Worrying about Provident Fund and doesn't have an inch of an idea about the withdrawal? Here is where you can learn "All About PF Withdrawal".

To start with, let's take an overview on Provident Fund (PF) in general.

What is Provident Fund (PF) or Employee Provident Fund (EPF)?

Provident Fund also known as EPF, is an investment done by the employers and employees to gain benefits only after retirement, disability, sickness or being unemployed. It basically helps employees to save a certain amount of their salary for their future use.

Now that we know what PF exactly is, let's get a little deeper and focus on the expression "PF Withdrawal" and “PF Withdrawal Status”.

The Term PF Withdrawal

Provident Fund Withdrawal also called as Provident Fund Scheme Withdrawal is the right of an employee to take away his fund during necessity. PF cannot be withdrawn unless you complete 5 years of service. Once the period is complete, it’s on the account holder to withdraw the amount or expand it for more years. In case if you get unemployed before 5 years of maturity, still you can withdraw the whole amount as the working period is not applicable for the withdrawal during unemployment.

Example: Raj was a new employee in the company and invested in the PF from his first month salary itself. The given period for his maturity was 5 years but he left the company within 2 years and since the past 2 months, he is unemployed. He could still withdraw his fund as the given period (5years) does not apply at the time of unemployment.

Do's (You can withdraw the amount when)

- You are in need of an immediate fund during employment.

- You retire from the employment.

- You remain unemployed for a period of 2 months or more.

According to the recent update by EPFO, the Government has decreased the minimum span of withdrawal from 2 months to 1 month. The member can withdraw 75% of its total fund if he is unemployed for a month and he can withdraw the remaining 25% after 2 months of unemployment.

Don'ts (You cannot withdraw the amount when)

- The period between switching from one job to the other, if you tend to withdraw the amount, it will be against the PF withdrawal rules.

[Also read our article on EPFO- 10 things you should know about EPF]

Types of PF Withdrawal

There are different types of EPF withdrawal, they are as follows:

1.Final Settlement

The person here incurs all of the funds which were available in his account including rate of interest and thus, the account gets settled or closed.

2.Partial Withdrawal

When the fund is withdrawn by a person in the middle of the employment, for the purpose such as repayment of loan, marriage, purchase or construction of house, fund before retirement, etc.

The above reasons could be classified further as follows:

Marriage

- Limit of withdrawal- 50% can be withdrawn from the employees’ contribution with interest.

- No. of Service Years- 7 years from joining.

- Other Conditions- If only marriage of self/son/daughter/brother/sister.

Education

- Limit of withdrawal- 50% can be withdrawn from the employees’ contribution.

- No. of Service Years- 7 years from joining.

- Other Conditions- For himself or for children after class 10.

Purchase of Land/House and Construction

- Limit of withdrawal- 24 month’s basic wages, DA (dearness allowance), a living adjustment allowance paid to government employees.

- No. of Service Years- 3 years from joining (if you are purchasing from the builder directly, then service period is considered as 5 years).

- Other Conditions- Property should be in the name of employee/spouse/ both jointly.

Home loan repayment

- Limit of withdrawal- 36 month’s basic wages, DA with interest.

- No. of Service Years- 10 years from joining.

- Other Conditions- i) Property shall be registered in the name of employee/spouse/both jointly. ii) Documents required for home loan should be furnished as demanded by EPFO. iii) The fund in the member’s PF account should be more than ₹20,000 including interest.

Before Retirement

- Limit- 90% of the balance acquired with interest.

- No. of Service Years- As per amendment, once he reaches 57 years.

- Other Conditions- Only for himself.

PF withdrawal process

You might be unsure about how to withdraw pf? Here is the PF withdrawal procedure mentioned to guide you.

1.Submission via Physical Application

Withdrawing even when not having an Aadhaar Number

You can download and fill the Composite Claim Form (Non-Aadhaar), with the attestation of employer if you wish to withdraw and do not have an Aadhaar number. If your total service period is less than 5 years, you may require Permanent Account Number (PAN). You also need to attach dual copy of the Form 15G/15H, if possible and you can mention only the PF account number if UAN does not exist.

Withdrawing with Aadhaar Card Number

The Composite Claim Form can be downloaded, filled selecting (Aadhaar) and submitted to the EPFO office without employer’s attestation. The form should be submitted attaching a cancelled cheque with it. The expected payment will be directly sent to your account.

