Export Promotion Capital Goods Scheme (EPCG Scheme) as you might know is used when an Exporter (Manufacturer exporter, service exporter or merchant exporter tied with a manufacturer exporter) intends to Import capital machinery at zero customs duty for production of export goods. Before studying the EPCG License procedure it is important to understand the basic concepts of an EPCG License.

[If you want a complete understanding of EPCG Scheme please read our article “EPCG Scheme | Export Promotion Capital Goods Scheme 2019 – Beginner’s Guide“]

Now, the EPCG License procedure is quite complex. It involves liaising with both DGFT and Custom Authorities. A proper understanding of the entire process is important to avoid any difficulty while applying & closing of EPCG License. This article intends to give you a fair idea about the entire EPCG License procedure as a whole.

EPCG License Procedure

It is important to understand the above image in detail. It can be simplified into 6 main steps. Let’s look at each step individually.

Apply for EPCG License at DGFT

Application for EPCG License should be done at jurisdictional DGFT Office. The application should preferably be done 1 month before the arrival of Machinery to avoid any chaos at the time of import. Since the issuance of a license from DGFT takes anywhere between 7-10 Working days or less and registration of EPCG license at Customs would take another 5-7 working days. Applying 1 month prior will ensure that at the time of import you have the Registered EPCG License ready with you.

Application for an EPCG license requires a lot of documentation. Hence Please find below the entire list of documents required:

1. Proforma invoice/purchase order of the capital goods/machinery.

2. Copy of IEC, RCMC, MSME & central excise registration & GST certificate.

3. Details of capital goods sought to be imported with HSN code/name, model number, and a technical description.

4. list of products to be exported using the above machinery with HSN code.

5. Chartered engineer certificate showing the nexus between the capital goods and the products to be exported.

6. CA certificate indicating the last three financial year turnover in USD & INR only for the above-mentioned export products.

7. Factory address where the machine will be installed.

8. Stepwise process/flow chart indicating the stages where the capital goods are to be used.

9. End-use of capital goods for export products and stage where and how to be used. (Detailed Explanation)

Following important points to be noted to make sure the documents are prepared error-free:

- IEC/RCMC should show the applicant as a manufacturer exporter.

- IEC/RCMC should have the address where the machine is proposed to be installed.

- MSME/SSI/Manufacturing proof should have the export products listed in the EPCG License.

