Numbers of taxes were levied by Government such as Central Excise Duty, VAT, Purchase Tax, Service Tax, Central Sales Tax etc. making Indirect Tax system complex. To simplify this system, the Goods and Services Tax (GST) was implemented by Government. GST is an indirect, value-added tax levied on goods and services. GST is paid by end consumer of goods and services, thus it is a consumption based tax. To understand exports under GST, first we need to understand the concept of Exports, Bond and Letter of Undertaking.

What is Export?

Exports of goods and services here, means sending of goods and services produced in India to another country. There are two types of Exporters:

- Merchant Exporter – One who buys goods from another manufacturer and exports.

- Manufacturer Exporter – One who manufactures goods and then exports.

Export directly affects economic stability in the country. Government of India promotes exports in our country in various ways.

Export under GST

Under GST, Exports and Imports are treated as inter-state supply and are governed under IGST (Integrated Goods & Services Tax) Act. As per the provisions of IGST, exporters of goods and services will be treated as “zero rated supplies” i.e., they are taxable, but the rate of tax is nil and they can also avail input tax credit. And following are the two options available to registered exporters while paying Tax:

- Export goods and services under LUT or bond and no need to pay IGST. (Supply meant for export under bond without payment of IGST)

- Export goods and services with the payment of IGST as usual domestic trade rates and claim refund later on.

Earlier exporters have to pay tax on purchase of Raw Materials or Finished Goods and also at the time of export. So, to remove the burden of double tax, government came up with Letter of Undertaking LUT/Bond for Exports under GST.

Here comes another question: what is LUT and Bond?

To ensure the government that, we will comply with all the laws, rules and regulations for export, exporters need to furnish an undertaking which is known as LUT/Bond. Form GST RFD-11 is the prescribed format in which LUT or Bond is filled along with other relevant documents.

Who can avail the facility of LUT?

According to Latest Notification of Government of India, any Registered Exporter can apply for Letter of Undertaking. Now there is no need to give any Bank Guarantee for LUT/Bond. Irrespective of past Turnover any registered Exporter is eligible for Letter of Undertaking.

However Any person who has been prosecuted for tax evasion of Rs. 2.5 crore or more is not eligible to furnish LUT. These LUTs are valid for one financial year. Initially when GST was implemented, either LUT or bond could be furnished. But according to the latest notification, Bank Guarantee is not required, so Bonds are no more valid and only LUTs can be furnished by exporters.

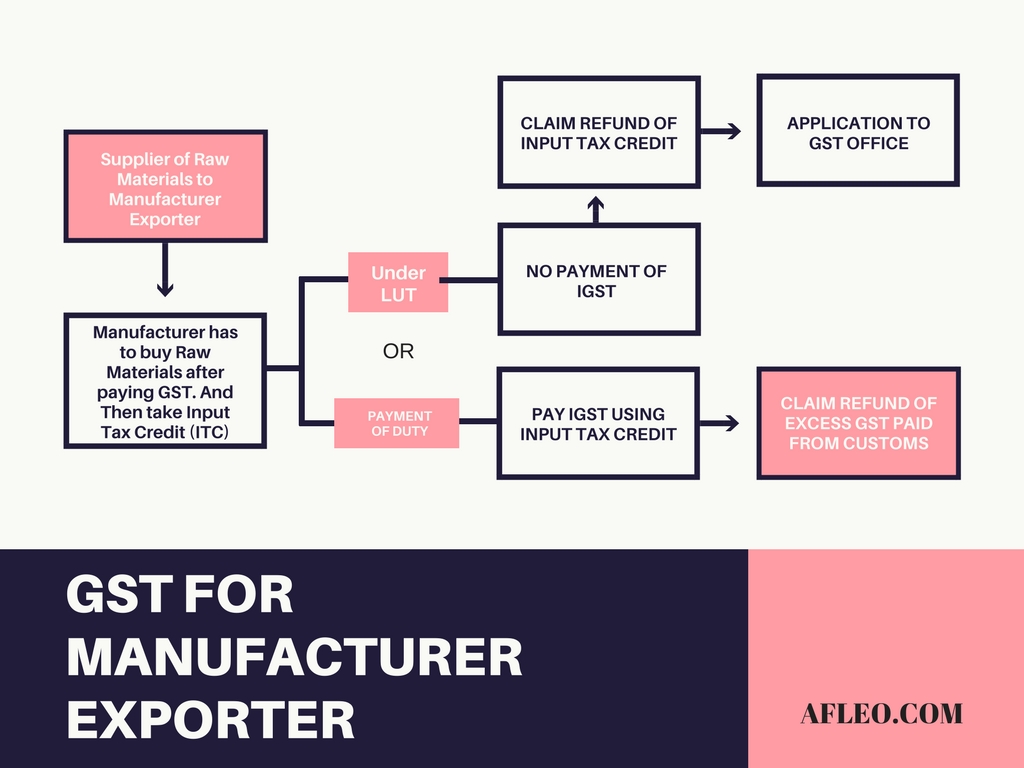

Tax Mechanism for Manufacturer Exporter under GST:

In above Image, it can be seen that manufacturer Exporter has to compulsorily buy Raw materials on payment of GST. Since GST is payable on every supply, Exporter also has to pay IGST at the time of Export. There are two options here, one is to clear goods or services under LUT without payment of IGST and other is to Clear Goods on Payment of IGST and then Claim Refund.

