You receive and send a lot of electronic documents on a regular basis like e-mails, text files, and spreadsheets. But how do you ensure its authenticity? One needs to be sure that the documents they receive are from a trusted source and are not altered in any manner. There must be some form of assurance of the identity of the sender and origin of the document. So, how do you know a document is genuine? With the help of a Digital Signature Certificate! Yes! You heard it right.

What is a Digital Signature Certificate (DSC)?

A Digital Signature Certificate or DSC is an electronic document with a digital signature, its public key and other details such as the name and E-mail address of the sender along with the date on which the DSC was issued and the name of the Certifying Authority.

Note: Certifying Authorities are the entities that issue Digital Certificates for validation of the users electronically. The Controller of Certifying Authority (CCA) has the responsibility of authorizing entities with the task of issuing Digital Signature Certificates. Under Section 17 of the IT Act, the Central Government appoints the CCA.

What are the types of Digital Signature Certificates in India?

The Digital Signature Certificates are used by individuals and different companies to maintain the privacy and security of the information they exchange electronically. However, there are different types of digital signature certificates required for different type of purposes. Let’s take a look at what are they:

- Class I Digital Certificate – These certificates are used to validate the name and contact details like the e-mail address of the users. Such digital signatures are usually issued to private subscribers.

- Class II Digital Certificate – These certificates are issued to individuals & people in different companies who hold the authority of e-filing for Income Tax Returns, Registrar of Companies (ROC) and GST Returns, etc.

- Class III Digital Certificate – These are mandatory for people and organizations who are involved in online auctions and tenders. These digital signature certificates have the highest level of encryption. To issue them, a person has to be physically present before the Certifying Authorities.

- DGFT Digital Certificate – This class of DSC is issued by people who run export and import business. It is used when they fill out applications for license approval. Depending upon the purpose of your work and the kind of information you want to exchange online, choose the DSC you need.

[Goods and Services Tax (GST) is the latest addition to Indian Tax Laws. Read our article on "GST Registration Process – Step by Step Guide" to know more about GST and its compliance]

Apart from classes, the DSCs can be classified according to the following categories as well.

- Signature Certificate – This kind of DSC is required for signing a document only. You would need it while Income Tax filing, GST Returns, etc.

- Encryption Certificate – Like a Class III DSC, you need this kind while involving yourself in e-tendering. While you submit different documents on the tender portals etc., you will need an Encryption Certificate.

- Signature & Encryption Certificate – Combining the best aspects of the two kinds, this type of DSC involves the features of both the signature and encryption certificates.

Bust a Myth: It is a myth that a person cannot issue two Digital Signature Certificates. The truth is an individual can issue two of them, one for personal use and the other for official purposes.

So, don’t you think the digital certificates have entirely revolutionized the way you exchange information online? You have to create digital signature online with the help of the trusted authorities and exchange all kinds of information without worrying about their security.

All you need to do is find a suitable and trusted provider who can create digital signature online for you.

How to apply for a Digital Signature Certificate?

In order to obtain a Digital Signature Certificate, you need to register for it, and there are certain documents required for doing so like a passport size photo, Photo ID proof and Photo Address Proof, etc. If you want a digital signature certificate for an organization, you would need the bank details & Registration Certificate of the same as well.

[PAN (Permanent Account Number) Card is one of the important legal documents of an Indian Citizen. Read our article on "How to Apply for PAN Card Online | Get E-PAN Card within Minutes" to know more]

- First off, you would need to fill out the digital signature application form and provide details like the class of DSC you need, the validity period, the type of DSC, name, address, identity proof and declaration, etc. An attesting officer must attest your ID proof and address proof.

- After filling in all the details, you would need to attach your passport size photo and sign under the declaration.

- Once you’re done, you must keep a copy of the duly filled in digital signature application form.

- You also need to pay a fee to the authority providing you the service of creating digital signatures online. The amount you need to pay differs from one entity to the other.

After following all these steps, the digital signature certificate provider will submit all your documents to the Certifying Authorities. After a few working days, you will have your registered DSC with you.

Note: The Digital Signature Certificates have a validity period which is usually 1 or 2 years. While applying for a DSC, you can choose whether you want it for a year or two. Once the validity expires, you can renew it as well.

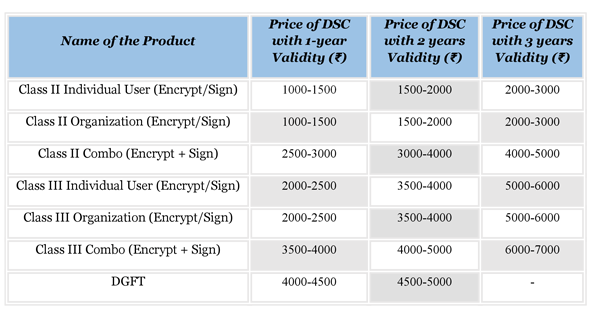

What is the Cost structure of Digital Signature Certificates?