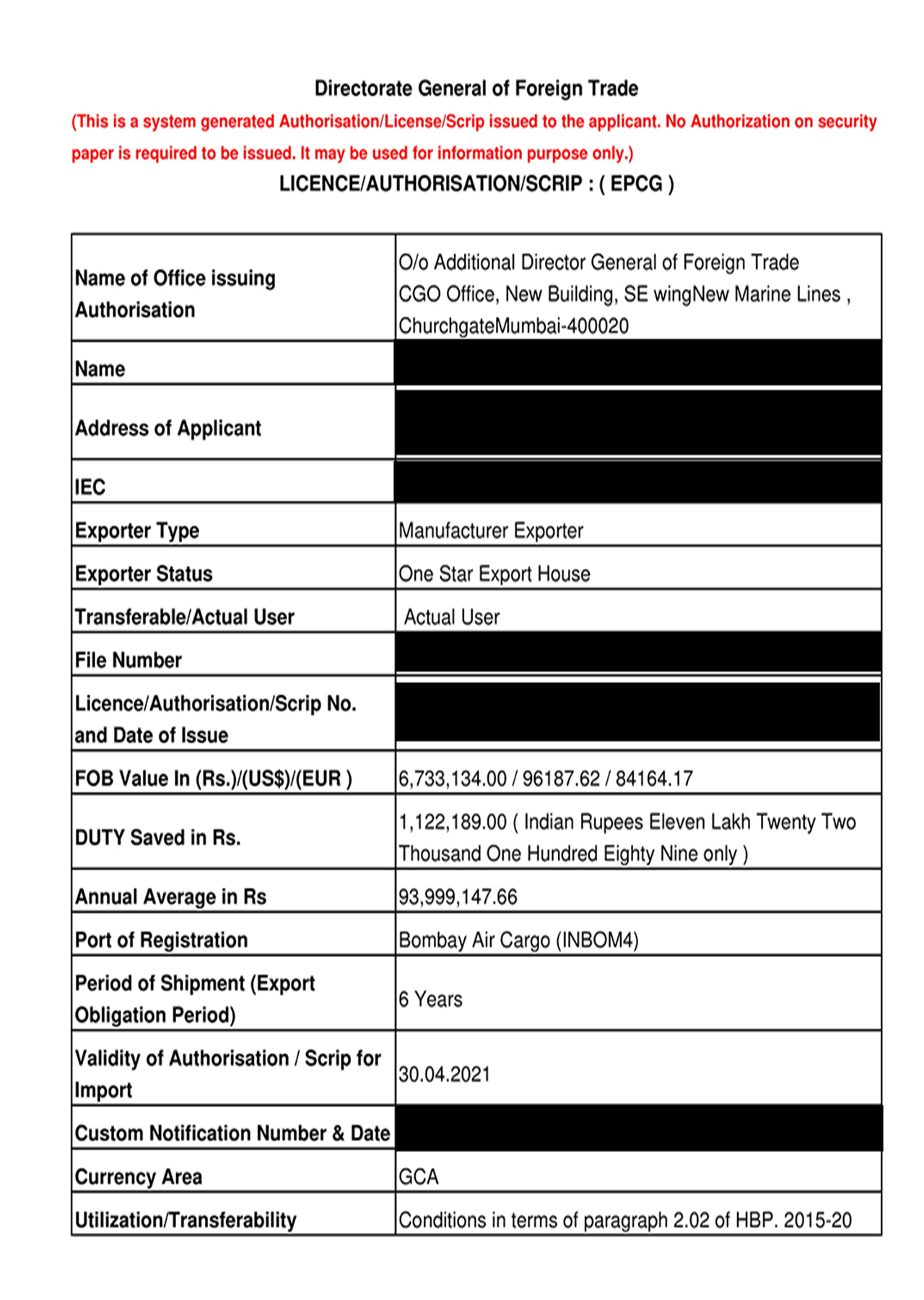

After a successful application, DGFT will issue the EPCG License. Please find below a sample of EPCG License for your easy reference:

Registration of EPCG License at Customs

After receiving the EPCG License from DGFT the next step would be to register the license at Customs. Please note that you will not be able to clear the machinery duty-free unless you register the license at the port where the consignment will arrive.

Now, a question might arise as to why is this registration mandatory? One answer to this would be to check the authenticity/genuineness of the License issued from DGFT. Another reason for this is – At the time of registration of license, Customs executes a Bond or Bank Guarantee with the exporter (any one of them is executed)

- If the exporter is a Star Export House, then a Bond will be executed which primarily takes an undertaking from the exporter that he will repay the duty saved with interest in case of non-completion of export obligation.

- If the exporter is not a Star Export House, then a Bank Guarantee up to 15% of the duty saved amount needs to be submitted.

[Detailed information pertaining to Registration for EPCG License at Customs, documents required, conditions for Bank Guarantee exemption can be found here]

Duty-free Import of Capital Machinery

After successfully registering the EPCG license at Customs and executing a Bond or Bank Guarantee, the Customs Department will allow duty-free import clearance of capital machinery.

Here, the following things will be checked:

- Is the imported machinery similar to what was declared under the license?

- What is the Quantity of Machinery?

- Does the HS Code match? etc.

After checking all the conditions thoroughly, the department will make an entry on the backside of the license and allow the Goods to be cleared.

Note – Machinery should be imported within 12 months from the date of issuance of EPCG Authorisation. Revalidation of the EPCG License would not be permitted.

Install the machinery and obtain Installation Certificate

At the time of the EPCG application, the exporter has to declare the factory premises/address where the machine is going to be installed. This is one of the important parts of the application.

So, after clearance of machinery from Customs, the said machinery needs to be compulsorily installed at the factory address declared in the license.

