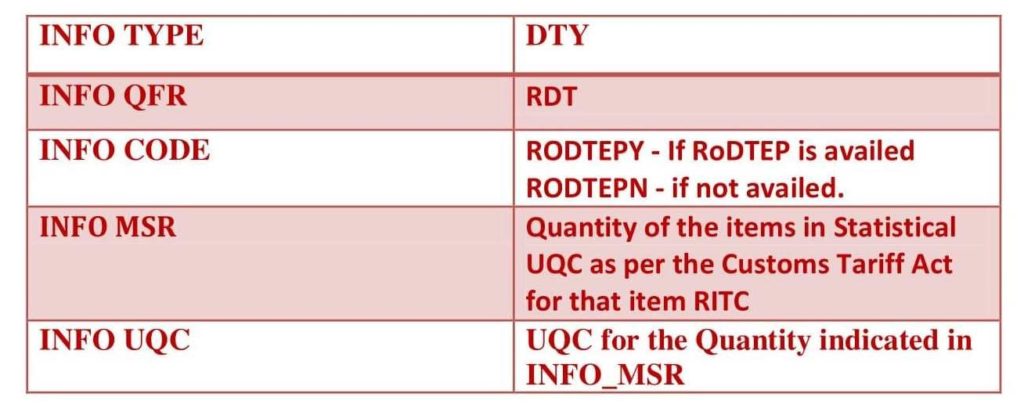

The exporter will have to make the following declarations is the SW_INFO_TYPE Table of the Shipping Bill for each item:

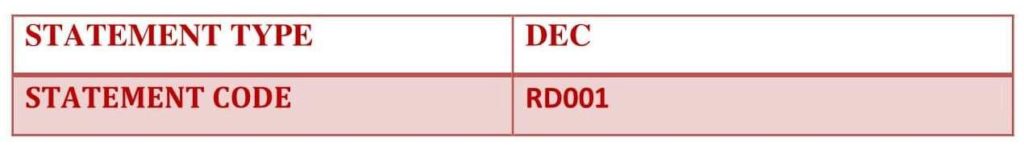

Additionally, for every item where RODTEPY is claimed in INFO CODE, a declaration has to be submitted in the Statement Table of the Shipping Bill as below.

Submission of the above statement code for RoDTEP availed items would indicate that the exporter has made the necessary declaration as enclosed in Annexure while claiming RoDTEP benefit.

Department of Commerce would specify the RoDTEP rates, conditions and exclusions under which benefits can be availed very soon based on the recommendation of a committee. The Final report of Dr. GK Pillai and the team is expected shortly.