What is Advance Authorisation for precious metals scheme?

To promote the growth of Gem and Jewellery sector the Government of India has introduced the Advance License scheme under foreign trade policy to import duty-free Gold, Silver, and Platinum in India to manufacture the export items. In simple language, it means that, if you are an exporter of gold, silver, or platinum jewelry you can import corresponding gold, silver & platinum required for manufacturing directly into India at 0% Import duty.

Watch this short video to know How we can use the Advance authorization scheme for the duty-free import of gold, silver & platinum into India for the manufacture of export items? It’s eligibility criteria and other important terms & conditions associated with the scheme.

Since the items like Gold, Silver and Platinum are highly sensitive items, many terms and conditions are associated with the scheme. Before going ahead, we will discuss who all are eligible for this scheme and the important condition associated.

Who all are eligible for the scheme?

- Advance License under Advance Authorisation for precious metals scheme can be obtained by Manufacturer Exporter or a Merchant Exporter with a supporting manufacturer.

Important Terms & Conditions to get the Advance License

- The advance License is granted on the pre-import basis with the “actual user” condition for duty-free import of inputs required to manufacture the export items, which means the inputs/raw materials can not be transferred and has to be used in the premises of the License holder only.

- Advance Authorization Scheme is not available where the item of export is ‘Gold Medallions and Coins’ or ‘Gold jewelry/articles manufactured by fully mechanized process’

- Gold of fineness less than 0.995, silver of fineness less than 0.995, and platinum less than 0.900 are not allowed to import

