The Government of India had introduced the Advance Authorisation Scheme (AAS) under the Foreign Trade Policy(FTP) to allow the duty-free import of raw materials and other inputs required to produce the export goods. The benefits of Advance Authorisation can be availed by the Manufacturer exporter or a Merchant exporter tied with a supporting manufacturer.

Redemption/Closure/EODC of Advance Authorisation(AA)

Once the Export Obligation is completed, the exporter has to submit all the relevant proof of export to DGFT and apply for Closure of Advance License.

Until the redemption of the Advance License is done, the exporter is not allowed to sell or dispose of the raw materials. The basic documents required for Closure/redemption of Advance License are Shipping Bill/Bill of Export, E-BRC. If all the documents for Closure of Advance License are in order, the DGFT will issue a Redemption/Closure letter. This essentially means that you have discharged your export liability.

[ To know each and every detail about the EODC/Redemption of Advance Authorisation online on the newly launched DGFT portal watch the complete video given below-]

Pre-Requisites for Applying for EODC/Redemption/Closure of (AA)

To enhance the ease of doing business and bring transparency in trade business the DGFT has enabled the online filing for the redemption of Advance License as per the trade notification 49/2020-21, 30th March 2021. Application for redemption/closure has to be submitted online on the DGFT website, manual application is not permitted for the closure.

Basic Amendment of Advance Authorisation

Before 30th March 2021, applications were done manually for closure/Redemption/EODC. Now to proceed with the online application for closure a transitional arrangement has been done by DGFT, which means before application for closure one more step for basic AMENDMENT has to be done for all the authorization issued before 01.12.2020.

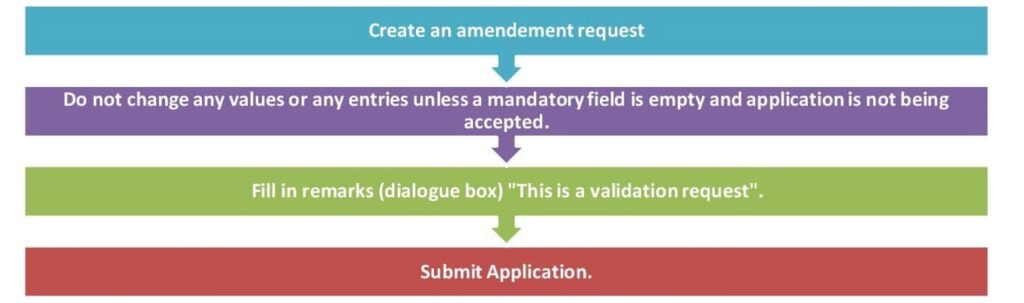

Steps for basic Amendment

To submit a one-time validation request follow the below steps: –

How to apply online for the EODC/Redemption/Closure of Advance Authorisation (Advance License)?

Step 1 – Visit DGFT Website

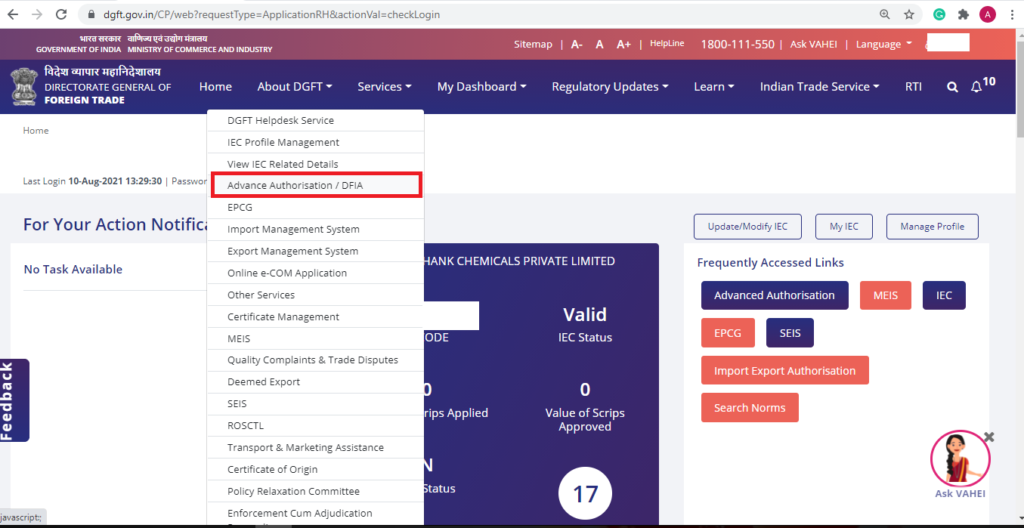

The Applicant needs to access the DGFT Website for the application.

- Click on “Advance Authorisation/DFIA” under the services tab.

