In this blog we will understand the main highlights of the new Foreign Trade Policy [FTP] 2023. Union Minister Shri Piyush Goyal launched the New FTP 2023 on 31 March 2023.

The last FTP came in 2015, and now this new FTP is coming almost after 8 years. The main thing about New FTP 2023 is that it has no end date. And this is a dynamic policy, which means the government will keep on adding/deleting the provisions.

The new FTP has a slightly different approach, it is a tax exemption based policy rather than an incentive based policy. You can call this a vision statement. In this, more emphasis has been given on emerging areas such as e-commerce exports, developing districts as export hubs. In this, more focus has been given on collaboration between exporters, states and districts to increase exports.

This policy is very interesting and major steps have been taken to increase exports. The New Foreign Trade Policy [FTP] 2023 has something for every type of exporter, be it a beginner exporter or looking to start exports, e-commerce exporters, well established exporters etc. There is something for everyone. So let’s get started.

Trade Settlement in INR

Instead of doing imports and exports in USD, the government is heavily promoting the Indian Rupee.

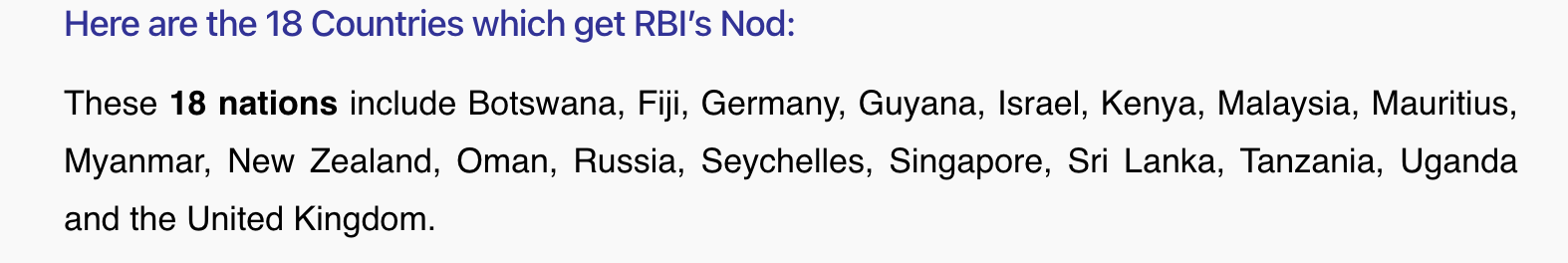

Already 18 different countries have agreed to do INR trade with India. Their list is given in the below image.

(Name of 18 countries who are already trading in Rupees)

The Indian Rupee has already become a global currency. And DGFT, CBIC and RBI have also already issued relevant notifications under this.

Trading in rupee will reduce transaction costs in terms of fees and time as businesses will not have to deal with complex regulations for cross-border transactions for imports and exports.

This will further streamline the FTP process and allow international trade to take place in maximum INR.

Merchanting Trade

You must have seen that Dubai, Singapore have developed themselves as a business center.

A trader sitting in Dubai takes goods from India and delivers them to Africa. In this case the goods do not go to Dubai from India, they go directly to Africa from India. This is called merchanting trade.

Similarly, the vision of the government is to make India as a trading hub, and for this they will streamline its strict rules which are already in place.

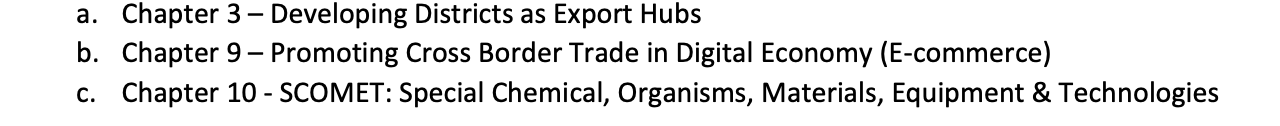

3.Addition of 3 New Chapters & Ease of Doing Business

FTP 2023 has added 3 new chapters, taking the total count of Chapters to 11.

(Addition in Chapter 3)

Chapter 3 – Districts as Export Hubs / Chapter 9 – On E-commerce exports & Chapter 10 on SCOMET.

