PAN or Permanent Account Number is a requisite document required for any financial transaction. A PAN card is a 10 digit unique alphanumeric identification code, which is issued by the Income Tax Department of India. PAN is a universal identity required by an individual, company, firm etc., as their income is taxable under Income Tax Act 1961. Any corporate body or individual having a PAN card relishes many benefits. This article will guide you with the process for Pan Card application and will brief you the benefits of having it.

What is E-PAN Card & Procedure for Application ?

Making India Digital the applications for Pan card have also gone online making it hassle free for the masses. The introduction of E-pan has made it easy for the masses as well as the government to carry out registration procedures peacefully as it can be obtained within few minutes. E-pan basically refers to E-Pan card, where in you can register and get your pan card online. The documents needed to apply for E-pan card is Aadhar Card. People already holding Pan Cards cannot apply for this service. The facility of E-Pan card is made available on the Income Tax Departments Website. The facility is only available for the citizens of India. As mentioned above, the Aadhar Card is a compulsion and with it the mobile number that is connected or linked with the Aadhar Card. The OTP pin will be sent to the number that is linked with the Aadhar Card to verify the details. Incase there is a mistake in the Aadhar Card details, then you can make the needful changes by login into the UID website and then get your Aadhar Card details copied for your Pan card. To apply for E-Pan card a signature is required on white paper, the resolution required is 200 DPI, the size should be of 10 KB, the dimensions should be 2×4.5 and the format should be in JPEG. The image should be coloured and not in black and white. After filing the form a 15 digit acknowledgment is sent to your registered email id and phone number. Thus, once E-KYC is done it take almost few minutes for the acknowledgment to be generated. After the generation of the acknowledgment it takes 2-3 days for the Pan card to come.

Apply PAN Card Online With Easy Protocols

You can apply for PAN on NSDL website(NSDL PAN) OR UTIITSL website(UTI PAN). Both are government authorized websites for issuing PAN and to make changes or correction in PAN.

Applying PAN card offline is a painstaking traditional method of visiting PAN centre and physically filling up the registration form whereas through online method, applicant can fill up a form in a hassle free way.

Apply for PAN card online in three easy steps:

- Fill up the pan card application form

- Online payment of the processing fee

- Copies of the required documents to be sent by post for verification purpose

1. Filling up online pan card

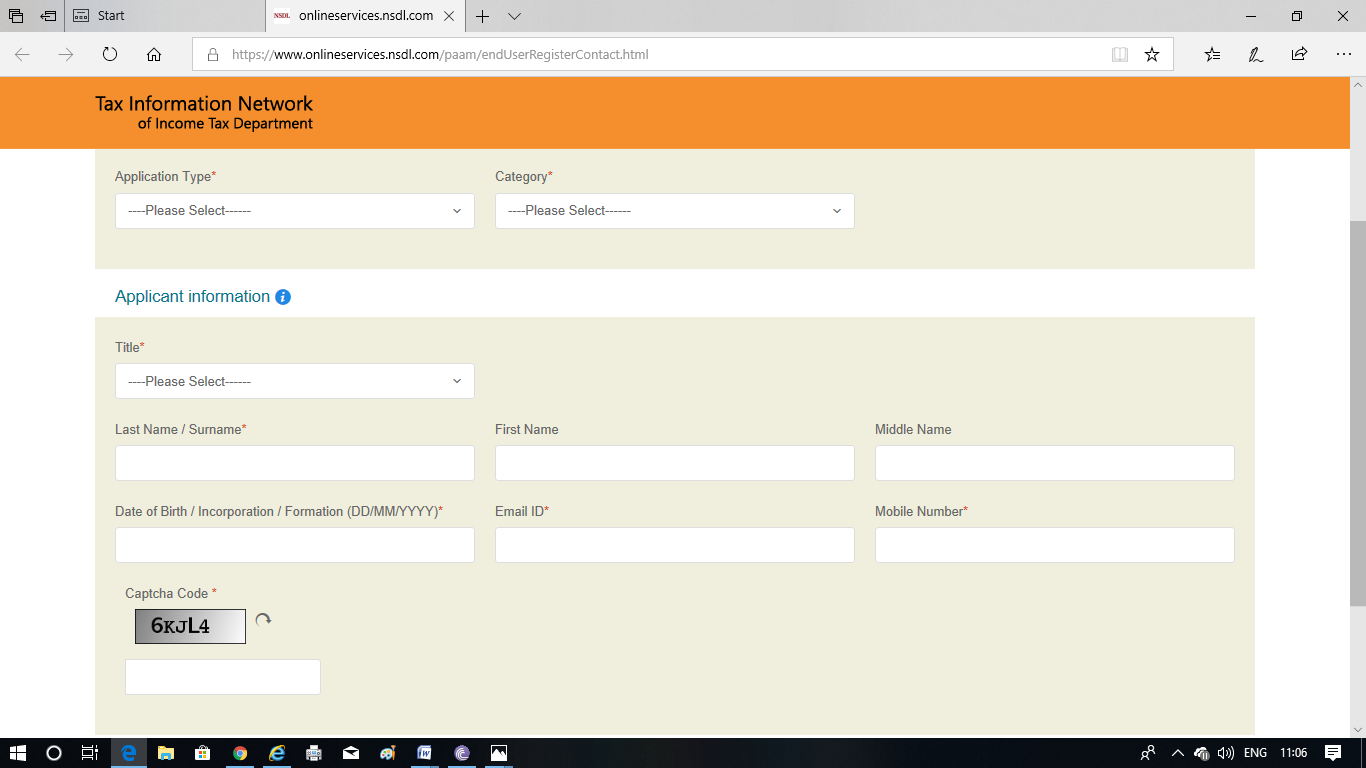

- Use ‘Form 49A’ or ‘Form 49AA’ as applicable to you ‘Form 49A’ for citizen residing in INDIA and Form ’49AA’ for a foreign citizen.For that one must visit:

https://www.onlineservices.nsdl.com/paam/endUserRegisterContact.html

These are some of guidelines to fill the pan card application form. The instructions are mentioned as follows:

- Applicant will initially select the required form along with category and title of the applicant and enter the required details.