- Please find the image for your reference below:

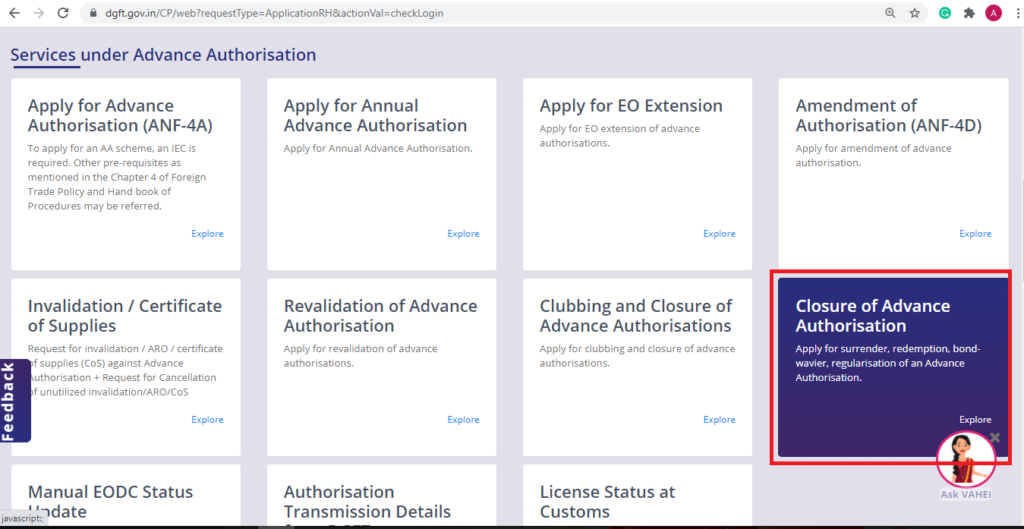

Select the Redemption/Closure of Advance Authorization option, a window for user login will be displayed.

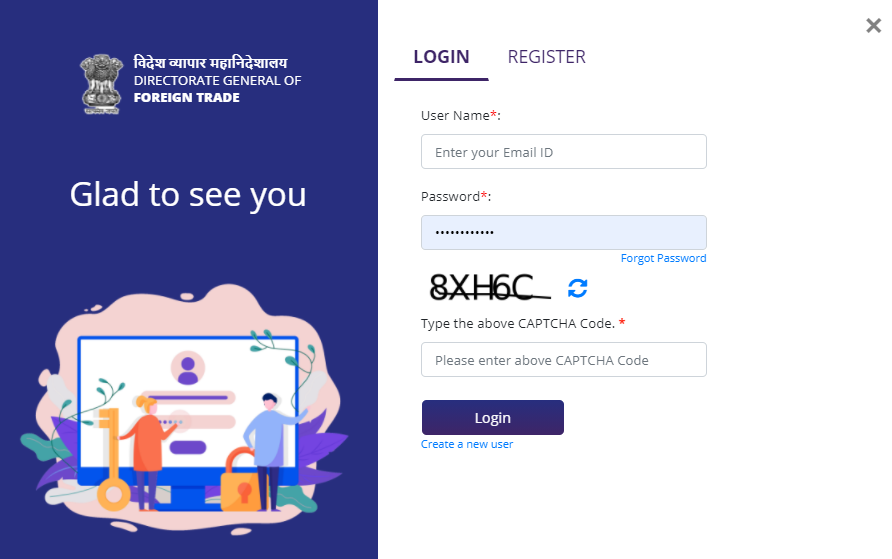

Step 2 – Login on DGFT Website

Do the login process by entering the required credentials. (Refer to the image below)

Step 3 – Start the Application

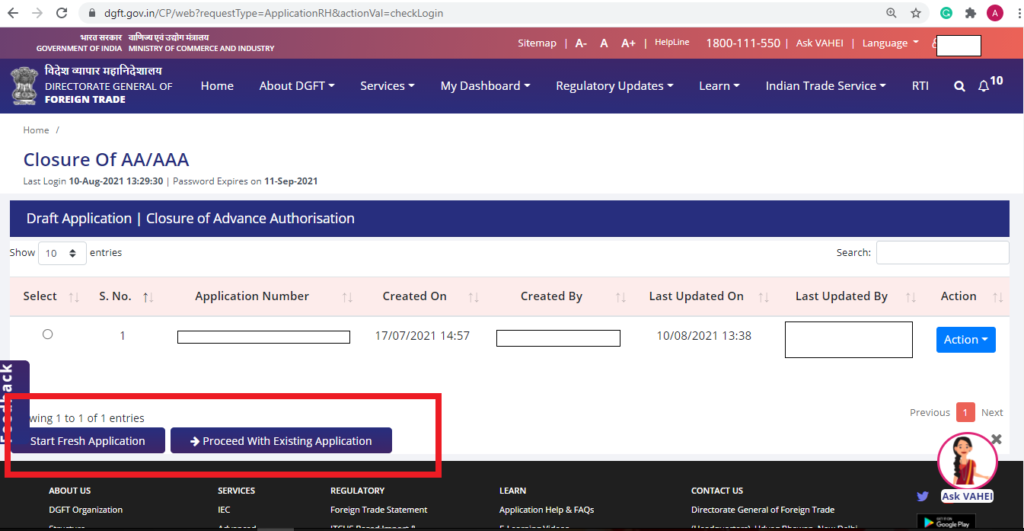

There would be two options 1) Start a Fresh Application 2) Proceed with an existing application. For the fresh application click on start fresh application.