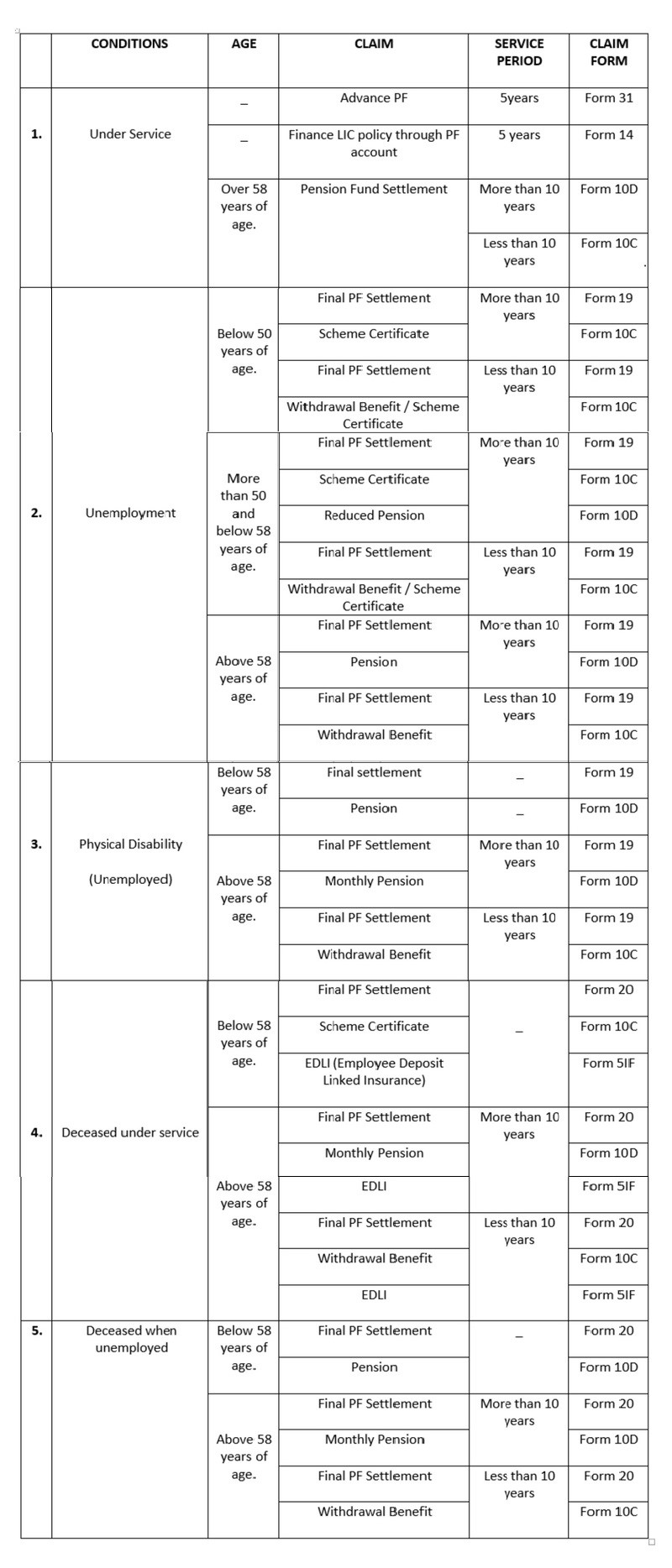

Withdrawal Forms

The physical withdrawal process is difficult as compared to the online process. Online process is more simplified and it provides you with all of your details required whereas, physical process asks you to mention your options by yourself. The claim form should be submitted based on the different criteria, below are some of the PF withdrawal forms should consider while withdrawing through physical process:

2.Submission via Online Application

Recently, EPFO has come up with a beneficial process of online PF withdrawal for the people who wish to do their transactions on internet. It is time saving, you need not require to visit the office and conduct the process.

Make sure you meet the following conditions if you are applying for EPF withdrawal online.

- The mobile phone should be in working condition in which the UAN (Universal Account Number) is activated.

- UAN shall be linked with the PAN, Aadhar and Bank details (KYC) with IFSC code.

If all this is done successfully then the attestation of the employer is to be carried.

Steps! How to withdraw PF online with UAN.