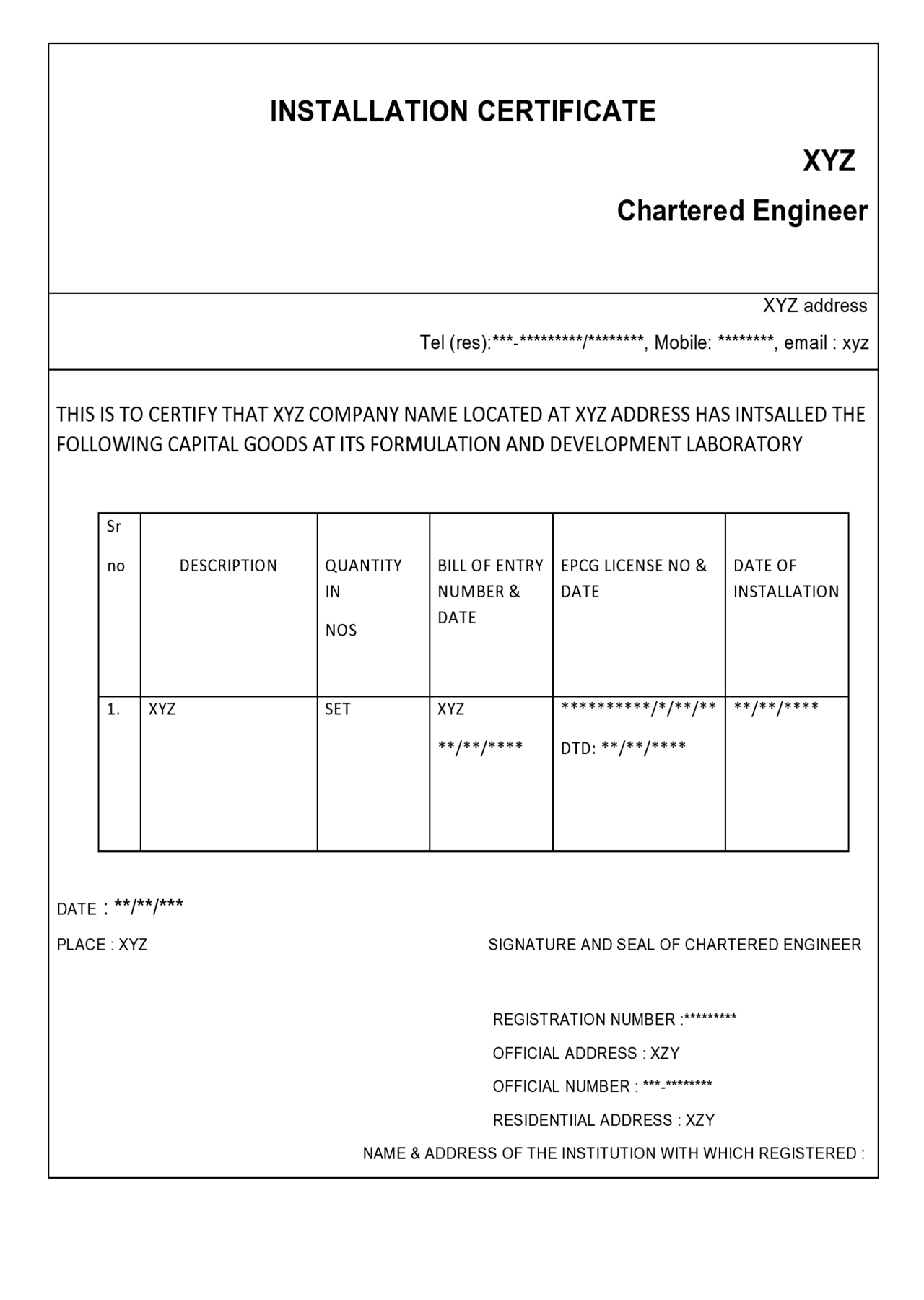

Installation Certificate under EPCG Scheme

Exporter has to submit an Installation Certificate from an independent Chartered Engineer within 6 months from the date of import. However, DGFT may allow a one-time extension for the said period by a maximum of 12 months with a penalty of Rs. 5000/-.

Installation Certificate primarily certifies that the said machinery is installed on the factory premises at this date and the machinery is functional now and can be used for the production of export goods. Please find below a sample format of the Installation Certificate.

Completion of Export Obligation

Once the installation of machinery is done, the export production should start to complete the export obligation.

To fully understand the EPCG License procedure, it is important to understand the types, manner and time frame in which the export obligation should be completed.

[There are two types of export obligation under the EPCG Scheme – 1) Average export obligation 2) Specific export obligation. Please find complete details here – “Export Obligation Under EPCG Scheme“]

Blockwise Export Obligation:

The specific export obligation of 6 times of the duty saved amount in 6 Years has to be completed Blockwise, as below:

- Block 1 – [1-4 Years] – Minimum 50%

- Block 2 – [5-6 Years] – Balance EO

Kindly note here that starting from Installation date till 4 years, minimum EO of 50% has to be completed, or else DGFT will impose a penalty as per FTP.

Closure/Redemption of EPCG License

Once the Export Obligation is completed, the exporter has to submit all the relevant proof of export to DGFT and apply for Closure of EPCG License.

Until the redemption of the EPCG License is done, the exporter is not allowed to sell or dispose off the said machinery. The basic documents required for Closure/redemption of EPCG License are Shipping Bill/Bill of Export, E-BRC, Statement of Average Exports, relevant forms & Declarations, etc.

If all the documents for Closure of EPCG License are found to be in order, the DGFT will issue a Redemption/Closure letter. This essentially means that you have discharged your export liability.

Bond Cancellation/BG Cancellation at Customs

One last step in the EPCG License Procedure is to cancel the Bond/Bank Guarantee that you have submitted to Customs at the time of import.

To complete this Bond Cancellation process, you have to submit the Redemption/Closure letter received from DGFT with other relevant documents to Customs. Once the Bond cancellation process is done the exporter is left with no liabilities and the entire EPCG License Procedure is completed.

We hope the above procedure to obtain the EPCG license & closure of EPCG License is clear.

How you can get EPCG license hassle-free?

EPCG license procedure is a difficult process, without proper guidance the whole process gets complex. Maintainance of Average Export Obligation is a major problem in EPCG Cases which we come across regularly. Therefore If the Company is sure to achieve stable export orders in the years to come, then the EPCG Scheme is a very good option for them.

Afleo Consultant is a recognized EPCG Consultant and a pioneer in the field of DGFT. We have handled numerous EPCG applications and helped our clients to successfully close the licenses. The expert advice “Afleo Consultant” provides is guaranteed to be truthful and trustworthy as per the reviews of many people who had been served under its guidance.

Please fill the form below to get in touch with us.