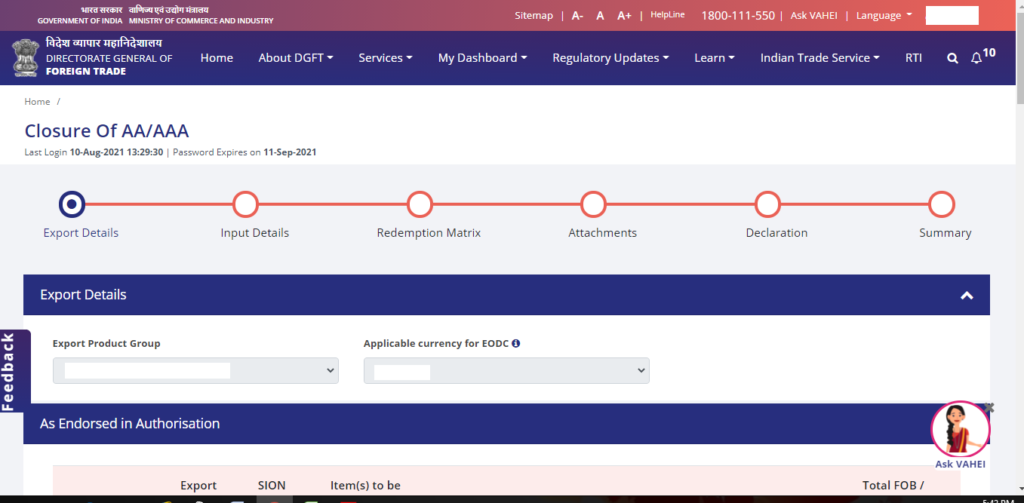

Step 4 – Fill out the mandatory details & Check Auto Populated Details

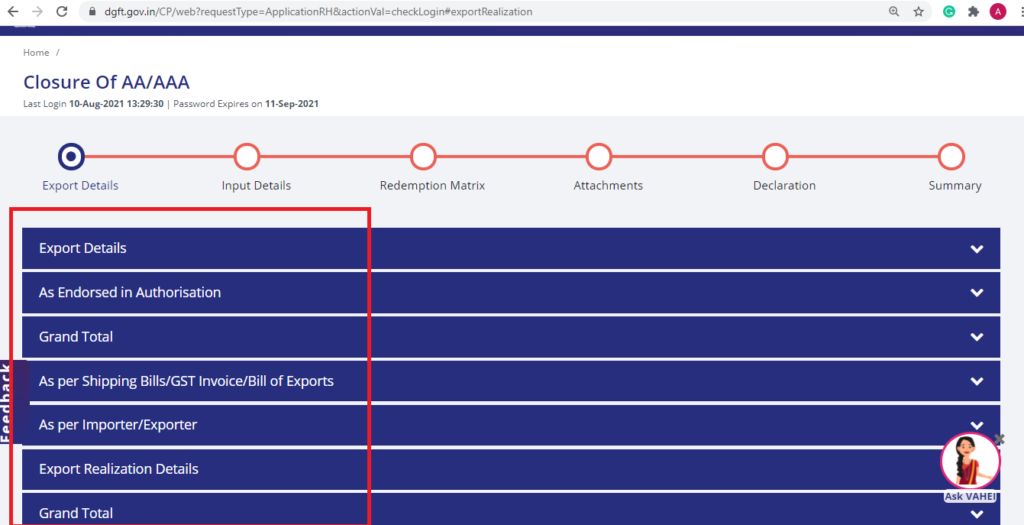

- There would be six important tabs on this screen, all the auto-populated details have to be checked and necessary changes have to be made in the application form.

- The Non-EDI Documents such as Shipping Bills, Bill of Entries, CA/CE/CS Certificates, GST invoices, TR Challans, BG/LUT which are not automatically available required to be uploaded by the Authorization holder to their respective repositories before closure/EODC application.

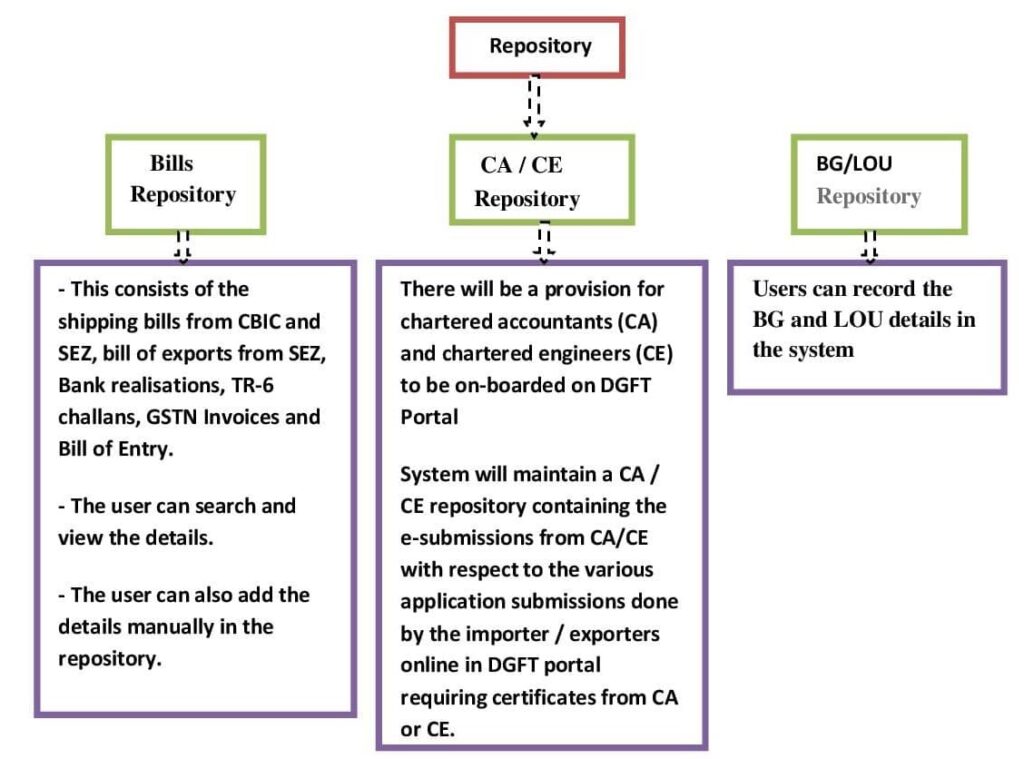

What is Repository and how Non- EDI documents can be added in the Application form

