Introduction to Advance Authorisation:

Advance Authorisation is a trade facilitation scheme that encourages and supports exports by allowing businesses to import raw materials and components without paying customs duties. This scheme is an initiative of the government to promote and boost the country’s exports while aiding industries in sourcing the necessary inputs.

Under the Advance Authorisation scheme, eligible exporters are granted permission to import materials required for manufacturing or processing goods that will be eventually exported. This exemption from customs duties on imports helps reduce production costs and enhances the competitiveness of domestically produced goods in the international market.

In this blog, we will discuss the extension of the Export Obligation (EO) Period and Import Validity period under Advance Authorisation.

As you all know, the initial Export obligation period under Advance Authorisation is 18 months, and the initial Import validity period is 12 months. This means that from the license issue date, you have 12 months to complete the import and 18 months to complete the export.

If your Import or Export is not completed within the validity period, you can seek an extension according to the policy provisions.

So, how many times and for how long can you get an extension? How and where do you apply for an extension? What documents are required? We will discuss all these topics in this blog. So, let’s get started.

Revalidation of Advance Authorisation License

We often discuss about extending the time when we can bring in imports. But in official terms, this is called “Revalidation of Advance License” as per the rules.

The initial validity is 12 months from the License issue date, and you can apply for a one-time extension for an additional 12 months. This means a total of 24 months.

To apply for revalidation, you need to submit an online application to the Regional Authority of DGFT. The application/government fees for revalidation are Rs.500. The required documents include a Request Letter, a Justification Letter, and Application Form ANF 4D.

If even after 24 months have passed, you still have a remaining portion of imports to complete, you cannot obtain further extension from the RA DGFT. For this, you need to approach the PRC Committee in Delhi. The PRC Committee approves further extension of 6 months only in cases of genuine hardships.

We have created a detailed blog about the Policy Relaxation Committee (PRC). To know more about What is PRC? What types of cases are accepted there? Please see the below link to watch that page – https://afleo.com/policy-relaxation-committee-prc-dgft-delhi/

Export Obligation [EO] Period Extension of Advance Authorisation Licenses issued for Restricted/Prohibited Items

Advance Licenses can come in various types. For instance, some licenses are meant for General/Normal products, while others are issued in accordance with Appendix 4J. There are also licenses specifically for restricted or prohibited items.

In each of these cases, the Export Obligation (EO) period and the terms for extensions differ. We will go through each type with examples.

For instance, the government recently announced that it would permit the export of Wheat flour [Atta] under Advance Authorisation. If an Advance License is obtained for Wheat flour, the initial Export obligation period is 180 days from the date of clearance of each Import consignment. In this case, no further extension of the EO period will be granted.

This means that the normal validity for importing will remain 12 months. However, as your imports are being cleared, the proportionate quantity should be exported within 180 days. No extensions will be provided beyond this 180-day period. If your exports are not completed within this timeframe, you will be required to pay duty and interest on the excess imports.

Have you ever thought about the specific period for importing and exporting goods? Don’t worry, we’re here to help. Check out this video about complete guide of Export Obligation [EO] Period Extension of Advance Authorisation Licenses:

Export Obligation [EO] Period Extension of Advance Authorisation Licenses – General Type

Advance Licenses that do not fall into the categories of Appendix 4J/Restricted/Deemed Project supplies will be referred to as General licenses.

For these licenses, the initial Export Obligation (EO) period is 18 months, and you have the option to apply for two further extensions of 6 months each through the Regional Office of DGFT.

The first EO extension will be for 6 months, and the second EO extension will also be for 6 months.

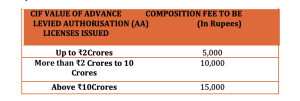

You can see the composition fees for the first EO extension in the provided image.

Composition Fees for 1st EO Extension of Advance Authorisation

So, initially, the fees that were calculated as a percentage have now been converted to flat fees by DGFT under the ease of doing business initiative, based on the CIF value of the Advance License.

