A company is an artificial entity created on guidelines of the law. Corporates aid in rising the economy of the nation in addition to generating employment for citizens. Among the various types of corporates, the Private limited and Public limited company are the two most popular ones.

Entrepreneurs are often obscure regarding what to choose between a public limited and private limited company. They can register their company in either and avail for the various benefits offered. However, multiple factors are determining the eligibility of the business to register either as private or public limited. This article will highlight the features, requirements, and advantages of choosing a private as well as a public limited company.

[Want to know the benefits of Start-up India Programme? Here is the article “All about Startup India programme launched by the Government of India”]

What is a Private Limited Company and Public Limited Company?

Private limited and Public Limited Companies are governed under the ambit of Indian Companies Act, 2013. However, they both have their limitations and advantages based on which a company can either choose to be a private limited or a public limited entity.

The differentiating features of a public and private company with examples are listed below:

Public Limited Company

Example:

Larsen and Toubro Limited is a Public Limited Multi-National Company with its headquarters in Mumbai, India. In the year 1943, Larsen & Toubro was registered as a private limited firm, after which the company got converted into a public limited company in the year 1950. The company has its shares issued to the public. Being a public limited company, L&T enjoys certain benefits such as transfer of shares, easy loan for funds, and other benefits for running their business.

Why did L&T turn into a Public Limited Company?

A Public Limited Company is a large corporation that has a national presence. They primarily enjoy the benefit of issuing their shares publicly. L&T is an MNC that has a nation-wide presence, and the public can buy its share.

By going Public Limited, L&T gained assistance in raising their capital by offering shares and unsecured debts like bonds and debentures to the public.

Why must you register your company under a Public Limited Company?

A Public Limited Company enjoys the advantage of issuing its shares in public for subscription. However, entrepreneurs can commence their business only after obtaining a Certificate of Commencement of business along with Certification of Incorporation. Whereas, in Private Limited Company the certification of incorporation is enough to begin the business. The business must also obtain a trading certificate before its commencement.

Some of the benefits enjoyed by L&T and other Public Limited Companies are:

- Transparency – Every public limited company is required to publish their prospectus viz. their complete financial statement annually. This helps in building the integrity of the company among the public who are introduced to the financial position of the business and aid in determining the value of their shares.

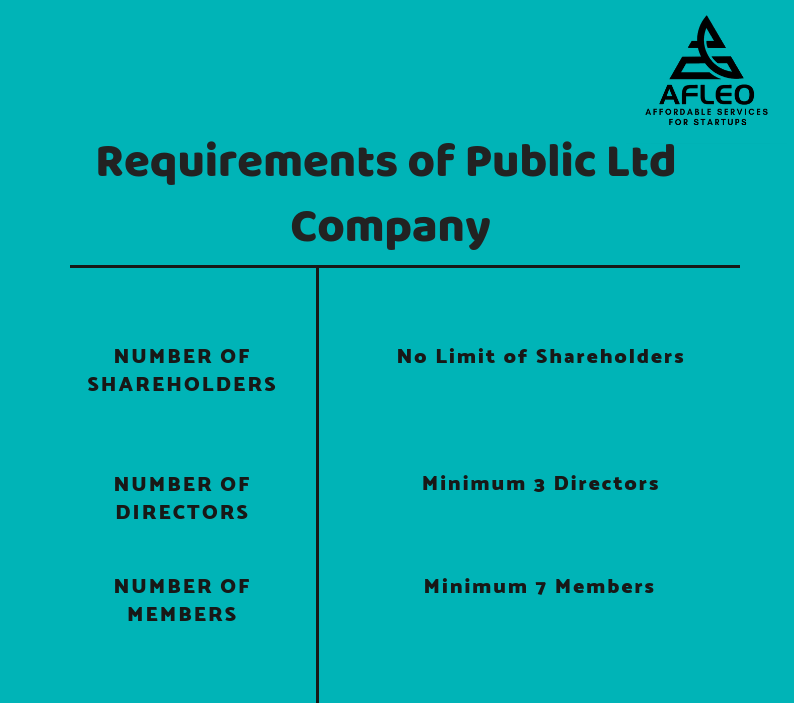

- Headed by a board of directors – The company is led by a board of directors who can be minimum of 3 to a maximum of 15 elected by the shareholders of the company. The board of directors ensures transparency in the business by taking appropriate managerial decisions.

- Raise capital by issuing shares – Public companies are in advantage of raising their capital by issuing shares, bonds, and debentures in the market.

- Transfer of shares – The ownership can be transferred by transferring of shares, done through signing, filing, and ownership certificate.

- You can start a public limited company if you have a minimum of 7 members without any upper limit.

What are the Limitations?

- Converting into a public limited company involves an extensive process of preparing reports, hiring accountants thus making it an expensive process.

- The company owners must own at least 51% of shares to raise money for the operation of a public corporation of shares.

- They have to periodically declare their financial position, operations and other matters to the public.

- The company cannot take decisions independently and requires the consent of minority shareholders.

Features of Public Company

A Public Limited Company is a legal entity that has its stock traded in public. Any individual can buy the company’s shares, as these shares are not restricted to the shareholders alone. They are supposed to issue prospectus before issuing their shares on the public domain.

- The suffix of “Limited” is added in case of Public Limited Companies.

- For allocating shares, the company must have a minimum capital requirement of Rs.5 lakhs.

- They must mandatorily file for an annual report with the registrar of the company.

- The consent of the directors is required in writing for enabling acts.

- Only two third of directors can retire from the management by rotation.

- There are restrictions on the payment of remuneration for a director.

- A statutory meeting must be held in every six months from the commencement date of business along with filing the report with the registrar of the company.