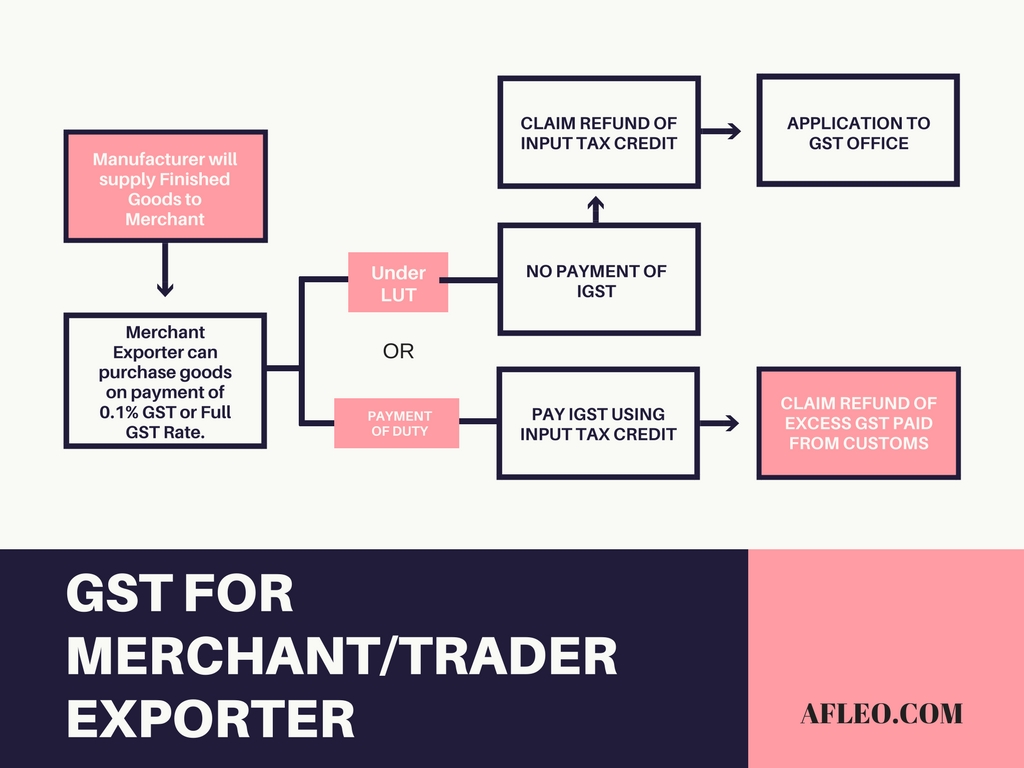

Tax Mechanism for Merchant Exporter/Trader under GST:

In above Image, it can be seen that Merchant Exporter can buy finished goods on 0.1% GST or full actual rate of GST. Since GST is payable on every supply, Exporter also has to pay IGST at the time of Export. There are two options here, one is to export under Bond / LUT without payment of IGST and other is to Clear Goods on Payment of IGST and then Claim Refund. If Merchant Exporter buys Finished Goods at 0.1% GST, then it is compulsory to Export under LUT. Therefore there is no Tax Burden for Merchant Exporter since it buys goods at nominal GST(0.1%) and Exports under LUT without payment of GST. This came as a huge relief to Traders. However it should also be noted that Merchant Exporter can also buy Goods and Full GST Rate instead of 0.1%

Procedure to submit LUT:

According to modifications in the procedure, you need to submit an online application in Form GST RFD-11 and there is no need to physically submit documents to the jurisdictional office. This process is now simplified, giving transparency in the entire process of exports.

What are the Documents Required for Letter of Undertaking:

As the whole procedure is online now, scanned copies of following documents need to be submitted along with the application:

- Undertaking of Non-prosecution as per CGST Notification No. 16/2017

- UT – 1 Bond on Stamp Paper

- GST Registration Certificate

- IEC Certificate

- Copy of PAN Card & Aadhaar Card of Proprietor/ Partners/ Directors.

Now the question arises which is better: Submit LUT or Pay GST and claim refund?

As the coin has two sides, in the same way every method has its pros and cons. If you go for paying GST and then claiming refund, from date of payment to date of refund your money will be blocked. Thus, you will need additional cash in hand, negatively affecting your cash flows. You need to file required forms every month to claim refunds. On the other hand, if you choose to submit LUT, than you will have to submit LUT once in a year because of its validity. There are no additional compliance like forms or documents needed to be furnished along with LUT. Also, you do not need to pay any money for submitting LUT. In a nutshell, if an exporter chooses to submit LUT he would benefit as he need not file documents every month and keep the money in loop.

While you keep increasing your business in international market, we will fulfill all the necessary documentations required for the same. You just have to submit your documents to us via email and we will take care of the rest. We will file LUT on your behalf for your export business and keep you updated about the same. Additionally, we will help you avail your Input Tax Credit too. So, see your business expand and forget the complications of filing an LUT, we will sort them out for you!

We at AFLEO would love to help you, for further details or in case of any queries regarding the same, Please fill below form.

[contact-form-7 id=”514″ title=”In Post form”]

Our presence on Youtube

[youtube-feed feed=1]