- There is a facility to save the details entered in the application form so that this data can be viewed by the applicant prior to its final submission by using this temporary token number.

- The generated token number will be displayed to the applicant before filling the form.

- Filling pan card application form requires general information of an individual i. Full Name Abbreviation to be printed on the PAN card, Date of birth/formation of the corporate body, Residential address/office address, source of income, representative assessee name and address.

- Submit the form after the correct details have been entered.

Once the application form is submitted, you can select one of the many options for its final submission to the department:

- Physical acknowledgement : Applicant has to successfully generate an online application on NSDL. Then the applicant has to print the generated application form, affix recent colour photographs, duly sign in the space provided and forward along with prescribed supporting documents to NSDL e-Gov at specified address.

- Digital Signature Certificate (DSC): In DSC option, an applicant needs to upload scanned images (as per defined parameters) of photo, signature and supporting documents while applying online. Digital signature is to be affixed to the online form. Submission of PAN application form and supporting documents to NSDL e-Gov is not required.

- Aadhaar based e-Sign: In Aadhaar based e-Sign option, an applicant needs to upload scanned images (as per defined parameters) of photo, signature and supporting documents while making application. Aadhaar would be considered as supporting document. Submission of PAN application form and supporting documents to NSDL e-Gov is not required.

- Aadhaar based e-KYC : In Aadhaar based e-KYC option, Aadhaar details would be considered as PAN application details (Name, Date of birth, Gender, Residential Address, Email ID, Mobile Number & Photograph) and Aadhaar as supporting document. The information would be forwarded to Income Tax Department for allotment of PAN. All these fields are non-editable. The photograph used in Aadhaar card would be used in PAN card and there is no need to upload supporting document, photo and signature. PAN card will be dispatched at address mentioned in Aadhaar. PAN application form and supporting documents need not be sent to NSDL e-Gov.

2.Online payment of processing fee

- Enter the details of bank draft which includes issuing bank, date of issue and the demand draft number and the amount to be paid for the PAN card Application. The charges for applying a PAN card varies as per your residential status and other parameters.

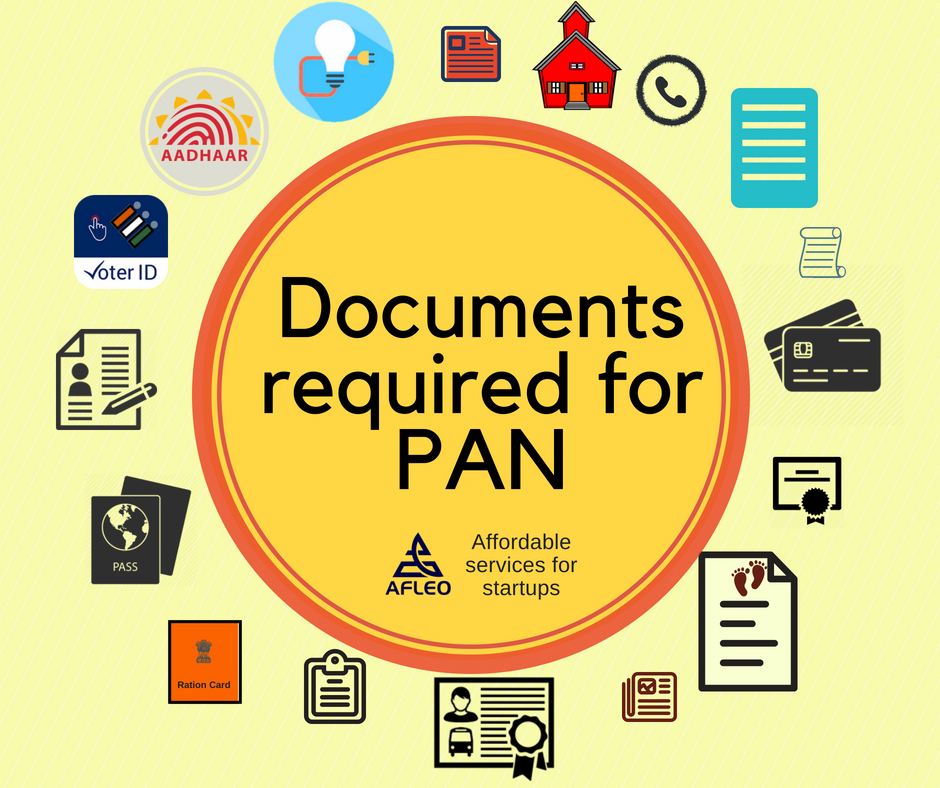

3.Copies of the required pan card documents to be sent by post for verification purpose

- Documents to be sent, includes one proof of identity, one proof of address and one proof of date of birth which has to be sent by courier to NSDL (National Securities Depository Limited) office for verification purpose.

- Submission of PAN card documents varies from individual to a company.

Here is a complete list of documents required for PAN card: https://www.incometaxindia.gov.in/Documents/documents-required-for-pan.pdf

After submission of application it takes 10-12 working days for issuance of PAN and you will receive your PAN card within 2 days after issuance.

A PAN card is a very important document that can help you gain access to many services, and if you haven’t applied for a PAN card yet, do so now!!

We at Afleo are always there to help you. Please fill below form to get in touch.

[contact-form-7 id=”514″ title=”In Post form”]