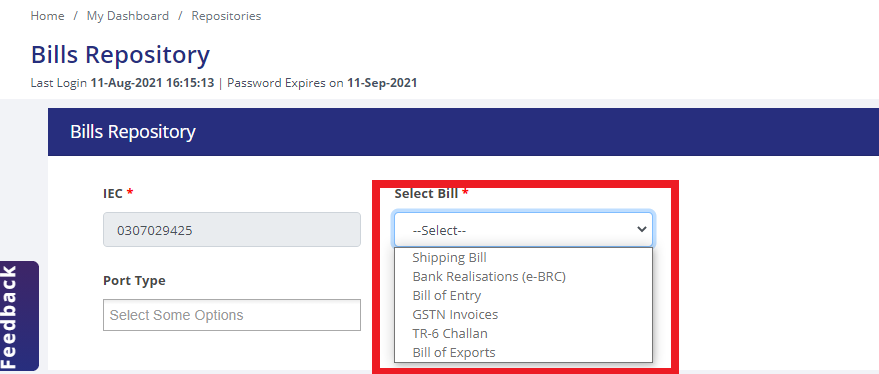

a) It is the centralized database for various transactional data such as shipping bills/bank realization/bill of exports, and even appendices certified by Chartered Accountant(CA) and Chartered Engineers(CE) for various schemes offered by DGFT.

(Refer to the image below of Repository and its type on DGFT Portal)

Important points –

- If Bills are not reflecting in the application form – Documents can be fetched from the customs from the repository.

- If bills are reflecting in the repository and not in the application form – Make sure the bills are about the same Advance Authorization number /File number for which application has to be done or make sure e-BRC details of the respective shipping bills are shared with DGFT by the Bank (BRC can be checked from the repository in search option).

- More bills / GSTN invoices / Bill of Exports can be added with the help of the “Add” option from the repository.

- If Quantity imported is coming 0 add bill of entries from the repository.

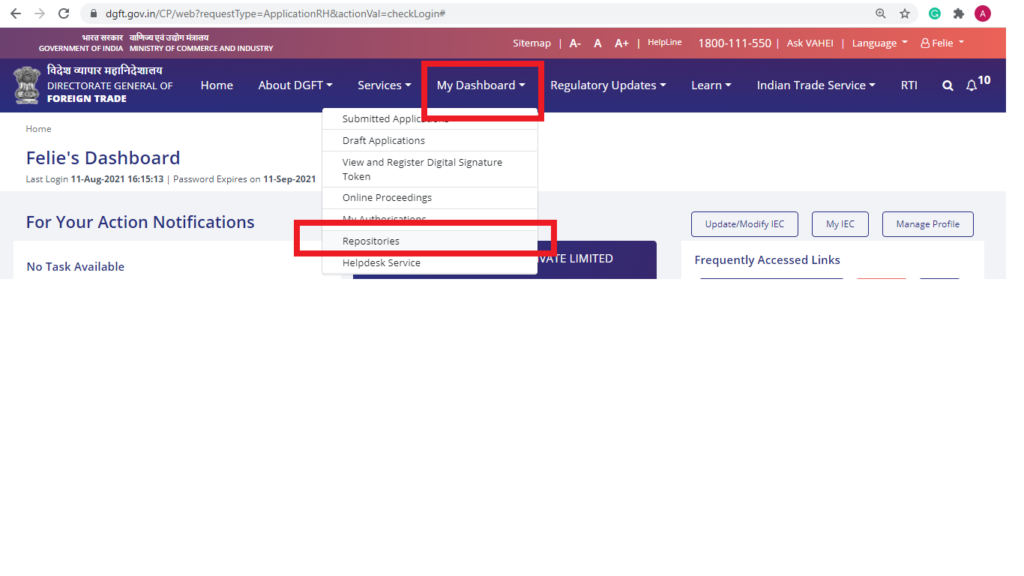

Procedure to Check and Add Non- EDI documents from the repository

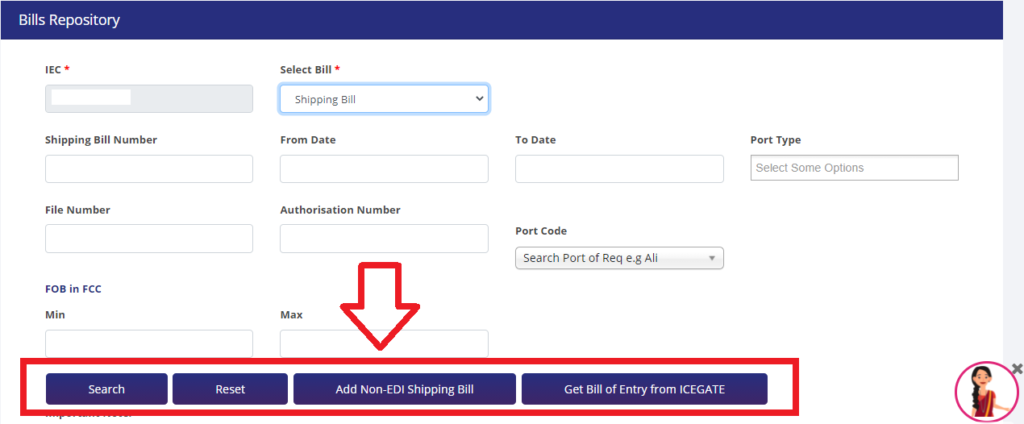

To check or add Non-EDI shipping bills/Bill of entries or other documents in the repository please follow the following steps:

- Click on Bills Repositories from Repository from My Dashboard.

- Click on ‘Explore’ and select ‘Bill Type’ as “Shipping Bill”.

- Enter the shipping details and click on ‘search’

- To add a Non-EDI shipping bill, click on “Add Non-EDI Shipping Bill”.

- To get shipping bill details from customs in the repository, click on “Get Shipping Details from Customs” and enter the shipping details to be fetched from the customs.

The procedure can be used for finding data related to other documents such as GST Invoice, Bill of Exports, BRC.

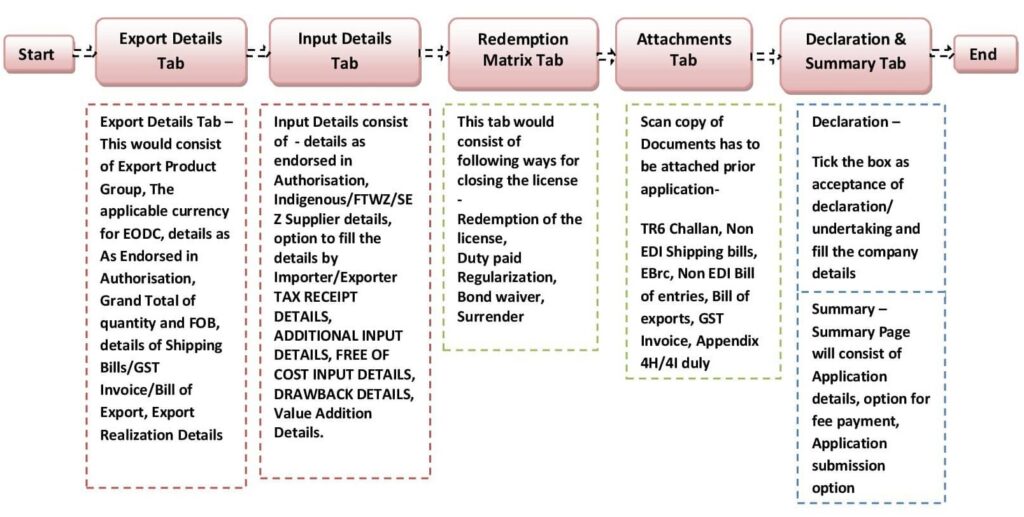

Step 5 – Export Tab

Check details & if required add from the repository

The EDI Shipping Bills(S/Bs) and Bill of Entries(B/Es) are electronically and automatically fetched from the DGFT-Customs Electronic interface. E-BRCs, as uploaded by the banks, are also automatically available under the Bills Repositories.

This tab would consist of the following options –

Export Product Group – The category of export goods would be auto-populated in this.

The applicable currency for EODC – Applicable Currency for EODC is the currency in which all the values in the online form will be calculated and the application would be processed on that basis. It is based on “Freely Convertible Currency” selected by the applicant while application.

As Endorsed in Authorisation –This option would consist of – Authorisation number, Export Serial No, Items to be exported/supplied, Export Item technical characteristics/Description, ITC, quantity with UOM, total FOB value of export.

Grand Total – It will consist of grand total quantity of export products and the total FOB value of export.

As per Shipping Bills/GST Invoice/Bill of Exports – this would consist of details such as Shipping Bills/GST Invoice/Bill of Exports Number, Invoice Date, Invoice Serial number, Export Item description in the invoice, ITC with the quantity of each bill.

As per Importer/Exporter – the applicant can add/edit/delete(with the help of repository) the details in this option, it will consist of all the details of Shipping Bills/GST Invoice/Bill of Exports as above.

Export Realization Details – It will consist of Bill number, EBRC number, the currency of realization, eBRC value, eBRC value in applicable export FCC. (Refer to the image below)