We present you an outline of the cost structure of the DSCs below:

The prices of the digital signature certificates mentioned here are exclusive of the token amount. Also, you need to remember a GST of 18% is applicable to the costs of the digital certificates.

[As a new entrepreneur, giving a legal identity to your business can be difficult. Read our article on How to Register a Company in India? to know more about various types of companies and their registration process in India]

Note: Digital Signatures are legal in India according to Section 3 of IT Act, 2000.

So, to validate your identity online, get yourself a digital signature and carry on your business as smoothly as you want. Keep your information private and secured and enjoy all the perks of having a Digital Signature Certificate.

To know more about Digital Signature Certificate (DSC) in India and its procedure, feel free to approach our experts by filling the form given below or click here.

![New Foreign Trade Policy [FTP] 2023](https://afleo.com/wp-content/uploads/2023/04/New-Foreign-Trade-Policy-FTP-2023-Important-Highlights-315x242.jpg)

I’m impressed, I need to say. Actually hardly ever do I encounter a weblog that’s both educative and entertaining, and let me let you know, you’ve got hit the nail on the head. Your thought is outstanding; the problem is one thing that not sufficient persons are talking intelligently about. I’m very pleased that I stumbled across this in my search for one thing referring to this.

Some truly good information, Sword lily I noticed this.

I really like your blog.. very nice colors & theme. Did you make this website yourself or did you hire someone to do it for you? Plz answer back as I’m looking to create my own blog and would like to find out where u got this from. thank you

Hi! This is my first visit to your blog! We are a collection of volunteers and starting a new initiative in a community in the same niche. Your blog provided us beneficial information to work on. You have done a extraordinary job!

I am now not sure the place you’re getting your information, but great topic. I needs to spend a while learning more or working out more. Thank you for wonderful information I used to be searching for this info for my mission.

There are some attention-grabbing closing dates on this article however I don’t know if I see all of them center to heart. There is some validity but I’ll take maintain opinion till I look into it further. Good article , thanks and we wish more! Added to FeedBurner as properly

I know this if off topic but I’m looking into starting my own blog and was curious what all is needed to get setup? I’m assuming having a blog like yours would cost a pretty penny? I’m not very internet savvy so I’m not 100 sure. Any recommendations or advice would be greatly appreciated. Many thanks

As I web-site possessor I believe the content material here is rattling wonderful , appreciate it for your hard work. You should keep it up forever! Good Luck.

Enjoyed reading through this, very good stuff, thanks. “I will do my best. That is all I can do. I ask for your help-and God’s.” by Lyndon B. Johnson.

I will right away grab your rss as I can’t find your email subscription link or newsletter service. Do you have any? Please let me know in order that I could subscribe. Thanks.

Great post. I am facing a couple of these problems.

Great write-up, I’m normal visitor of one’s web site, maintain up the excellent operate, and It’s going to be a regular visitor for a lengthy time.

Hello there, just became alert to your blog through Google, and found that it’s really informative. I’m gonna watch out for brussels. I will appreciate if you continue this in future. Numerous people will be benefited from your writing. Cheers!

As a Newbie, I am always browsing online for articles that can aid me. Thank you

I¦ve learn some good stuff here. Certainly price bookmarking for revisiting. I wonder how a lot attempt you place to make any such excellent informative web site.

I’m just commenting to make you be aware of of the notable experience my cousin’s princess experienced browsing your web site. She came to find many things, most notably what it is like to have an awesome helping heart to let the others clearly know precisely specified complex issues. You truly did more than visitors’ expected results. I appreciate you for supplying such valuable, healthy, revealing and also easy thoughts on the topic to Evelyn.

This really answered my problem, thank you!

Fantastic goods from you, man. I’ve understand your stuff previous to and you’re just extremely excellent. I really like what you have acquired here, certainly like what you are saying and the way in which you say it. You make it enjoyable and you still care for to keep it wise. I cant wait to read much more from you. This is really a wonderful website.

I like this web site so much, saved to fav.

Hey very cool website!! Guy .. Excellent .. Wonderful .. I will bookmark your web site and take the feeds additionally?KI am satisfied to search out a lot of helpful info here within the submit, we want develop extra techniques in this regard, thank you for sharing. . . . . .

Thanks for every other informative website. Where else may just I get that kind of information written in such an ideal means? I’ve a undertaking that I’m just now running on, and I’ve been at the glance out for such information.