[Wondering whether to register as One Person Company or Private Limited Company? Read our article on “8 Major Differences One Person Company vs Private Limited”]

Private Limited Company

Example:

Amit runs a medium scale business of selling products online. He operates the business in collaboration with his partner Ajith. The total capital they have invested in is, ₹ 2 lakhs. They wish to turn their company into a Private Limited firm.

What are the requirements and salient features of Private Limited Company?

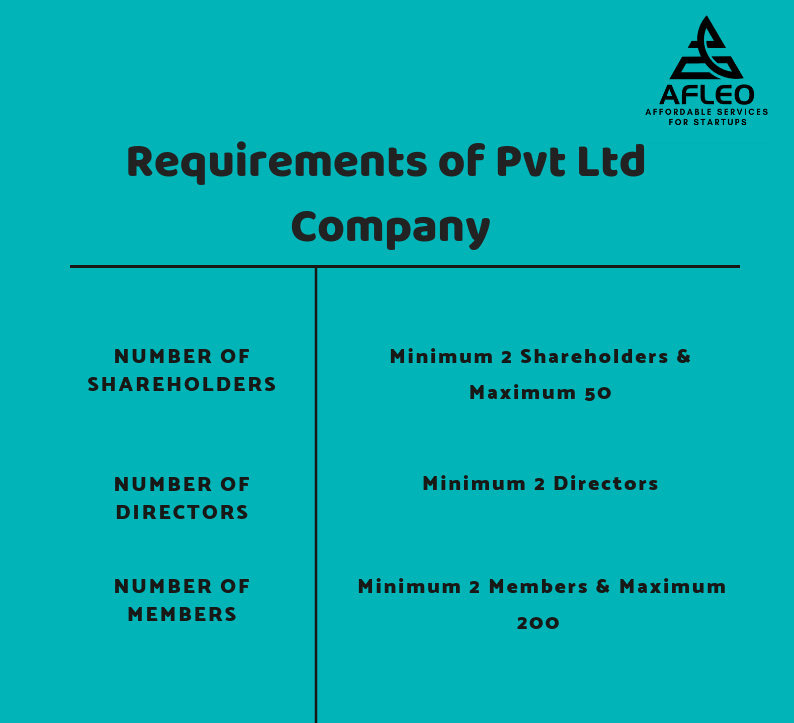

Entrepreneurs need to be well-adapt with their business, its pros and limitations before choosing a private limited company. The entrepreneur needs a minimum of 2 members and 2 directors. A minimum capital of ₹ 1 lakh is required hence even if your funds are limited you can start with a Private Limited Company.

Features of Private Company

- A private limited company does not enjoy the right to issue shares publicly.

- A Private Limited company must add a suffix of “Private Limited.”

- It doesn’t necessitate the consent of director to act.

- The Retirement of Directors – It is not mandatory for directors in a Pvt. Ltd company to retire.

- Remuneration of Directors – There are no restrictions on the payment of remuneration.

- Need of Statutory Meeting – It’s not mandatory to hold a statutory meeting.

Who must choose a Private Limited Company and What are its benefits?

Foremost, starting with a Private Limited Company is not an arduous task. If you have a minimum capital of 1 lakh in hand, that is more than enough to start the business. The crux of any business is to make a stand in the market and reach out to the audience. Registering as a private limited company lends recognition to the company in addition to generating trust of employees and consumers.

[Indian Government is encouraging entrepreneurship everyday. Are you looking for financial assistance? Read our article on How to get Pradhan Mantri Mudra Yojana (PMMY) Loan]

Advantages of Private Limited Company

- Easy to commence – All you need is a minimum of 2 members (maximum 200) and Bingo! You can start your own company!

- Minimum capital share – The minimum capital share required is just ₹ 1 lakh.

- No need to issue Prospectus – Unlike a Public Limited company, which is required to publish a prospectus for inviting subscribers to buy their shares, a private limited company is not required to issue a prospectus as they have limited stock and cannot sell their shares in public.

- Ownership of Property – After registration, the ownership of property lies on the company alone. No shareholders can claim rights on any property of the company without the consent.

- Responsible for liabilities – The shareholders have limited liability over the debt which is limited only to the equity invested. This ensures the security of personal assets of shareholders and members who are not required to be compensated against the loss. Each shareholder and a member is liable for their share alone.

- No dissolution – The company enjoys an uninterrupted existence which remains undissolved unless dissolved legally. The company continues to function even if it goes bankrupt, the death of any member, change in ownership, or on the transfer of shares from one person to another. Thus, with the dissolution of members or transfer of shares, the company doesn’t fail to exist. It’s just the management that changes while the company continues to function as before.

Limitations

- A private limited company is barred from issuing their shares to the public.

- The shares can neither be sold or transferred unless a 100% consent is obtained from other shareholders.

Compliance

As the incorporation of a firm into private limited and public limited falls under the compliance of Companies Act, the businesses are compelled to meet specific criteria which are:

- As per the guidelines set by the Companies Act, every private limited firm should file their Annual return within 60 days of conducting the AGM.

- The financial statements must be filed within 30 days after conducting the AGM.

- Every individual who is subscribed the MOA must deposit the subscription fee for shares.

- The company must issue a certificate of all securities allotted to the subscribers. This must be done within 2 months from the date of incorporation.

- The company appoints a statutory auditor for the purpose of conducting the statutory audit of accounts within 1 month from the date of incorporation.

- They must pay quarterly tax, file for tax returns and file for tax audit report in case the annual turnover exceeds 1 crore.

How long will it take to register your company?

Afleo offers services for registering your company as Private Limited or Public Limited Company within a short period. We help in carrying out all the procedure in behalf of you and getting the necessary approvals and certificate of registration.

To know more about Public Limited Company and Private Limited Company Registration fees and for the process, you can approach us. Contact details and form is mentioned below.