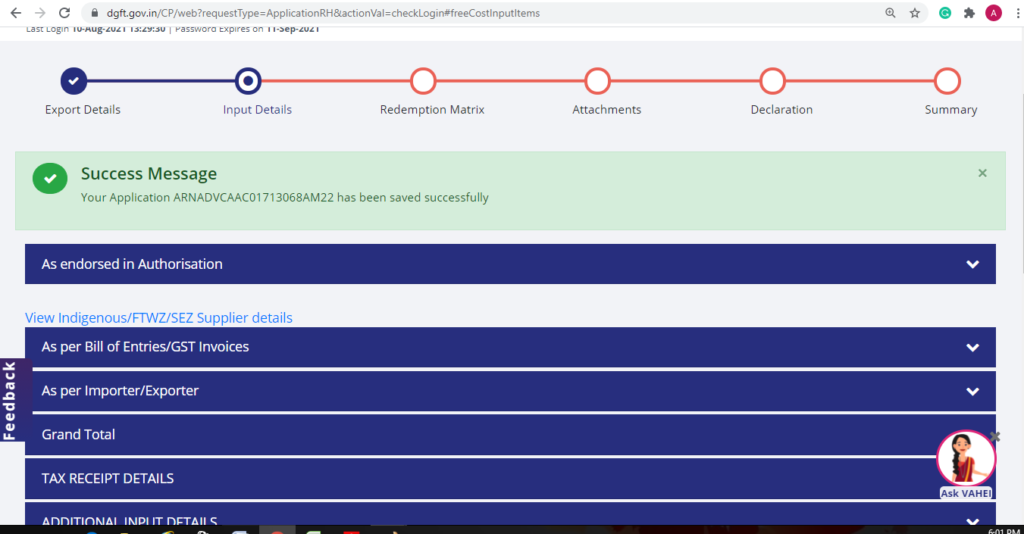

Step 6 – Input Tab

As endorsed in Authorisation – This would consist of Authorisation number, Input item serial number, Input Name, Input item technical features, ITC code, Quantity invalidated, Total CIF value.

View Indigenous/FTWZ/SEZ Supplier details –All the details of BOE/GST invoice such as BOE/GST invoice number, date, input item description in the invoice, ITC code, Quantity, CIF value, Foreign currency as per Invoice, Total CIF value.

As per Importer/Exporter – The above details can be added/edited/deleted in this.

TAX RECEIPT DETAILS – This would consist of Challan number, Challan date, Amount of challan paid, challan interest

Input detail tab would consist of other details such as – ADDITIONAL INPUT DETAILS, FREE OF COST INPUT DETAILS, DRAWBACK DETAILS, Value Addition Details.

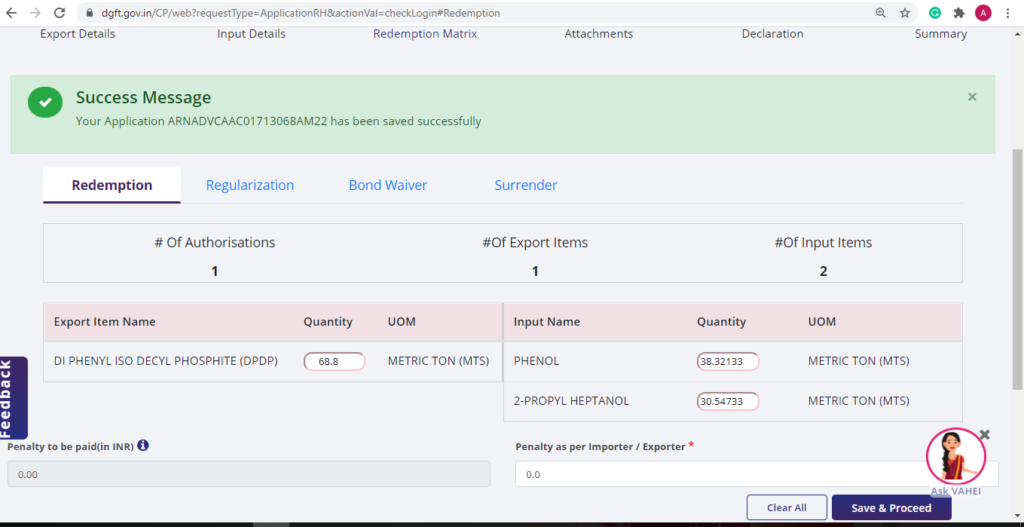

Step 7 – Redemption Matrix Tab

The new facility can be utilized for Redemption of the license, Duty paid Regularization, Bond waiver, and Surrender. If the details present in the redemption matrix are not populated correctly it can be edited as per the Importer/Exporter. The correct value of penalty can be filled in “Penalty as per Importer/Exporter”. The application can be submitted by paying the required penalty.

Redemption/EODC of the license –

For the redemption of license authorization holder has to submit all the relevant proof of export to DGFT, and checking the completeness of the application in every aspect the DGFT will issue the redemption/EODC letter to the license holder.

Duty paid Regularization –

If the export obligation is fulfilled in terms of value, but there is a shortfall in terms of quantity the license holder shall pay duty along with interest and close the license –

- Customs duty on the unutilized value of imported raw materials/input along with interest @ 15%.

- 3% of the CIF value of the unutilized imported material ( for restricted materials)

If the export obligation is fulfilled in quantity but there is a shortfall in value the license holder shall pay duty along with interest and close the license –

- No penalty has to be paid if the license holder has achieved minimum VA

- If VA falls below the minimum then it is required to pay 1% on the shortfall in FOB value in Indian Rupee.

Bond waiver –

If the export is made first before importing raw materials, the license holder can apply for the bond waiver certificate. To get the Bond Waiver Certificate, an application has to be done online on the DGFT portal by submitting the export evidence and other required documents.

Surrender – Under the Surrender option, the authorization holder can surrender the license if no export and import are made under the license.

