Starting a business in India and came across the terms that you never knew existed. Here is an article to explain in brief what those short forms denote and what their importance is.

Permanent Account Number (PAN)

Permanent Account Number (PAN) issued by Income tax department under the Income-tax Act, 1961. It is a 10-digit unique alphanumeric number. It is granted to Individuals, Company, Association of Persons, Body of Individual, Hindu Undivided Family, Trusts, Government Agencies, Co-operative Society and also those whose income are taxable under the Income Tax Act, 1961. PAN is an essential identity that one must bear to carry out business activities in India.

PAN card is useful in opening a bank account as well as while applying for credit card. PAN card also helps to avoid deduction of tax at a higher rate than dues. With the help of PAN card, an individual can open a DEMAT account for security sale and purchase. PAN is mandatory for starting a business in India.

[Our article How to apply for PAN will help you out to register for PAN while starting your business]

Tax deduction and collection Account Number (TAN)

What is TAN number? TAN number is 10-digit alphanumeric number for every person who is responsible for deducting tax at source and collecting tax at source on behalf of Income Tax Department. It auto-captures complete address of the person who deducts tax on behalf of the IT department. It also captures the Postal Index Number recorded with Income Tax Department. The TAN no. is compulsory in tax deduction at source (TDS) and tax collection at source (TCS) returns, payments, certificates, annual information and other documents.

Example: Company X realizes payments to contractor or transport firm, Company is liable to deduct tax at source (TDS). In this scenario Company X must have the TAN.

If the person does not quote TAN number in the necessary documents or fails to apply for it, a penalty of ₹10,000 gets filed. PAN and TAN, both have different purposes; therefore, an applicant cannot provide their PAN number where TAN is asked.

Tax-Payer Identification Number (TIN)

What is TIN number? Tax-Payer Identification Number (TIN) is also known as Value Added Tax (VAT). TIN number 11-digit unique number allotted by the Commercial tax department of respective State. It is necessary to mention TIN no. for sales made within a state or between two or more states. TIN registration is necessary for Manufacture/Dealers/Traders/Shopkeepers as well as Exporters. It is used to identify dealers registered under VAT.

First two digits of TIN indicate the issued state code as used by the union ministry of home affairs and rest nine digits of TIN may differ from state to state.

TIN, VAT, CST, and GST all come under indirect tax stream. VAT was applicable till 30th June 2017.

Value Added Tax (VAT)

VAT was introduced into the Indian taxation system from 1st April 2005.

VAT full form Value Added Tax is a tax on the value that gets added to a product at every stage of its production, from raw material to finished product. The term ‘Value added’ refers to increase in value of goods and services at each stage of production/transfer of goods or services.

Example: Suppose Mr. A owns a restaurant and spends Rs.25,000 towards obtaining raw materials. Input tax is 10%, so input tax becomes 10% of Rs.25,000 = Rs.2,500. Now after selling the food products made by using the purchased raw materials, Mr. A was able to make Rs.80,000. Supposing 10% output tax, output tax becomes Rs.8,000. So, final VAT payable by Mr. A comes out to be Rs.8,000 – Rs.2,500 = Rs.5,500.

VAT was applicable till 30th June 2017. From 1st July 2017 onwards GST was introduced into Indian taxation system.

Goods Service Tax (GST)

Goods service tax (GST) was introduced to reduce the cascading effect of the multiple indirect taxes such as Excise Duty, VAT, Service Tax, Central Sales Tax, Counter Vailing Duty (CVD), Octroi. A taxable person like individual, company, firm, co-operative society, trust, etc who engages in economic activities (i.e. trade and commerce), who carries out any business at any place in India, should Register for GST under GST Act.