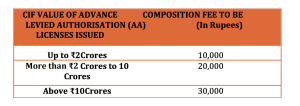

For the second EO extension, the previous requirement was that a minimum of 50% of the Export Obligation should be completed for eligibility. However, as per the new Handbook of Procedures (HBP) 2023, this condition has also been removed. The composition fee for the second EO extension is separate, as shown in the provided image.

Composition Fees for 2nd EO Extension of Advance Authorisation

You can see that the composition fees for the 2nd EO extension are double that of the 1st EO extension.

After these two extensions, you will not be able to obtain any further extensions from the Regional Office of DGFT. If you still require an extension, you would need to approach the Policy Relaxation Committee (PRC) in New Delhi.

Export Obligation [EO] Period Extension of Advance Authorisation Licenses – issued under Appendix 4J condition

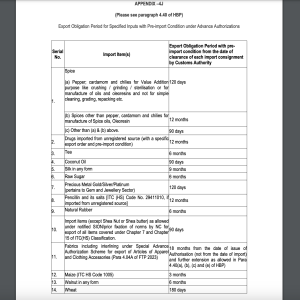

Appendix 4J is a comprehensive list of import items for which, if you obtain an Advance License, the Export obligation period is significantly reduced.

You can view the list of Appendix 4J in the provided image

Appendix 4J of Export Obligation Period for Specified Inputs with Pre-import conditions under Advance Authorizations

You can observe that mainly this category covers items such as drugs imported from unregistered sources and precious metals like gold, silver, and platinum.

For drugs imported from unregistered sources, the Export Obligation (EO) period is 12 months from the date of clearance of each import consignment, while for gold, silver, and platinum, it is 120 days from the date of clearance of each import consignment

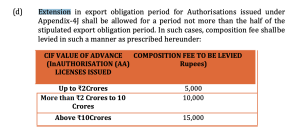

Advance Licenses issued under the conditions of Appendix 4J are eligible for only one EO extension, which is limited to half the duration of the initial EO period.

For drugs, you can receive an EO extension of 6 months, and in the case of gold, silver, and platinum, you can obtain a single EO extension of 60 days beyond the initial 120 days.

The composition fees for EO extension can be seen in the provided image

Composition fees in case of gold, silver, and platinum

Once again, if you require an additional EO extension beyond the mentioned limits, you will need to reach out to the Policy Relaxation Committee (PRC) in New Delhi.

Documents Required for EO Extension of Advance Authorisation

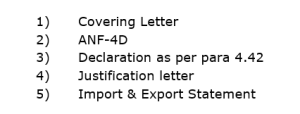

In the image, you can see the list of documents that are required for extending the Export Obligation (EO) period of Advance Authorisation:

The required documents for extending the Export Obligation (EO) period of Advance Authorisation are as follows:

- Covering letter or Request Letter: This is a letter explaining the purpose of the extension request.

- ANF-4D Application Form: This form needs to be properly filled and submitted.

- Declaration as per para 4.42: In this declaration, you self-declare that the duty-free raw materials you imported under Advance Authorisation are still available.

- Justification Letter: This letter explains the reason for requesting the extension.

- Duly-certified Import and Export Statement: A statement detailing the imports and exports must be certified and submitted.

These documents are necessary for the process of extending the Export Obligation period for Advance Authorisation.

Smarter Shipping Begins Now – Discover Our Complete Digital Freight Platform.

Who are we & Why Choose Us?

We at AFLEO Group, are a team of DGFT & Customs Experts having a rich experience of 10+ Years in Exim Consultancy & International Logistics [Freight Forwarding] and also deal in Buy/Sell/RODTEP/ROSCTL/DFIA License With our vast knowledge and experience in this field we can represent your case for all the activities pertaining to the services and get it in a hassle-free manner. We are well-equipped to handle the logistics of global trade with efficiency and expertise. Let us handle the logistics while you focus on growing your business. Contact us today to learn more about how we can help you streamline your supply chain and increase your bottom line. We are dedicated to providing efficient and cost-effective logistics services to help our clients.

So do get in touch with us for any of your requirements and our team will be happy to help you.

We request you to share this information with your other Industry friends, Trade associations, as this information might help them as well.