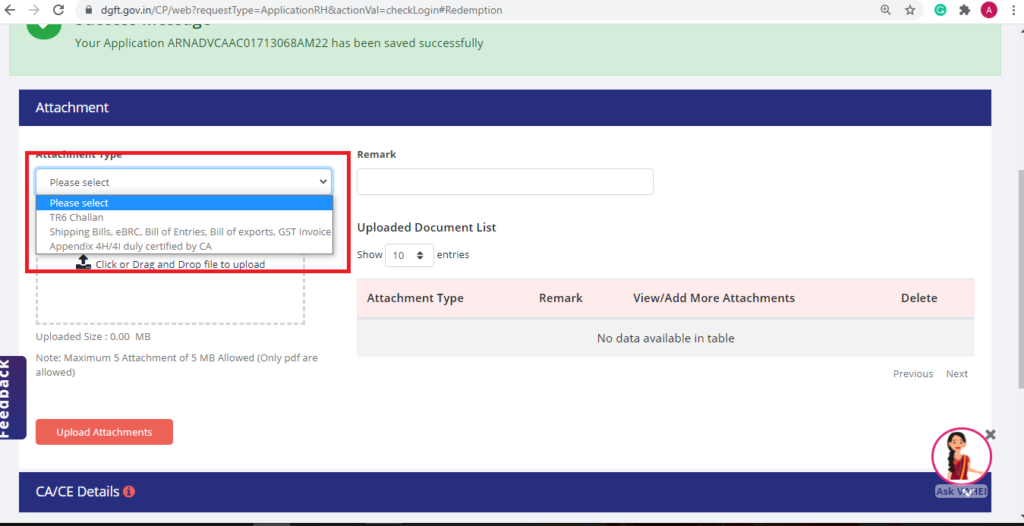

Step 8 Attachment Tab

The following documents will not be available online, and the authorization holder is required to upload them to their respective online repositories before preparing the online closure application.

- Non-EDI Shipping Bills/Bill of Entries/GST invoice

- CA/CE/CS Certificates

- TR Challan

- BG/LUT

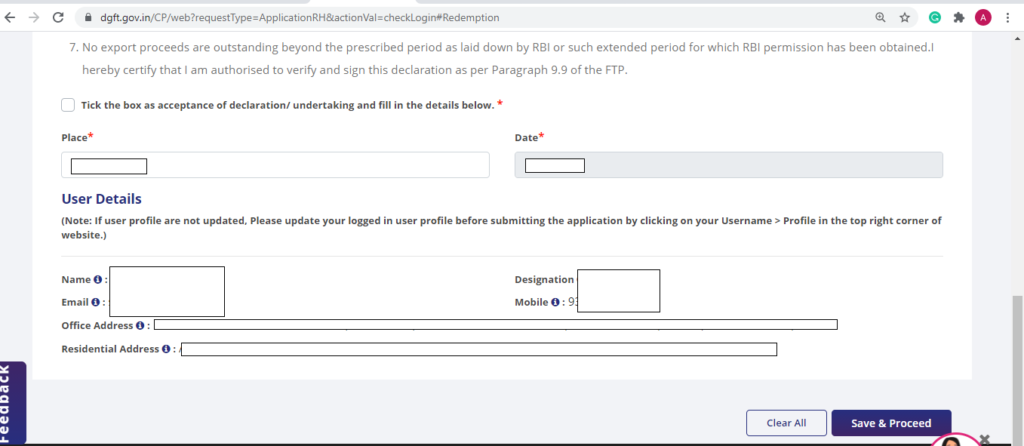

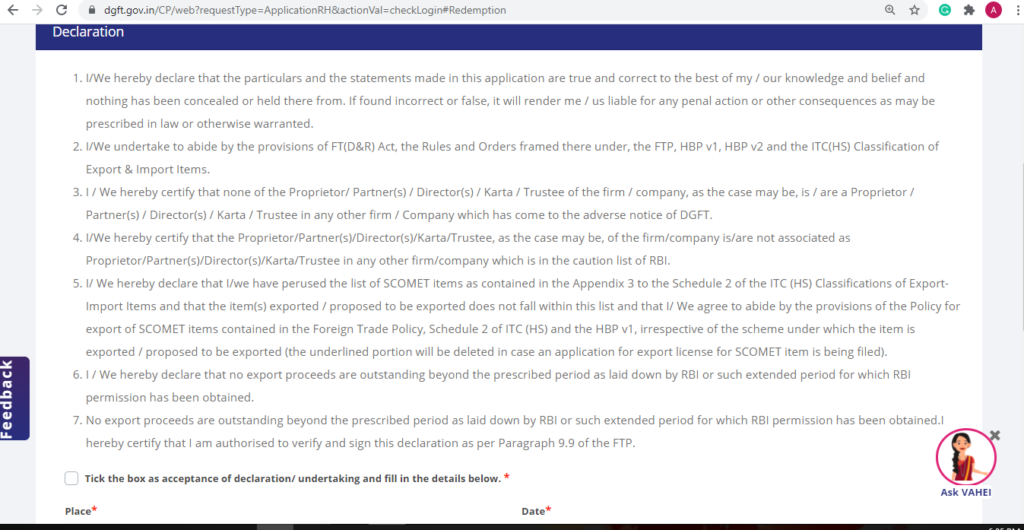

Step 9 – Declaration Tab

Under this tab, accept the terms and conditions after reading each point carefully by clicking on the check box.