SCOMET is a very important topic for new exporters as well as for existing exporters. It is important to understand this. We have already made a detailed video on what is meant by SCOMET. Please find it below:

The government has always focused on Ease of Doing Business.

In this policy also the DGFT has given a time frame for speedy approval of various applications. And it has also been told that all EODC/Redemption applications will also be submitted online only.

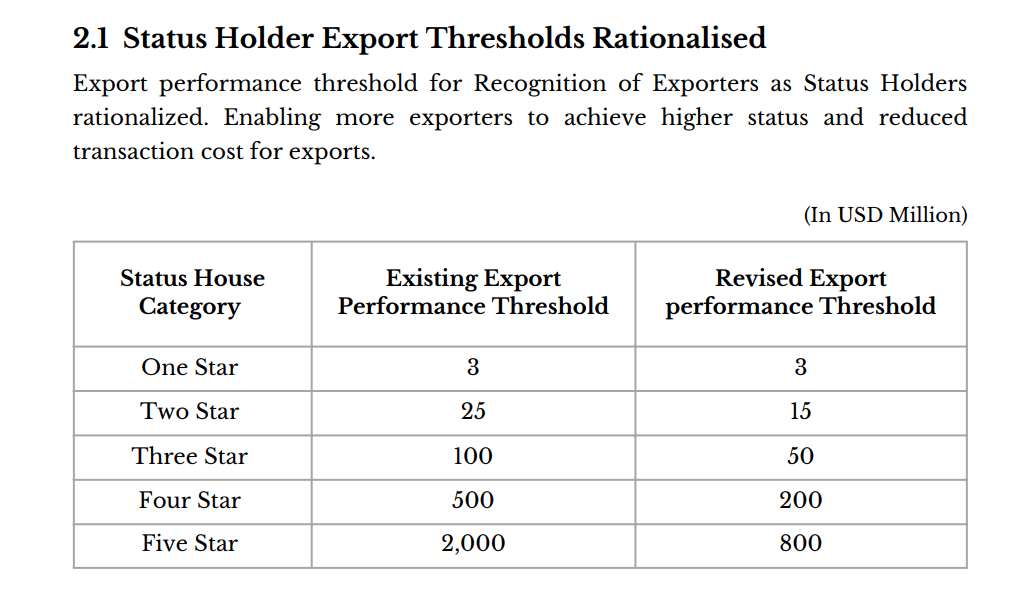

Star Export House

In New FTP 2023 DGFT has reduced the limits of 2 Star and above Export Houses as per image below – This means now more exporters can be eligible for 2 Star Export Houses and can take advantage of it.

(New Eligibility criteria for Star Export House / Status holder)

As per the image you can see that there is no change in the criteria of One Star Export House.

In another update to Star Export House Policy, exporters of fruits and vegetables are made eligible for double weightage status in addition to MSME units. That is, if the exports of Fruits and Vegetable exporters in the last 3 plus current financial years is USD 1.5 million, they can still claim 1 Star Export House.

If you want to understand more about the benefits of Star Export House Certification and it’s process, Please watch the video given below:

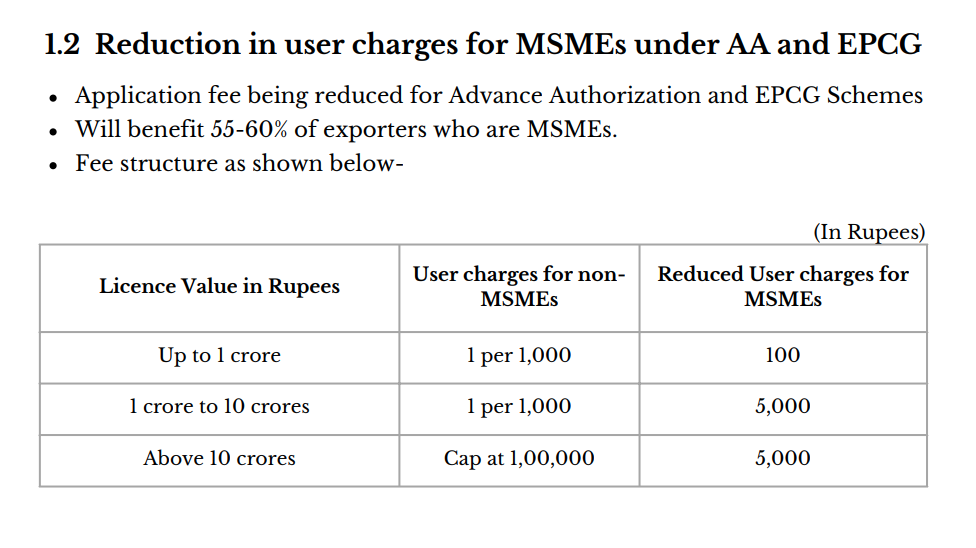

Advance Authorization Scheme Related Changes

In the Advance Authorization Scheme the major change is that the DGFT has reduced the application fees for MSME exporters, as per the image below –

(Reduction in use charges for MSME under AA & EPCG) So you can see that where non-MSMEs will pay 1 lakh, MSMEs will pay only Rs. 5,000 as Govt application fees. And our exporters account for 50 to 60% of MSMEs, so there is a very good saving.

Fresh Advance License, Revalidation, EO Extension applications under DGFT Ease of Doing Business will be processed in 1 to 2 days and EODC/Redemption applications will be completely paperless.

Further, the Special Advance Authorization scheme meant for apparel and made-up has been made eligible as per self-declaration para 4.07, which was earlier available only as per SION.

Under Advance Authorization, Norms fixed by the Delhi Norms Committee after 01.04.2023 will be valid for 3 years.

Smarter Shipping Begins Now – Discover Our Complete Digital Freight Platform.

EPCG Scheme Related Changes

A major change in the EPCG scheme is that now the Post Export EPCG scheme has been removed.

EPCG scheme to promote major upgradation of technology in dairy sector, dairy sector is exempted from annual average maintenance.

Apart from this, the export obligation of many green technology products has been reduced to 75%. (New categories who are eligible for reduced EO under EPCG)

And like advance licenses, the government fee for application of Fresh EPCG License has also been reduced.

District as Export Hubs

The District as Export Hub Scheme has a clear objective to make every district of India an export hub.

Identifying the main specialty products of each district and increasing their export. The whole work will be done in collaboration with the exporters, state level officials, DGFT officials under this scheme.

Every new exporter should visit its official website – https://exporthubs.gov.in. In this every district wise product and their draft action plan has been published.

With the help of this information any individual can start the work of exporting popular products of his/her district

The website also gives the names and contact details of the main district wise DGFT and state level officials in case a person faces any difficulty in exporting.

So overall this is a very effective scheme for new upcoming exporters.

E-commerce Exports

The government is seeing a huge scope in e-commerce exports.

Therefore, in this new FTP 2023 DGFT has announced that e-commerce exporters will also get all the export benefits that a normal exporter gets.

Export benefits like RoDTEP scheme, RoSCTL scheme, Advance License, EPCG, DFIA etc. etc.

For this, DGFT/CBIC/Post will prepare the necessary IT platform in the next 6 months.

In addition, the government will significantly simplify the procedures for e-commerce exports. Necessary support and training will be given to small exporters.

Apart from this, a major change has been made that the limit of export parcels by courier has been increased by the government to 10, 00,000 per consignment. And it has also been said that if needed, it will be increased further or else this limit will be removed in future.

So the government has started the process of taking India’s total e-commerce exports to [400-500] billion USD.

Amnesty Scheme

This amnesty scheme is a one-time solution for cases of default in export obligation by Advance and EPCG license holders. This means that you had taken the benefit of duty free import under one of your advance licenses or EPCG license and you are no longer fulfilling the required export obligation, then with the help of this scheme you will have to pay less duty + interest and you can come out of this scheme..

Please watch below our detailed video on this topic.

Who are We

We at Afleo Group are experts in Customs/DGFT/Freight Forwarding and have an experience of over 10+ years.

So any of your work pertaining to above schemes, you can contact us and our team would be happy to help you.

Write in the comments your views about this new FTP 2023, its positive and negative points.

Thank you so much.

![New Foreign Trade Policy [FTP] 2023](https://afleo.com/wp-content/uploads/2023/04/New-Foreign-Trade-Policy-FTP-2023-Important-Highlights.jpg)