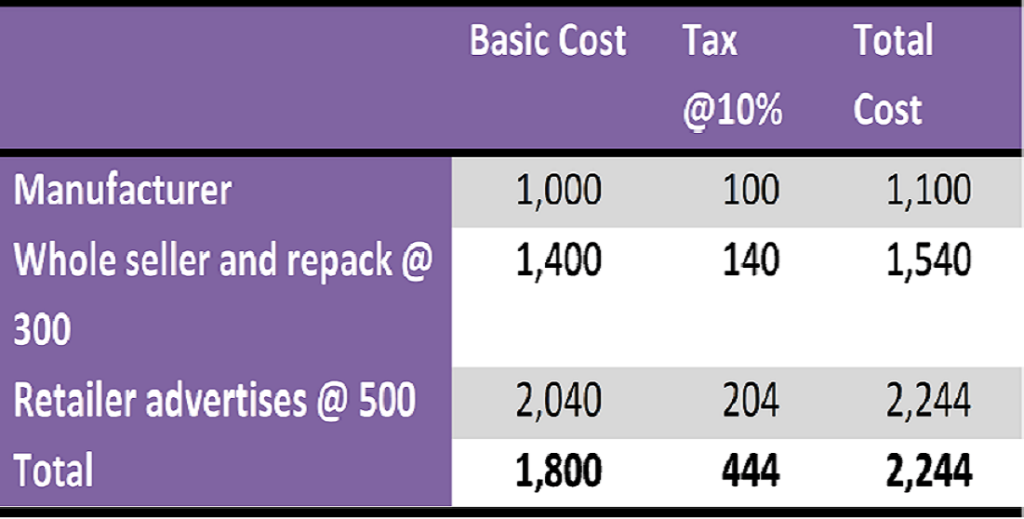

Before GST

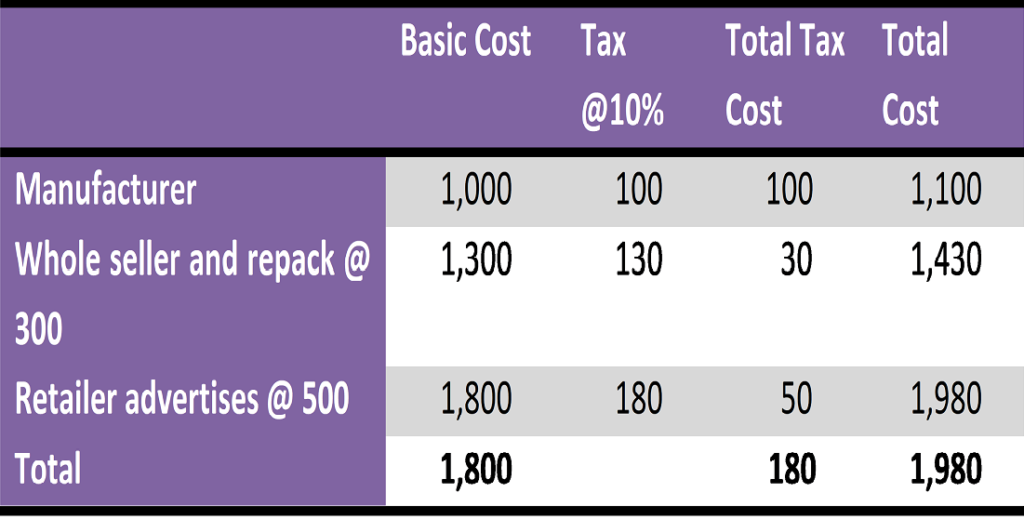

After GST

[To know more about GST, refer to our article on 28th GST Council Meet & Advantages and Disadvantages of GST]

Director Identification Number (DIN)

Any individual intending to get appointed as Director or existing Director of a company is required to have DIN, as an identification number, allotted by the Ministry of Corporate Affairs of India. DIN contains all the information of the director. By submitting identity and address proof, DIN can be obtained by Indians as well as Foreign Citizens. Digital Signature Certificate (DSC) is mandatory while applying for DIN.

Difference between PAN and TAN

Although PAN TAN sound similar but has vast differences. The differences between TAN and PAN are as follows:

1.Meaning: PAN is 10-digit code for the people who are involved in the transaction exceeding a particular limit, allotted on registering with the Income Tax Department. TAN is 10-digit code allotted to the entities or individual responsible for tax deduction or tax collection at source.

2.Form: In the case of PAN, 49A for Indians and 49AA for foreigners. In the case of TAN, 49B.

3.Issued under: Both PAN and TAN are issued under Income Tax Department.