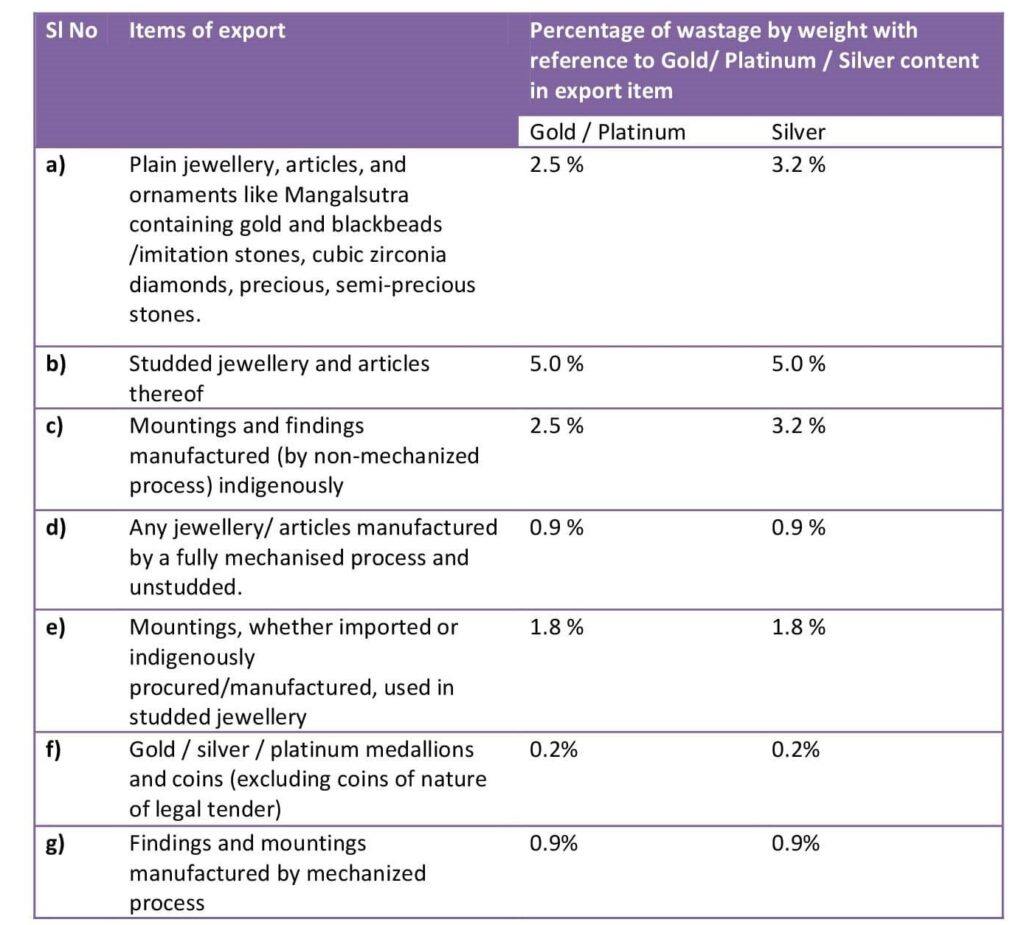

- Wastage norms are predefined by the DGFT and are as below:

- For Export of plain jewelry, you get a wastage (Manufacturing Loss Allowed) of 2.5% for Gold/Platinum & 3.2% for silver, and for export of studded jewelry, you get a wastage of 5% for Gold/Platinum and silver.

Export Obligation and Other Compliances to be followed after getting the Advance License

The Export Obligation is the criteria to get the advance license and has to be fulfilled by the exporters through value and quantity-wise. The Minimum value addition of 3% has to be achieved for the export of plain jewelry and 6% for the export of Studded Gold/Silver/Platinum Jewelry.

The export Obligation period will be 120 days from the date of import of each consignment. No further extension will be given.

Value Addition is calculated as per formulae given below –

VA = {(A-B)/B} * 100

Where,

- A = FOB value of export realized/FOR value of supply received.

- B = Value of inputs such as gold/silver/platinum content in export product plus admissible wastage along with the value of other items such as gemstone etc.

Compliances to be followed

During Export of Jewelry, shipping bill and invoice presented to customs should contain following details –

- Description of item, its purity, Net content of Gold/Silver/Platinum

- Wastage Claimed

- Equivalent quantity of Gold/Silver/Platinum in terms of 0.995/0.999 fineness for Gold/Silver and 0.999 fineness for platinum.

- FOB value of exports and value addition achieved

- In the case of studded items, the shipping bill shall also contain description, weight, and value of precious/semi-precious stones/diamonds/pearls used in manufacturing and weight/value of any other precious metal used for alloying Gold/Silver.

- Proof of export for the purpose of closure/Redemption will be EP copy of shipping bills, custom attested tax invoice, and Bank Certificate/E-BRC.

