The 28th GST Council Meeting held on 21st July 2018, has proposed many changes which will lead to amendments in the GST Act, conducted under Mr. Arun Jaitley, Chairman of GST Council. This is the first time that the Acts will be amended, previously any amendments or changes were always made applicable by issuing circulars and...

Mumbai is one of the most populated cities in the world which was formerly known as Bombay. The city is considered as the financial center of India and major business houses and corporates operate in this city. Mumbai is also known as “city of opportunities” because of easy availability of the resources and very high...

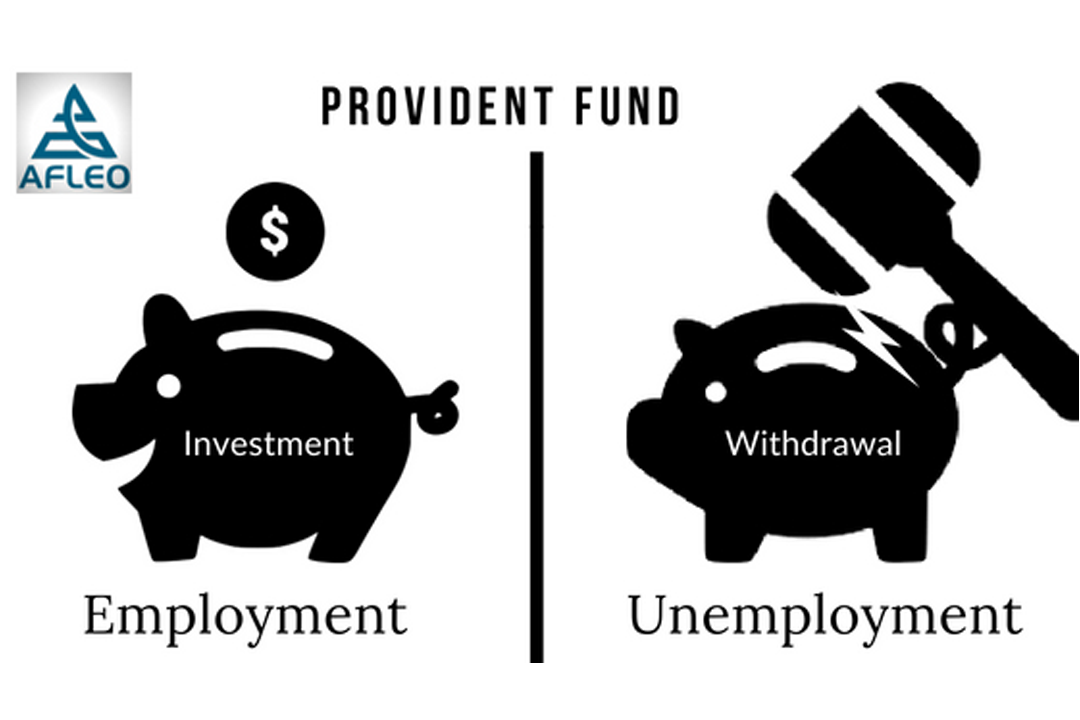

Worrying about Provident Fund and doesn’t have an inch of an idea about the withdrawal? Here is where you can learn “All About PF Withdrawal”. To start with, let’s take an overview on Provident Fund (PF) in general. What is Provident Fund (PF) or Employee Provident Fund (EPF)? Provident Fund also known as EPF, is...

What is a PAN card and Aadhaar card? Permanent Account Number (PAN) consists of 10 unique character code which links all the taxable transaction data in a single source, which makes it convenient for the Government to keep track. A PAN card is mandatory to file Income Tax returns in India. Everyone residing in India...

Permanent Account Number (PAN) is a 10 digit alphanumeric number assigned to each individual by the Department of Income Tax. PAN card has wide spread usage and acceptance which makes it almost compulsory for anyone as a document required for verification. If new PAN card is applied online or if you need a reprint of...