4.Requirements: PAN is quoted at the time of preparation and submission of Income Tax Return. TAN is to the people who are liable to withhold tax from the amount paid or payable under the Income Tax Act.

5.Role: PAN is used for all financial transaction’s identification. TAN is used to furnish tax deduction at source details collected by any individual or entity.

Difference between TIN and TAN

TIN TAN differs in various aspects. The differences between TAN and TIN are as follows:

1.Composition: TIN is in numerical digits. The first two digits denote the state in which it gets issued.

TAN is an alphanumeric number which contains both numbers and letters. The first four letters are according to the state in which it gets issued. The next five are random numbers. The last number mentioned in the order, serves as a check.

2.Reason: TIN is used to track the transaction relating to VAT for a specific company. It indicates when the VAT was paid and also the upcoming VAT.

TAN helps agencies to monitor tax deducted at source and tax collected as a source. An identification number to be mentioned in all the documents for reference purpose.

3.Entities: The company or individual who pays VAT or liable to pay VAT must have the TIN code.

Company or an individual who deduct tax or collect tax must have TAN.

4.Assign: Internal Revenue Service or Social Security Agency assigns TIN vs TAN is assigned by Income Tax Department.

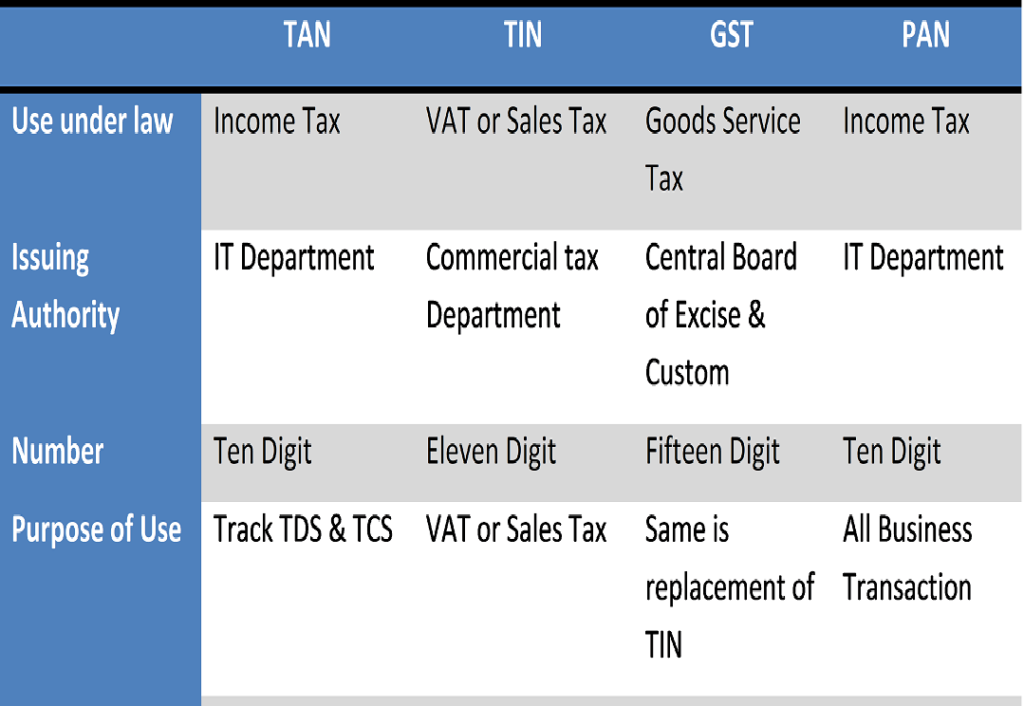

Comparison of TAN, TIN, GST, and PAN

Conclusion

Changes occur in these terms time to time. Ex: VAT is replaced by GST. All this is done for a smooth running of business and has already reduced many other taxes that businesses had to face. India is growing with the upgrading business environment. If someone is planning to enter into the business market, must be aware of the terms and procedures existing in it. Obeying laws are as important as running a business. Walk hand in hand to make your business reach on the top.

Customer satisfaction is our motto. For any queries, feel free to contact us.