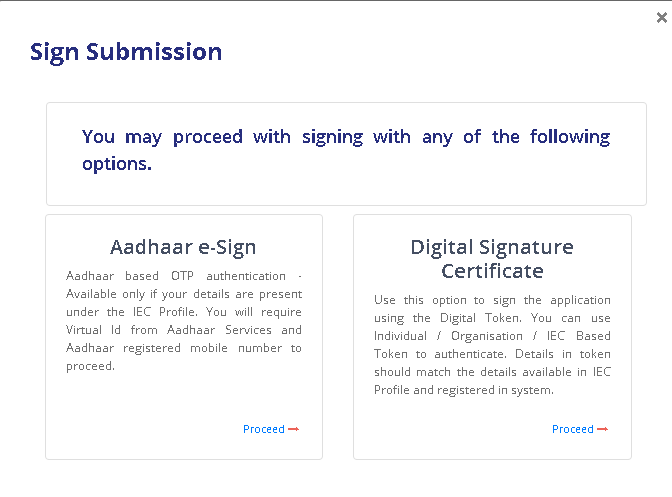

Fill out all the required company details & sign the application using Digital Token or Adhar card.

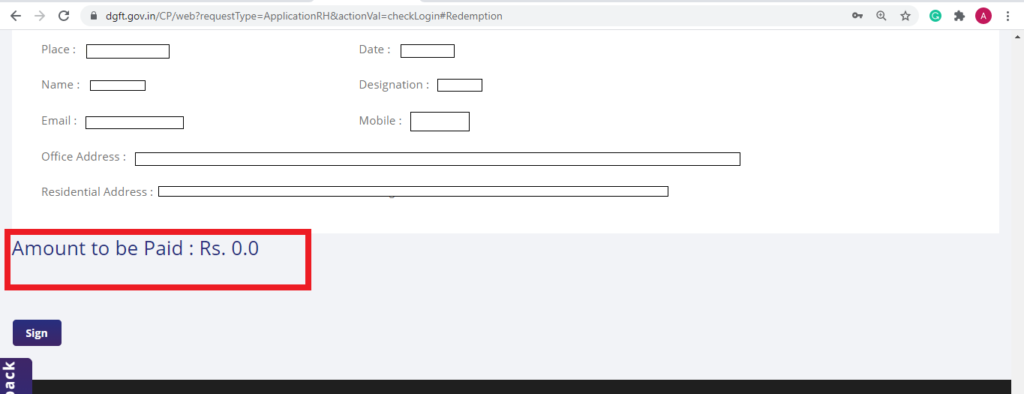

Step 10 – Summary Tab: Sign and Submission

From the Summary Tab applicant can verify all the details filled in the application, It can be saved in PDF format by clicking on the summary button.

- Click on the Sign button to sign the application using a digital token or Aadhaar.

- Do the payment of any penalty/composition fee using a preferable mode of Payment,

- The advance License redemption/closure will be rejected if the mandatory fee is not paid.

Submit the Redemption application to the relevant DGFT office after paying the required fees.

After checking the completeness of the closure application in every aspect the regional authority of DGFT will issue the Export Obligation Discharge Certificate (EODC)/ Redemption Letter to the Authorisation holder.

DGFT will not ask for any physical submission of the forms and required documents. However, in cases of genuine difficulty, documents have to be submitted to DGFT with the approval of the Head of the RA. Further communication, clarification, deficiency letter or redemption, needs to be issued through the online module.

[Please find the summary of Online application tabs and the detail should be present in each.]

How to check the approved EODC/Redemption Letter online

- Select the Submitted option from My Dashboard.

- Select the Type of the scheme – Advance Authorisation (AA).

- Select Type of Sub scheme – Closure of an issued Advance Authorisation.

- From the action section, select “View approved Letters”.

We hope that the procedure for “How to apply for Redemption/Closure of Advance License Online” is now clear.

How Afleo can help you in Online EODC/Redemption of Advance license hassle-free?

Advance License Closure procedure is a difficult process, without proper guidance the whole process gets complicated. Afleo Consultants is a recognized Advance Authorization Consultant and a pioneer in the field of DGFT. We have handled numerous Advance License applications and helped our clients to successfully close the licenses. The expert advice “Afleo Consultant” provides is guaranteed to be truthful and trustworthy as per the reviews of many people who had been served under its guidance.

We at Afleo Consultants are India’s leading Export Import Consultants, having rich experience of 10+ Years in the domain. We specialize in all the DGFT related matters, Export promotion schemes such as RoDTEP, MEIS, SEIS, Advance License, EPCG, DFIA, AEO certification, Star Export House certification, Duty Drawback, IGST Refund, etc.

- We comprehend new schemes and all the policies under FTP, realizing the benefits for exporters and importers,

- Turning the policies into a simple form that is easily understandable to our clients.

- We have an experienced team working on understanding the foreign trade policies and finding the value it will add to our client base from various industries in the most effective manner.

- We assist our clients by updating them about the foreign trade policies to understand the value addition policy will bring for their benefit and guide them to avail all the benefits given under FTP.

[Not sure whether your company is taking all the Export incentives notified by the Govt? – Refer to our article on “18 latest Export promotion schemes/Export Incentives in India”]

We have a PAN India presence.

We would appreciate your comments and views on the above topic.

Have any doubts? Please fill the form below to get in touch with us.

[contact-form-7 id=”514″ title=”In Post form”]

1 thought on “How to apply for EODC Online/Redemption/Closure of Advance Authorisation (Advance License) – Step by Step Guide”

Its like you read my mind! You appear to know a lot about this, like you wrote the book in it or something.

Comments are closed.