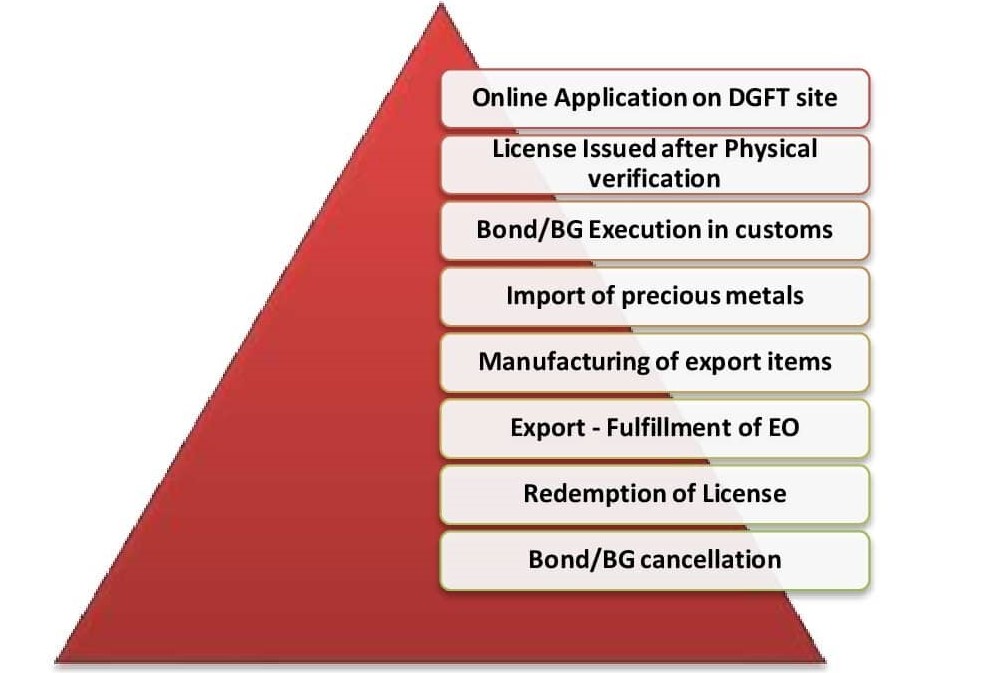

Working of Advance Authorisation(AA) scheme for precious metals

The image below shows the working of Advance Authorisation for precious metals, It consists of the following steps –

The Application for License

- The Application shall be done on the DGFT website with the help of a Digital Signature Certificate (DSC).

Physical verification of the premises

- The license is issued after the physical verification of the premises where the manufacturing of the export items has to be done.

- In case the license is issued to a merchant exporter, physical verification of the supporting manufacturers premised will be conducted.

Registration of the License

- Registration of the License shall be done at the customs office to check the genuineness of the license received from the DGFT and customs will execute a bond/BG at the time of license registration at the port.

- The Gold/Silver/Platinum imported under the Advance authorization shall be subject to the Actual User conditions.

Fulfillment of Export Obligation

- Export Obligation is mentioned on the license received under the scheme and should be fulfilled both in terms of quantity & value.

Redemption of License at DGFT

- The exporter has to submit relevant proof of export to DGFT for the closure of the Advance License. After checking the completeness of the application in every aspect the DGFT will issue the Redemption Letter to the License holder.

Bond/BG Cancellation at Customs

- After the redemption of the license from DGFT, the important step in the Advance License procedure is the cancellation of the Bond/BG, which has been executed at the time of Import.

How to get an Advance Authorisation(AA) License for precious metals

- Visit the DGFT website – https://www.dgft.gov.in/CP/ and click on “Online Ecom Application” under the services tab.

- Login into the portal with the help of a digital signature by entering the required credentials.

- Start the fresh application and fill out the mandatory details.

- An Application has to be made to the jurisdictional DGFT office indicating the net content of Gold/Silver/Platinum in the export item.

- Quantity of Gold/Silver/Platinum allowed for import under Advance Authorization should be “NET CONTENT IN THE EXPORT ITEM PLUS THE ADMISSIBLE WASTAGE/MANUFACTURING LOSS.”

- Uploading the required documents Online.

- Confirmed Export Order from the buyer is mandatory to get Advance License.

- Gold/Silver/Platinum can also be obtained on a free of cost basis from the foreign buyer, in such cases, necessary declarations should be made in the application.

- Do the payment using a preferable mode of Payment,

- Submit the Advance License application to the relevant DGFT office.

- The license would be issued by the DGFT only after physical verification of the manufacturing premise is conducted.

How can we assist you with the Advance Authorisation Scheme?

We at Afleo Consultants are a team of DGFT experts, having rich experience of 10+ Years in the domain. Since compliances related to Advance Authorisation for precious metals are a little complex in nature, you should always choose experts in the field having accurate policy knowledge and relevant domain experience.

We are helping more than 25+ clients to get their AA benefits for the Duty-Free Import of GOLD/SILVER/PLATINUM from DGFT. Our experts assist you in getting Advance License Benefits from DGFT & Customs as under:

- We help you in preparing documents for the application of an Advance License for the Duty-Free Import of GOLD/SILVER/PLATINUM from DGFT.

- We assist in Obtaining Advance License from DGFT.

- Guiding regarding the procedural requirement & Compliances to be followed by the Client after issuance of Authorization.

- Obtaining Amendment, Enhancements, or Extension for the License.

- Getting Redemption Letter from DGFT RA and release of Bond after fulfilling the export obligation from Customs.

[Not sure whether your company is taking all the Export incentives notified by the Govt? – Refer to our article on “18 latest Export promotion schemes/Export Incentives in India”]

Get in touch with us if you have any doubts related to the working of the AA scheme and our team would be happy to help you.

[contact-form-7 id=”514″ title=”In Post form”]