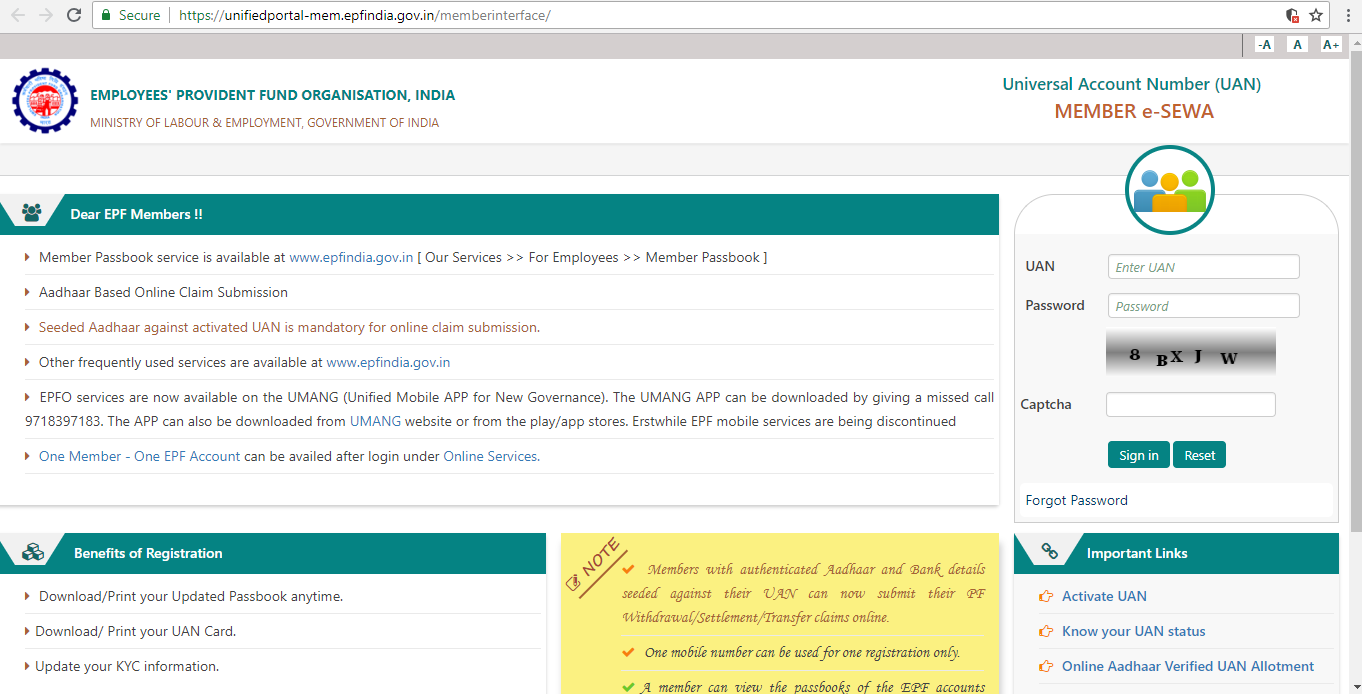

STEP 1: Visit the UAN portal by clicking here.

STEP 2: Login with the UAN, password and finally enter the CAPTCHA.

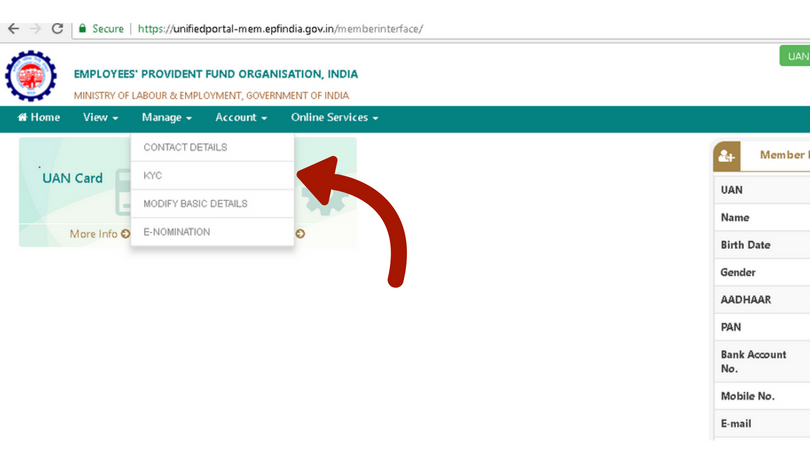

STEP 3: Check for the "Manage" tab above, click on it and then select the option "KYC" to check you details PAN, Aadhaar, Bank details.

STEP 4: Once your details are correct, click on the "Online Services" tab and select "Claim".

STEP 5: The Claim page will show you all of your details, move on and click on the "Proceed for Online Claim Form" to submit.

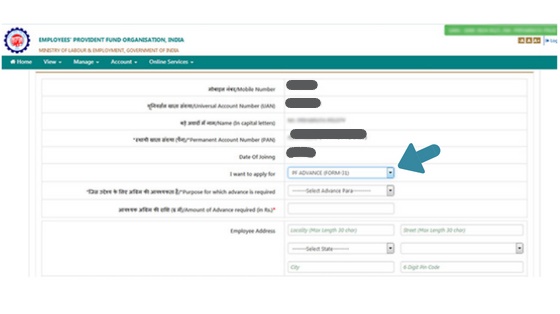

STEP 6: Here, select the claim you want to i.e. full settlement, partial withdrawal (loan/advance), pension withdrawal; under the column " I want to apply for". If the person is not eligible for any above services then that particular option won’t be available.

The claim is forwarded for the approval of the employer and gets credited within 10 days to your account, once it is approved.

Difficulties in PF Withdrawal

- If you leave the company and after few years the company gets closed but you still haven't withdrawn your PF, it might be a huge loss as there are chances of your PF generated in lacs.

- If you have submitted your documents to the previous employer for PF withdrawal and the employer doesn't go through your submitted form, then that might be a problem because the employer is not starting the withdrawal procedure for you.

These are the basic terms you should consider regarding the PF withdrawal and withdraw accordingly. Hope this content was informative and useful to you.

Cheerful Reading!

If any queries, feel free to contact us.

![New Foreign Trade Policy [FTP] 2023](https://afleo.com/wp-content/uploads/2023/04/New-Foreign-Trade-Policy-FTP-2023-Important-Highlights-315x242.jpg)